GTL technology augments gas production options

Natural gas (methane) converted to a liquid, primarily for fuel use, is being touted as a new option for accelerating exploitation of the world's natural gas resources, especially accumulations that are commonly termed "stranded," in the foreseeable future because of high development and transportation costs.

The new enthusiasm for converting gas-to-liquids (GTL) has been spurred on by recent advances in Fischer-Tropsch technology that promise reduced processing costs. This would make the produced liquids more competitive with petroleum-based fuels, as long as the feed-gas prices are relatively low and crude prices stay at or above the $18-22/bbl level.

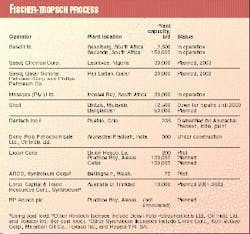

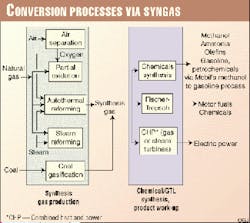

Table 1 lists ongoing, possible, and pilot projects that use Fischer-Tropsch GTL technology (Fig. 1) . The conversion process of synthesis gas (carbon monoxide and hydrogen), from both natural gas and coal, can yield fuels and various chemicals or be burned for generating electric power (Fig. 2).

Ceramic membranes (Fig. 3), not shown in Fig. 2, are a possible option for reducing the cost of producing syngas for the Fischer-Tropsch process. In one project, the US Department of Energy (DOE) is sponsoring research at the University of California at Berkeley on ceramic membranes.

Early DOE estimates suggest that ceramic membrane technology could reduce the GTL conversion costs by as much as 25%, depending upon conversion plant configuration.

Reserves estimate

As with oil, the ultimate amount of gas that will be recovered in the world is debatable but it is substantial. Oil & Gas Journal (Dec. 28, 1998, p. 39) estimated that the world had 5,115 tcf of proven gas reserves, which means that 61 years would be needed to deplete these reserves at the current 83 tcf/year producing rate. This compares to the 41 years for depleting the 1 trillion bbl of proved crude reserves at the current 24.5 billion bbl/year producing rate.

Of course, the reserve numbers will change as exploration and new technologies replace produced volumes and possibly add to these numbers. The general trend has been that each year more proved gas reserves are added to the world's inventory than are produced.

If the new reserves are found closer to existing infrastructure, development of the more remote gas fields tends to be postponed.

One prediction, by Arthur D. Little Inc., is that GTL in the next 15-20 years potentially could add 0.3-0.7 billion bbl of liquid/year, about 1-3% of the current crude production rate. If 10 Mscf are needed to produce 1 bbl of liquid with a GTL process, world gas production would increase by 3-7 tcf/year (4-8% of the current gas producing rate).

Arthur D. Little has estimated that $25-50 billion in capital investment would be required to attain these production rates.

Potential targets

By some estimates, half of the world's proved natural gas reserves may not find a market in the near future because of their remote locations.

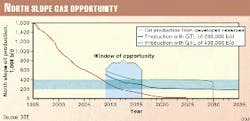

On Alaska's North Slope alone, DOE estimates that about 25 tcf of gas-in-place could be accessed with GTL technology, if proven cost effective. A 1996 strategy-assessment project by DOE, examining the economics of Alaska's North Slope gas options, found that GTL technology would be economically comparable to the large-scale liquefied natural gas (LNG) technologies and other export plans for the gas.

DOE's conclusion incorporates the savings to current oil-producing reservoirs that would result from extending the productive life of the Trans-Alaska Pipeline System (TAPS) from Prudhoe Bay to Valdez, from which tankers transport liquids to markets.

The study also found that near and mid-term advancements in GTL technology would lower the cost of this option by 25% or more, primarily through reduced capital costs and conversion efficiency gains. Fig. 4 illustrates the window for exploiting this opportunity before the oil rates through the pipeline fall below those required for continuing its operations. The GTL could extend TAPS life by more than 25 years and prevent shut in of as many as 200,000 bo/d of the last remaining North Slope oil, according to DOE.

Another potential for GTL is for skids, barges, and ocean-going vessel for developing offshore oil fields in which associated gas cannot be flared and pipeline installation is too costly. For these fields, feed-gas costs could be considered zero.

GTL also has potential for being installed in smaller gas fields. Syntroleum, Texaco Inc., and Kellogg Brown & Root had planned to develop a small GTL plant based on Syntroleum's process, but during 1998 Kellogg decided not to continue participating in the project as an equity partner.

The project has been suspended, although Syntroleum indicates that it is currently reviewing small plant designs that might attract necessary capital for design and construction.