Brazil Round 2 a critical new step in Brazilian E&P sector opening

On Sept. 30, 1999, David Zylbersztajn, Director General of the Agência Nacional do Petróleo (ANP), announced the formal opening of the second round of exploration licensing, known as Brazil Round 2. This round follows immediately upon the signature of concession agreements for Brazil Round 1 and marks the next significant step in the opening of Brazil's petroleum sector.

Key features of Brazil Round 2 include: the offer of 23 blocks (13 offshore, 10 onshore), all of which received nominations; opportunities ranging from exploratory frontiers to mature basins; special provisions for small players in mature basins; no mandatory drilling in the first exploration period; review of the royalty relief structure; import duty relief extended from 2001 to 2005; authorization of dollar accounts.

Round 2 features

In Round 2, the 23 blocks being offered reflect industry nominations, including certain of the "blue blocks" recently relinquished by Petroleos Brasileiro SA (Petrobras).

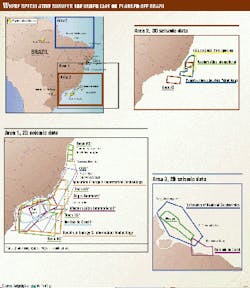

Thirteen of the blocks are in six offshore basins, including the prolific Campos and Santos basins (see map on p. 32). In the Santos basin, the blocks are in the vicinity of both the areas that were vigorously contested in Round 1 and where Petrobras has recently reported discovery of a giant oil field. This discovery is significant not only for its size (reported as 600-700 million bbl), but also as being the first giant light oil discovery in the basin, demonstrating the deepwater potential of the Santos basin, compared with its more illustrious neighbor to the north. Petrobras's Caravela field (light oil) has been on stream for several years, and there are a number of other small development projects in the Santos basin under evaluation.

Ten of the blocks are onshore, including in mature basins such as Potiguar (the second largest producer, after the Campos basin), Rec

No mandatory drilling will be required within the minimum work program in the first exploration period, although relinquishment and more-significant expenditure obligations will apply for subsequent periods within the exploration phase. In mature basins, a first period of technical evaluation is available before the concessionaires commit to any significant expenses.

Exploration opportunities

The range of opportunities on offer is considerable, with most of the geological provinces within Brazil being represented. Whether a company's appetite is for Paleozoic light oil and gas plays in Paraná and Amazonas (pre-rift megasequence); the Cretaceous syn-rift megasequence of Recôncavo, Sergipe-Alagoas, and Potiguar; or the drift megasequence from Pará-Maranhão to Camamu-Almada, Campos, and Santos, there is something for everyone in Brazil Round 2. In very general terms, the blocks offered occur in three principal basinal settings: onshore rift, offshore rift to passive margin, and passive/wrench margin. The major plays associated with each of these settings may be summarized as follows:

- Onshore rift plays. These include the Paleozoic rift section of Amazonas and Paraná as well as the Cretaceous "failed" rifts of the Atlantic margin. The Paraná and Amazon basins both contain a proven petroleum system, with gas and light oil tested from Devono-Carboniferous/Permian sands sourced by interbedded coals and shales in fault-dip closures beneath, in the case of the Paraná basin, Jurassic-Cretaceous flood basalts. The Cretaceous rift sections of Recôncavo, Sergipe-Alagoas, and Potiguar basins offer numerous fluvio-deltaic sand plays, with reservoir providence from active rift shoulders and/or resedimentation along axial trends. Rich, oil-prone, lacustrine source rocks are interbedded or underlie the principal reservoirs in all of these basins and were largely within the oil generation window after trap formation during the late Cretaceous and Tertiary.

- Offshore rift to passive margin. The oil-prone source rocks of the early to mid-Cretaceous failed rifts are also present in the passive margin basins of Brazil's Atlantic coast, with oil and light gas migrating from kitchen areas beneath the Aptian salt through "windows" produced by salt withdrawal associated with listric faulting. Numerous plays are proven in the early to late drift section, ranging from shallow marine sand/carbonate reservoirs within salt swell traps of shelfal Sergipe-Alagoas, Camamu-Almada, Campos, and Santos basins to the giant, deepwater turbidite fields of the Campos and, most recently, Santos basins.

- Passive/wrench margin. Brazil's northern coastal basins (including the Potiguar basin) display elements of wrench tectonics associated with the major transcurrent faults in this region. As a result, the extremely thick drift megasequence present in the Pará-Maranhão basin contains marine carbonate and sand plays in both listric rollover and transpressive structures. At least some of these structures may also contain elements of shale diapirism; salt appears to be absent in this region. Light oil and gas have been tested from the drift megasequence.

While some parts of some of these basins have seen significant drilling, in no way can Brazil be considered a mature play. Since exploration first started in the country, there have been only about 17,000 exploration and development wells drilled in this huge country-compared with double that number in Argentina and Venezuela, and a staggering hundredfold more in the US. Plenty of opportunity still remains.

Progress cited

Brazil has come a long way in a short time. It was on Aug. 6, 1997, that Law 9478 (the Petroleum Law) came into effect. This law commenced the process of ending Petrobras's historic monopoly over most of the petroleum sector and created the ANP to administer and oversee the introduction of competition. ANP did not start functioning until Jan. 14, 1998.

One of ANP's first acts, in regards to the upstream sector, was taking control of the country's acreage portfolio. A concession agreement needed to be written, a new fiscal regime needed to be designed, and 6.4 million sq km of sedimentary basins needed to be licensed.

First, Petrobras could apply for blocks where it had performed exploration activities and had shown the financial means to be able to test prospects within 3 years. After significant discussion as to the areas to be included, 1 year after the signing of the Petroleum Law, ANP and Petrobras signed agreements covering 397 exploration and production licenses. Petrobras was given the right to carry out agreed work programs and establish the commercial potential of its exploration licenses until August 2001 or return them to ANP. These blocks would then be put into the pool for later exploration licensing.

Brazil Round 1

The remaining acreage was then available for licensing under competitive tender. In December 1998, Brazil Round 1 was announced and included 27 blocks in eight basins. Hardly an auspicious time, with oil prices nudging 30-year lows in real terms.

Furthermore, concerns were expressed by the oil industry over certain clauses in the concession agreement and the fiscal terms-which, while straightforward in concept, were untested in implementation. In addition, all those "little" problems that come with a major transition from a "state" to a "private" sector regime were being raised.

While there was nothing ANP could do about oil prices, it did take the view that prices have always proved to be cyclical, that exploration is a long-term business, and that the results of Round 1 would unfold only during the 2000-05 window. Thus, the agency determined that its best course of action should be to treat the round as just one step in a much longer-term business; continue with the offering in the most professional manner, and seek to address where possible the other concerns raised by the industry.

The issues raised by the industry were treated in a number of ways. As part of the Round 1 process, a 2-day conference was organized with all participating companies where they could discuss with the ANP all the legal, fiscal, and technical issues that were causing them concern. This resulted in a large number of submissions on proposed contractual rewording. The ANP reviewed these and was able to make modifications in regards to some and provide clarifications in regards to others.

Furthermore, Brazil Round 1 was the first "virtual" licensing round anywhere, using the internet as a primary means of communication with-and receiving input from-the participating companies. This allowed completely up-to-date information to be made available to all and improve dialogue across the course of the round.

Fiscal terms

On the fiscal side, concerns were raised on several fronts: royalties, the Special Participation rule, indirect taxation, import duties, and accounting.

The royalty for all Round 1 blocks had been set at 10%, a level the industry claimed was too high under prevailing conditions. While ANP looked at various forms of royalty relief and remained open to renegotiating these levels if future discoveries were proven uneconomical, it proved impossible to introduce any changes during Round 1. However, the issue was not discarded, and various forms of royalty relief linked to project economics are being actively considered as a part of the Round 2 process.

Many of the concerns expressed on Special Participation (SP)-which is effectively an added tax for bigger fields-were based on a poor understanding of the rules. Some press reports suggested very high levels of government take, making the terms subeconomic. Although SP does, indeed, provide for rates of up to 40% on the very large fields, its rate structure is progressive, preserving the lower rates applicable to the lower bands of production. Thus, for a 100,000 bo/d field-substantial by any measure-in the deepwater Campos or Santos basins, for example, the average rate of SP to apply would, in fact, be only around 11.5% of the net field revenue (Fig. 1). The rules established for the calculation of SP make this operate in similar fashion to the special petroleum taxes (PRT, SPT) in the UK or Norway.

A third area where a lot of concern was expressed was in relation to import duties and the application of indirect taxes. While, for the most part, these would be creditable or deductible against other taxes to be paid in the event of successful production, the impact was felt both as a result of the time-value-of-money issue, and especially for those companies not successful in the exploration phase. As a result, Decree 2889 introduced the Special Temporary Admission Regime (STAR), providing relief from import duties and indirect taxes for certain classes of equipment needed for exploration and development, if they entered the country before the end of 2001. Since the completion of Round 1, the STAR regime was extended, through Decree 3161, to the end of 2005 and to the spare parts for the equipment covered by STAR. The whole issue of indirect taxation and these import duties is one aspect of the reforms currently being considered and debated in Brazil. While nothing is yet resolved in regards to this issue, the thrust of the temporary reliefs-and preferred reform-is to move taxation from investment to profitability.

Another industry concern was the issue of holding their E&P accounts in US dollars. The Brazilian Central Bank has recently issued an ordinance giving an important exception to the oil industry, which now has the right to hold US-dollar accounts in Brazil.

Future licensing rounds

Round 1 was just one step along the way of establishing a regular licensing process to the industry. The medium-term objective is to have annual licensing of open and recycled acreage, including industry-nominated blocks. For this process to work, data availability is crucial. To assist this, ANP has established an open policy of granting licenses for speculative seismic surveys.

The industry response to this policy has been substantial, and currently there are 300,000 km of 2D and 70,000 sq km of 3D seismic being acquired by 12 geophysical contractors, which corresponds to a quarter of all 2D and one-and-a-half times all the 3D seismic ever acquired in Brazil. By the end of October, an unprecedented 16 vessels were acquiring data off Brazil, a very high proportion of the world's fleet (Fig. 2). This effort is likely to pay large dividends in forthcoming rounds. To spur onshore seismic data acquisition, ANP also will allow spec onshore 2D seismic data to be counted towards the fulfillment of the minimum work obligations (in Round 1, only 3D seismic data could count).

While much of the focus has been on the upstream and licensing areas, ANP has not neglected other details in its efforts to introduce competition. Trunklines are now subject to open access-common carriage regulations, ensuring that firms with developments in areas that cannot sustain their own infrastructure will not be at a disadvantage.

Furthermore, gas has an ever-increasing role to play in Brazil's energy mix. While much of the increase is being met in the shorter term by imports from Bolivia-and possibly northern Argentina as well-this reflects the limited amounts of nonassociated gas that have been found in Brazil outside the Amazon region, rather than demand. With the enhanced pipeline access and competitive prices to producers, opportunities are also seen for gas exploration and development in the country. ANP is committed to developing a vibrant and competitive oil and gas industry in Brazil.

Brazil Round 1 demonstrated this commitment, and while some aspects of that process have been revised for Round 2, others have not changed-namely, ANP's commitment to keeping to the schedule, maintaining an open dialogue with the industry, and adhering to complete transparency in the process.

Acknowledgment

The author thanks Bob George and John Weston of Gaffney, Cline & Associates for assistance in the preparation of this article.

The Author

Ivan de Araújo Simões Filho holds a BS degree in geology from the Universit

Correction

In the article by Kairat Z. Sydykov and Mark B. Korostyshevsky, "Prestack Depth Migration Helps Seismic Imaging In Salt-Prone Pre-Caspian Basin" (OGJ, Oct. 25, 1999, p. 73), a number of figures were inadvertently mislabeled. For Figs. 2d, 4b, 5b, 6b, and 7b, the heading for each should read: Prestack time migration, not Prestack depth migration. In addition, in Figs 2a, 2c, and 2d the value on the left axis should be in km, not sec.