Petroleo Brasileiro SA has mapped out a battle plan for the next decade that calls for the Brazilian state petroleum company to transform itself into a multinational energy company.

The plan hinges on spending $32.9 billion to increase crude oil and gas production in Brazil significantly by 2005, improve refining-marketing efficiencies, expand domestic gas and power investments, and venture deeper into international exploration and production.

Petrobras Pres. and CEO Henri Philippe Reichstul outlined his company's strategy for the coming decade in an exclusive interview with Oil & Gas Journal.

The strategy's goal is to position Petrobras to better compete with private-sector companies that are scrambling to gain footholds in Brazil's petroleum industry-recently thrown open to competition after the state oil company's 45-year monopoly ended.

Privatization

However Petrobras positions itself to meet the new competition head on, it will still be as a largely state-owned firm, company officials say.

Reichstul insists that there are no plans to fully privatize Petrobras. However, he also says there has been no change in the government's plan to sell a 34% stake in the company's voting stock to build on the 14.77% share now held by the private sector.

Sale of a 34% stake would still leave the Brazilian federal government with a controlling stake of 50% plus 1 share. According to Reichstul, Petrobras will not undertake a strategic sale of the stock in order to enter into a partnership, but will sell it on the open market.

Even if ownership of Petrobras remains in the control of government hands, some of the state company's assets will not, according to the National Petroleum Agency (ANP).

David Zylbersztajn, ANP executive director, says Petrobras will sell some of its refineries and pipelines. He said that limiting Petrobras's participation in the refining and transportation of petroleum by selling some of these assets is an urgent priority and part of the government's drive to make Brazil's oil sector more competitive. According to Zylbersztajn, the average fee for transporting oil products charged in the US is about one third lower than it is in Brazil.

"There is no doubt that Petrobras's monopoly in the transportation of oil products and its refinery monopoly are not good for the Brazilian economy," he said. Of Brazil's 13 refineries, Petrobras owns 11.

Zylbersztajn criticized oil products distributors for not pressuring ANP about what he called "abusive" pricing practices by Petrobras.

He contends that Brazilian law has established that when there is a conflict regarding fees for transporting products, a distributor can appeal to the ANP so that the agency can resolve the dispute.

Brazil has 4,000 km of pipelines, some with idle capacity, that are mostly operated by BR Distribuidora, a Petrobras marketing subsidiary.

Strategy

The strategic plan to turn Petrobras into a global energy company is intended to prepare the company to face competition in newly deregulated environment, Reichstul said.

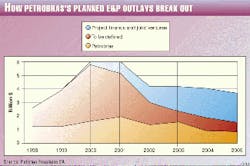

The lion's share (68%) of the 5-year, $32.9 billion capital budget will be invested in oil and gas E&P. The remaining outlays break out as: refining-marketing and transportation, 17%; petrochemicals and natural gas, 10%; and distribution, 5%.

According to Reichstul, as an energy company, Petrobras will focus on its core business but will move into gas distribution and electric power and thus seek to increase shareholder value by improving return on capital employed.

Its target is a 12% return on net equity. By 2010, the company expects to be positioned as a regional major in Latin America and to have significantly raised its profile abroad through international subsidiary Braspetro.

"To become an energy company means greater involvement in the natural gas and electricity sectors," said Reichstul. He pointed out that Petrobras has already started going in this direction by buying minority stakes in gas-fired thermoelectric power plants.

The main points of Petrobras's new strategic plan are to:

- Boost gross annual revenues to $35 billion by 2005, up from an estimated $20-22 billion in 1999. To achieve this target, Petrobras intends to invest $32.9 billion, of which 70% will come from the company's own resources and the rest through project finance. Petrobras had revenues of $22.3 billion in 1998, with net income of $1.2 billion.

- Lower oil lifting costs to $2.80/ bbl from the current $5.10/bbl. "We are projecting that, in year 2000, crude oil production will rise to 1.3 million b/d and, by 2005, it will hit 1.8 million b/d," said Reichstul. "This should mean near self-sufficiency (of crude oil) for Brazil." In 1999, Petrobras's crude oil production has averaged 1.1 million b/d. After consulting with international and Brazilian specialists, Petrobras values its 8.8 billion bbl of proven oil reserves at an estimated $30-32 billion.

- Increase refining capacity to 1.8 million b/d by 2005 from 1.5 million b/d today. In addition, "Petrobras's refineries will be adapted to process a greater volume of domestically produced heavy crude oil to diminish dependency on imported oil, considering that the crude oil from Campos basin, Brazil's most prolific oil province, is mostly heavy," said Reichstul.

- Expand its downstream assets outside Brazil. The company intends to work with the private sector in terms of refining abroad. Refining costs are expected to drop to $0.80/bbl from the current $1.08/bbl.

- Reduce general and administrative costs from the current level of 8.8% of total operating costs to 5.2% by 2005; that will result in savings of $270 million during 2000-05.

- Significantly increase natural gas production, to 60 million cu m/day (MMcmd) in 2005 from the current level of 34 MMcmd, said Reichstul. Petrobras expects national gas consumption to increase by 35%/year on average, to reach 73 MMcmd in 2005. Additional gas supplies will come via imports: 30 MMcmd from Bolivia through the Bolivia-Brazil pipeline; 12 MMcmd from Argentina via the Uru- guaiana-Porto Alegre gas pipeline in southern Brazil; and as LNG from other countries, Reichstul said.

Financing

Petrobras will finance part of its ambitious capital spending program for 2000-05 with revenues from oil and gas production undertaken on its own and through joint ventures, plus external borrowing, Reichstul said: "Seventy percent of the investments will come from Petrobras's own resources and conventional financing, while 20% will come from project financing. Where [the remaining] 10% of the money will come from is still to be defined (Fig. 1)."

Reichstul acknowledged that Petrobras suffers under certain constraints when competing for capital with private companies because it is a state-owned company.

"The government is our major shareholder; thus, it has the right to cut Petrobras's investments, as it has done," said Reichstul. "But certain restrictions can be compensated for by project financing and by balance sheet structures that do not get into these accounts. Of course, it is different from a private sector company, but I think it won't affect our competitiveness dramatically."

To achieve its spending goals, Petrobras is seeking project financing adding up to more than $17 billion, Reichstul said.

"We are negotiating a big package of $4.9 billion that involves Japan's Export-Import bank, trading companies, Japanese commercial banks, and some other international banks," Reichstul said. "We have been informed that the Eximbank's board of directors approved a portion of the $800 million for (the) Cabiunas project."

Japan's Eximbank approved $430 million as part of project financing for Petrobras's Cabiunas project, which calls for producing associated gas from the offshore Campos basin and transporting the gas via pipeline to treating and processing plants in coastal cities in Rio de Janeiro and Espirito Santo states. The project also represents an effort to eliminate gas flaring in the basin; about 35% of Petrobras's gas production is vented or flared, Reichstul said. Currently, natural gas accounts for only 2.5% of Brazil's energy mix, compared with almost 50% in neighboring Argentina, leaving Petrobras's extensive gas reserves largely underutilized.

"This approval from the Eximbank makes me optimistic that the total $800 million project finance package for increasing natural gas production will be approved by Japanese commercial banks, Japan's Ministry of International Trade and Industry, some other international banks, and (Brazil's) National Economic and Social Development Bank," said Reichstul.

Restructuring, new competition

The CEO also noted that the program presents daunting challenges, namely in changing the company's organizational model to face a newly competitive market after a 45-year monopoly.

Restructuring has already started with the creation of an administrative council-staffed by prominent private sector representatives and chaired by Mines and Energy Minister Rodolpho Tourinho-to whom Reichstul must report. Before Reichstul's appointment last March, the company was overseen by a board of directors-all Petrobras employees-and was headed by the company president.

Petrobras is positioning itself to compete with a whole new roster of players on Brazil's petroleum scene. Ten multinational companies purchased exploration acreage auctioned by ANP last June, and that is just a first step (see related story, p. 30).

ANP estimates that the petroleum industry will invest $40 billion in Brazil over the next 5 years, generating 150,000 jobs.

Petrobras's strategic plan also sees the competitive environment heating up in refining, transportation, and retail marketing because of the introduction of imports in these sectors by private companies-something forbidden during the monopoly era.

Price competition will take place in the retail marketing sector with the emergence of entirely new categories of participants. Petrobras's target is to reach a minimum return of 15% on net equity in retail marketing. Historically, Brazilian oil product prices have been subsidized and heavily taxed, unlike the situation in the US, Reichstul noted.

Petrobras expects that competition in E&P will depend upon public tenders, but oil production will not make significant gains until 2005, given the time needed to develop acreage under concessions to Petrobras and private companies. This is also the case with natural gas, except that the development (and transportation) window affects projects where Petrobras is not a participant.

All told, Petrobras has undertaken joint oil exploration and production in 21 partnership agreements with private companies that cover $2.6 billion in investments. In addition, Petrobras won E&P concessions in 5 of the 12 areas auctioned by ANP.

The company paid $8.8 million in bonus bids for these blocks; it was the sole purchaser of a block in the Campos basin off Rio de Janeiro and will operate with foreign partners in four other blocks.

New gas, power role

Reichstul characterizes the "new" Petrobras as an integrated energy company that, in addition to focusing on oil and gas, will also become a major player in the power sector.

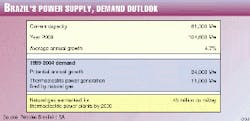

Petrobras sees a need to expand Brazil's installed electric power capacity by more than 40,000 Mw in the next 5-6 years, up from the current level of 61,300 Mw, in order to avoid blackouts (Fig. 2). Thermoelectric power generation fired by natural gas is expected to add 11,000 Mw of capacity to the power grid by 2004. For this purpose, natural gas supplies earmarked for thermoelectric power plants are expected to reach 45 MMcmd by 2005.

By 2005, Petrobras expects its gas unit to be selling 70 MMcmd of gas in Brazil and 12 MMcmd abroad, with a return on net equity of 12%. Most of this gas will be imported from Bolivia and Argentina.

"We are working on some 20 gas-fired thermoelectric plants either in our refineries or getting into minority shareholdings with other groups, and I think that, within the next 6 months, we will see a lot of progress on that," Reichstul said.

Oil production growth

Reichstul contends that Petrobras is in a "peculiar" situation: it is working in a market that consumes more oil products than Petrobras can supply, regardless of the state of the nation's economy.

Brazil currently consumes 1.75 million b/d of crude oil, and Petrobras produces only 1.1 million b/d of oil and refines 1.55 million b/d of that total, so the rest must be imported.

However, he predicts that, by 2005, Petrobras's production of crude oil and NGL will exceed 2 million b/d, of which 1.85 million b/d will be produced in Brazil and about 170,000 b/d will be produced abroad.

"To develop our strategic plan, we used as a medium-term price $15/bbl Brent for the 2000-05 period," said Reichstul, "and I think we have the reserves, so basically most of that plan involves investments to put (Petrobras's worldwide) proven reserves of 8.8 billion bbl of oil into production."

The company forecasts that these reserves will increase to 13 billion bbl by 2005, of which 90% will be located in Brazil.

Refining growth

As its crude oil productive capacity is set to increase, Petrobras aims to hike its refining capacity as well, to 2.1 million b/d in Brazil and 300,000 b/d abroad by 2005. Another target in this sector is to reduce the average refinery operating cost by 20% to less than $0.80/bbl and secure a return of at least 10% on net equity in refining, transportation, and marketing of refined products.

"Petrobras is not planning to build new refineries. There are some projects being discussed among private companies to build two or three new refineries, to avoid the importation of refined products," said Reichstul.

Instead, Petrobras plans to invest about $5 billion to adapt its refineries to process a larger volume of domestic oil and diminish dependence on imports. By 2003, Petrobras's domestic refineries are expected to have a processing capacity of 1.8 million b/d.

"What kind of market we will find then will depend on the growth of the Brazilian economy," said Reichstul.

Petrobras has a price and demand elasticity outlook that is very positive, he added:"Our strategic plan forecasts a 4% annual growth in domestic demand for oil products, relative to a 3.9% (annual) growth in GDP for the next 6 years, on average," he said. "This year will probably close with 0.5% GDP growth-which is a surprise for most people-and a rather low inflation of 7% on the year."

The Petrobras CEO said that the government favors efforts to transform Petrobras into a multinational corporation. As part of this strategy, Petrobras forecasts that 86% of the $32.9 billion will be invested in Brazil and 14% abroad through Braspetro, the company's international subsidiary.

Accounting changes

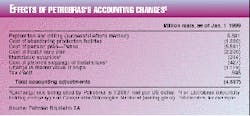

To make the company more competitive in world markets, Petrobras's administrative council recently approved accounting adjustments that will give a clearer picture of the company's capital structure and of the added shareholder value it is creating.

Petrobras has hired PricewaterhouseCoopers and some other consultants to reconcile all of its accounting procedures in accordance with US Generally Accepted Accounting Principles (GAAP) and expects this process will be completed by the end of the year. Reichstul hopes that, as a result, Petrobras will be able to register Levels 2 and 3 American Depositary Receipts (ADRs) with the US Securities and Exchange Commission during the first quarter-or at least the first half-of next year. At present, Petrobras can only trade over-the-counter Level 1 ADRs.

The new accounting practices will increase Petrobras's attractivness to international investors, in part because many investors have been unable to make reasonable comparisons of Petrobras results with those of other companies, said Petrobras Finance Director Ronnie Vaz Moreira. "This will allow us to give more information about our company, increase transparency for investors, and help the value of our shares to rise," Moreira said. "There have been (some doubts expressed) about the value of our company."

When Moreira disclosed the accounting changes, he acknowledged that Petrobras previously had followed a conservative approach: "Exploration and drilling costs were accounted as expenses by Petrobras, independent of the commercial results of the associated projects."

According to Moreira, alterations to accounting procedures included those for: exploration and drilling costs; provisions for well abandonment costs; the company's Petros pension plan; and adjustments related to the company's installations, losses of marine assets, and tax credits (Table 2).

As a result of the alterations to Petrobras's accounting practices, the company suffered a first-half loss of 1.032 billion reals, Moreira said.

"Petrobras's decision was courageous, and the alteration in the Petros pension plan was an old request from the market," Joao Carlos Franca de Luca, president of Repsol-YPF SA's Brazilian unit, told OGJ. In the process, Petrobras recognized a huge 5.591 billion-real deficit in pension payments, plus 2.230 billion reals in health-care benefit plans.

Future payments due to Petros, with regard to responsibilities to retirees, will now be recognized as liabilities to be adjusted by annual actuarial revisions, Petrobras said.

Jean Paul Prates, director of Expetro International, a prominent Brazilian oil and gas consulting group, told OGJ that changes were needed to clear up doubts that made it harder for the company to sell debt in international markets.

With the new accounting treatment, Petrobras foresees capitalization of expenses in fields commercially producing oil and gas (with a calculation based on the price of the hydrocarbons as of Dec. 31, 1998) prorated to the start of field operations (an application of the "successful efforts" method used by other major oil companies).

Also, provisions for listing expenses will be considered with regards to future abandonment of production facilities. The depletion rate of the related hydrocarbon assets will be calculated according to the ratio between the volume of monthly production and the proven and developed reserves in each producing field.

Under the new accounting regime, expenses associated with geophysical, geological, and other exploration costs for unsuccessful wells, as well as expenses pertaining to technological research and development, will continue to be recognized within the fiscal year in which they are incurred.

The changes also include expenses related to periodic preventive maintenance of industrial units, such as refineries and process vessels, which will be provided for in the period that preceded the plant maintenance.

Petrobras's administrative council slashed almost a quarter of the company's shareholder equity with a decision to expose previously hidden obligations, but that has paved the way for debt and equity sales, say local analysts.

Petrobras's shareholder equity, the value of its assets minus liabilities, fell by 4.83 billion reals ($2.4 billion) to 17.3 billion reals by the end of last year as a result of the accounting changes.

The adaptation to GAAP standards, however, should help prospective investors to accurately assess the value of Petrobras shares ahead of the government's planned sale of the company's shares.

In that regard, Petrobras officials expect the move will improve the company's image with investors, bolstering their trust in its ability to face competition from major foreign oil companies after the company lost a 45-year monopoly over almost all segments of Brazil's petroleum sector.

Henri Philippe Reichstul

Petrobras President,

CEO

The strategic plan to turn Petrobras into a global energy company is intended to prepare the company to face competition in newly deregulated environment.