Value added synthetic fluids key to Mossgas' success

While most economic analyses of the gas-to-liquid (GTL) ventures focus on feed costs and investment capital, Mossgas' experience suggests that the ability to make value-added products is the key to commercial GTL profitability.

Government-owned Mossgas (Pty) Ltd., Mossel Bay, South Africa, operates an offshore production platform to feed its onshore GTL plant. With the exception of Shell's Bintulu, Malaysia, GTL plant (which is down for reformer repairs after a major fire), Mossgas has the only GTL plant today that uses natural gas as a feed.

The plant has a production capacity of about 30,000 b/sd of refined products.

The conception of the Mossgas synfuels mega venture in 1987 was made in the age of South African sanctions when feasibility studies predicted higher than realized future oil prices.

Although high oil prices did not come to pass, Mossgas has achieved operational profits since its second full financial year, before taking into account certain state contributions for which it qualifies.

With reserves in the FA field expected to dwindle by 2001, Mossgas has focused on securing a more long-term gas supply in the past 2 years. With the EM project approved in June 1998, which is expected to extend gas supply to Mossgas until 2006, Mossgas has turned its focus on securing projects that add value to final products.

Beginning of Mossgas

The sanction years in the 1970s and 1980s created an ideal breeding ground in South Africa for the development of strategic projects. The successes achieved by Sasol combined with the energy crisis of the first half of the 1980s gave birth to Mossref (today Mossgas). At that time, Sasol was a state-owned national asset responsible for developing and optimizing coal-based synthetic fuels technology.

The energy crisis had a profound effect on many decisions made during those years. It had a resounding impact on the approval of the $4 billion (1992 dollars) proposal to build Mossref. World oil prices peaked at more than $40/bbl, and very conservative long-term oil price forecasts predicted $25-30/bbl. At that time, no oil expert predicted that oil prices below $10/bbl would materialize before the turn of the century.

Fig. 1 shows the oil prices required to make a 10% real internal rate of return. However wrong these predictions were, the strategic thinking at the time wrote the course of Mossgas' history:

In August 1985, the first project feasibility study was completed by Foster Wheeler UK. The Fischer-Tropsch (FT) technology selection was made in November 1986. The government announced the project in June 1987.

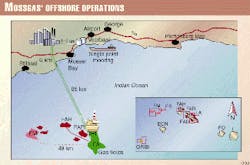

The Mossgas project would produce synthetic motor fuels from natural gas from the FA and EM fields. The FA gas field in the Bredasdorp basin was discovered in 1980 and the EM field, 50 km west of the FA, was discovered in 1984.

Fig. 2 shows a map of these offshore fields, as well as some smaller fields. The original commissioning included only the FA and two nearby satellite fields, FAH and FAR. The EM field was scheduled for commissioning in 2001 when the FA field is depleted.

In 1992, a Bateman & Davy consortium (with Fluor as the primary onshore engineering contractor) completed the construction of the GTL plant. The complex was fully commissioned and running at capacity in January 1993.

In early 1996, the shareholder (government) unsuccessfully tried to privatize the venture. In 1996 and 1998, the same government approved additional investments to extend the business horizon

Since start-up, the complex has been running at an average onstream factor above 90%.

Details of the plant

The Mossgas complex consists of two operations: an offshore production platform about 85 km from the shore and an onshore plant, about 5 km inland from the sea.

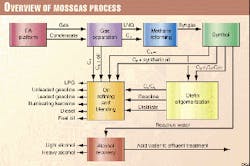

Fig. 3 shows the onshore process that receives gas and condensate from the offshore platform. Currently, the onshore plant receives about 210,000 normal cu m/hr of lean natural gas and more than 9,000 b/d of associated condensate.

Mossgas owns, operates, and develops both these as part of the full GTL value chain. Gas and associated condensate are recovered, separated, compressed, and transported in two streams to the onshore plant via an 18-in. dry gas pipeline and an 8-in. condensate pipeline.

The offshore platform (Fig. 4) is anchored on the seabed in 105 m water depth. It is the focal point in the current as well as future development of the offshore gas and condensate recovery infrastructure.

Onshore operations consist of 21 process units supported by 19 utility units, which are being centralized on a 410-hectares process site. An adjacent 360-hectares modern solid-waste handling facility completes the onshore complex.

A slip stream of natural gas is routed to an onshore LNG plant, which functions as a storage facility for a 24-hr supply of natural gas in case offshore production is interrupted.

Mossgas reforms the natural gas by a three-train mixed reforming (steam followed by autothermal) technology supplied by Lurgi AG, Frankfurt. To Mossgas' knowledge, these are the biggest combined reforming trains currently in operation in the world.

Each of the two world-scale oxygen plants supplied by Linde AG, Wiesbaden, provides 2,500 tonnes/day of 99.5% pure oxygen to the secondary reformers. The resulting CO, H2, and CO2 molecules from the reformer make up the synthesis gas (syngas).

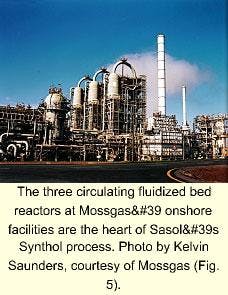

Syngas is the feed for the high-temperature Fischer-Tropsch (HTFT) process, called Synthol, licensed by Sasol to produce synthetic crude. The iron-based catalyst for the FT technology is manufactured on site. Fig. 5 shows the Synthol reactors.

On site refining processes consist of fractionation, isomerization, alkylation, oligomerization, hydrotreating, and platforming. These units are required to produce on-specification final products in the gasoline-to-diesel range.

The design capacity of the plant is 32,000 b/sd, of which the syncrude contribution is about 24,000 b/sd. The balance is derived from the associated condensate. The original design makes the following final products:

- Leaded 93 and 97 RON (research octane number) gasoline.

- Unleaded 95 RON gasoline.

- Automotive diesel.

- Kerosine.

- Light and heavy industrial alcohol.

- Fuel oil.

These products are shipped to local and international markets via two separate buoy mooring systems in a nearby bay.

Process developments

Since start-up, several process enhancements have been designed into both the offshore and onshore facilities.

On the offshore platform, three new subsea production wells were added to the nine already in operation in 1998. In October 1998, two 10-Mw gas turbine compressors were added to the FA platform to boost the supply pressure to the onshore process to a minimum of 4,500 kPa. This additional pressure boosted the supply of gas recovery from low-pressure wells.

The company further extended the gas reserves with the EM project, which ties in sub-sea developments 50 km west of the FA platform. First gas from the EM project is expected in April 2000.

The major developments of the onshore complex have centered on the gas processing units. The focus has been to improve the online availability of the combined (steam and oxygen) reforming plant.

Three sets of waste-heat boilers on the secondary reformer heat-recovery section were replaced in 1997. The stability of the oxygen blown secondary reformers was improved with the installation of new generation burners in 1997.

The desulfurizer reactors upstream of the primary (steam) reformers were extended to improve catalyst economics. A third 40-bar boiler was installed just after start-up to reduce electricity import from the national grid. Process control of boiler feed water quality on the 110-bar steam system has been dramatically improved.

A new design spiral wound cryogenic exchanger was installed and successfully tested in the natural gas liquefaction plant in 1998.

This new exchanger was provided practically free to Mossgas as a part of a Linde and Statoil test program. The Linde-Statoil alliance provided the new exchanger, and Mossgas provided the LNG plant, off site engineering, procurement, and installation.

The rebuilding of Train 3 of the reforming unit was completed in November 1998, 12 months after an explosion destroyed it. Although most procedures were deemed sufficient, Mossgas has made several modifications to reduce the potential for an explosive mixture in the firebox: instrumentation modifications, operating procedure changes, improved portable ignitors, and additional supervision during commissioning.

Changes to the Fischer-Tropsch plant have been minor. Three of these changes are the installation of a de-entrainment device to clean up the synthetic crude, improvements to the catalyst valves, and replacement of carbon steel gas lines with stainless steel as a result of stress corrosion cracking (SCC). These changes plus pre-emptive maintenance doubled run lengths between reactor shutdowns.

Export facilities for LPG marketing, which include a high-pressure storage sphere, blending bullets, and rail and road loading facilities, allowed the introduction of LPG as a new product in 1993.

On the refinery side of the complex, severe corrosion in the COD (conversion of olefins to distillates) oligomerization process forced selective changeout to stainless steel piping and equipment over a 2-year period. The COD distillate is a high-value low sulfur, low aromatic product, destined for environmentally friendly applications.

By mid-2000, Mossgas will produce an additional 8,000 b/d of products from its condensate top-up project, expected to add $6.6 million/year to its net operating surplus. The $17.4 million project will allow Mossgas to import low-sulfur condensate to augment its owns gas-associated condensate. This additional condensate will use the spare capacity available in its condensate processing units.

Lurgi South Africa received the contract from Mossgas to install four new storage tanks and a new 30-cm (12-in.), 13-km overland pipeline necessary for the condensate top-up project.

Krupp/Uhde will install process modifications in the onshore plant, which includes debottlenecking of the condensate stabilization and platforming process units.

Economic perspective

The economic debate on synthetic fuels over the past 2 decades has been interesting. Even more fascinating (yet understandable) is the see-sawing interest in GTL. When oil prices increase, interest flares up; invariably this interest subsides when the fuels business goes through its down cycles.

From a Mossgas perspective, the interest is not merely an academic debate but actual company earnings. Having built and operated a GTL plant for almost a decade, Mossgas is in a position effectively to evaluate the economics of a real plant.

One's specific circumstances have a definite bearing on the approach to synfuels economics. Divorcing the localization and historic issues of Mossgas from the economic debate, however, results in three key variables that have a dramatic effect on the viability of synthetic fuels. For the sake of simplicity, it is tempting to say the variables are money, money, and money.

Specifically, however, in order of declining priority, the variables that affect the economic debate are:

- The price achievable for the product.

- The investment capital required.

- The cost of feedstock.

Cost of feedstock

Starting at the bottom, in literature, much emphasis has been placed on the cost of gas as a precursor to synthetic fuels. The focus of technology suppliers has been on so-called remote gas where the use of associated gas is seen as an environmental advantage, and the cost of this gas is subsequently minimal, if not zero, and in some cases, negative.

Although one could hardly fault the argument that there is a major advantage to ultra-low cost feedstock, the emphasis of this as a prerequisite to synthetic products can and should be challenged.

Of the three most important economic drivers listed above, Mossgas' experience suggests that feedstock cost is the least sensitive of the three.

Investment capital

Technology developments have aggressively focused on the reduction of capital cost for each production barrel of synthetic fuels. Although Mossgas' experience supports this drive, capital investment is still only the second most important economic variable.

Technology investors and licensors should not only look at the actual capital of the synfuels plant but the operating costs. Logistics and refining costs can be dramatically reduced if synergies with existing facilities can be optimized.

In the Mossgas scenario, with the benefit of hindsight, it is doubtful whether a very small (30,000 b/sd) refinery to work up syncrude to final product quality can be economically justified compared to toll processing the syncrude in an existing refinery.

Final product pricing

Final product pricing is by far the most important variable in the economic debate. Fortunately, this is also the one aspect with which the owner has the most flexibility.

As synthetic fuels prices are invariably linked to the international oil price, the owner cannot influence the oil price. The owner does, however, have a choice of which intermediate and final products on which the technology should focus.

Mossgas has had great success in the past 3 years in more than doubling the value of certain intermediate products through low-capital process manipulation and new market applications. A well-developed synfuels complex should achieve average final product prices more than 50% higher than the equivalent synthetic fuels products.

The single most important oversight in the economic debate thus far is the undervaluation of the potential rapid advancement of synthetic fluids (not just fuels), however.

The fact that Sasol restricts Mossgas to producing only fuels, not petrochemicals, from its FT technology is further proof to Mossgas that there is much to be gained in producing the right products.

If Mossgas is able to expand its production into petrochemicals, the company will have realized its goal of pursuing synthetic fluids. It believes that value adding in this way will be the difference between commercial success and economic mediocrity.

Focus on value added

Mossgas' emphasis on synthetic fluids is a result of the expected higher prices that value-added products will earn. Although this focus generally means an emphasis on petrochemicals, Mossgas also sees a premium diesel market in the US.

The company does not have the option of influencing the capital cost of the plant; the hardware is in place and has been in operation for more than 6 years. It only has limited influence on the price of its feedstock. This economic variable was semi-fixed with the decision on plant location in 1987.

It is therefore understandable that emphasis and effort are spent on the other remaining key economic variable which critically influences synthetic fuels viability, namely value adding.

With the emphasis on more value-added products, operating expenses must also be carefully studied. These expenses have been a key focus over the past 3 years. On its own, however, minimizing operating expenses will not create the step change in net revenue that is required to make the venture a commercial success.

A few of the more obvious value-adding opportunities with the HTFT process that Mossgas operates are listed:

The HTFT gaseous by-products are highly olefinic. Thus, economic parcels of propylene, butylene, hexene, and octene exist. These are precursors to value adding byproducts. Conversion of propylene to acrylic acid and acrylates alone would add about 30% to the net revenue of the company.

The further development of chemical by-products from HTFT, such as a full range of alcohols, has already added and will further add to the bottom line in the future.

The low aromatics content, together with the unique branching of the distillate fraction of the COD oligomerization process, has achieved prices more than double that of fuels in the chemicals markets.

The low sulfur of the synfuels automotive products has clear and proven emission benefits that niche markets have been and will be prepared to pay a premium for.

To this end, the company has applied for registration of its diesel fuel as an alternative fuel under the US Department of Energy's EPACT (Energy Policy Act of 1992) program.

The Author

Kobus Terblanche is technical and development manager of Mossgas, Mossel Bay, South Africa. He is responsible for technology projects, environmental management, and business development.

Previously, he worked for Sasol in process development. He was a project manager during the design of the Fischer-Tropsch plants at Mossgas and responsible for the commissioning, start-up, and production of these units.

Terblanche holds a masters degree in chemical engineering on FT slurry kinetics from the University of Pretoria, South Africa.