JV builds world's largest single train olefins plant

At the beginning of 2001, BASF Corp., Mount Olive, N.J., and Fina Inc., Dallas, will own the largest single train olefins capacity in operation in the world.

The two companies formed BASF Fina Petrochemicals LLP in November 1998 to build and operate this new liquids cracker and its related facilities. BASF holds a 60% share and Fina a 40% share in this new partnership (OGJ, Aug. 3, 1998, p. 31).

The new steam cracker will be integrated with and built next to Fina's existing refinery in Port Arthur, Tex. It will convert naphtha and light hydrocarbons into mainly ethylene and propylene, key materials in the manufacture of plastics, fibers, solvents, paints, and surfactants.

By itself, the ethylene unit will be capable of producing 2.1 billion lb/year (950,000 metric tons/year of polymer-grade ethylene and 1.2 billion lb/year (540,000 metric tons/year) of polymer-grade propylene. With the olefins conversion unit, the plant can produce 1.9 billion lb/year (860,000 metric tons/year) of polymer-grade ethylene and 1.9 billion lb/year (860,000 metric tons/year) of polymer-grade propylene.

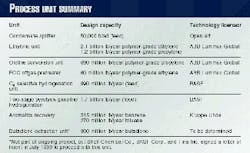

The ethylene unit and the olefins conversion units are part of a larger complex that will consist of several coprocessing units:

- An ethylene unit

- An olefins-conversion unit

- A condensate splitter

- An FCC offgas pretreater

- A selective hydrogenation unit for the mixed C4s from the ethylene unit

- A benzene and toluene extraction unit

- Utilities and waste-treatment facilities

- A cogeneration facility.

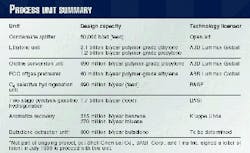

Table 1 (at right) summarizes their capacities and licensors. All chosen technologies in these units have been commercially demonstrated. Fig. 1 (below right) shows how these units will be integrated.

The initial capital investment of the complex is $1 billion. This number includes all the above units as well as the refinery integration and storage facilities. It excludes long-distance product pipelines and cogeneration facilities, however.

Ethylene, propylene units

The ethylene unit will contribute to the new complex by manufacturing the flagship products, ethylene and propylene. The olefins-conversion unit, downstream of the ethylene unit, will combine n-butenes with ethylene to produce even more propylene.

The unit will consume about 6.3 billion lb/year of a wide range of liquid feedstocks.

By-products of the ethylene unit will be sent to other units within the complex and to the refinery.

The design of the ethylene unit incorporates the proprietary ethylene technology, Ethylene 2000, from ABB Lummus Global Inc., Bloomfield, N.J. The unit will include the heart of the ABB Lummus process, which is the SRT VI pyrolysis furnace model, designed for high selectivity, short residence time, and low pressure drop.

Ultra low-NOx burners will be used in the pyrolysis heaters. Provisions have been made for catalytic DeNOx beds in the flue gas flow of each cracking heater, which will further reduce NOx.

The ethylene unit also includes a low-pressure demethanizer first fractionation sequence and a low capital propylene-recovery scheme.

When completed, the unit's nameplate ethylene capacity will be 2.1 billion lb/year. About 200 million lb/year of this production will be feeding the olefins conversion unit.

At 2.1 billion lb/year of nameplate capacity, the ethylene unit will be the largest single-train, liquids-feed plant built to date.

The ethylene unit and the olefins-conversion unit combined have an ethylene capacity of 1.9 billion lb/year and a propylene capacity of 1.9 billion lb/year. Together, these units represent the largest single-train olefins capacity in the world.

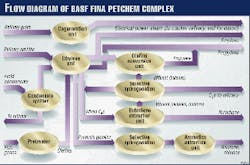

The olefins conversion unit will use ABB Lummus Olefins Conversion Technology (OCT) to control the production of propylene using metathesis. The catalyst in the fixed-bed metathesis reactor promotes the reaction of ethylene and butene-2 to form propylene. Simultaneously, it encourages butene-1 to isomerize to butene-2, which is consumed in the metathesis reaction.

A simple process flow diagram of the olefins conversion unit is shown in Fig. 2.

The process enhances propylene production by 58%, or by 690 million lb/year more than it otherwise would.

The advantage of the olefins-conversion unit is its ability to respond to changing market values for ethylene, propylene, butene, and mixed C4s. When the value of propylene is high, the olefins conversion unit can be operated to increase the propylene-to-ethylene ratio to above 1.0.

When propylene values fall, the olefins-conversion unit can be shutdown and the cracking severity increased. Raising the cracking severity can squeeze another 200 million lb/year of ethylene from the cracker, which allows it to produce as much as 2.3 billion lb/year of ethylene.

Other units

The condensate splitter will closely integrate the existing Fina refinery with the new ethylene complex. It will fractionate the naphtha feedstock for the ethylene unit as well as for other units within the Fina refinery.

An FCC offgas-recovery unit will pretreat offgas from the FCC for feed to the ethylene plant. It will recover olefins from a stream that was previously sent to the refinery-fuel system.

The unit will have extensive pretreatment facilities to remove the many trace impurities typically found in FCC offgas. It will use a patented low-pressure (LP) recovery sequence, which processes the offgas while maintaining an olefins recovery above 95%.

The combined features of the pretreatment system and the LP recovery sequence avoids any of the NOx-related safety issues typically raised when FCC offgases are integrated with the cracked gas of an ethylene unit.

The ethylene unit produces mixed C4s and C5s as well as ethylene. A selective hydrogenation process will treat the mixed C4s to make butenes and butanes, which are then returned to the refinery for use as alkylation feeds.

Another selective hydrogenation unit will treat the pyrolysis gasoline. Aromatics extraction from this pyrolysis gasoline will yield benzene and toluene.

Aromatics extraction units will have a production capacity of 240 million lb/year high-purity benzene and 140 million lb/year nitration-grade toluene from the hydrogenated pyrolysis gases.

New utility and waste-treatment facilities will support the new process units. Most of the utilities requirements will be provided internally. A 75-Mw cogeneration facility will supply electrical power and steam to the new complex.

Financially separate from this particular project, Shell Chemical Co., Houston, BASF, and Fina signed a nonbinding agreement in July of their intent to construct the world's largest butadiene-extraction facility next to the Fina refinery (OGJ, July 19, 1999, p. 34). The plant will extract high-purity butadiene from C4s, likely using N-methylpyrrolidone (NMP) solvent.

The feedstock for the butadiene extraction unit will come from both BASF Fina's new petrochemical complex and Shell's olefins complex in Deer Park, Tex.

Currently, the three companies plan to start up a 900 million lb/year butadiene plant by 2002. The facility will primarily supply butadiene to the east Texas cities of Beaumont, Port Arthur, and Orange.

Process control

The steam cracker will use a Foxboro IA Series distributed control system (DCS) to provide regulatory process control and data acquisition. A Triconex triple modular redundant (TMR) emergency shutdown system (ESD) will provide safety interlocks.

A MicroNet TMR digital control system from Woodward Governor Co., Rockford, Ill., will control the compressors and steam turbines. A GE Mark V control system will be used to operate the 75-Mw cogeneration plant, and ABB process analytics analyzers complete with a data-acquisition system will be used to meet online analytical requirements.

The TMR ESD systems, compressor and cogeneration control systems, machinery monitoring, analyzer data acquisition, and other third-party control systems will be integrated with the DCS via serial communication networks.

Control of the plant will be from a central control building with control systems equipment located in remote substation buildings throughout the plant.

A process operator training system is being provided by Aspen Technology Inc., Houston, and implementation of advanced process control requirements are planned for the future.

Environmental considerations

The environmental standards and specifications for the new petrochemical complex are based on emission requirements for nonattainment areas in Texas and federal standards for stationary sources.

The facility also based its design on National Emission Standards for Hazardous Air Pollutants (Neshap), Hazardous Organic Neshap (HON), and U.S. Environmental Protection Agency (EPA) air toxic emission standards for volatile organic compounds (VOCs) and benzene.

Best achievable control technology (BACT) and lowest achievable emission rate (LAER) were considered in the design of the cracking heater, boilers, and cogeneration gas turbines.

The air permitting process was dictated by Texas Natural Resource Conservation Commission (Tnrcc) standard procedures on New Source Review. Offsets for VOCs and NOx will achieve the final emission requirements. Emission reduction credit (ERC) certificates for VOCs have been deposited in Tnrcc's ERC bank.

BASF Fina will report the hours of operation of the facility and submit a summary of the periods of noncomplying emissions. Except during start-up or shutdown, the company will report causes of continuous emissions monitoring (CEM) downtimes for NOx, CO, and SO2 for all combustion sources.

CEM downtimes for ammonia in selective catalytic reduction (SCR) control equipment used on the gas turbine cogeneration system will also be reported.

Several environmental features will control emissions on the new units. As mentioned, ultra low NOx burners will be used for the pyrolysis heaters. Also, ultra low NOx burners will be installed for the boilers.

SCR systems will help to reduce NOx in the gas turbine exhausts. Low-pressure vents will be routed to a thermal oxidizer for destruction of VOCs.

In the case of a plant upset, flaring will be minimized by the use of instrumented load reduction. The entire flare capacity is 100% smokeless and is routed to a single ground flare for hydrocarbon-emission control and reduction. This flare will minimize the impact on the local community.

Process wastes and storm waters will be segregated and collected separately. Spent caustic wastes are oxidized and neutralized separately. All waste water streams will be combined, equalized, neutralized, and treated with corrugated plate interceptor (CPI) oil/water separators, induced gas-flotation cells, and steam strippers.

Stripped effluent will be then sent to a central bio-oxidation treatment facility in the existing refinery complex for reduction of biological oxygen demand (BOD), chemical oxygen demand (COD), and other contaminant levels.

Project schedule

BASF Fina awarded a lump sum, turnkey contract to ABB Lummus for engineering, procurement, and construction services. As prime contractor, ABB manages all of the site construction.

Basic engineering began in late 1997, and detailed engineering began in March 1998. Although construction began in September 1998, the groundbreaking ceremony did not take place until November. During peak construction, there will be about 2,000 construction jobs.

BASF Fina expects mechanical completion at yearend 2000; start-up in 2001.

Zachry Construction Co., San Antonio, under contract to ABB Lummus, is the general contractor for the project. It is performing site work, civil/structural, mechanical, and instrument/electrical construction. ABB Lummus is also managing other specialty subcontractors such as those for insulation and refractory.

J.A. Jones Inc.'s Lockwood Greene, Dallas, is the contractor for the cogeneration facility. Also, a number of local contractors are being employed for the project infrastructure.

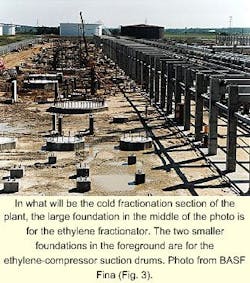

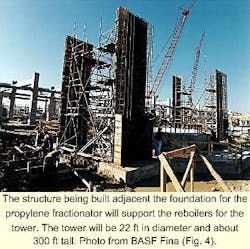

Figs. 3-6 show construction of the new plant.

null

null

null

null

Once the project is complete, approximately 150 new jobs will be associated with the operation and maintenance of the new facility.

Local demand

The two joint-venture partners will consume almost all of the products from the new complex. BASF Fina expects to sell a very small amount of the ethylene output to the U.S. Gulf Coast merchant market; that is, only 10-20%.

The metathesis unit enhances the by-product flexibility of the unit by allowing the production of more propylene. BASF Fina expects propylene growth to outpace ethylene.

Integration of the olefins-conversion unit and the ethylene unit permits the propylene-to-ethylene ratio to be higher than 1.0. This is well above the conventional ratios of 0.4-0.6. The by-product flexibility allows the complex to respond to changes in ethylene and propylene demands over the life of the facility.

According to the two companies, the partnership between BASF and Fina is an ideal solution for three reasons.

First, BASF and Fina achieve mutually beneficial ethylene and propylene production, primarily for internal use. Second, both companies derive significant cost advantages from integrating the cracker with Fina's existing refinery. Third, the companies gain significant economies of scale, which makes the new complex an attractive and efficient investment.

Economies of scale associated with having the largest single train olefins capacity in the world brings investment advantages to the complex. By partnering to build one cracker instead of two separately, the two companies believe they benefit both from economies of scale and improved economics.

For BASF, the new steam cracker is in line with the company's integrated manufacturing strategy in North America, referred to as Verbund.

"The cracker will be the heart of our integrated manufacturing strategy throughout North America and represents the largest investment BASF has ever made outside of Europe," said Carl A. Jennings, president of BASF Corp.'s chemicals division.

"We are very excited about this project because it will serve as a platform for future expansion in the Nafta [North American Free Trade Agreement] region," he added. About two thirds of the existing steam crackers in the Nafta region are integrated into refinery networks.

The steam cracker will ensure economically attractive, long-term product supplies of propylene, ethylene, and other key precursors such as butadiene, benzene, and toluene for BASF's major integrated sites. These sites include Geismar, La., and Freeport, Tex., which are, respectively, BASF's third and fourth largest facilities in the world.

The two BASF sites will be supplied via new pipelines from the new cracker.

The cracker's additional capacity will ease propylene requirements that have nearly doubled as a result of recent oxo alcohol and acrylic acid expansions at the company's Freeport site. It will also secure a supply of ethylene to produce ethylene oxide and ethylene glycol at Geismar.

Both ethylene and benzene from the cracker may be used to produce styrene, which BASF uses to make polystyrene in Joliet, Ill., and Altamira, Mexico, and expandable polystyrene at South Brunswick, N.J.

For Fina, the advantages of the new steam cracker will be both in refining and petrochemicals. The steam cracker provides an attractive and economic alternative for materials from Fina's refinery.

The project will also ensure long-term security of raw material supply for its styrene manufacturing plant in Carville, La., and for its polypropylene plant in La Porte, Tex., which produces about 1.4 billion lb of high-quality polypropylene annually. According to Fina, the plant in Carville is the largest single-site styrene monomer facility in the world.

Fina plans to expand its La Porte polypropylene capacity to 2.1 million lb/year and its Bayport polyethylene plant in Pasadena, Tex., to 850 million lb/year.

In spite of this new source of ethylene, Fina will continue to be a net buyer of olefins.

Refining, petchem integration

BASF Fina expects to reap major rewards from integrating the new cracker with Fina's existing 180,000 b/d Port Arthur refinery.

When the new complex is built, Fina will retain sole ownership of its Port Arthur refinery. BASF will be the operator of the cracking unit and its coprocessing units, while Fina will be responsible for off-site facilities of the cracker on behalf of the partnership, which mainly consists of the condensate splitter.

The naphtha reformer and the fluid catalytic cracker both produce products whose values can be increased in a chemical plant. Reformers produce aromatics such as benzene and xylenes. Fluid catalytic crackers produce olefins such as propylene, ethylene, and butadiene.

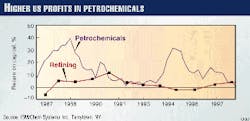

Ron W. Haddock, president and chief executive officer of Fina, during a presentation at the NPRA's (National Petrochemical & Refiners Association) March 1999 International Petrochemical Conference in San Antonio, said that profitability is the main driver for this integration.

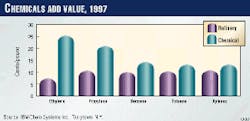

Although the return on capital employed (ROCE) has been erratic for petrochemicals in the past 10 years, he pointed out that ROCE for petrochemicals has been higher than that for refining (Fig. 7).

Haddock expects the integration between the new steam cracker and the existing Fina refinery to generate more than $50 million/year in synergies. Synergies come from both increased revenues and decreased costs and risks.

Exchanging streams for those with higher value dispositions brings in more revenues to the complex. Fig. 8 compares the value of typical fuel products in a refinery before and after a chemical plant has transformed it.

Lowered costs result from avoiding transportation costs; having less inventory; sharing infrastructure, services, and utilities; eliminating middle-man transaction costs; and operating with flexibility.

Secure feedstock supplies and by-product outlets reduce the dependency of the chemical plant and the refinery on market demand, thus reducing their risks. The petrochemical plants are provided with a secure supply, while the refinery has a reliable outlet for its products. Also, chemical by-products may be recycled to the refinery for finishing.

In Port Arthur, the new cracker will provide the existing Fina refinery with even more flexibility. Besides gasoline production, the refinery now has the option of focusing on chemicals production. For example, naphtha, formerly used for gasoline, can now be run in the steam cracker to produce olefins.