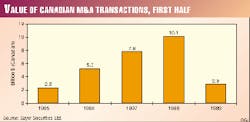

Canadian M&A activity plummets in first half

Canadian oil and gas merger and acquisition (M&A) activity showed a dramatic decline during the first half of 1999, compared with the first halves of the last 3 years.

M&A transactions for the period totaled just $2.9 billion (Canadian), a 71% decline vs. the $10.1 billion spent during first-half 1998 (see chart). It is also the lowest first-half total since the first 6 months of 1995, when Canadian M&A activity totaled $2.3 billion.

These were among the findings of Sayer Securities Ltd., Calgary, in a recent analysis.

Sayer expects M&A activity to increase for the second half of 1999. In fact, by late August, third quarter M&A transactions had already surpassed $5 billion.

In addition, the high value of certain key transactions will increase the average value of second-half deals, compared with the first-half average.

Key M&A measures

The decline in total Canadian M&A spending during the first half was accompanied by a drop in the number of transactions, with only 56 deals recorded during the period vs. 82 during the first 6 months of 1998. (Sayer limits its analyses to transactions with a minimum value of $5 million.)

The average size of deals also waned, falling to $32 million from $100 million in first half 1998.

"Depressed M&A activity levels for the first half are not surprising, given difficult equity markets for Canadian oil and gas exploration and production companies during the period," said Sayer. "The total value of equity financings fell to $529.1 million for the first half of 1999, compared to $1,049.4 million during the first half of 1998."

The median acquisition price for reserves, taking into account both property and corporate acquisitions, was also lower during first half than during the same period last year. "During the first half of 1999," said Sayer, "the median acquisition price paid for oil and natural gas reserves was $6.28/boe, compared to a median of $6.34/boe paid during the first 6 months of 1998.

"Higher prices were paid for the acquisition of natural gas reserves, which (in Canada) have been favored over oil reserves since the fourth quarter of 1997. Natural gas acquisition prices in the first half of 1999 commanded a premium of 16% relative to deals where reserves were primarily oil: $6.67/boe compared to $5.75/boe."

The average price of reserves purchased as part of corporate acquisitions also decreased compared with the first half of last year. "The median price paid for (reserves in) corporate acquisitions during the first 6 months of 1999 was $6.59/boe, compared to $7.86/boe for the same period of 1998," said Sayer. This 16% decline is attributable to lower equity markets for most of the first half, according to the analyst.

The average reserves price for property transactions declined as well, but less drastically-from $5.90/boe in 1998 to $5.83/boe.

Outlook

Despite the decline in Canadian M&A activity during the first half, the trend is unlikely to continue through the second half, says Sayer.

The second half total is bound to receive a boost from at least two planned acquisitions, reckons the analyst. Spending will be bolstered by Burlington Resources Inc.'s $2.6 billion purchase of Poco Petroleums Ltd. (OGJ, Aug. 23, 1999, p. 35) and Talisman Energy Inc.'s $870 million offer for Rigel Energy Corp. (OGJ, July 26, 1999, p. 46; and June 28, 1999, p. 32).

Also supporting an increase in M&A activity during the second half will be the $4.7 billion worth of oil and gas properties that have gone up for sale at the end of the second quarter, says the firm. The flagship of these transactions is BP Amoco plc's off loading of its Canadian oil business to Canadian Natural Resources Ltd. and Penn West Petroleum Ltd. for a combined $1.6 billion (OGJ, Aug. 16, 1999, p. 36).

Sayer predicts the highest-priced deals will probably be corporate acquisitions of firms weighted towards natural gas.