Subsea technology growth boom anticipated

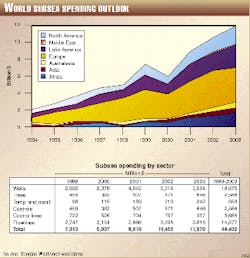

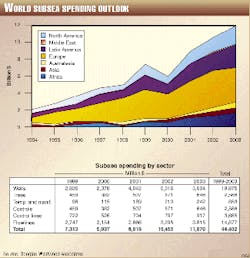

The markets for subsea technology companies are set for unprecedented growth, according to analyst Douglas-Westwood Associates, Canterbury, UK.

DWA Partner John Westwood told a recent New York conference the company had identified prospects in sectors ranging from subsea oil production to submarine cables and ocean minerals: "We envision a total subsea industry market with an annual value exceeding $20 billion in 2003."

Westwood added that, following the oil price recovery, sales of equipment and services to the subsea oil and gas production market are expected to double from their 1998 levels, to reach nearly $12 billion in 2003, giving a total market of $44 billion over the next 5 years.

DWA expects that subsea well numbers will rise from 287 in 1999 to a total of 404 in 2003, which it reckons represents a quadrupling of the rate of installations over the 10-year period from 1994.

Brazil and West Africa offer huge prospects, due to the discovery of very large fields in very deep waters, in which development will be dependent on the use of subsea production technology.

"Significant prospects also exist in the Gulf of Mexico," added Westwood. "Offshore Europe offers opportunities for the exploitation of the large numbers of small fields by subsea wells tied back to existing platforms. A secondary benefit is that this will enable oil companies to postpone some expensive platform decommissionings."

Deepwater activity

Meanwhile, Westwood notes that the recent string of major discoveries in very deep waters promises exciting opportunities for the industry but presents operators with the problem of how to carry out precision surveys needed for subsea installations.

Conventionally, said DWA, these involve towing sensors from survey ships, but in water depths beyond a few hundred meters, it becomes impractical due to the long cable lengths involved: "The result is that data quality suffers, and in harsh weather areas such as West of Shetland, a survey that should cost £100,000 has been known to escalate to £500,000 or even £900,000."

The analyst said autonomous underwater vehicles (AUVs) are being developed for this purpose. "They are true, preprogrammed robots, operating without cables to surface and using advanced navigation systems; they are designed to dive to the seabed, carry out high-precision seabed surveys, then return to their support ship with the data."

Westwood told a symposium in Copenhagen that, until recently, AUVs were restricted to prototypes in oceanographic research institutes and military establishments, but that the potential they offer for cost savings in deep waters has opened up a number of potential applications.

Westwood said AUVs also had the potential to greatly increase the efficiency of hydrographic survey operations. "I envision several AUVs running in parallel with a survey or research vessel, doubling or trebling its efficiency. Or in some instances, AUVs could replace the vessel completely."

He added that the global ocean survey market, currently valued at $1.1 billion, is expected to grow by 32% over the next 5 years and cited survey contractor Fugro-Geoteam AS, Stavanger, which has ordered an AUV in the belief that "in deepwater surveys, their use could reduce survey time by 50%."