Results Posted By OGJ200 Companies Illustrate Depth Of Downturn In 1998

The depth of the decline that hit the oil and gas industry in 1998 is reflected in the financial and operating results posted by the companies on the OGJ200 list of publicly traded oil and gas producing companies in the U.S.

All financial indicators for the group hit record lows for the 16-year history of OGJ group listings. And most operating indicators were down from the previous year.

Almost two-thirds of the companies on the list posted losses in 1998. And few companies posted gains in net income or stockholder's equity. Only 3 of the 200 companies met the qualifications to be included on the OGJ200 list of fastest-growing companies.

Net income for the OGJ200 group plummeted, falling 88.9% in 1998 to $3.6 billion. This was down from earnings of $32.5 billion in 1997 and the record-high group earnings of $33.8 billion in 1996. It was the worst performance, in dollar terms, for annual profits for the OGJ group since the list was started in 1983 as OGJ400, reflecting the prior year's operations. The previous low OGJ group profits were $5.2 billion in 1986, when the group still contained 400 companies.

As always, data for this year's list reflect the prior year's operations.

Dismal results

Total OGJ200 group revenues fell sharply in 1998, down 27.6% from the year before to $406.3 billion. The highest group revenue was $626 billion in 1983.

Assets for the OGJ200 group totaled $454.8 billion for 1998, a decline of 12.9% from 1997. This was the lowest level of total assets for the group since the original list was started. The previous low was $468.5 billion in 1988. The highest total OGJ group assets were posted in 1983 at $543.8 billion.

Reevaluation of asset values due to the sharp drop in oil prices had a major impact on the groups' assets total. Consolidation and diversification also affected the value of the assets listed. A significant portion of the oil and gas industry assets of companies that have disappeared because of mergers or acquisition have been incorporated into remaining operating companies. However, some assets no longer appear in the list. For example, the former Amoco Corp.'s foreign assets are now a part of the non-U.S. headquartered BP Amoco plc and are no longer included.

In addition, some companies are no longer predominantly oil and gas companies, as they have successfully diversified into other industries. Only their oil and gas industry assets are counted for the OGJ200 list.

Total stockholders' equity of the companies represented by the OGJ200 fell 22.7% to $157.9 billion in 1998.

Comparisons between totals for one year's OGJ200 with those for another year must take into account the company changes that occur. But for any given year, the OGJ list does represent a significant part of the U.S. oil and gas industry and therefore accurately reflects trends in industry activity and financial performance.

The OGJ200 ranks companies by assets without regard to whether they use full-cost or successful-efforts accounting methods.

Even though earnings collapsed for the OGJ200 group, the listed companies continued to invest for the future last year. Strong earnings in the previous 2 years may have also boosted their confidence and available financial resources. Capital and exploration spending for the group slipped by only 3.7% in 1998, to $69.3 billion. This was in contrast to net income, which fell 88.9%, and revenues, which fell 27.6%. Even with the group's dismal financial performance last year, this was still the second highest level of spending since the OGJ list was started. Outlays for the OGJ200 group totaled a record $71.9 billion in 1997.

The decline in capital sending resulted in a drop in exploration and drilling activity. The number of net wells drilled by the OGJ200 fell to 11,832 from 13,036 in 1997. The group drilled 10,834 wells in 1996 and only 9,202 in 1995.

Market snapshot

Lower oil prices were the main culprit for the poor showing in 1998 by the OGJ200 group. This effect was partially offset by stronger demand for oil, both in the U.S. and worldwide. Natural gas prices also slipped, due to lower consumption related to warmer than normal winter weather and competition from other fuels.

Worldwide petroleum products demand increased in 1998, but at a slower pace than in previous years. Petroleum products consumption increased in most areas of the world. But increases in some regions were offset by declines in the Asia-Pacific region and the former Soviet Union. Economic problems in the Asia-Pacific region surfaced in 1997 and continued into 1998, slashing demand for refined products. In the FSU, the decline in demand that dates back to 1990 has continued but at a slower pace.

According to estimates from the International Energy Agency, oil consumption worldwide increased 0.7% to average 74.3 million b/d in 1998. In the Organization for Economic Cooperation and Development countries, petroleum consumption increased to 46.9 million b/d from 46.7 million b/d in 1997. Consumption increases in North America and Europe were partially offset by a decline in the Pacific OECD region. In North America, increased economic activity helped boost demand 2.2% to an average 23.2 million b/d. Demand in OECD Europe increased 2% to 15.3 million b/d, while OECD Pacific demand fell 6.7% to 8.4 million b/d. The economic slowdown in South Korea and Japan was the major reason for the decline in that region.

In the non-OECD countries, including the FSU, petroleum products demand moved up 1.1% last year to average 27.4 million b/d. The biggest increase was in Latin America, where demand increased 200,000 b/d, or 4.3%, to 4.8 million b/d. Demand in China moved up 2.4% to average 4.2 million b/d. Elsewhere in non-OECD Asia, demand remained steady at 6.8 million b/d. Demand in the Middle East increased 2.4% to average 4.3 million b/d and in Africa by 4.3% to 2.4 million b/d.

In the FSU, demand fell to 4.3 million b/d from 4.4 million b/d in 1997.

In the U.S., petroleum products consumption moved up 1.6% to average 18.917 million b/d in 1998. This was the highest year on record for U.S. consumption, surpassing the previous record of 18.847 million b/d in 1978. Demand was up for all of the major product groups. Consumption of motor gasoline increased 2.9% to a record 8.253 million b/d. Distillate demand moved up 0.8% in 1998 to average 3.461 million b/d. Residual fuel oil demand jumped 11.3% due to low prices and averaged 887,000 b/d. Jet fuel demand increased 1.4% to average 1.622 million b/d.

Worldwide natural gas consumption increased 1.3% in 1998 to 79.1 tcf. Consumption increased in all regions except North America. Natural gas consumption increases were posted for: Europe, 2.7% to 15.1 tcf; Central America and South America, 2.6% to 3 tcf; Asia-Pacific, 5.4% to 9.1 tcf; Middle East, 5.4% to 6.1 tcf; and Africa, 5.4% to 1.7 tcf. FSU demand increased after declining for several years, up 2.2% to 18.7 tcf.

The largest regional demand was still in North America, where gas consumption fell 2.7% in 1998 to 25.4 tcf. In the U.S., natural gas consumption fell in 1998, declining 2.9% to 21.326 tcf from 21.972 tcf in 1996, which was the second highest year on record. The record high for U.S. consumption was 22.049 tcf in 1973. Canadian gas demand also fell in 1998.

Lower prices

The sharp drop in oil prices and a slide in U.S. natural gas prices took a heavy toll on OGJ200 group revenues and earnings in 1998.

The world export price of crude oil averaged $11.92/bbl in 1998, down 35.1% from $18.38/bbl in 1997. Oil prices have been volatile in recent years. The world export price averaged $20.04/bbl in 1996, $16.78/bbl in 1995 and $15.28/bbl in 1994.

The price of light sweet crude oil futures on the New York Mercantile Exchange (Nymex) averaged $14.42/bbl in 1998, down 30% from $20.59/bbl in 1997. The futures price averaged $22.01/bbl in 1996.

The average U.S. wellhead price for crude oil slipped to $10.88/bbl from $17.22/bbl in 1997, a drop of 36.9%. The wellhead price averaged $18.46/bbl in 1996, $14.62/bbl in 1995, and $13.19/bbl in 1994.

The average U.S. refiner acquisition cost of crude for the composite of both domestic and imported crude oil fell 34% in 1998 to an average $12.57/bbl, down from $19.04/bbl in 1997 and $20.71/bbl in 1996.

In the U.S., product prices also fell in 1998, following the trend in crude oil prices. The refiner price for finished motor gasoline fell 25% in 1998 to an average 52.7¢/gal vs. 70¢/gal in 1997 and 71.3¢/gal in 1996. The average pump price for all types of motor gasoline fell 13.6% in 1998, to $1.115/gal from $1.291/gal in 1997. The pump price averaged $1.288/gal in 1996.

The refiner price for finished aviation gasoline fell 15.3% to 90.2¢/gal for 1998 vs. $1.066/gal in 1997 and $1.055/gal in 1996. The refiner price for No. 2 diesel fuel fell 26.7% to an average 44.4¢/gal in 1998 vs. 60.6¢/gal in 1997 and 65.9¢/gal in 1996. The average distillate price to a residence fell 13.4% to 85.2¢/gal in 1998 vs. 98.4¢/gal in 1997 and 98.9¢/gal in 1996. The average price of residual fuel oil for sale to end users fell 28.6% in 1998 to 30.2¢/gal vs. 42.3¢/gal in 1997 and 45.5¢/gal in 1996.

Product prices fell in 1998 but not as sharply as crude oil prices. Lower product prices and continued economic growth helped to boost product demand worldwide.

This combination of strong demand and lower feedstock costs led to an improvement in refining margins in 1998. Increased volumes also lowered unit operating costs and helped boost margins. According to Ernst & Young Wright Killen, average U.S. Gulf Coast cash operating margins increased to $0.99/bbl in 1998, from $0.83/bbl in 1997, $0.71/bbl in 1996 and $0.25/bbl in 1995.

Natural gas prices declined as well in 1998, but nowhere near as precipitously as oil prices did.

The average U.S. wellhead price of natural gas slipped 15.5% to $1.96/Mcf from $2.32/Mcf in 1997. The wellhead gas price averaged $2.25/Mcf in 1996 and only $1.55/Mcf in 1995. The average spot price for natural gas fell 16.8% to $2.03/Mcf in 1998 from $2.44/Mcf in 1997. The spot price averaged $2.30/Mcf in 1996 and $1.57/Mcf in 1995.

Drilling activity

The sharp drop in oil prices triggered a collapse in exploration and drilling activity worldwide.

Lower natural gas prices especially exacerbated the decline in drilling in the U.S. and Canada, where it is increasingly focused on natural gas.

In the U.S., drilling activity fell 12% to an annual average 831 active rotary rigs, by the Baker Hughes count. Strong gas demand and prices the previous 2 years had boosted the U.S. average rig count to 944 in 1997. That was up from 779 in 1996 and 723 in 1995.

The annual average active rotary rig count in Canada also fell, to 266 in 1998 from 375 in 1997. The Canadian average rig count was 270 in 1996 and 229 in 1995. The sharp drop in oil prices was the major reason for the lower Canadian rig count. But there was also a decline in gas well drilling in Canada, where there previously had been a rising trend to accommodate growing gas exports to the U.S.

The level of drilling activity outside the U.S. and Canada was also hit by the sharp drop on oil prices. The average international rig count excluding the U.S. and Canada fell to 755 in 1998 from 809 in 1997. The international rig count was 793 in 1996 and 759 in 1995.

Group financial performance

Only 69 companies in the OGJ200 posted a profit in 1998, compared with 139 companies in 1997 and 163 companies in 1996.

In 1998, the number of companies posting net income of over $100 million fell to only 12, from 32 companies in 1997 and 34 in 1996. There were 18 such companies in 1995, 23 in 1994, 24 in 1993, 19 in 1992, 18 in 1991, and 30 in 1990.

A total of 131 OGJ200 companies posted a net loss for 1998. This compares with 61 companies in 1997, 37 in 1996, 79 in 1995, 116 in 1994, 108 in 1993, and 125 in 1992.

In 1998, 23 of the OGJ200 companies posted a loss of over $100 million. In 1997, there were only 4 companies posting a loss of over $100 million. None of the companies posted a loss of that magnitude in 1996. There were 8 companies with a loss of $100 million or more in 1995, 4 in 1994 and 1993, and 7 in 1992.

Due to the sharp drop in net income, the indicators of financial performance fell significantly in 1998, crashing through the previous floors established in the wake of the 1986 oil price collapse.

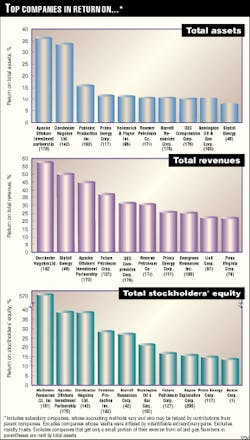

Return on assets for the OGJ200 group fell to 0.8% in 1998 from 6.2% in 1997. The OGJ200 group's return on assets set a record high of 6.6% in 1996. Prior to 1996 and 1997 the best year for return on assets was 5.7% in 1982. The return on assets was 3.9% in 1995, 3.3% in 1994, 3.9% in 1993, 2.2% in 1992, 3.4% in 1991, and 4.7% in 1990. The previous low level for group return on assets was 1% in 1986.

In 1998, the return on revenue for the group fell to 0.9% from the record high of 5.8% set in 1996 and 1997. Both net income and revenues fell in 1998, but net income fell much farther. Return on revenue was 3.6% in 1995, 3.3% in 1994, 3.9% in 1993, 2.1% in 1992, 3.3% in 1991, and 4.3% in 1990. The previous low return on revenue was 1.2% in 1986.

Return on stockholder equity fell to 2.3% in 1998. Return on stockholder equity was 15.9% in 1997 and a record high of 17.6% in 1996. Return on stockholder equity was 10.7% in 1995, 9.4% in 1994, 10.9% in 1993, 6.4% in 1992, 9.8% in 1991, and 13.6% in 1990. The previous low for this measure of performance was 3% in 1986.

Even though the rates of return on investments fell sharply, the level of capital spending was reduced only moderately. The OGJ200's 1998 capital and exploration spending fell 3.7% to $69.3 billion from $71.9 billion in 1997. The 1997 level of capital spending was the highest for the group since the first OGJ400 list was compiled, reflecting 1982 results. The previous highs were $66.5 billion in 1983 and $66 billion in 1985, when the list still contained 400 companies. The capital spending low for the group was $41.6 billion in 1987.

Group operations

Most of the indicators of OGJ200 group operations also fell in 1998. Only U.S. natural gas production and reserves were higher in 1998 than the year before.

Part of the decline this year is attributable to the merger of British Petroleum Co. plc and Amoco Corp. In previous years, all of Amoco's operations were included in the list. Reporting by BP Amoco resulted in only their combined U.S. operations posted in the list this year.

Group worldwide natural gas production fell 6.8% to 16.2 tcf from 17.4 tcf in 1997. In 1997, the group posted the highest gas output in the history of the OGJ group listings. Total worldwide natural gas production was up 2.2% in 1998 at 80.2 tcf.

U.S. natural gas production for the OGJ200 group increased 2.4% to 11.9 tcf. Total U.S. marketed natural gas output was down marginally in 1998 at 19.853 tcf from 19.866 tcf for 1997.

Group natural gas production outside the U.S. slipped to 4.3 tcf from 5.8 tcf in 1997.

OGJ200 worldwide liquids production slipped to 3.259 billion bbl from 3.375 billion bbl in 1997. U.S. liquids production remained at 1.821 billion bbl, the same as in 1997. The group's non-U.S. output was 1.438 billion bbl vs. 1.554 billion bbl in 1997.

Both worldwide liquids reserves and natural gas reserves were down in 1998. Worldwide liquids reserves for the group totaled 35.3 billion bbl, down from 37.1 billion bbl in 1997. Group worldwide liquids reserves moved up for 4 consecutive years, from 1994 through 1997, after falling for the 5 previous years.

Non-U.S. liquids reserves at yearend 1998 were 15.5 billion bbl, compared with 16.6 billion bbl in 1997. Group U.S. liquids reserves totaled 19.8 billion bbl in 1998 vs. 20.5 billion bbl in 1997. U.S. liquids reserves were down in 1998 after increasing for 3 consecutive years, 1995-97. The group's U.S. liquids reserves fell from 1987 through 1994.

Worldwide natural gas reserves for the OGJ200 group fell in 1998 to 179.3 tcf from 195 3 tcf in 1997. The group's worldwide natural gas reserves had moved up for 5 consecutive years, 1992-97. That followed 4 consecutive years of declining group reserves. Group natural gas reserves in the U.S. climbed to 109.4 tcf from 108.2 tcf in 1997. Non-U.S. natural gas reserves fell to 69.9 tcf from 87.1 tcf in 1997.

Changes in the group

This year's list contains 22 companies that were not on the list in the previous year, of which 17 have never been on the OGJ list. There were 16 new companies in the previous year.

The list contains three publicly traded limited partnerships, compared with four LPs last year. The largest LP is Hallwood Energy Partners LP, with assets of $139.1 million. The smallest was Apache Offshore Investment Partners, with assets of $9.8 million.

There are seven royalty trusts listed for 1998, the same as the year before. There are 15 companies that are subsidiaries of non-U.S. energy companies or of companies operating mainly in another industry.

The smallest company on this year's OGJ200 list had yearend 1998 assets of $1.585 million vs. the smallest listee in 1997, which had assets of $2.062 million.

The minimum asset value to be included in the top 100 companies fell to $139.6 million from $179.6 million in 1997. This compares with $129.4 million for 1996 and $116.9 million for 1995.

Top 20 companies

In 1998, there were 4 new companies in the top 20 companies ranked by assets. Mergers and acquisitions contributed to part of the change in the top 20.

In addition, for those companies that have diversified into other industries and have less than 50% of their revenues coming from oil and gas operations, only data from their oil and gas operations are now listed. This dropped Enron, Columbia Energy Group, and Consolidated Natural Gas from the top 20.

The Kerr-McGee Corp. acquisition of Oryx Energy Co. helped move them into the top 20 at No. 17. The other new companies in the top 20 this year are Anadarko Petroleum Corp., No. 18; Pioneer Natural Resources Co., No. 19; and Apache Corp. No. 20.

There was also considerable reshuffling of asset position. BP Amoco's U.S. operations are ranked at No. 5. Last year, Amoco was No. 4 and BP (U.S. operations) was No. 13. Texaco moved to No. 4 from No. 6. Shell Oil Co. slipped to No. 6 from No. 5. Conoco Inc. moved up to No. 8 from No. 9. Occidental Petroleum Corp. is now listed at No. 9 vs. No. 10 a year earlier. Unocal Corp. moved up to No. 13 from No. 16. Amerada Hess Corp. is now No. 14, up from No. 15. Union Pacific Resources Corp. advanced to No. 15 from No. 20. Burlington Resources Corp. moved up to No. 16 from No. 19. Kerr McGee moved up to No. 17 from No. 25.

The top 20 companies had total assets of $397.5 billion at yearend 1998, down from $434 billion at yearend 1997.

Assets of the top 20 companies represented 87.4% of total group assets in 1998, up from 83% in 1997 and 1996. The top 20 represented 84.1% of total group assets in1995 and 82.9% of the OGJ200 total in 1994.

The top 20 received revenues of $384.8 billion in 1998, down sharply from $512.3 billion in 1997 and $536.7 billion in 1996. In 1998, the top 20 revenues represented 94.7% of the total revenues for the OGJ200 vs. 91.4% in 1997 and 91.6% in 1996.

The combined net income of the top 20 was $11 billion, down significantly from $30.6 billion in 1997. Net income of the top 20 was $29.9 billion in 1996 and $18.2 billion in 1995. The net income for the top 20 was 303.8% of the group total in 1998. The remaining 180 companies posted an aggregate loss of $7.4 billion last year. The top 20 net income represented 94.1% of the OGJ200 total in 1997 and 88.1% in 1996.

BP Amoco does not report stockholder equity for its U.S. operations. Total stockholder equity for the remaining 19 companies of the top 20 totaled $143.5 billion, down from $169.4 billion in 1997. This was 90.9% of the OGJ200 total stockholder equity.

Capital and exploration expenditures in 1998 by the top 20 group totaled $52.8 billion, down from $53.6 billion in 1998. Spending by the top 20 was $46.2 billion in 1996, $41.1 billion in 1995, and $37.8 billion in 1994. The top 20 spending was 76.2% of the OGJ200 total capital spending in 1998.

The top 20 companies drilled 6,114 net wells last year, down slightly from 6,151 net wells in 1997. In 1998, this was 51.7% of total wells drilled by the OGJ200 group of companies. The top 20 drilled 4,882 net wells in 1996 and 4,147 net wells in 1995. The top 20 drilled only 3,599 net wells in 1992.

The top 20 companies accounted for 89% of the group's worldwide liquids production and 84.8% of U.S. liquids production. They had 74.1% of the group's worldwide natural gas production and 67.7% of U.S. natural gas production.

With respect to future production potential, the top 20 hold 90.4% of the OGJ200 group's worldwide liquids reserves and 88.1% of U.S. liquids reserves. They also have 76.4% of the group's worldwide natural gas reserves and 67.6% of the U.S. natural gas reserves.

Group's relative scope

The OGJ200 group's total revenue of $406.3 billion in 1998 was equal to 4.8% of U.S. gross domestic product. This is down from 6.9% in 1997 and 7.7% in 1996. Revenues as a percentage of GDP have been falling since the group list was started. The OGJ group revenues were as much as 18.4% of GDP in 1983.

The OGJ200 companies also accounted for a substantial share of total U.S. oil and gas production and reserves in 1998. The group's liquids production was 62.3% of the U.S. total. Group natural gas production was 59.9% of the U.S. total. The group had 64.8% of total U.S. liquids reserves and 62.3% of U.S. natural gas reserves.

On a worldwide basis, the statistics for the OGJ200 group of companies are not as impressive. Members of the Organization of Petroleum Exporting Countries and other national oil companies control a good portion of international reserves and production. The OGJ200 group holds 3.3% of worldwide liquids reserves and 3.5% of worldwide natural gas reserves. In 1998, the group accounted for 12.2% of worldwide liquids production and 20.2% of worldwide natural gas production.

Fastest-growing companies

The ranking for the OGJ200 list of the fastest-growing companies is based on growth in stockholder equity. Other qualifications are that companies are required to have positive net income for 1998 and 1997 and have an increase in net income in 1998. Subsidiary companies, newly public companies, and LPs are not included.

Under the above criteria, only three companies in the OGJ200 qualified for the list of fastest-growing companies. In all past years, at least 20 companies were listed in this category, from a larger group of companies that qualified. This clearly demonstrates the magnitude of the oil industry crash in 1998.

Most of the companies on the OGJ200 list posted a decline in net income or a loss in 1998, and that disqualified them from consideration.

The only three companies that qualified were Pontotoc Production Co., Reserve Petroleum Corp., and Coastal Corp. Pontotoc was not in the OGJ200 last year, although the company was operating.

Pontotoc led the list this year. Its stockholder equity moved up 41.9%, and net income increased 4% to $367,000. They were ranked 192nd in total assets. Reserve Petroleum posted an increase in stockholder equity of 10.1%, and net income increased 119.2% to $857,000. They were ranked 174th in total assets. Coastal had an increase in stockholder equity of 5.9%, and net income moved up 47.4% to $444.4 million. They were ranked 12th.

None of these companies were on the fastest-growth list last year.