First-half US oil, gas asset sales a record

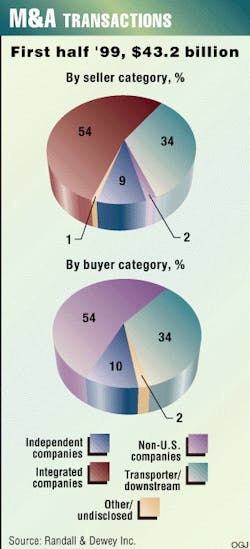

Sales of US oil and gas properties during second quarter 1999 reached $28.2 billion with 148 transactions, bringing the first-half total to a record $43.2 billion, according to Randall & Dewey Inc., Houston. That's the key finding from a recent review of selected global merger, acquisition, and divestment (MA&D) activity, based on transactions announced in first-half 1999 (Fig. 1).

Seeming to mimic the activity seen during the first quarter, large transactions-those worth $100 million or more-made up the bulk of the MA&D volume. Randall & Dewey said, "Looking back at the beginning of the year, the predictions were almost unanimous that 1999 would see a glut of properties on the market and the emergence of a buyers' market for the expected flood of high-quality properties.

"Although many thought the industry consolidation trend would continue and that megamergers would again lead the way, few thought that there would be a lack of asset transactions to satisfy acquisition appetites."

Transaction breakout

Of the 148 transactions recorded for the second quarter, the 32 largest deals-each near $1 billion and worth an aggregate $27.9 billion-covered reserves totaling about 3.372 billion boe.

Randall & Dewey calculated the average acquisition cost for these deals at $8.27/boe vs. $8.87/boe for the first quarter. Second-quarter transactions of slightly lesser value had a higher dollar value per boe than deals announced in the first quarter. For transactions announced during the second quarter and valued at less than $1 billion, the implied cost was $5.03/boe vs. $4.28/ boe during the first quarter. Transactions worth less than $500 million showed an implied cost of $4.16/boe vs. $3.85/boe in first quarter, said Randall & Dewey.

"The trend toward larger transactions continued in the second quarter with eight announced transactions in excess of $100 million, bringing the total for the first half to 11," noted Randall & Dewey. "The total volume of such transactions was $41.6 billion, or 96% of the announced first-half transaction volume. This compared with the first quarter, when transactions greater than $100 million accounted for 95% of the announced volume."

Dwarfing other industry segments in the buyer category, the non-US segment was bolstered by BP Amoco PLC's announced acquisition of ARCO. Conversely, the same announcement dominated the integrated segment in the seller category.

Meanwhile, Randall & Dewey considered the independent segment to be "virtually a wash," because it accounted for such a low percentage in both the seller and buyer categories-a respective 9% and 10%.

"In the era of megadeals, it is not surprising to see the independent segment accounting for a smaller part of the current transaction volume," said Randall & Dewey. "When asset-based transactions begin to increase, the independent segment should record a higher level of activity."

A changing industry

The oil and gas industry continues to be dominated by megamergers, notes Randall & Dewey, while asset-based transactions comprised "the smaller part of a highly stratified MA&D market." This pattern of activity also was seen as a continuation of those activities announced during the first quarter.

Overall, Randall & Dewey noted an asset buying and selling trend during the first half. It said, "At lower product prices, many sellers were reluctant to part with quality assets.

"Now that prices have strengthened, balance sheet repair jobs are well under way, and previous acquirers have sorted their property portfolios, the market may be set for a more rational approach to portfolio management decisions."

In addition, numerous merger attempts-both friendly and unsolicited-served as a driving force behind the growth of the transporter and downstream segment as buyers during the first half. Prominent examples of this activity were seen in potential mergers between NiSource and Columbia Energy Group (OGJ, June 28, 1999, Newsletter); Dominion Resources Inc. and Consolidated Natural Gas Co. (OGJ, July 12, 1999, p. 34); and El Paso Energy Corp. and Sonat Inc. (OGJ, Mar. 22, 1999, p. 37).

"As this segment was mostly immune to the drop in oil prices, its ability to continue to build impressive cash positions has clearly placed the segment in a position to be a dominant upstream player, if it so chooses," said Randall & Dewey.

The firm concluded, "For the most active market MA&D participants, the long-awaited build-up in asset volume may soon arrive, as mega-acquirers, within the constraints of pooling-of-interest accounting rules, take advantage of building demand and higher prices to bring properties to market.

"If this proves to be true and other mega-mergers are announced, then 1999 is well on its way to challenging the record transaction volume set in 1998 (OGJ, Mar. 15, 1999, p. 24)."