OGJ Newsletter

BP Amoco's proposed purchase of ARCO may have hit a major snag amid unconfirmed press reports last week that federal antitrust enforcers threatened to sue to block the deal for fear that the combine would translate into elevated gasoline prices in California.

In addition to increased West Coast refining capacity and ownership of more retail outlets, the acquisition would give BP Amoco upstream dominance in Alaska, with controlling interest of 70% of North Slope oil production and more than 70% of the trans-Alaska pipeline (OGJ, Nov. 1, 1999, p. 27).

The threat of the suit came close on the heels of Alaska Gov. Tony Knowles asking US federal regulators to block the deal if BP Amoco didn't reverse a filing that would have forced the Federal Trade Commission to deliver a speedier, 20-day decision.

"I regard this action by the companies to preclude negotiation with federal authorities at this stage to be inconsistent with both the spirit and content of the negotiations between Alaska and BP Amoco," said Knowles.

As OGJ went to press, BP Amoco had conceded to provide 20 days' notice to the state and FTC before closing the ARCO deal.

The privatization of state-owned petroleum assets continues, with deals being struck in varied nations.

Williams has reached a deal with Lithuania on acquisition of a stake in state oil company Mazeikiu Nafta. Williams will purchase a 33% interest in the company for $150 million and assume operational control of a 263,000 b/d refinery and a related pipeline and crude oil terminal. The purchase price will be invested in the refinery, where a $650 million modernization project is planned. The Lithuanian government is to invest $350 million in the upgrade, which was a major sticking point in the negotiations.

The final deal prompted the resignation of three key Lithuanian officials: Prime Minister Rolandas Paksas and the ministers of economy and finance. The politicians believed the $350 million expense would result in a financial crisis for the Baltic nation. Paksas served only 5 months as Prime Minister; his predecessor resigned earlier this year as a result of displeasure over the deal with Williams.

Taiwan's Executive Yuan (cabinet) and Securities and Futures Commission (SFC) have given their approval for foreign investment in the country's gas supply business.

Taiwan has long prohibited foreign ownership in public utilities. But under the terms of the new regulations, foreign companies will be permitted to own stakes as large as 50% in gas supply companies listed on either the Taiwan Stock Exchange or on Taiwan's over-the-counter market. Three such firms are listed on the Taiwan Exchange: Taipei Great Gas, Hsin Hsin Natural Gas, and Shin Hai Gas Corp. The shares of three others-Shin Shiung Gas Co., Shin Kao Gas Co., and Hsin Tai Gas Co.-are traded over-the-counter.

Meanwhile, Nigeria has initiated the first phase of a plan to sell by yearend its shares in 10 publicly traded firms active in oil and gas, banking, and cement, according to the executive secretary of the newly created Nigerian Investment Promotion Commission, Baba Gujbawu. Included in the list of companies is African Petroleum and National Oil & Chemical Co.

Continuing unrest in Nigeria's Niger Delta region is causing more problems for international petroleum firms operating there.

Shell has declared force majeure on its Bonny terminal after three of the Niger Delta flow stations that feed it were forced to shut down as a result of community unrest. The move comes only 2 weeks after Shell extended the same declaration for its Forcados terminal.

Shell's most recent shut-ins cut production by about 100,000 b/d.

No time frame was set for the Bonny force majeure, and Shell is reportedly in discussions with the communities involved.

The disturbance is the latest in a series of conflicts in the area.

Malaysia and Thailand are at last moving forward with their plan to develop gas reserves in the Joint Development Area (JDA) on the two countries' continental shelves.

The countries have inked an agreement to invest nearly $1.04 billion to exploit gas resources in the Gulf of Thailand JDA. State firms Petronas and the Petroleum Authority of Thailand (PTT) will spend $137.5 million each on the project, which entails laying a 352-km, 34-in. pipeline from Block A-18 to Kedah province in northern Malaysia. The partners will jointly seek loans for the remaining capital.

Production from Block A-18 is being developed by Carigali-Triton Operating Co., which comprises Petronas-Cariga* (50%), Triton Energy (25%), and ARCO (25%).

Meanwhile, Petronas and PTT have signed a gas supply agreement for the project. The state firms will purchase gas from Block A-18 from Petronas-Carigali, Triton Oil Co. of Thailand (a 50-50 joint venture of Triton and ARCO), and the Malaysia-Thailand Joint Authority. Triton expects the first phase of development to produce about one fourth of the block's estimated 10 tcfe resource base.

In the second phase of the project, a 50-km, 30-in. pipeline will be laid from Block A-18 to Block B-17 and connected with PTT's grid. Although this project is tentatively slated for completion in 2005, its timing will depend on gas demand in the two countries, according to PTT officials.

Thailand has asked Oman to take an equity stake in its foundering refining company, Thai Oil Co. The Thai refiner recently announced a program to reduce its debt to $1.38 billion from $2.2 billion (OGJ, Nov. 1, 1999, p. 42).

The debt restructuring would be aided by the injection of capital from Oman, if a deal comes to pass.

Oman is a major supplier of crude to Thailand (see Industry Briefs, p. 36).

Canada's oil sector is forecasting a strong drilling year in 2000, with emphasis on natural gas projects in Alberta. The Petroleum Services Association of Canada (PSAC) estimates 14,500 wells will be drilled in 2000, most of them in Alberta. That compares with an estimated 10,200 wells in 1999.

PSAC calls its estimate for 2000 "conservative" and takes into account a possible shortage of trained drilling staff. It expects an increase of about 30% in drilling activity next year in Canada's four western provinces.

The Canadian Association of Oilwell Drilling Contractors forecasts 14,331 wells will be drilled in 2000, based on an average utilization rate of 60% and an oil price of $18/bbl (US) for WTI. Canadian drilling hit a peak of 16,484 wells in 1997 and fell to 9,744 wells in 1998.

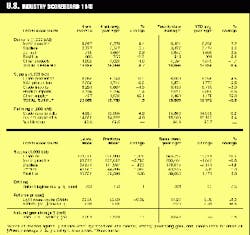

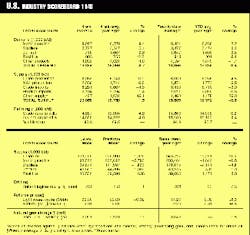

Energy company earnings for the third quarter showed a significant improvement in many cases vs. those of a year ago. Except where noted, the results shown are for the third quarter and in millions of dollars, with 1999 results shown first, followed by 1998 results. Losses appear in parentheses: Exxon, 1,500 vs. 1,400; Mobil, 688 vs. 509; Southern Co., 615 vs. 517; Chevron, 582 vs. 461; EOG Resources, 512.9 vs. 5.9; Duke Energy, 441 vs. 428; Texaco, 387 vs. 215; ARCO, 372 vs. 872; Noble Affiliates, 255.5 vs. 212.3; Conoco, 223 vs. 183; Enron, 223 vs. 168; Phillips, 221 vs. 46; Imperial Oil (Can. $), 209 vs. 196; TransCanada PipeLines (Can. $), 148 vs. 142; Schlumberger, 139 vs. (29.5); Occidental, 126 vs. 38; Tosco, 113.9 vs. 80.3; Coastal, 102.1 vs. 89.5; PanCanadian (Can. $), 100.7 vs. 16.3; Petro-Canada (Can. $), 95 vs. 15; Ultramar Diamond Shamrock, 84.2 vs. 25.8; CMS Energy, 83 vs. 81.3; Alliant Energy, 71.5 vs. 51.7; Vastar, 71.1 vs. 37.6; Apache, 67.8 vs. 2.6; Halliburton, 58 vs. (527); Transocean Offshore, 46.9 vs. 93; Burlington Resources, 42 vs. 15; Diamond Offshore, 37.8 vs. 108.7; Santa Fe International, 31.8 vs. 72.7; Ocean Energy, 28 vs. (14.4); Petroleum Geo-Services, 20.1 vs. 40.6; Northern Border, 19.4 vs. 18; Sunoco, 14 vs. 80; Consolidated Natural Gas, 10.8 vs. 5.7; Houston Exploration, 8.5 vs. 2; TC PipeLines, 8.5 vs. 11.5; Frontier Oil, 8.4 vs. 9.4; Meridian Resources, 6.4 vs. (6.5); Patina Oil & Gas, 5.3 vs. (1.5); Pogo, 2.7 vs. (8.3); Hydro GeoServices, 2.6 vs. 3.3; Chieftain, 1.3 vs. (2.5); Unit Corp., 0.7 vs. 0.7; McMoRan Exploration, (1.3) vs. (1.1); Semco Energy, (2.2) vs. (2.4); Spinnaker Exploration, (2.5) vs. (2.5); Syntroleum, (4.5) vs. (3); Columbia Energy, (9.7) vs. 11.2; Weatherford International, (11.1) vs. 42.8; Lyondell Chemical, (17) vs. (15).

Chevron Chemical Co. and PDVSA have reportedly canceled plans to build a $1.5 billion integrated aromatics plant at Cardon industrial park on Paraguana Peninsula in Falcon state, Venezuela (OGJ, June 2, 1997, p. 41).

PDVSA cited frail petrochemical prices for the decision to terminate the project.