Petrochemical sector headed for cycle trough

Petrochemical prices are headed toward a trough, which would represent the end of the sector's current 8-year cycle. This bottoming out will be reached at around 2001-02. At that time, the sector is expected to regain momentum, with capacity utilization and profitability increasing during 2004-07.

This view was presented by Probe Economics Inc., Millwood, NY, upon completion of a study of feedstock, petrochemical, and polymer prices.

Recent increases in petrochemical and polymer prices can be attributed, in part, to a recovery in Asia, says Probe Pres. Fred Peterson. However, increasing costs of energy and feedstocks have contributed the most to these price rises, he says.

"Little, if any, margin increases have been realized." said Peterson. "Given the excellent knowledge that purchasers have these days about costs throughout their supply chains, it will take them little time to request and receive price decreases once energy prices settle back down again.

"It seems likely energy prices will fall over the next year," he added. "Current oil pricesellipseare unsustainable. If they last too long, they will lead to oversupply and another oil price collapse down the road. In today's dollars, $18-20/bbl is closer to a sustainable equilibrium for oil prices."

Analysis breakdown

Probe outlined three likely scenarios that the petrochemical industry could take through the next 5 years, assigning a probability percentage to each. These scenarios and their respective probabilities are: steady growth, 60%; recession-inflation, 10%; and Asian stagnation-cheap oil, 30%.

The steady-growth scenario involves some slowing of the US economy and the acceleration of economic growth internationally, mainly in Asia. Recession-inflation assumes an oil price run-up and a "classic" business cycle, with a recession seen in 2002. And Asian stagnation-cheap oil assumes lingering problems in Asia.

"The steady growth scenario has the highest economic growth, with real, world GDP (gross domestic product) growing 3.1%/year during 1999-2004," said Probe. "Plagued by high oil prices, inflation, and a cyclical business downturn in 2002, the recession-inflation scenario has a slower, 2.6% growth rate in real GDP during 1999-2004.

"Asian stagnation-cheap oil growth is depressed by problems in Asia and other developing economies-such as Brazil-so that real, world GDP growth doesn't get back over 2%/yearellipseagain until 2002. During 1999-2004, world GDP grows (an average) 2.2%/year in the third scenario."

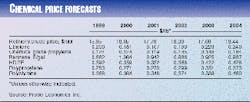

Probe then combined these three scenarios into a single case considered the most likely scenario (see table).

Price outlooks

According to Probe's analysis, petrochemicals such as ethylene enjoyed high profitability in the late 1980s and again during 1994-97. And the timing of the expected return to that level of tightness in the ethylene market depends on which scenario is considered, the firm says.

"In Path A, with its healthy economic growth, ethylene markets get to be quite tight again by 2003. On the other extreme, the depressed economic environment of Path C means ethylene capacity does not get tight again until 2006," said Probe.

Meanwhile, margins for monomers such as acrylonitrile have been reasonably stable, says Probe, which is characteristic of a market occupied by ma- jor buyers and sellers.

"BP (Amoco) Chemicals dominates (acrylonitrile) supply, because it owns the Sohio (Standard Oil of Ohio) process and also is developing a new process for producing acrylonitrile directly from propane and ammonia," said Probe.

In forecasting polymer prices, Probe found that margins for this group of products tend to be less volatile than for other petrochemicals-something the firm attributes to low broker and trader activity.

"Also, most polymer plants can be planned and built more quickly than petrochemical plants, so that supply imbalances can be corrected more quickly, before big margin swings can occur."