Growth in U.S. cogen use of gas to slow

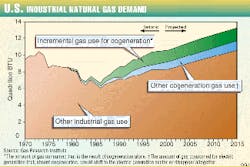

The U.S. cogeneration market will continue to favor natural gas as its primary fuel source in the coming years, but the 10%/year growth rate of gas use in cogeneration seen in the late 1980s and early 1990s is not likely to continue.

Cogeneration currently accounts for 65% of U.S. industrial gas consumption.

The slackening pace in the growth rate of cogeneration use of gas could mean that natural gas producers may not be able to rely on industrial cogeneration as a driving force behind gas demand growth in the near future.

Also, "as the industrial cogeneration market has matured, fewer favorable sites are available for development. Many of the industrial sites that use steam and offer the most attractive cogeneration economics already have cogeneration facilities," said Gas Research Institute.

These were a few of the findings in a recent study by GRI, which projected the near to mid-term outlook for the industrial cogeneration industry's use of gas.

GRI's findings

GRI's study, which covers 1996-2015, found that the industrial cogeneration market will show an average growth of about 1.4%/year. Faster growth will take place earlier in the projected time period and give way to a slower pace toward the end of the study period.

"As a share of total industrial gas consumption growth, cogeneration will decrease from nearly 70% during a 5-year period in the late 1980s down to 12% after 2005. Future growth in industrial gas consumption will be driven predominantly by more traditional gas applications, including drying, fluid heating, metal heating, smelting, and heat treating," said GRI.

Marie Lihn, GRI project manager, added, "The phenomenal growth of the past was a one-time event resulting from a unique combination of regulatory and market changes. Although cogeneration will remain a sizable and important gas market, future growth of the same magnitude is highly unlikely."

Past, future market growth

This "one-time" period when cogeneration consumed natural gas at a particularly rapid pace occurred throughout the 1980s. During that time, says GRI, "the traditional cogeneration market-in which the industrial steam requirement is the driving force-operated in a catch-up mode to capture opportunities created by the Public Utilities Regulatory Policy Act (Purpa)."

"Much of the new capacity added during this period was installed at existing industrial sites where cogeneration was previously attractive but not used because of regulatory barriers," said GRI.

GRI explained: "The regulatory factors that stimulated rapid growth in the non-traditional market no longer exist, and gas consumption (growth) in the market sector-which grew rapidly in the late 1980s and early 1990s-will reverse and then decline through 2005 as uncompetitive cogeneration facilities are closed."

Meanwhile, a non-traditional market developed, which took advantage of Purpa's mandatory buy-back provisions. This market was where third parties could match steam load to capitalize on electric generation revenues. "From 1985 to 1990," said GRI, "gas consumption in (the non-traditional) market grew 22%/year vs. 7%/year in the traditional cogeneration market."

These mandatory buy-back incentives, however, weakened once the Energy Policy Act of 1992 (Epact) was passed, says GRI, and created a new class of non-utility power producers called exempt wholesale generators (EWGs). "The legislation didn't create a mandatory purchase obligation for EWGs, comparable to that created under Purpa," said GRI.

"As a result, many states implemented 'all-source' bidding programs for deciding on solicitations of incremental capacity. The changes sharply reduced incentives for independent power developers to design power plants as non-traditional cogeneration facilities."

In certain regions, reckons GRI, low buy-back rates will hinder future growth in the traditional facilities. "In addition, electric deregulation will create capacity surpluses in some regions and create continued downward pressure on buy-back rates. However, buy-back rates will again become a function of a region's generation costs by 2010 with the rebalancing of supply and demand," the institute said.