The continuing decline in U.S. natural gas wellhead deliverability may be setting the stage for a sharp spike in natural gas prices later this year.

While this trend of declining deliverability has been under way for some time, its impact on gas markets has been somewhat masked by recent lags in the rate of growth in U.S. gas demand-in turn largely the result of aberrant weather patterns.

But the arrival of a hotter-than-normal summer and the forecast return of normal (or colder-than-normal) winter weather have stripped the mask away from the U.S. deliverability dilemma.

Many industry observers are moving toward a consensus that the convergence of usual market factors-cooling load, storage injection levels, Canadian pipeline export capacity, etc.-are coupling with the fundamental problem of falling wellhead deliverability in the U.S. to firm up gas prices. While analysts offer a range of insights regarding a potential spike in natural gas prices, the extent of that price effect remains open to debate.

Regardless of the debate over the scope of the price spike, analysts seem to concur on a few observations. First, there is a consensus that such a spike in gas prices will likely happen sometime during the upcoming winter heating season. Similarly, most analysts agree that a spike, however great, would depend on several other fundamental components. These include: gas storage inventory levels (both preceding and following the winter season); declines seen in U.S. gas deliverability curves, specifically, wellhead deliverability in the Gulf of Mexico; availability of imports from Canada (see related story, this page); overall sensitivities of gas supply to outside fundamentals; the weather in late 1999 and early 2000; and the construction of new pipelines.

Finally, there remains the question of whether the recent uptick in oil and gas prices has generated enough cash flow to spur a rebound in gas drilling significant enough to dent the U.S. wellhead deliverability dilemma in the near term. It is too soon to tell on that score, but recent studies point to declining deliverability in the U.S. gas sector being a long-term, fundamental problem related to accelerating depletion rates in the shallow-water Gulf of Mexico (OGJ, Dec. 7, 1998, p. 33). So the 1999 winter heating season might well set a pattern for some years to come, with gas prices reined only by market factors other than wellhead deliverability.

Recent market events

So far this summer in the U.S., higher-than-normal temperatures have put a substantial strain on gas supplies. Gas consumption for power generation plants meeting peak cooling loads continues to be a large contributor to industry's inability to build storage levels to the level required for the upcoming heating season. Increased need for electrical power thus is undercutting gas storage injection levels.

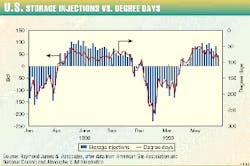

During the week ended Aug. 13, the American Gas Association reported natural gas net injections of only 51 bcf compared with 76 bcf a year ago. As a result, natural gas storage levels are now 142 bcf below last year's level. According to investment firm Raymond James & Associates, St. Petersburg, Fla., this fact is significant because it shows that the unusually hot weather has had a notable impact on gas storage levels.

"Lower levels of storage, combined with decreasing U.S. natural gas production rates, give us increased confidence that we will see a very strong natural gas pricing environment over the next year," the firm said.

Actually, gas markets are already seeing pretty robust prices, especially with the onset of the Gulf of Mexico storm season coming on the heels of a long heat wave across most of the U.S. Henry Hub spot gas prices last week broke the $3/Mcf barrier for the first time this year as Hurricane Bret started a course for the northern Gulf of Mexico, where so much U.S. gas production is concentrated. Prices later retreated as the storm fizzled out.

Upcoming heating season

During the upcoming heating season, say some analysts, increased gas demand will likely exceed supply. And, even if the U.S. does reach the start of the heating season (Nov. 1) with storage levels exceeding those seen during the past several years, the country could still experience some of the historically lowest storage levels by winter's end.

In a report released early in the second quarter this year-when natural gas prices had not yet reached the more-robust $2.50 and above range-Raymond James cited expectations that spot gas shortages would occur during the upcoming winter season. When and if this occurs, explains the firm, the result will be a sharp spike in spot gas prices-even as high as $10/Mcf-rather than a slow, gradual rise in price.

"...This kind of supply shock," said Raymond James, "would likely awaken the natural gas markets to the true underlying natural gas supply and demand fundamentals. Such an awakening should drive average 2000 natural gas prices well above levels we have seen in the pastellipseWe believe that, once the U.S. gas markets receive their wake-up call this winter, average gas prices above $3/Mcf in 2000 are very realistic."

The analyst bases its 2000 price forecast on these assumptions:

- A steepening of wellhead deliverability decline curves, with U.S. wellhead gas supplies expected to decrease 2%, on a year-to-year basis.

- A decline in drilling activity.

- An increase in Canadian supplies to the U.S. of only 5%, on a year-to-year basis.

- An expectation for a "more-normal" winter, which would drive up demand by more than 8%, on a year-to-year basis.

Raymond James added, "...History has proven that there is a decent correlation between the amount of gas in storage at the end of winter (Mar. 31) and the natural gas spot price high during that winter. In other words, the lower the gas storage (inventory number) at the end of the winter, the higher the probability of exceptionally high prices during the winter (Fig. 1a)."

In fact, according to its base case, Raymond James anticipates storage levels in March 2000 will slide below 300 bcf-the lowest level seen to date. And, because storage has never been drawn down to these levels, the firm expects spot shortages to result. Even if the winter season ends with a level below 700 bcf, says the firm, the potential exists for spot prices to reach into the double digits.

A similar winter's end storage scenario-albeit a more conservative one-is envisioned by research firm Simmons & Co. International, Houston. The firm's base case predictions, released at about the same time as Raymond James's study, shows a peak storage level of 2.8 tcf at the end of the third quarter. Ending the third quarter with a storage inventory level below 3 tcf, says the firm, would place upward pressure on prices. By the close of first quarter 2000, the firm expects storage to bottom at 1.04 tcf (Fig. 1b).

Simmons' storage and price forecast for 1999-2000 assumes: natural gas demand is unchanged from 1998 levels (except for a 5% reduction for second and third quarters of 1998, due to the hot summer weather); Canadian exports to the U.S. will increase by 0.7 bcfd, or 8%; U.S. gas production will decline 4%/year due to a reduction in domestic directional drilling. (Various storage scenarios are included in the tables on this page).

Also affecting gas prices, the increasing number of cooling degree days (CDDs)-the average temperature deviation from 65° F. for a period of 24 hr-this year compared with last year has had a dramatic effect on injections into storage. In the week ended July 24, for instance, the National Oceanic and Atmospheric Administration noted that the U.S. had experienced 13 more CDDs compared with last year, 98 vs. 85 (Fig. 2). An increase in CDDs tends to have a strong effect on the volume of gas injections.

Supply, deliverability issues

U.S. natural gas wellhead deliverability has declined by almost 1.5 bcfd, or about 3%, compared with a year ago, said investment firm PaineWebber Inc. in a report released earlier this month. The firm said, "This (decline) has been somewhat offset by greater nuclear and hydropower supplies, higher Canadian imports, and depressed demand by the chemicals industry. Nonetheless, natural gas storage injections have failed to approach levels witnessed last year during this period, despite 7% cooler temperatures (measured by CDDs weighted by electric home-cooling customers) on average, compared with last year during mid-April through July."

In fact, PaineWebber's analysis concludes that deliverability could be down by as much as 2.5 bcfd, or 5%, by the start of the approaching winter season. And, says the firm, this decline is expected to continue, even with the recent increase in upstream capital spending: "Therefore, even though storage levels are only slightly below last year at this juncture, the push to fill storage before the start of this winter should keep the 'heat' on natural gas prices. Of course, (the weather) will continue to be a key factor affecting the natural gas price dynamics near-term," said PaineWebber.

The potential for a sharp increase in gas prices should the U.S. experience a cold winter reflects the view that the gas markets of recent years have been aberrations.

"Our view of natural gas prices," said Charles Davidson, CEO of Wesford Management LLC, Greenwich, Conn., "reflects the experience of the past few years and the way in which the product is currently delivered. We've had several U.S. winters in a row of unprecedented warmth. That has masked what we believe is an imbalance between supply and normalized demand.

"A cold winter this year could show demand that can't be met. Only so much gas can be produced, there are only so many pipelines with only so much capacity, and only certain places that those pipelines go."

Gulf of Mexico development

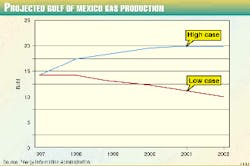

As one remedy to declining U.S. gas deliverability, production from the Gulf of Mexico Outer Continental Shelf remains very promising, assures the U.S. Energy Information Administration. And, the number of deepwater projects approaching the development phase adds to this optimism. Overall production from the gulf is expected to reach 10-20 bcfd by 2002 (Fig. 3). Concerns exist, however, over the production levels of certain shallow-water projects.

"The gas production trends to date indicate that the bulk of production in the offshore will flow from shallow-water fields. Thus, if shallow-water fields do not maintain their level of production, the offshore Gulf of Mexico total likely will decline as reductions in the much larger shallow-water production rates would more than offset anticipated new deepwater gas production," said the EIA. Increased production from the gulf, therefore, would rely on both shallow and deepwater finds.

However, the high case of EIA's production outlook would call added production of 20 bcfd by 2002 from the gulf. EIA said, "Introduction of such large volumes in a relatively short period would have a significant impact on regional gas markets. This volume is equivalent to 10.6% of total gas produced in the U.S. during 1997ellipseAny large incremental volumes from deepwater fields depend on development of both the projects themselves and the associated infrastructure, so these volumes are less certain than those from shallow-water fields."

Gas supply sensitivities

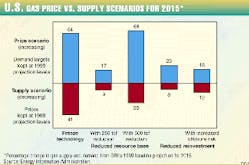

As part of a report released by the Gas Research Institute, various gas supply sensitivities were analyzed from the firm's 1999 baseline projection for 2015 (Fig. 4). In looking at these sensitivities, GRI hoped to quantify the potential impact of changes in each of these parameters. The price and supply deviations were determined for each supply sensitivity.

GRI's projection, it determined, was particularly sensitive to three key parameters:

- The rate of exploration and production technology improvement.

- The size of the gas resource base.

- Industry investment levels in E&P.

GRI evaluated each supply sensitivity separately to determine a range of supply and price impacts.

GRI explains its methodology: "Each sensitivity was run in two formats. In the first format, price was kept at the levels established in the 1999 edition of the baseline projection, and the model was solved for supply constrained by the changes in the key parameters. In the second format, the demand targets for supply were kept constant at the levels in the 1999 projection, and the model was solved for price."

By using this approach, GRI was able to determine certain endpoints between which its results could fall, given the varied results for each key parameter.

GRI determined that the technology parameter manifested the greatest percentage change. It explained, "In (the technology) sensitivity, there was either a 41% supply shortfall by 2015, or the price increased by 64% to attract the needed supply.

"The resource base sensitivity had the next largest impact. Depending on the magnitude of the resource base cut, there was a supply shortfall (of) 9-25%, or gas prices would need to increase byellipse17-68% by 2015, respectively, above the levels in the 1999 baseline projection to offset the resource deficiency in this sensitivity.

"Following in overall impact were the reduced-reinvestment and higher offshore (economic) hurdle sensitivities. The reduced reinvestment sensitivity resulted in an 8% supply shortfall, which would require a 23% increase in price to eliminate. Combining a higher offshore hurdle rate with the lower reinvestment sensitivity results in a 12% supply shortfall, which would require an 18% increase in prices to offset. Overall, Gulf of Mexico production in 2015 was reduced by 1.1 tcf and 2.4 tcf, respectively, in these two sensitivities.

"For gas customers, city gate prices increased by up to 57% in the technology case, 63% in the 500 tcf resource case, and 21% in the reinvestment sensitivity."

Pipeline expansions

Ultimately, the deliverability of gas in the U.S., or lack thereof, will have a direct effect on price in the short to medium term. Meeting the long-term projected demand growth over the next decade will take tremendous investment and significant pipeline expansions, says EIA.

"Interstate pipeline capacity has increased by more than 16% (on an interregional basis) during the past decade. Average daily use of the network was 72% in 1997, compared with 68% in 1990.

"More than 17 new interstate pipe- lines were constructed, as well as numerous expansion projects, between 1990 and the end of 1998," said EIA. "In 1998, at least 47 projects were completed, adding about 10 bcfd of overall capacity to the national grid."

Proposed in the Lower 48 for 1999 and 2000 are more than 75 pipeline projects, which would add about 20.1 bcfd of capacity to the national grid. Over the course of the next 2 years, says EIA, as much as $10 billion could be spent on natural gas pipeline expansions, based on initial estimates.

EIA said, "The largest expenditures, about $6 billion, would include several large projects now scheduled for completion in 2000, such as the Alliance Pipeline ($2.9 billion), the Independence Pipeline ($680 million), and the Columbia Gas System's Millennium project ($678 million). In all likelihood, however, some of the 75 proposed projects may be canceled or postponed until the next decade, because of competition, changed market conditions, and/or regulatory actions."

The growing availability of exported Canadian gas has also fueled the various expansion projects. During 1990-97, says EIA, Canadian gas supplies (as measured by cross-border pipeline capacity) rose by 75%, to 11.4 bcfd from 6.5 bcfd. And 1998 saw another 9% increase, just short of 1 bcfd.

If all currently planned projects are completed, says EIA, an additional 3.7 bcfd of capacity could be in place by 2000. All told, during 1990-2000, import capacity will have increased by about 132%.