Contributing to this article were Chief News Editor Anne Rhodes, Executive Editor Bob Williams, and Staff Writer Steven Poruban

The Organization of Petroleum Exporting Countries' successful efforts to rein in production are keeping oil prices at 2-year highs-and poised to go higher-but are also setting the stage for a recovery in non-OPEC oil supplies next year.

That recovery, in turn, could undermine OPEC's recent success at restoring oil prices. In the longer term, however, the call on OPEC oil is likely to accelerate sharply as world oil demand resumes its upward march and non-OPEC supply stagnation sets in.

So said Leo Drollas, deputy executive director of London's Centre for Global Energy Studies, at a conference on oil price challenges into the next century sponsored by CGES and Oil & Gas Journal in Houston Sept. 9-10.

Other presentations at the conference focused on:

- The need for OPEC to better wield its market power, particularly in regard to improved understanding of the role of financial markets in setting oil prices.

- The role of "wild card" that Iraq will continue to play in global oil supply scenarios, and how geopolitical factors surrounding that situation will affect oil supply.

- The respective roles of the Middle East and the Caspian Sea region in the outlook for new productive capacity in the early part of the next century (see Newsletter).

Oil price outlook

Drollas noted that OPEC has, since 1986, generally not been a good manager of oil prices, always reacting to market conditions instead of anticipating them-and then reacting late.

Noting that it took three rounds of production cuts in concert with some key non-OPEC oil exporters to rescue oil prices from the cellar in the past 18 months, Drollas said, "And OPEC is still acting too late and cutting too little when it does act."

Such an approach led to a "tremendous involuntary global stockbuild in 1998," in which the actual increase in world oil stocks totaled as much as 400 million bbl, he added.

The global stock overhang still persists at about 300-350 million bbl, Drollas said, and yet oil prices are at 2-year highs. With that in mind, Drollas contends that there is usually an inverse correlation between global oil stocks cover and oil prices (Fig. 1).

"For $18/bbl (OPEC basket price) to be sustainedellipseit seems as if we need around 82 days of cover. We are not yet at 82 days of cover. In 1999 second quarter, we were still around 86 days of cover. So we are actually far away from the target level, and yet the price of oil has shot up beyond $18 and is around $20-plus," Drollas said. "This is another kind of indication that there is something odd going on, that the fundamentalsellipsedon't justify where the price is; it must be another factor, and the other factor is the futures market, which has such a big influence-and the hedge funds in particular, which move in and out according to their expectations."

He expects oil markets to remain tight through the winter-with the degree of tightness depending on the weather-keeping a prop under prices. He called on OPEC to start thinking about increasing production to keep oil prices from rising too high, as the physical fundamentals of the market start to overtake speculators' expectations in the fourth quarter.

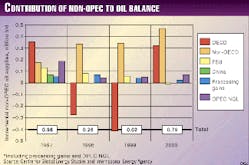

Drollas also noted the effect on non-OPEC production from the recent rebound in oil prices, predicting that non-OPEC oil supplies are likely to rise by about 800,000 b/d in 2000 (Fig. 2). Conversely, when non-OPEC production declines-as it did during the 1998-99 price collapse-that sets the stage for price hikes.

"Historically, when non-OPEC production begins to decline, then we see an increase in the real price of oil beyond $16/bbl, in 1998 dollars," Drollas said.

Looking at oil markets for 1998-2010, Drollas estimated that global demand would rise by 14.6 million b/d, non-OPEC oil production would stagnate, and OPEC NGL output would increase by 1 million b/d. These predictions assume "business as usual," especially if there is no significant fallout from efforts to implement Kyoto Protocol goals (see related story, p. 28).

This would put the incremental call on OPEC oil at 12.6 million b/d in that period, when plans by OPEC call for an increase in productive capacity of only 12.5 million b/d. But Iraq's plans to expand its productive capacity are one of the linchpins of this scenario, "ellipseand when we get to Iraq, there are huge uncertainties associated with this country," Drollas said.

OPEC and markets

The key to understanding the future role of OPEC lies in anticipating if and how OPEC will wield its considerable market power, Sarah Emerson, managing director, petroleum, for Energy Security Analysis Inc., Cambridge, Mass., told conference attendees.

Traditionally, OPEC's market power has been viewed as a trade-off between maximizing price and maximizing market share. But given the group's dependence on steadily climbing oil consumption-as witnessed by the Asian economic crisis's role in the latest oil price collapse-and the stimulus that high oil prices gives to non-OPEC oil investment, the idea of deliberate supply curtailments designed to dramatically raise prices is, at the extreme, a non-starter, she said.

At the other extreme, the idea of raising production to lower prices and thereby shutting down non-OPEC output to seize market share also poses a problem.

"In short, OPEC does not have the stomach to wield its power in this way-or it would have by now," Emerson said. "At the heart of it, OPEC's current spare capacity is concentrated in only a few countries. As a result, there are too many countries within OPEC that suffer from low prices but cannot necessarily increase production to gain market share."

The upshot is that OPEC chooses to pursue a middle path by pursuing close management of stable prices, which ultimately puts it at odds with financial markets.

"When OPEC makes big mistakes, like over-producing in 1998, or takes strong action, like cutting production in 1999, it determines the general price direction," Emerson said. "The futures markets and their pure financial (noncommercial) players, however, can dramatically influence the pace and scope of that price move.

"We would not have approached $10 WTI in early 1999 without large-scale short-selling by the hedge fundsellipseSo, even though OPEC may be a passable crisis manager, the subtle maintenance of stable prices may be beyond its grasp because the financial markets have made it possible for hedgers and speculators to exploit the market's inefficiences."

She also rejected as unrealistic such proposals before OPEC as setting price-band mechanisms to trigger changes in production or monitoring global stock levels to determine production policy.

Emerson contends that, if OPEC wants price stability, it must embrace the other factors shaping price, understand them, and position itself through production decisions to avoid sharp drops or jumps in oil prices.

"In a sense, this means a renewal of the interseasonal quota-adjusting approach (used) back in the late 1980s and early 1990s," she said. "From 1994 to 1998, OPEC meetings were essentially opportunities to roll over or raise the production ceiling, or at least lift the official ceiling to the level of actual 'overproduction.'"

"The gradual return of Iraq and the Asian economic crisis, however, has ended the period during which OPEC can just keep letting production increase. Now, the pursuit of stable prices must once again entail cutting or raising production periodically or cyclically.

"The more OPEC tries to micro-manage supply, the more vulnerable it will be to an overreaction in price."

Iraq production outlook

As with Iran, the U.S. policy towards Saddam Hussein has not been successful, according to CGES Executive Director Fadhil Chalabi. Economic sanctions against Iraq-which, in this case, are multilateral-have not diminished Hussein's power, nor are they likely to, he says.

Chalabi was unable to attend the conference, but his remarks were delivered by Drollas.

Iraq is currently producing about 2.8 million b/d of oil, says Drollas. This includes: 1.288 million b/d exported from Mina al-Bakr; 1.012 million b/d sent by pipeline to the export terminal at Ceyhan, Turkey; 350,000 b/d consumed domestically; 100,000 b/d exported to Jordan; and 50,000 b/d exported to Turkey for its that country's use. Another 40,000 b/d of gas oil is smuggled out of the country in small tankers that travel near the Iranian coastline to export facilities at Dubai.

Both the country's major export pipelines are operating, but some of the pumping stations and "certain segments" are "in trouble," said Drollas. "With the right equipment, this can be fixed, but it will take time."

Capacities of the export routes are: Iraq pipeline to Turkey, 1.05 million b/d; and Mina al-Bakr, 1.3 million b/d. Repairs to the Turkey export line could raise its capacity to 1.6 million b/d by April 2000. In addition, Iraq is continuing talks with Syria regarding rehabilitation of an idle export pipeline; the project has a target capacity of 300,000 b/d.

The outlook for Iraqi oil production is difficult to predict, given the disagreement between Baghdad and the United Nations over the U.N.'s efforts to catalogue Iraq's nuclear weapons arsenal. If sanctions continue, the country aims to raise its production to 3 million b/d by December 1999, to 3.2 million b/d by March 2000, and to 3.5 million b/d by December 2000. "This can be done as long as spare parts continue to arrive," said Drollas, "but any capacity constraints in the country's transportation and export infrastructure will undermine this expansion."

He pointed out that, despite the excess global productive capacity of today, "The world does need Iraqi oil in 5-7 years. The Iraqis certainly won't produce it. The problem is the regime and how the end game will unfold."

Drollas added, "Iraq's prospectivity is phenomenal. It is a second Saudi Arabia."

If U.N. sanctions are lifted soon, Chalabi predicts a 500,000 b/d increase in Iraqi production capacity by the end of next year, bringing total capacity to about 3.2 million b/d. Another 900,000 b/d could be gained within 3 years through further work on nine partially developed fields. And, within 7-10 years, Iraq's production capacity could increase another 2.8 million b/d through work on its undeveloped fields. This would bring the country's productive capacity to 6.9 million b/d, a level that is second only to Saudi Arabia.

But the future of Iraq is very uncertain at this point. Chalabi sees three possible outcomes for the political situation:

- A new regime, which, even if it comes from Hussein's family and has similar characteristics, the West would deem acceptable.

- Continuation of the status quo, with further deterioration of the country and possibly further trouble with the Kurds, which Drollas called "a source of great instability for the oil industry."

- What Chalabi refers to as "living with the devil."

There is a joint U.K.-Dutch proposal before the U.N. now that attempts to disengage the economic issues from the nuclear weapons concerns. The U.S. has taken issue with parts of the proposal, says Drollas. "Iraq, howeverellipse rejects it totally. But it opens the door to a new, pragmatic approach," he said.

To solve these considerable problems, Drollas believes the situation in Iraq should be viewed as a part of the broader Middle East peace process.