Gas Demand Growth To Outstrip That Of Other Major Energy Sources To 2002

Natural gas will be the fastest-growing major source of energy during 1999-2002.

Abundant reserves, competitive prices, and environmental advantages over the other hydrocarbon fuels ensures strong market growth for natural gas during the next 3 years.

Gas consumption will increase more rapidly than overall energy demand, which will also move up significantly in response to worldwide economic growth (see related story, p. 43).

Worldwide gas demand will increase 8.4% from the 1999 level, to 87.2 tcf, in 2002. Over the forecast period, this growth rate will only be exceeded by the "other fuels" category, which includes relatively smaller energy sources such as hydroelectric, geo-the rmal, and biomass.

The natural gas share of the expanding world energy market will move up to 24.2% in 2002 from 23.8% in 1998-99.

Regional gas demand

Gas consumption among members of the Organization for Economic Cooperation and Development will move up 7% during the forecast period, to 47.2 tcf in 2002. The natural gas share of the OECD energy market will increase to 23.1% from 22.5 % in 1999.

Natural gas prices are expected to stay in line with the prices of other fuels. That will help stimulate demand for gas, particularly for electrical power generation. Gas has been displacing oil and coal in power generation markets as technology raises the efficiency of gas-fired turbines and as stricter environmental regulations favor cleaner-burning fuels.

In the OECD, gas has appeal as a price-competitive fuel able to supply significant amounts of energy but with relatively less carbon-related air pollution than other hydrocarbons.

Increased European consumption will require growth in imports. Through 2002, the current sources of imports-the former Soviet Union and Northern Africa-will satisfy most European demand. However, the region may have to seek additional supplies from the Middle East, where capacity to export liquefied natural gas is growing. Europe is already purchasing LNG from Qatar and Abu Dhabi.

The ability of the FSU to export significantly more gas to Europe is in doubt. Demand for gas in the FSU is projected to increase 4.7% to 19.3 tcf in 2002. The natural gas share of the FSU energy market will rise to 53.8% from 53.2% in 1999. Economic growth in the FSU is very dependent upon adequate natural gas supplies. And there is increased concern over environmental issues, which favors the use of natural gas. Any continuation of the transition to market economies will stimulate economic growth in the region and increase demand for energy. The huge gas reserves would make substitution of natural gas for more readily exploitable oil both possible and economically attractive. But meeting the indigenous demand growth may strain the ability of the FSU to develop more production, given the current chaotic political and economic conditions.

Gas consumption in the developing countries is projected to move up 15.5% from current levels to 20.6 tcf in 2002. This will be an increase of 2.8 tcf over the next 3 years. The natural gas share of the energy market in the developing countries will continue to climb, reaching 17.2% in 2002, compared with 16.8% in 1999. Gas demand growth during the forecast period is expected to be part of a much longer trend towards increased gas consumption in the developing world.

In the developing countries, gas demand will grow more rapidly in areas with indigenous supplies and in those countries prosperous enough to afford imports. Areas with limited domestic energy supplies and limited funds will tend to continue to favor oil.

Growth in demand for natural gas will depend heavily on the ability of the fuel to compete with other hydrocarbons in terms of price. Despite the many advantages of gas as a fuel, most consumers won't favor it over other fuels if they have to pay a premium.

Consumption patterns, trends

According to the BP Amoco PLC Statistical Review of World Energy, worldwide gas consumption increased 21.3% over the past decade. Total world demand moved up from 65.2 tcf in 1988 to 79.1 tcf in 1998. The natural gas share of worldwide energy consumption increased from 21.8% in 1988 to 23.8% in 1998.

The increase in worldwide natural gas consumption came despite a significant decline in FSU consumption. The rapid decline in economic output in the FSU, following the collapse of the communist state in 1991, led to a decline in energy demand and natural gas consumption. FSU consumption in 1998 totaled 18.68 tcf, down 14.7% from 21.91 tcf in 1988. FSU demand peaked in 1991 at. 23.5 tcf.

There was a decline in FSU gas consumption during the past decade, even though natural gas was displacing oil in the domestic markets in order to allow sufficient supply for oil exports. The natural gas share of the FSU energy market increased to 53.1% in 1998 from 40.5% in 1988.

In the OECD, the increase in natural gas production has not been as dramatic as in the developing countries, but the total volume is much larger. The comparative slowness in demand growth is in part due to the relative maturity of the OECD gas markets compared with markets in the developing countries.

OECD gas consumption increased 30.9% over the past decade, from 33 tcf in 1988 to 43.2 tcf in 1998. The gas share of the total OECD energy market increased from 19.3% in 1988 to 22.3% in 1998.

In the developing countries, natural gas consumption increased 67.2% from 10.3 tcf in 1988 to 17.3 tcf in 1998. Gas provided 13.9% of the energy consumed by this group of countries in 1988 and 16.7% in 1998.

Looking at natural gas demand from a regional perspective, some of the fastest growth over the past decade occurred in regions with either rapid economic growth or significant indigenous reserves.

Gas consumption in the Asia-Pacific region increased 95.1% from 4.7 tcf in 1988 to 9.2 tcf in 1998. Demand in the Middle East moved up 90.9% over the same period from 3.2 tcf in 1988 to 6.1 tcf in 1998. Gas consumption in Central and South America increased 57.5% over the decade from 1.9 tcf to 3 tcf in 1998. African gas demand increased 60.7% from 1.1 tcf to 1.7 tcf. European consumption increased 36% from 11.1 tcf in 1988 to 15.1 tcf in 1998. And North American consumption surpassed FSU demand during the decade, moving up 18.9%, from 21.4 tcf to 25.4 tcf in 1998. Over the same period, FSU demand fell 14.7% from 21.9 tcf in 1988 to 18.7 tcf in 1998.

Gas production

To support the increases in consumption over the past decade, natural gas consumption has risen in most areas of the world.

World production increased 20.5% over the decade, from 66.6 tcf in 1988 to 80.2 tcf in 1998. The increase came in spite of a 10.4% decline in FSU production, which fell from 25.4 tcf in 1988 to 22.7 tcf in 1998. Due to the FSU drop, North America took over the top spot in world natural gas production. North American output of gas climbed 21.1% from 21.5 tcf in 1988 to 26.1 tcf in 1998.

The Middle East was the fastest-growing region, as gas production climbed 94% from 3.3 tcf in 1988 to 6.4 tcf in 1998. The Middle East has vast reserves of natural gas but no significant natural markets in the region.

Next in terms of growth rate was the Asia-Pacific region, where production moved up 84.4% from 4.7 tcf to 8.7 tcf in 1998. In Africa, output climbed 72.7% from 2.1 tcf to 3.6 tcf. Gas production in South and Central America moved up 58.2% from 1.9 tcf in 1988 to 3 tcf in 1998. Production in Europe increased 26.6% from 7.7 tcf to 9.7 tcf in 1998.

Gas trade

Worldwide trade in natural gas is increasing as advances in technology lower the costs of long distance pipelines and of LNG processing and transportation.

An estimated 15.8 tcf of natural gas moved in international trade in 1998. This was 19.6% of total world gas production. In 1994, 12.5 tcf of natural gas was exported, which represented 17% of total world production.

Of the total traded in 1998, 11.8 tcf moved via pipeline and 4 tcf in the form of liquefied natural gas. LNG trade has been increasing significantly in recent years, as more and more countries build processing and exporting facilities.

The FSU is the world's leading exporter of natural gas by virtue of its large-diameter pipelines to East and West Europe. FSU exports were an estimated 4.3 tcf in 1998.

Canada was the second leading exporting country with pipeline deliveries to the U.S. of 3.1 tcf in 1998.

Algeria was the next largest exporter with total shipments of 1.85 tcf. Algeria's exports were split 52.5% via pipeline and 47.5% LNG. The vast majority of the Algerian exports were to Europe.

Norway exported 1.5 tcf in 1998 via pipeline to other European countries. The Netherlands exported 1.29 tcf of gas, also throughout Europe.

Indonesia was the next largest natural gas exporting country and the largest exporter of LNG. Indonesia exported 1.27 tcf of LNG in 1998.

Looking on the import side, the U.S. was the largest importer of natural gas with at 3.18 tcf in 1998. The vast majority was pipeline imports from Canada, but there were also LNG imports from Algeria, the UAE, and Australia.

Germany was the next largest importer of natural gas at 2.6 tcf in 1998, Germany imported large volumes of natural gas via pipelines from the FSU, Netherlands, and Norway. Smaller quantities of gas came from the UK and Denmark.

Japan was next in line, with LNG imports of 2.33 tcf in 1998. The major sources were gas from Indonesia and Malaysia, but Japan also received LNG from Australia, the US, Qatar, and the UAE. Japan was by far the major importer of LNG. The second largest importer of LNG was South Korea, with imports of 505 bcf in 1998, from Indonesia, Malaysia, Brunei, and the UAE.

Italy imported 1.5 tcf of natural gas in 1998, mostly via pipeline from Algeria, the FSU, and the Netherlands. They also imported a small quantity of LNG from Algeria and the UAE.

France was the next biggest importer with 1.26 tcf in 1998. Russia, Norway, and the Netherlands supplied the pipeline gas to France. Significant imports of LNG came from Algeria.

Natural gas prices

Natural gas prices have fluctuated in recent years but have remained in a range below the peak levels they reached in the first half of the 1980s.

According to the BP Amoco energy review, prices in different areas of the world were very different over the past decade. Natural gas is more of a region-specific fuel than oil. The disparities seem to be related somewhat to crude oil prices but also to changing demand conditions in the region. The actual price level is dependent upon factors such as transport costs and the cost of competing fuels in the region.

In OECD Europe, the average price of gas hit a peak of $3.18/MMbtu in 1991. The price dropped to $2.27/MMbtu in 1998 as oil prices fell. In the US, the price hit a peak of $2.76/MMbtu in 1996. The price slipped to $2.08/MMbtu in 1998. The price of LNG in Japan moved up to $3.91/MMbtu in 1997 but then fell to $3.05/MMbtu in 1998. The price of LNG was as high as $5.23/MMbtu in 1983.

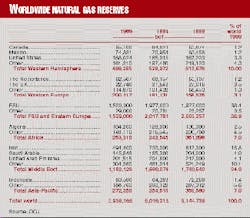

Gas reserves

Worldwide reserves of natural gas totaled 5.144 quadrillion cu ft (quads) at the start of 1999 (OGJ, Dec. 28, 1998, p. 38). This was up from 5.086 quads a year earlier.

Based on 1998 production, world reserves represent 62.3 years of supply.

OPEC does not dominate natural gas reserves as the group does with oil, but the reserves are still substantial. OPEC reserves totaled 2.207 quads at the first of this year, 35.9% of the world total. By contrast, OPEC has 77.4% of world oil reserves. Last year, OPEC gas production represented only 12.2% of the world total. Without convenient major markets, OPEC has been slow developing and producing the available reserves. Based on 1998 production, OPEC reserves represent 218.6 years of supply. It is expected that OPEC will move more aggressively to exploit these reserves during the forecast period.

OPEC member Iran has the world's second largest reserve of natural gas with 812 tcf at the start of 1999. Because of the country's distance from large markets, however, relatively little of the gas potential has been developed. At the current rate of production Iran's reserves life index is 677 years.

The FSU, with estimated natural gas reserves of 1.977 quads, accounts for 38.4% of the world total. The FSU has been more aggressive than the Middle East countries in developing gas reserves for both domestic consumption and export. The FSU reserves life index is 79.9 years.

US reserves totaled an estimated 167 tcf at the start of 1999. At the 1998 rate, that production represented only an 8.4-year supply. With a large and growing demand for gas, the US will rely on imports for future needs. Canadian gas reserves were an estimated 64 tcf at the start of the year. At the current rate of production, this represents a 9.6-year supply.

Future consumption growth in Europe also depends upon imported supply, although recent North Sea discoveries have boosted reserves. Western Europe's gas reserves totaled an estimated 158.8 tcf, and the region produced 9.4 tcf, in 1998. The reserves represent about a 17-year supply at that rate of production.

Development of large deepwater gas reserves off Europe might moderate the need to import growing volumes of gas from the FSU and North Africa.

Outside the FSU and OPEC, gas reserves totaled 941 tcf at the start of 1999. Production last year totaled 47.8 tcf. The reserves life index for the remaining countries is 19.7 years. But reserves are somewhat elastic and can expand with improved economics and technology.