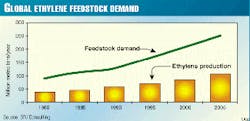

Worldwide ethylene feedstock supplies are likely to be sufficient through 2005, despite demand for feedstocks growing at twice the rate of production.

Ethylene feedstock demand is projected to growth by 4%/year, while production of ethylene feeds is expected to increase by only 2%/year. And petrochemical production will account for 15-20% of total naphtha demand through 2005. Extraordinary processing steps should not be required, however, to meet increasing demand.

These were among the findings of a recent study by SRI International unit SRI Consulting, Menlo Park, Calif.

Ethylene demand

World demand for ethylene rose 5%/year during 1985-95 to 70 million metric tons/year from 44 million tons/ year. This increase was mostly driven by dramatic growth in the Asia-Pacific region. But, a ripple effect caused by the Asian economic crisis will continue to curtail growth in ethylene demand through early 2000, predicts SRI. Demand growth is expected to decline to 4%/year during 1995-2005, with ethylene demand reaching 104 million tons/year in 2005.

About two thirds of the incremental ethylene demand over the period will come from North America and the Asia-Pacific. This increase will be driven by growth in demand for polyethylene, says SRI (Fig. 1).

Feedstock supply, demand

Naphtha will continue to dominate the ethylene feedstocks slate, which is expected to reach 247 million tons/ year by 2005 (Fig. 2). Global naphtha consumption in ethylene units should reach 3.6 million b/d by 2005 from 2.9 million b/d in 1995.

"The world crude oil supply is expected to reach 74 million b/d and supply 15.7 million b/d of straight-run naphtha in 2005," said SRI. And the availability of condensate (naphtha recovered from NGL processing) will increase at a rate of 3%/year. This increase will be greater than that in the supply of straight-run naphtha, which SRI expects to increase to 1 million b/d from 700,000 b/d. Together, the indigenous naphtha supply will increase to 16.7 million b/d from 14.4 million b/d during 1995-2005," stated the firm.

Worldwide naphtha demand exceeded supplies of readily recoverable naphtha by 6.1 million b/d in 1995 and will do so by 8.5 million b/d in 2005, says SRI. But changes in refinery configurations will alleviate this to some degree.

"An additional 6.3 million b/d of (refinery) cracking capacity is expected, which will increase cracked naphtha supply by 2 million b/d. This increased capacity breaks down into 3.3 million b/d from fluid catalytic cracking, 1.6 million b/d from hydrocracking, and 1.4 million b/d from coking," said SRI.

World demand for NGL, another important ethylene feedstock, is expected to reach 234 million tons/year in 2005, an increase of 54 million tons/ year during 1995-2005. Of this total, says SRI, 73 million tons/year will be used by ethylene crackers mainly in North America and the Middle East.

The firm estimates new oil and gas projects will increase NGL production in South America, the Middle East, Canada, and the U.S. Gulf Coast area.

"Traditionallyellipsethe supply of NGLellipsehas been abundant, and it has been attractive for this industry to separate and sell NGL as petrochemical feedstock and thus obtain a premium over fuel value," said SRI. "At the same time, the lack of a competitive market for ethane in other commercial areas has made it available to the petrochemical industry and helped to keep the price attractive. However, because associated gas feedstocks are linked to oil production, a decline in oil production may lead to an interruption in NGL availability."