Azeris must hurry to supply gas to Turkey

BP Amoco PLC's Shah Deniz gas find in the Caspian Sea off Azerbaijan has created a new potential supplier to join the fight over Turkey's fast-growing market.

This is the view of Wood Mackenzie Consultants Ltd., Edinburgh, which pegs the field's estimated reserves at 14-24 tcf of gas and up to 550 million bbl of condensate (OGJ, July 19, 1999, p. 35).

"Such reserves could deliver production rates in excess of 15 billion cu m/yearellipse" said the analyst.

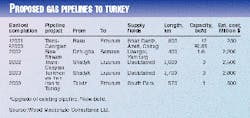

"Azerbaijan is competing with a number of producers with which Tur- key has contracted or signed MOUs (memorandums of understanding) in the past 4 years for gas suppliesellipseby pipeline or as LNG." Among the contenders: Russia is progressing on the Blue Stream pipeline project to take Siberian gas to Turkey across the Black Sea; the Trans-Caspian gas pipeline aims to deliver Turkmen and possibly Azeri gas from Turkmenbashi across the Caspian, through Azerbaijan and Georgia to Erzurum, Turkey; and Iran plans to develop massive gas reserves for export and is near completion of a pipeline from Tabriz to the Turkish border (a link from there to Erzurum is being laid).

"ellipseAzeri gas would be the cheapest new supply of gas to the Turkish market," said Wood Mackenzie. "The high cost of production would be offset by theellipselower level of pipeline investment required.

"While (Shah Deniz) production costsellipsewould be relatively high, other Azeri gas-for example, associated gas from the Azeri and Chirag fields-are lower-cost and could further improve the competitive position. However, uncertainty must remain over the cost of linking Azeri fields to Turkey, and particularly, whether the upgrade of existing pipelines is a realistic, cost-effective option."

There is one caution, says the firm: "It is clear, however, that Turkey is the only major market for Azeri gas in the near term, and this will place Azeri suppliers at a disadvantage in any contract negotiations."

Worse still for the Azeris, Wood Mackenzie believes any delay in plans to deliver Turkmen or Azeri gas to Turkey, while Azerbaijan weighs its options, would be likely to benefit the Blue Stream consortium, because the project is "already slightly more advanced than the Trans-Caspian project."

"It would appear that the prospective Azeri gas suppliers have a limited period in which to turn their plans into reality before the opportunity is diminished or gone," the firm said.