Mexico to tender two gas distribution areas

Mexico's Energy Regulatory Commission (CRE) continues expanding the country's natural gas distribution system as it has made a call for technical bids for one permit area, while starting the process to award another.

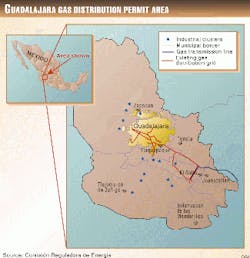

CRE began the process to award a gas distribution permit in an area surrounding Guadalajara in Jalisco state (see map). The Guadalajara system is intended to reach eight cities: Guadalajara, Tlaquepaque, Tonalá

During the project's 5-year operation period, CRE anticipates an investment of $100 million. The commission is expected to make a formal call for technical bids before yearend.

Presently, Guadalajara is supplied about 40 MMcfd of natural gas via a 36-in. pipeline owned by Petroleos Mexicanos.

The line originates in Venta de Carpio in southeastern Mexico. CRE expects Guadalajara's gas consumption could reach as much as 100 MMcfd.

Some benefits that Jalisco state sees in developing the distribution system, says CRE, are an incentive for regional development and potential to reduce emission levels.

Bajío Norte permit

Meanwhile, CRE has released information on technical bids for the Bajío Norte gas distribution permit, which will cover gas supply to Aguascalientes, San Luis Potosí, Zacatecas, and Fresnillo. CRE estimates investments in the Bajío Norte distribution system could reach $35 million.

CRE has already awarded a gas transportation permit for the Bajío region earlier this year to Midcoast del Bajío SRL de CV-a joint venture of Midcoast Energy Resources Inc. and Associated Pipe Line Contractors Inc., both of Houston (OGJ, June 28, 1999, p. 32). Midcoast intends to build a 59.1-mile, 16-in. pipeline in Guanajuato state from Valtierrilla to Leon.

Submitting offers were eight firms, grouped in four consortia. They were: Spain's Gas Natural México; France's Gaz de France International (GDF) and Mexique Investissement; Belgium's Tractebel; and Spain's Soc. de Gas Euskadi, Elecnor, and Idom and Mexico's Alcance Construcciones.

While the Soc. Euskadi group are new to the Mexican LDC permit-bidding process, the other three bidders already hold distribution permits in Mexico. Gas Natural México has permits for the Saltillo, Nuevo Laredo, Monterrey, Bajío, and Toluca geographic zones; GDF distributes gas in North Tamaulipas and the metropolitan area of Mexico City (Cuautitlán-Texcoco Valley); and Tractebel is the distributor for Querétaro. Collectively, these three permit-holders have committed to spending more than $560 million in the next 5 years.

Winning distributors must project a minimum coverage of 40,000 customers by the end of the 5-year operation period, starting from the date of issuance of the permit, says CRE. Permits are valid for 30 years, renewable annually, and the winner will be permitted a 12-year exclusivity permit over the system's construction and the reception, transmission, and delivery of gas within the zone.

The commission says it will assess the technical bids over the next few weeks. Results of the bidding process will be announced by Nov. 15.