High-Quality 3D Data Identifies Fractured, Karsted Carbonate Reservoir Prospects In High-Potential Eastern Gulf of Mexico Play

This article was adapted from a presentation given Sept. 22, 1999, at a Houston seminar on the Eastern Gulf of Mexico play sponsored by TGS-Nopec, Houston.

The proposed Eastern Gulf of Mexico Federal Offshore Lease Sale 181 is the most exciting exploration opportunity for oil and gas companies since the first area-wide lease sales in the Gulf of Mexico more than 15 years ago.

Oil and gas fields have been discovered on trends that extend directly into the Eastern Gulf of Mexico Planning Area, and the US Minerals Management Service has assessed the eastern gulf's hydrocarbon potential at 7.5-8.7 tcf of natural gas and 1.6-2.5 billion bbl of oil.

At Devon Energy Corp., the technical staff is currently evaluating 14 clastic and carbonate plays associated with this trend. The fractured-carbonate reservoir play, which is the focus of this article, may be, from a volumetric perspective, the most significant reservoir type in the trend.This article will review some of the analogs associated with the play, the play model, and apply the model to a 3D data set in the Main Pass-Viosca Knoll area. It will also briefly cover seismic attribute analysis techniques, economics, and geologic risk.

Location, geologic setting

Rifting opened the Gulf of Mexico during the Triassic, and by the Middle Jurassic, the influx of seawater into the basin was cut off or restricted, which resulted in deposition of the Louann salt.

Near the study area, the Norphlet was subsequently deposited, which currently produces from aeolian sands off Alabama, followed by the Smackover, which produces from oolite and coated-grain carbonate facies in Alabama and the Florida panhandle.

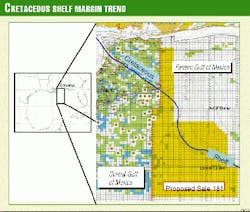

The Cretaceous shelf margin extends from a point just north of New Orleans and follows the Main Pass-Viosca Knoll area boundary to the southeast. The scarp continues into the Destin Dome area and southeast through Desoto Canyon and Lloyd.

Through the Cretaceous, carbonate deposition dominated on a broad shelf, although evaporites and clastics are also present in the section. The area proposed by MMS for OCS Lease Sale 181, scheduled for Dec. 5, 2001, is highlighted in yellow (Fig. 1).

Fracture-karst play

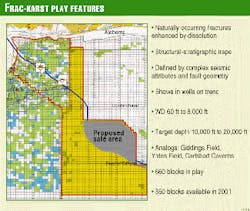

Reservoir development from karsting occurred during the frequent lowstands experienced by the trend (Fig. 2), and the best reservoir consists of natural fractures enhanced by dissolution.

Note that the influx of clastics during this time could have an important impact on the vertical seal risk associated with this play type. A schematic of the play concept is shown in Fig. 31. Folding at the shelf margin induced conjugate fractures. Variations in the underlying section, such as carbonate build-ups, may have focused the stress locally, which results in a variable density of the fracture network.

In the traditional model, groundwater percolated through the fractures, dissolved the limestone, and enhanced the porosity. At the edge of petroleum basins, sulfuric acid derived from hydrocarbons enhanced porosity through the chemical process shown on the bottom right of Fig. 3. Diagenetic anhydrite is a byproduct of this mechanism, and it is a point of interest in the Carlsbad Caverns, one of the analogs that is worth visiting.

Analogs

Analogs for this play are: Giddings field, Yates field, and Carlsbad Caverns.

Giddings field produces from the fractured Cretaceous Austin chalk reservoir and has an estimated ultimate reserve potential of 260 bcf. Production at pipeline-curtailed rates of 35 MMcfd of are common.

Yates field is located at the southern end of the Central basin platform in West Texas. The reservoir is a combination of Permian clastic and carbonate reservoirs with porosity enhanced by karsting. The estimated ultimate recovery of Yates field is 2 billion bbl, which sets the end-point for the reserve size distribution curve in this play. Fig. 4 shows the initial production of liquids for the top 100 wells in the field; note that 15% of these wells initially produced at rates that exceed 1,000 b/d of liquids, and the best well initially produced at over 3,000 b/d.

One can actually examine a first-class example of this play type at Carlsbad Caverns, located at the northwestern edge of the Permian basin in New Mexico. The footprint for the cavern system is only about 170 acres, but if filled with hydrocarbons, it would produce 100-200 million bbl.

Aerial extent, characteristics

The aerial extent of the play is shown in Fig. 5. There are about 660 blocks in federal waters that are potentially available for lease, and about 350 blocks will become available for lease in OCS Sale 181.

This play can be classified on the basis of several distinct characteristics. The highest-quality reservoir consists of naturally occurring fractures enhanced by dissolution. The traps are stratigraphic, but the lowest-risk prospects have an element of structure. Targets can be identified by complex seismic attributes, fault geometry, shear wave analysis, and gravity or magnetic evaluations. The interpretation of drilling reports demonstrates that wells along this trend have encountered fractured reservoirs with hydrocarbon shows in the Cretaceous section. Water depths for this play range from 60 ft to 8,000 ft and drilling targets range from 10,000 ft to over 20,000 ft subsurface.

Model application

The structure map of a major Cretaceous sequence boundary in the Main Pass-Viosca Knoll area is shown in Fig. 6. Note the northwest-southeast lineations that parallel the shelf margin, as well as the northeast-southwest lineations. This could be the surface expression of the intersecting fault pattern that is characteristic in our play type.

In looking at topographic map2 of our analog, Carlsbad Caverns, the lineations projected from stream valleys are outlined in Fig. 7, with the cavern network highlighted in red and superimposed on the map. This demonstrates a startling correlation.

We can do the same thing with our map of the Cretaceous sequence boundary in the Main Pass-Viosca Knoll area. The Azimuth Map feature in the Landmark Graphics software can be used to color-code the strike of irregularities on a horizon, like fault traces. Fig. 8 (at right) shows a sweep through the azimuth range of the data, along with color-coded areas of alignment, while Fig. 9 (below right) shows the highlighted lineaments. Most of the lineations trend northwest-southeast, and others trend at nearly 90

Complex seismic attribute analysis

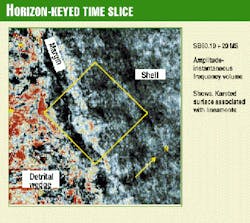

Statistical analysis of compressional wave seismic attributes calibrated with well control shows that there is a low-impedance and low-frequency signature associated with porosity development through fractures and dissolution.

A horizon-keyed extraction from a seismic attribute volume that combines amplitude and instantaneous frequency is shown in Fig. 10. Note the change in orientation of North, which is an artifact of the application. The illustrated data extraction was taken at 20 ms, about 200 ft below the mapped sequence boundary. Note how the anomaly blooms where it is associated with the intersecting lineations of the shelf margin.

Economics and risk analysis

Quantitative risk-reserve calculations and engineering feasibility studies have been made for each play that the Devon staff is evaluating in the Cretaceous shelf margin trend.

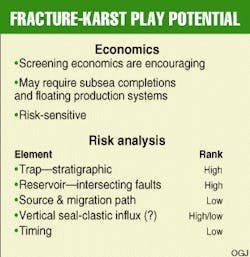

The engineering scoping evaluation of the economics associated with this play are encouraging, but the details are proprietary. However, qualitatively, in order to meet our economic thresholds, the well rates needed to be high, with large reserves recovered per well. In the deepwater portion of the trend, the development scenario requires subsea completions and possibly floating production systems (Fig. 11).

The economics are risk-sensitive and in an unrisked case, the fracture-karst play has one of the highest potentials. However in a risked-reserve case, it has one of the lowest, because of the high geologic risk. The element of trap carries a high risk because the traps are stratigraphic and depend on intersecting faults. The reservoir element also carries a high risk because it consists of intersecting faults with porosity enhanced by dissolution. Hydrocarbon source is a relatively low risk, because this is a known hydrocarbon province, and geochemical evaluations show that hydrocarbons are sourced in the Cretaceous and Jurassic section. High-quality seismic data show that deep-seated faults are pervasive, and they are inferred to be the hydrocarbon migration pathway. The risk of vertical seal is either high or low, depending where the prospect is in the trend. Clastic influx can destroy the seal, so the risk for this element is higher to the north, because it is closer to the clastic source. The risk associated with timing is relatively low because the reservoir was created during lowstands, initially enhanced by meteoric water and subsequently by sulfuric acid prior to hydrocarbon migration.

Summary

The fracture-karst carbonate reservoir play is one of 14 plays that the technical staff at Devon Energy is evaluating in preparation for the Gulf of Mexico OCS Lease Sale 181.

This high-risk, high-potential reservoir is characterized by dissolution-enhanced conjugate fractures that are associated with the shelf margin. Analogs from the Permian Basin show that the best reservoir is associated with intersecting faults. Statistical analysis of the section shows that there is a low-impedance and low-frequency seismic signature associated with reservoir development. Seismic workstation applications that combine structural analysis with complex seismic attributes can be used to identify fractured reservoir opportunities in the Cretaceous shelf margin trend. Engineering and economic feasibility studies for development projects are encouraging.

Acknowledgments

The authors would like to thank the Devon Southern Division Management Team for their support and allowing the publication of this article. The authors would like to acknowledge the management and staff at TGS-Nopec for conducting the Eastern Gulf Information Seminar, where this information was first publicly shown. The authors owe special thanks to Ed Denman and Melissa Stowe at TGS-Nopec for their encouragement and assistance with the logistics of their presentation. Finally, the presentation examples illustrating the article are courtesy of Veritas Marine Surveys, Houston, from their 3D data set .

References

- Handford, C.R., and Loucks R.G. (1993), Carbonate Depositional Sequences and Systems Tracts-Responses of Carbonate Platforms to Relative Sea-Level Changes, in Loucks R.G. and Sarg, J.F. (eds.), Carbonate Sequence Stratigraphy: AAPG Memoir 57, pp. 3-41.

- Topographic map (1996) courtesy of Trails Illustrated, a division of Ponderosa Publishing Co.

The Authors

Martin Wensrich is a geophysical advisor for Devon Energy Corp. in Houston. He has 14 years of experience in the Gulf of Mexico in shallow-water and deepwater exploration and development projects. Other domestic and international experience includes onshore and offshore, clastic and carbonate exploration and development in extensional, compressional, wrench, and salt-tectonic structural settings. His current project is prospect generation and evaluation in the Central and Eastern Gulf of Mexico planning areas in preparation for OCS Lease Sale 181. Martin obtained his BS in Geology from the University of California at Santa Cruz, and MS in Geology from San Diego State University.

Ed Clerke is a multidisciplinary geoscientist and CEO of Clerke Enterprises. Previously, he was the petrophysical engineering advisor for PennzEnergy Co. in Houston, with ARCO Exploration & Production Technology in Plano, Tex., and with Shell Oil Co. in New Orleans and Houston. He has been involved in reservoir characterization, exploration and production reservoir issues in many reservoir types in clastic (consolidated and unconsolidated), shaly sand, and carbonate depositional systems around the world. Ed received his doctorate in physics from the University of Maryland in 1982. Ed has published articles in the Log Analyst, SPE Production Engineering, Physical Review, Physica, and the Journal of Physical Chemistry and with colleagues received the Best Paper Award from the West Texas Geological Society in 1993. He holds four patents for borehole televiewer technology and interpretation.