Norway introduces industry-boosting measures to offsetexpected decline in E&P investments

While the Norwegian government is anticipating increased production and earnings from petroleum revenues, it is concerned over the "drought" that is threatening the country's oil companies and their suppliers.

Oslo expects to rake in 85 billion kroner ($10.8 billion) from petroleum-related activities in 2000, which would be 38 billion kroner more than is anticipated this year.

This estimate is based on an average oil price of 125 kroner/bbl ($15.82/bbl) for both 1999 and 2000. Oil export revenues are expected to rise by 34 billion kroner to reach 191 billion kroner in 2000.

Norway expects to produce an average 3.5 million bo/d in 2000, a rise of 500,000 bo/d from 1999, of which the State's Direct Financial Interest (SDFI) would amount to 1.5 million bo/d. Norwegian natural gas exports are expected to reach 61 billion cu m in 2000, up from 52 billion cu m in 1999.

The government's concern is that, despite rising income and output, the investment level in petroleum operations-mainly for exploration, development, and production operations in producing fields and approved field developments-is forecast to fall to 43 billion kroner in 2000 from 67 billion kroner this year.

Government measures

In October, the Ministry of Petroleum and Energy announced a series of measures intended to boost work in Norway's fabrication yards and petroleum industry.

The ministry said that major parts of the oil and gas supply sector are struggling to obtain work and that new measures would help the yards, and the industry as a whole, overcome their current problems and adapt to anticipated market conditions for the coming years.

In the budget for 2000, the ministry proposed setting aside 100 million kroner to ensure the development of new technology and competence through a program called Demo 2000. This would be a continuation of an existing program that put a similar amount into development work this year.

A steering committee comprising representatives from the oil companies, supply companies, and research institutions would be charged with seeing that the money would be spent in the best possible way. "The aim is to speed up technology development," said the ministry.

The Norwegian Labor Market Administration was charged with providing training courses aimed at maintaining the competence of the workforce and teaching new skills, at a time when the petroleum industry is "suffering from the drought in investment."

Specifically for the yards, the government proposed a grant to support construction of a new marine research vessel and to provide support or loans for the construction or modification of a number of ferries in Norwegian yards: "With this extended mandate and previous consents, about 10 new ferries will be delivered next year."

For the Norwegian offshore sector as a whole, the ministry proposed reducing its carbon dioxide tax by 21.3% to 0.70 kroner/l. (8.8¢/l.) of oil or 0.70 kroner/cu m of gas.

"The proposal," said the ministry, "will contribute to an increase in the profitability of new and existing fields and should give a basis for the companies to put forward new projects. At the same time, the tax level will be sufficient for companies to act in an environmentally efficient manner."

The ministry also proposed gradually abolishing the royalty paid to the government for the eight fields currently affected by the CO2 tax: for Heimdal, Tor, and Murchison, the tax would be abolished by Jan. 1, 2000; for Valhall, Statfjord, and Ula, the tax would be phased out over 3 years, beginning Nov. 1, 1999, for Valhall and Jan. 1, 2000, for Statfjord and Ula; and for Oseberg and Gullfaks, the tax would be phased out over 6 years.

The ministry also proposed that, in its 2000 budget, the government should spend 5 million kroner in grants to help Norwegian companies "internationalize" their petroleum activities.

"By strengthening the work of internationalizing the Norwegian petroleum industry," said the ministry, "the government wishes to give its support so that the competence, experience, and technology base developed during 30 years of operations on the Norwegian continental shelf will contribute to new business opportunities.

"Experience from international projects will also give enhanced knowledge and insight, which will benefit the activities in Norway and contribute to the launching of new, cost-efficient development solutions on the Norwegian shelf."

A ministry official told OGJ the plan was to present the industry-boosting measures before the Storting (Norway's parliament) in February or March and that a report on petroleum taxation was expected to be completed in late spring.

In the meantime, the ministry would be working on drafting an energy white paper, which the official said would concentrate on strategic issues and the outline of the industry, rather than issues such as taxation: "There will be no revelations of its content beforehand."

While details of the contents of the white paper would not be forthcoming, the official said that the introduction of increased competition in the Norwegian sector, state ownership of petroleum assets, and the internationalization of the Norwegian petroleum industry were to be the broad thrusts.

"There may not be much legislation arising from the white paper initially," said the official. "This would come later. Hopefully, the white paper will be debated in the Storting this summer, but that's up to the parliament."

Operators' view

The two Norwegian offshore operators that dominate activity on the Norwegian continental shelf see the government measures announced so far as small steps, but in the right direction.

The Oslo government has a firm grip on Norway's petroleum industry: Statoil AS is owned outright and manages SDFI for the government; Norsk Hydro AS is an independently managed industrial conglomerate, in which the state holds a 44% stake since Hydro took over Norway's only independent oil company, Saga Petroleum AS, earlier this year (OGJ, June 21, 1999, p. 24).

A Hydro official told OGJ that the changes to the CO2 tax and royalties suggested by the government were important signals, because they particularly touch on Norway's basic problem: the competitiveness of its petroleum industry.

"We look forward to more speedy change in the coming years," said the official, "but we know that the changes were discussed when the oil price was $10/bbl.

"The industry was badly affected and made significant cutbacks in spending. Since then, the oil price has more than doubled, and the government feels more relaxed. At $25/bbl, there is less incentive for concessions."

Hydro sees the white paper as a more important catalyst for change than the ministry's measures-particularly the privatization plan for Statoil and the potential divestment of the SDFI.

Like Statoil, Hydro was asked by the government to make a proposal for how the SDFI should be split, and like Statoil, Hydro put itself forward as the best custodian of the state investment.

"We expect a large reduction in state ownership," said the Hydro official, "and a larger share of Norwegian assets being made available to private companies. One of the problems on the Norwegian continental shelf is that private companies' shares in licenses are so small. Things are happening, but more slowly than originally expected."

Statoil believes that the proposed 21% reduction in CO2 taxation is not enough to give a big boost to new field development; nor is the royalty concession, although it should increase the lifetimes of the fields in question.

A Statoil official explained that the company would like the government to look into reducing the total tax level affecting Norway's petroleum sector, particularly as the region's discoveries are becoming smaller and more marginal.

"In Statoil, we need to look into conditions and opportunities around the world," said the official, "and for Statoil in Norway, it is important to have new areas available in which to find more oil and gas."

Statoil's view is that the SDFI should be given mostly to Statoil, because it has been taking care of the state investment to date and because it has an organization in place to do this. The state firm accepts that Hydro could justifiably be awarded a share of the SDFI, because it would be important for Norway to have one or two big domestic players off Norway.

Statoil is particularly keen to keep its hands on the SDFI gas portfolio, as demand for Norwegian gas grows in Europe and the European gas market is liberalized.

The state firm took the lead in negotiating the long-term gas supply contracts to Europe's big markets and is concerned that splitting the gas assets within the SDFI would lead to the loss of a single gas strategy from the Norwegian viewpoint.

Also important is the government's proposal for the partial privatization of Statoil. The state firm suggested that privatization would be best achieved in stages, starting with 30% of the company in private hands and increasing this share gradually to 50%.

Contractors' view

Like the two big Norwegian operators, Norway's two large engineering and fabrication contractors see the government's tax measures as a small step in the right direction.

Kvaerner AS, Oslo, is doubtful whether the CO2 tax and royalty concessions will lead to a recovery in the rate of development of fields off Norway, but the company has begun to look increasingly outside the North Sea for business anyway.

In early November, Kvaerner outlined a new strategy that would see it change its focus from North Sea to international operations while at the same time changing its emphasis from large-scale fabrication to subsea and process technology projects.

Until recently, Norwegian and UK projects accounted for about 80% of Kvaerner's business. But under the new strategy, the dependence on the North Sea is expected to be lowered to 50% through the pursuit of contracts in the Gulf of Mexico and Offshore West Africa, in particular.

A Kvaerner official told OGJ, "The international part of our field development work will be handled out of Norway, but the North Sea is mature. If we want to develop as a company, we must look elsewhere.

"There are still more prospects in Norway than in the UK, but we had 80% of our activity around the North Sea and 20% outside, and now we are looking at a 50-50 split.

"We are also putting more emphasis on technology-particularly subsea and process systems-in line with perceived developments in the petroleum industry."

Rival contractor Aker Maritime AS, Oslo, also believes that nothing in the government's recent proposals will do a great deal to stimulate field development and, like Kvaerner, has changed its strategic stance.

An Aker official told OGJ that two to four Norwegian offshore projects are anticipated to be brought forward for development in 2000, including Kvitebjørn prospect, but that it would be a serious error for politicians to think that the Norwegian sector was picking up.

"Projects coming forward now are uncertain," said the official, "and they are much smaller than before. They will not save the industry, but they will help."

Aker's own survival strategy is different from Kvaerner's. In October, Aker secured ministry recognition of its competence to develop and operate marginal oil fields, although the official emphasized that the contractor would not compete with its traditional clients.

"We are looking to be a potential operator on the Norwegian shelf only," said the Aker official. "We don't plan to extend this outside Norway but to use it to give us a broader foundation for the Norwegian part of our business.

"There are several factors behind this move: notably, the tremendous structural changes that have taken place in the industry over the last 18 months. These could lead to operators and contractors taking on new roles and could open up new models for operations."

The official cited the mergers to form the supermajors Exxon Mobil Corp. and BP Amoco PLC, which are creating companies that are expected to be less interested in developing small, marginal fields (see related story, p. 30). Added to this is Norway's lack of small operators with expertise in developing marginal fields, as exist in the Gulf of Mexico and Offshore UK.

"Independents have no major foothold in Norway," said the official. "Also, most of Norway's major finds have been developed.

"It is time for a new phase where marginal fields expertise comes in. Whether it is Aker Maritime or somebody else that operates the projects is not important; what is important is to get marginal fields into production."

The official said Aker has not committed to becoming a marginal operator yet but that it is holding discussions with license holders to see whether marginal finds could be made available to Aker. This study is expected to be concluded early in the new year.

Analysts' view

Mackay Consultants Ltd., Inverness, Scotland, said that a large part of the Norwegian continental shelf remains to be explored, so the country is confident it will be heavily involved in the offshore oil and gas industry for many years to come.

The analyst said Norway is the largest offshore oil producer in the world and the third largest offshore gas producer, after the US and the UK. In 1998, Norway's output amounted to 150.5 million tonnes of oil and 43.6 billion cu m of gas.

This year, Mackay predicts Norway will produce 162.1 million tonnes of oil and forecasts that output for 2000-03 will amount to 178.9, 181.4, 180.4, and 171.2 million tonnes, respectively.

Similarly, Norway's gas output is expected to amount to 46.1 billion cu m this year, and is forecast during 2000-03 to average 53.8, 65.2, 69.6, and 73.8 billion cu m, respectively.

Norway has estimated proven reserves of 1.4 billion tonnes of oil and 1.17 trillion cu m of gas, and in 1998, oil and gas accounted for 11.8% of Norway's gross domestic product and 29.8% of exports.

"The proportions were even higher in 1997," said Mackay, "at 15.7% and 37.8%, respectively, but fell substantially last year because of low oil prices."

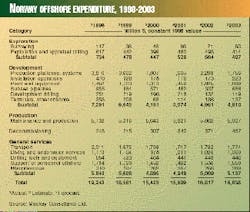

Mackay reckons that Norway accounted for 49.9% of total offshore expenditures in the North Sea in 1998, and that this share will rise to 54.4% in 2003: "Activity on the Norwegian continental shelf is expected to be relatively stable because of the number of new fields waiting to be developed" (see table, p. 26).

The analyst identified 10 fields as either coming on stream recently or being under development and due on stream in the near future: Åsgard, Balder, Heidrun North, Huldra, Jotun, Oseberg East, Oseberg South, Snorre B, Troll Phase 2, and Visund.

A further 25 developments prospects were identified: Borg, Dagny, Fram, Freja, Gjoa, Glitne, Grane, Hild, Kristin, Kvitebjørn, Lavrans, Ormen Lange, Skarv, Skirne, Snøhvit, Southern Triangle Upper Jurassic (STUJ), Sigyn, Sygna, Tambar, Tommeliten Alpha, Trestakk, Tune, Tyrihans, Vale, and Volve.

However, Wood Mackenzie Consultants Ltd., Edinburgh, describes the tax and royalty concessions that would be brought in under the government's 2000 budget program as "an incremental gesture."

Wood Mackenzie said that the proposed changes would have only an incremental effect on company revenues and that the measures for the fabrication industry were insufficient in isolation to compensate for the lack of new oil industry contracts.

"Nevertheless," said Wood Mackenzie, "the boost to cash flow on individual fields is significant in the short term, and this could encourage incremental capital investments.

"This could, in turn, help prolong field life and keep major infrastructure open-for example, Statfjord, Oseberg, and Gullfaks-for further satellite tie-ins. For Valhall, in particular, this is a positive move that would allow the waterflood project to proceed. And for Ula, the tie-in of Tambar would become more viable."

The path of the proposed budget measures will not be easy, according to Wood Mackenzie, with the weak Christian Democrat-led minority coalition government having to gain approval from opposition parties for controversial general tax increases among the raft of budget plans.

Meanwhile, the analyst identified issues under debate for the white paper as: licensing policy and, specifically, no SDFI interest in marginal licenses and a maximum of 25% in high-prospectivity blocks; the fiscal regime, including a potential reduction in Special Tax from the current level of 50%; the regulatory regime, particularly a review of gas infrastructure tariffs and a relaxation of drilling rig regulations; and Statoil privatization and future SDFI management.

"These possible future policy directions are of far greater importance than the 2000 budget proposals to the future success of the upstream sector in Norway," said Wood Mackenzie.

"However, given the recent oil price recovery, any further reductions in the level of government take-for example, in the rate of Special Tax, which is [at the] top of the agenda for the companies-could prove politically difficult.

"Should further changes be limited to nonfiscal items, there is still the scope for additional incentives for exploration and development to be made. Whether they would be considered adequate enough by the companies is another matter."