Improving viability of renewable energy beckons petroleum firms' investment

The forward-looking sector of the energy industry is no longer asking whether renewable energy will prove viable but when it will make money without government concessions.

In the petroleum sector, Royal Dutch/Shell and BP Amoco PLC are building renewable energy businesses with a view to the long term, while a shoal of small enterprises is nibbling its way into the energy industry through small-scale power generation projects.

Perhaps the most significant milestone in the progress of renewable energy towards commercial viability was the establishment of Shell International Renewables (SIR) as a new core business for the Anglo-Dutch petroleum giant in November 1997.

Shell committed to invest more than $500 million over 5 years in renewables; not much for Shell, but much more than any other renewables company to date.

Initially, SIR was built around two renewables technologies: photovoltaics, which form the basis of solar panels; and biomass, specifically the harvesting of fast-growing trees as fuel for wood-burning power plants.

Significantly, Shell's solar technology is being developed in-house, while its biomass schemes are a spin-off of its forestry businesses, which have been making money from pulp and wood veneer production for almost 20 years.

The formation of SIR was based on Shell's expectation that renewables will provide 5-10% of the world's energy needs by 2020, rising to perhaps more than 50% by mid-century.

With worldwide energy demand expected to grow at about 2%/year to more than 650 million boe/d by 2060, that 50% represents a massive potential to earn money.

When BP and Amoco merged, the world's largest solar power company was created. This unit expects to achieve a turnover of more than $1 billion/year by 2010. While BP Amoco bought into technology initially developed in the academic sector, its commitment to solar power is shown by its steady investment to expand production capacity.

DTI survey

In March 1999, the UK Department of Trade and Industry (DTI) issued a consultation paper on the prospects for renewable energy in the 21st century, as part of its drive to reduce greenhouse-gas emissions in the wake of the Kyoto climate change agreement.

DTI set a target of providing 10% of UK electricity demand from renewable energy sources by 2010. This compares with a European Union target to have 12% of all primary energy to be met by renewable resources by 2010.

Despite the difference in approach between the UK and the EU, the responses to the DTI consultation paper can be viewed as a microcosm of how renewables are being viewed in Europe, and show some technologies are further down the road to acceptability and viability than others.

DTI said that, despite the growth in renewable energy capacity in recent years, the renewables sector is unlikely to be able to meet the government's 10% target: "The industry is perceived to be too small and fragmented."

The consultation paper received 260 responses from a wide variety of organizations and individuals, including conventional energy producers, the renewables sector, the environmental lobby, local government, and the general public.

"Most respondents," said the DTI, "expressed satisfaction that the government is taking renewable energy seriously and agree that renewable energy has an important role to play in meeting climate change targets.

"Most welcome or support the 10% target or believe that the target should be set at a more challenging level. There is also considerable support for a longer-term view to maintain the momentum after 2010, when additional CO2 emissions reductions can be expected.

"At the other end of the spectrum are those who feel that the government is not taking its 10% target seriously, often referring to it as an aim rather than a target. There are also those who believe the 10% target to be over-ambitious, given current planning and financial constraints and the limited level of development achieved to date."

IEA concern

DTI's recognition of limited achievement to date was reflected by the Renewable Energy Working Party of the International Energy Agency, Paris, which in June 1999 called for the energy industry to speed the rate of adoption of renewables.

The IEA said that, to solve the slow-implementation problem, industry and governments must work towards the reduction of technology costs, innovative financing mechanisms, stable energy policies, fair access for renewables, information and training, enhanced research and development efforts, and international cooperation.

"The current renewable energy market is small but growing," said the agency. "The increased push to develop renewables in IEA member countries is largely driven by environmental concerns, notably the fear of global climate change. In the developing world, renewable energy technologies can offer needed energy services to regions that are poorly served by conventional energy.

"Renewable energy development is at a crossroads. Notable progress in installing renewable systems has been made in recent years; however, the base is relatively small, and the industry is still young.

"Yet momentum has picked up. There is significant public support, and the technologies are becoming more reliable and cheaper. Governments are adjusting their policies to encourage greater market penetration of renewable energy and to foster industries based on renewable energy sources."

While the implementation of renewables programs may be slower than the environmentalists and renewables sector would like, there has nevertheless been much progress worldwide in recent years, to the extent that renewables are increasingly being accepted as a viable business.

Solar power

DTI said that respondents to its consultation paper felt that photovoltaic technology offered enormous potential and that the government is wrong to view solar power as a long-term technology.

"Other countries," said the DTI, "have recognized and are developing the potential of this technology, and the UK is likely to be left behind if it does not follow suit.

"Building-integrated photovoltaics is perceived to be mature technology and to be cost-effective in a growing number of applications. Cautionary notes include the high capital costs and low efficiencies of photovoltaic systems and a lack of sustainability associated with the use of rare metals."

Solar panels manufacturers see the integration of photovoltaic cells in building facades for new buildings as a major market. Yet the cheapest stone building facade costs about $450/sq m compared with $1,300-1,600/sq m for a photovoltaic panel.

While the cost for solar panel facades is roughly the same as that for marble, the market is cautious because it remains to be proven that a solar panel facade can bring in the same rent per square meter as marble in new buildings built for office developments.

Recognizing this fact, the governments of Japan, Germany, and the Netherlands have started government initiatives to support building-integrated solar projects. Meanwhile, in Germany and the US, support is being provided at municipal and state levels.

In addition to providing panels for integration into buildings, Shell's solar thrust is in undeveloped energy markets such as South Africa, India, and Sri Lanka, where small domestic solar power units are being installed as an alternative to traditional, capital-intensive rural electrification programs.

Shell claims to be developing such schemes on a commercial basis and argues that, for the hundreds of millions of people, usually poor, in areas without electricity, the small solar units cost less each month than the batteries, candles, and kerosine they rely on normally.

Likewise, BP Amoco is looking beyond the main building-integrated solar power market for innovative applications. It has secured contracts to power entire communities in the Philippines through solar power, and it is installing solar panels in many of its European gasoline stations as a way of slashing mains electric power requirements.

BP Amoco also provided 500 solar power units for the athletes' village under development for the 2000 Olympic Games in Sydney. The village will be sold off for conventional housing when the games are over; its 665 permanent houses each have a 1-kw peak solar panel installed.

One problem facing photovoltaics manufacturers is health and safety concerns over the use of cadmium in some solar-cell technologies. One thin-film technology with great performance potential is cadmium telluride, but this has already been banned from the Japanese market.

However, manufacturers are working on alternative materials, such as copper indium gallium diselenide, and are investigating the prospects for amorphous silicon technology. These processes still face major obstacles in manufacturability, though.

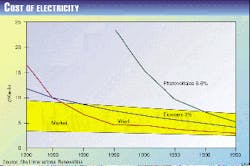

Despite the problems, solar panel manufacturers are confident they are onto a winner. The sales price for current crystalline silicon-based solar panels equates to $5-7/watt for electric power, but anticipated developments in thin-film technologies are expected to bring this cost down to less than $1/watt.

Wind power

While wind turbines might seem the most obvious candidate for a truly renewable resource, wind power faces the most opposition from local environmentalist groups.

"Wind turbines," said the DTI, "are perceived as industrial developments that damage the landscape and pose a major threat to the environment. Their adverse effect on tourism-present and future-is highlighted, and other problems raised include declining property values and the impact of turbine noise and rotation."

The British Wind Energy Association (BWEA) says the claims about turbine noise are exaggerated but admits that the reliance of wind turbines on an unreliable force limits its potential. The group anticipates that wind power could supply up to 15% of the UK electric power requirement without a problem.

But Britain is looking to the example of Denmark for how to develop its wind power sector. Denmark has one inshore wind farm and is developing another, while the UK has sanctioned its first inshore wind farm near Newcastle-upon-Tyne.

In the longer term, Britain's wind power companies are looking at the feasibility of building offshore wind power installations, which export electric power to shore via subsea cables. One scheme is being studied for the East Anglia region, the hub of the UK offshore gas industry.

So far, petroleum companies have not got involved in the wind power sector. However, Shell became of member of the BWEA and is studying the technology's potential with a view to adding it to its renewables portfolio. Shell is also studying the feasibility to building a wind farm alongside one of its onshore installations in Scotland.

Meanwhile, wind-turbine technology improvements are expected to reduce the unit cost of electricity generation. Now the largest wind turbines have capacity to generate 1.5 Mw of power, but new turbines expected to be commercially available after 2000 will be rated to 4.5 Mw. Besides capacity increases, manufacturers are also looking to reduce the "over-engineering" of early turbine designs.

Biomass

One form of biomass-wood burning-has long been the energy source of the rural poor, but now it is being promoted as a large-scale energy source through recent developments in forestry and technology.

Shell's forestry program resulted in the development of techniques to grow eucalyptus trees at a rate of up to 10 m/year, enough to provide sustainable-fuel power projects. As with its solar installations, Shell sees biomass as a candidate for remote locations and rural electrification schemes.

While most biomass projects are expected to be built in the developing world, Shell's first biomass operation is in Norway. Shell bought a district heating plant at Kirkenaer, 140 km northeast of Oslo, alongside which it built a plant to make wood-waste blocks from shavings from a nearby wood mill. Shell is using the blocks to fuel its own plant and is also selling them to industrial customers nearby.

In the UK, a unit of Yorkshire Water PLC built a 10-Mw power plant that burns wood from coppiced willow and poplar plantations, to meet the daily energy requirements of 34,000 people nearby.

DTI saw benefits from biomass schemes of sustainability, potential for local jobs, and suitability for small and large-scale projects but raised concerns over emissions and said that more attention needs to be given to anaerobic digestion as a potential biomass technology.

Wave power

Harnessing the power of the sea has long been a dream of Europe's inventors, but it was only in 1999 that the vision became a commercial reality.

Applied Research & Technology Ltd., Inverness, Scotland, won a 15-year power purchase contract based on the installation in Ireland of a 2-Mw wave turbine, on which was to be mounted a 1.5-Mw wind turbine.

However, an anticipated EU grant was not forthcoming, and the project was shelved. Nevertheless, the same technology was incorporated in a smaller wave-power unit later installed in a cave in Scotland's Hebrides Islands, to supply power to the local community.

While wave power is thus still marginal as a stand-alone power technology, it may become commercial as a means of providing power to remote offshore oil and gas platforms. Anticipating this, London-based British-Borneo Petroleum Syndicate plc bought a 19.73% stake in ART with a view to developing the technology for generating several Mw of power in remote offshore fields.

Time to act

These are the main contenders for viable renewable energy, and while all of them have problems, the energy industry is expected to overcome them.

Analyst Arthur D. Little Inc., Cambridge, Mass., conducted a survey on sustainable development and found that 83% of respondents saw business potential in sustainable projects, but were unsure of how to capitalize on opportunities in the short term.

"Getting past that uncertainty," said the analyst, "is one of the most valuable things a company can do today. We have studied the issue of sustainable development deeply over the past 10 years, and believe that it represents the least-appreciated-and potentially most significant-set of major business opportunities facing industry in the coming decade.

"The opportunities are of two kinds: avoidance of threats to growth caused by operating constraints; and pathways to greater success through new products, new technologies, and an enhanced license to operate, innovate, and grow.

"So far, only a few companies have forged strong links between their core missions and strategies and the opportunities posed by sustainable development. Now, however, is the time to act. Today, companies can gain the rewards of being first movers. Later, when trends are obvious, these advantages will be harder to achieve; competitors could very well own positions that could have been yours."

The Author

David Knott is Associate Chief News Editor of Oil & Gas Journal and writes the magazine's weekly Watching the World column.