New Technology Is 'Lifeblood' For Northwest Europe Offshore

As the average size of Northwest Europe's remaining development prospects dwindles and operators look to screw down development and operating costs, new technology is the key to making many projects viable.

Innovation is the theme of many of the conference papers and exhibits to be presented at Offshore Europe in Aberdeen during Sept. 7-10 and was the theme focused on by the conference committee ahead of the event.

Stig Bergseth, executive vice-president of Statoil AS and general chairman of Offshore Europe 99, said technology has changed the mental map of the offshore industry over the last 10 years.

"I am a firm believer in technology as a competitive leverage," said Bergseth. "Technology has been a driver for performance and growth regardless of the prevailing business environment.

"When oil prices are high, we are encouraged to develop new technology in order to explore in increasingly demanding areas. On the other hand, if prices are low, we equally need technological improvements to cut costs and increase efficiency. Thus, irrespective of the state of our markets, technology must be at the center of our attention."

Malcolm Brindred, chairman of the Offshore Europe conference and chairman of Shell U.K. Ltd., sees technology as the key to unlocking a future for Northwest Europe's offshore industry.

"In the North Sea," said Brindred, "we now face income per barrel down to one-fifth of the early '80s in real terms, as well as new field sizes one fifth (that) of the early '80s.

"Together this makes a typical new project prize worth only one twenty-fifth of then. I find that a daunting prospect. We can only stay in business against this background because of the technological advances we've made in the last decade.

"To stay profitable in the future, we'll have to find even better new technology and apply it even faster, in order to explore and develop more small pockets of oil and gas at lower cost. This is not only essential to bring new fields on stream economically, but also to extend the commercial lifetime of our existing platforms."

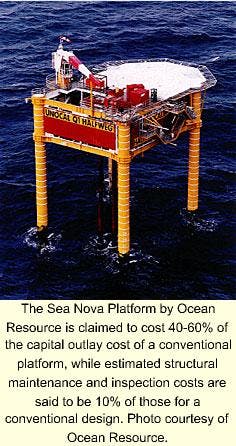

Sea Nova platform

An example of how ideas about offshore infrastructure are changing is the Sea Nova low-cost platform design by Ocean Resource Ltd., Chepstow, U.K.

Ocean Resource said its Sea Nova is essentially a self-installing platform requiring a minimum of marine vessels and no specialist or heavy-lift vessels. Because it is removable, it is seen as a "field-hopping" development concept for marginal, shallow water fields.

Burlington Resources (Irish Sea) Ltd. plans to install a Sea Nova platform to develop West Millom gas field in the Irish Sea off the U.K. This will be an updated version of a platform installed by Unocal Netherlands BV on Block Q1 in the Dutch sector of the North Sea.

Ocean Resource said the Sea Nova comprises a concrete gravity base structure (GBS) that can be ballasted and deballasted, into which are fitted a number of unbraced tubular columns supporting a conventional trussed deck. A four-column design with a rectangular pancake deck is seen as the most likely typical configuration.

The GBS is designed to be deballasted during tow-out and to form "an inherently stable composite unit" with an installation barge. On location, it would be moored between two premoored winch barges.

Then control and lowering lines would be connected to the GBS, and it would be unlocked, ballasted, and lowered to the seabed. Once the GBS was fully ballasted, the deck would be locked and the jacking system started up.

Once the deck was clear, the barge would be towed clear and jacking would continue to the final level. The installation would be ready for hook-up and commissioning ahead of post-drilling or completion work.

Ocean Resource said the cost of Sea Nova would be dependent on the type of certification, location, water depth, topside load, environmental conditions, and other design parameters.

For guidance, the company quotes a figure for a typical Northwest European continental shelf project, with costs estimated in association with a fabricator for installation in shallow water within 50 km of the construction site: "The facility can be procured, fabricated, transported, and installed for a cost of £3.8 million ($6.1 million). This does not include process equipment or owners' costs.

"We can provide Sea Nova on an engineering, procurement, installation, and commissioning (EPIC) basis in conjunction with this fabricator, and if required, ongoing maintenance and operation can be included.

"As a general guide, Sea Nova is between 40% and 60% of the capital cost of a conventional platform. The estimated structural maintenance and inspection costs are approximately 10% of those for a conventional platform. Because the structure is reusable, a cost reduction is also achievable, as capital costs can be partly written to later projects.

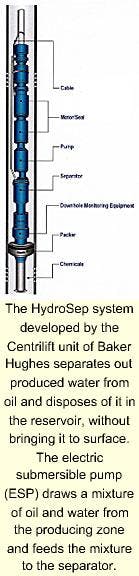

Downhole separation

The Centrilift unit of Baker Hughes Inc., based in Egham, U.K., has appraised a downhole oil and gas separation system that was first unveiled at Offshore Europe 97.

Centrilift claims the HydroSep system is set to prove itself in previously uneconomical high water-cut reservoirs, thus extending the boundaries of oil retrieval again through technological advancement.

HydroSep is intended to be the first downhole process unit in what Baker Hughes calls "the downhole factory." This unit was appraised under a joint industry project at an onshore facility in Humble, Tex. There it was deployed in a standard 95/8-in. cased well to provide a nominal 20,000 b/d capacity with water cuts at 50-90%.

Chris Shaw, Centrilift's manager for wellbore separation products, said: "As part of this stage in the test loop for HydroSep, there was a clear demonstration that, as a more complex downhole installation, it can function effectively in the well environment, confirming confidence in running field applications.

"We were particularly satisfied with the ability of the system to respond to changing conditions downhole and to sustain both a clean-water discharge at a target of less than 500 ppm of oil and a concentrated produced-oil stream at a target greater than 70%."

The HydroSep comprises an electric submersible pump with water separation and disposal within the same well. Disposal of produced water before it is lifted to the surface brings significant reductions in operating costs.

Bernie Fay, Centrilift's business development manager for well-bore separations, said: "With HydroSep, you can reduce lifting costs, reduce topsides surface facility requirements or expensive upgrades, and improve recovery of reserves.

"Accelerated production is a particularly exciting proposition where limited surface facilities are available, for example, offshore or on floating production, storage, and offloading vessels.

"Installation is straightforward and compatible with up-to-the-minute developments in horizontal wells, multilateral wells and intelligent completions."

Seabed hazard alarm

An innovation that will not be used by the oil and gas industry itself but will reduce the hazards of its offshore installations was developed by petroleum companies and the fishing industry.

The FishSafe system is an electronic device designed to warn fishing crews of seabed hazards such as wellheads and pipelines, based on information from navigational equipment and a subsea obstacles database.

The development followed the loss of the Westhaven trawler and its crew in the U.K. North Sea in 1997, when the ship's gear snagged on a subsea oil pipeline.

Development of FishSafe was instigated by the Triton project team, led by Amerada Hess Ltd., Shell U.K. Exploration & Production, and Texaco Ltd. which jointly developed the Bittern, Guillemot West, and Guillemot Northwest fields.

Besides the Triton partners, FishSafe development work was aided by the U.K. Offshore Operators Association (Ukooa), the Scottish Fishermen's Federation (SFF), and the National Federation of Fishing Organizations.

Ukooa said the recent oil and gas industry trend to install seabed equipment and pipelines in preference to conventional-and highly visible-production platforms has increased the potential risks of snagging on seabed hazards.

There is a 500-m exclusion zone around subsea production manifolds. Ukooa said that, while recent manifolds and wellheads are designed to be over-trawlable, fishing crews would be better off assuming they are not: "Seabed kit is unlikely to be over-trawlable within the 500-m zone."

Another hazard is wellheads, many of which are no longer producing and have been abandoned-but these are being removed under an oil industry program.

The box-like FishSafe device was designed and is built by Fugro Starfix (U.K.) Ltd., Aberdeen, and costs £150,000 ($240,000). It measures the position of the fishing vessel from its on-board global positioning system (GPS) receiver and compares this with a database of subsea obstacles.

Information about subsea obstacles in the ship's vicinity, plus details of exclusion zones surrounding oil and gas installations, is displayed on a small screen. If the ship approaches within 6 miles of a potential hazard, audio and visual alarms are triggered, increasing in intensity as the ship nears the hazard.

The system is designed to provide details on an adjustable scale, with the screen covering from 6 miles down to 1/2-mile across, with enough detail and advanced warning to enable the crew to avoid any obstacles.

Trials of FishSafe on 10 Scottish fishing vessels began in June 1999, with a view to making the device available commercially by yearend. The SFF said, "This is the system we have been waiting for, for many years."

Active-heave draw works

National Oilwell (U.K.) Ltd., Aberdeen, claims its active-heave drilling draw works represents a quantum leap in the provision of active-heave motion compensation for drillships and semisubmersibles.

The active-heave drilling (AHD) unit consists of traditional draw works combined with a compensating system comprising a single-speed, single-shaft direct gear drive and six ac motors

The vessel's heave motion is measured by the AHD's motion-reference units and fed to the AHD control system, which uses feedback signals from block-position sensors to provide data for controlling the draw works speed and hence providing active-heave compensation

The AHD system has less working parts than a conventional draw works, and because the compensator is drillfloor-mounted rather than installed in the derrick, there is easier access for preventive maintenance. Similarly, the use of gears instead of chains in the draw works reduces the need for maintenance, as does the use of ac motors rather than dc motors, as installed in conventional systems.

National Oilwell claims the AHD system sets new standards for compensation accuracy and improves wire life and load-working range. It also claims that the AHD unit can increase the drilling operating window typically by 20 days/year in comparison with conventional passive-heave compensating equipment, as a result of greater compensating capacity and accuracy.

Key to the performance is the replacement of the conventional clutch or gear shift with direct gear drive, with the motors being used for both hoisting and braking. Riser-handling and tripping are normally time-consuming operations, but with the AHD, these are carried out without using brakes, which is said to increase efficiency.