OGJ Newsletter

OPEC compliance with pledged oil production cuts remains high at 87% for October, according to the latest IEA data. "OPEC compliance has not dropped as much as some believed, and OECD stocks are indeed shrinking, so the turning point for prices has probably not come yet," said IEA.

The news has bolstered oil markets, contributing to a rise in crude oil futures prices, which were trading in London and New York at about $24.50/bbl as OGJ went to press. On the IPE in London, Brent for December delivery settled at $24.49/bbl on Nov. 10, up 36¢ for the day and a rise of $1.66 from close of trading on Nov. 5. In New York on the morning of Nov. 11, NYMEX crude for December delivery was trading at $24.47, a rise of $1.47 from Nov. 5.

Crude prices had retreated in early October on rumors of a significant increase in OPEC production, but IEA says its latest report has ruled this out. The agency qualified October's OPEC output rise as "modest," noting that the majority of the increase came from non-OPEC suppliers. Global oil production averaged 74.1 million b/d in October, a jump of 730,000 b/d vs. September, about 620,000 b/d of which is attributed to non-OPEC producers.

To replace the OPEC supplies being withdrawn from the market, oil stocks in OECD countries were reduced by 1.8 million b/d during September, an indication that the awaited drawdown has begun. Crude demand in excess of supply had been satisfied from non-OECD stocks in recent months, and that trend changed in the third quarter, says IEA. The agency's estimates now show that the OECD stock-build has been halted, and about 300,000 b/d has been drawn from inventories in the third quarter.

IEA also says oil demand is rebounding, with the global average expected to rise from 75 million b/d in the second quarter to 77 million b/d in the fourth quarter, an increase of 2.4%, or 1.8 million b/d, over fourth quarter 1998. For all of 1999, demand growth should be 1.1 million b/d, or 1.5%, and average demand should reach 75.3 million b/d. IEA expects demand to average 78 million b/d in first quarter 2000 and 77.1 million b/d for 2000 as a whole. This is an increase of 2.4%, or 1.8 million b/d, vs. 1999. About half of this growth would come from Asia demand and the rest from North America, says IEA.

Beginning Nov. 16, the IPE will publish a new price indicator it hopes will become a benchmark for the oil industry. Devised at the request of traders, the indicator will be a trade-weighted average for each month of the Brent crude oil futures contract. The trade-weighted average would be calculated by dividing the value of business transacted for each contract month by the total volume of trade at the end of each day; it will be published on the IPE web site.

The UN Security Council has deferred a proposal by Sec. Gen. Kofi Annan that Iraq be allowed to double to $600 million the money it can spend to repair and further develop its long-neglected oil production industry.

The proposal will be debated next month when the Security Council reviews whether to extend the oil-for-aid program, which allows Iraq to sell a limited quantity of oil to pay for food and medical supplies.

The Exxon-Mobil merger has received further approvals, with Canada's federal Competition Bureau approving a takeover involving the Canadian units of the two firms. The bureau said it will not challenge the merger after finding that it would not substantially lessen competition in Canada.

Imperial Oil, owned 70% by Exxon, would merge with Mobil Oil Canada, thus enhancing Imperial's position in Canada's oil sector. The combined units would have an asset value of about $22 billion (Can.).

A bureau spokesman said the agency analyzed individual markets and concluded there was not a basis for challenging the transaction. Mobil Canada is a major natural gas producer with significant interests in East Coast offshore oil and gas developments such as Hibernia, Terra Nova, and the Sable Offshore Energy Project. Imperial is Canada's largest oil and gas producer and refiner, holding significant interests in oilsands and heavy oil operations in Alberta.

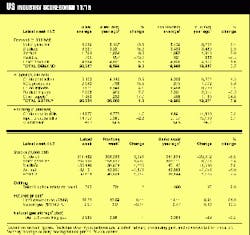

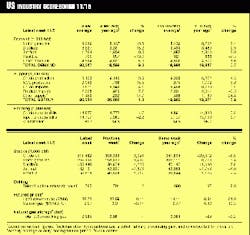

Despite falling oil and gas prices in 1998, US drilling expenditures for the year were at the highest level since 1985, says API. The 1998 Joint Association Survey on Drilling Costs says the US industry spent $17.6 billion to drill and equip wells last year, up 9.6% from the 1997 figure of $16 billion. Natural gas targets dominated US drilling, and there was an emphasis on deep to ultradeep (10,000 to more than 20,000 ft) development objectives, mainly offshore, which inflated the average cost per well.

In a move that could launch interests in a major play area, BG International claims an historic deal in the Eastern Mediterranean area with the signature of a contract with the Palestine National Authority to explore for gas off the Gaza Strip. This first license awarded by the PNA covers three phases of activity, said BG: seismic data acquisition and exploration drilling, offshore development, and gas delivery to local onshore markets.

At least two exploration wells are to be drilled over the next 18 months. BG said that, depending on successful exploration and market development, together with partner Consolidated Contractors Co., it could spend up to $500 million in establishing a Palestinian gas industry.

BG is currently building a portfolio of gas exploration, production, and distribution projects in the region. It has had a string of exploration successes in Egypt and plans to establish a gas industry in Israel (OGJ, Nov. 1, 1999, p. 34).

A team of French and Australian scientists has taken a closer look at what it now believes to be the world's largest natural gas deposit: a methane hydrates field off the coast of New Caledonia. The deposit was studied by the research vessel L'Atalante as part of a joint study of the Australian Geological Survey Organization (AGSO) and the French Research Institute for the Exploitation of the Sea. The team says the hydrates field measures 80,000 sq km, much larger than thought when they discovered it in May 1998.

The field lies 240 km off the western coast of New Calendonia and about 600 m below the seabed. The scientists believe the gas comes from an oil deposit several hundred meters deeper. "We must ascertain if [the gas hydrates] are derived from a deep-seated thermogenic or shallow biogenic source," said AGSO in the October 1999 issue of Ausgeo News. "If the former applies, this would be the first real proof that conventional hydrocarbons are being generated on the Lord Howe Rise, opening it up as a petroleum exploration target." Water depths on the rise range from 1,000 m to 4,000 m.

As part of a package to spur investment in Britain, UK Chancellor Gordon Brown announced that the climate-change levy on businesses will be reduced, following intensive lobbying by industrial energy users. In a Nov. 9 speech before parliament, Brown said, "Our original proposal cut carbon environmental pollution by 2010 by 1.5 million tonnes/year. Our consultation has shown that we can cut environmental pollution even further by 2010-by a total of over 2 million tonnes/year-and at the same time cut the levy from £1.7 billion to £1 billion."

Renewable energy sources and combined heat and power schemes will be exempt from the levy, while industry will see its levy rate cut to 0.15 pence/kw-hr from 0.21 pence/kw-hr. "And there will now be an 80% discount to energy-intensive sectors signing energy efficiency agreements," added Brown. "Taken together, these changes approach a 90% discount on the levy published at [the previous] budget time in return for agreed industry action to cut emissions."

Pakistan's new military government has appointed Usman Amin Uddin as Minister of Petroleum and Natural Resources.

A graduate of Cambridge University, Usman was previously chief executive of Pakistan's Attock Refinery Ltd. and Pakistan Oil Field; most recently, he advised Premier Oil and Royal Dutch/Shell regarding their Pakistan operations.

Transneft has been denied funding from Russia's Sberbank and the European Bank for Reconstruction & Development for construction of a pipeline segment that would reroute the Baku-Novorossiisk pipeline around Chechnya, it was announced at OGJ presstime. Last month, Transneft announced prematurely that the banks had agreed to provide $120 million in funding for the project, designed to enhance security on the pipeline, which has been repeatedly tapped by crude oil thieves, prompting numerous shutdowns (see related story, p. 25).

Despite lack of funding, Transneft says construction of the pipeline has begun and is expected to take 6 months. The line will bypass northern Chechnya, transporting Azeri oil from the Caspian Sea.