OGJ Newsletter

Oil prices are at their highest level in 2 years, breathing new life into an industry still recovering from an extended downturn.

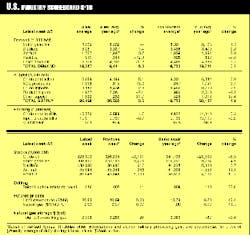

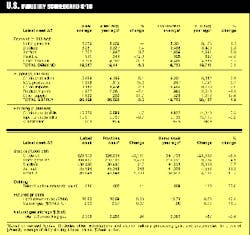

In New York trading on Aug. 12, the price of Nymex crude for September delivery opened at $21.25/bbl and had risen to $21.52 by mid-morning. In London trading the previous day, September-delivery Brent closed at $20.63/bbl, up 14¢ on the day. Prices in the U.S. were buoyed by a 3.16 million bbl drop in U.S. oil inventories the week of Aug. 6, according to API statistics. This brought oil stocks down to 323.1 million bbl (see Scoreboard, next page).

This 1.0% decline in crude inventories was surpassed by a 1.7%, or 3.5 million bbl, decline in U.S. gasoline stocks, to 206.6 million bbl.

Despite the recent price rise, OPEC's monitoring subcommittee has warned OPEC members against raising output too soon. After its July 30 meeting in Vienna, the subcommittee noted that the year-to-date average price of OPEC basket crude was still less than $14/bbl and that global oil stocks are still higher than during 1995-97. The group said it "strongly cautioned against complacency and emphasized the importance of continued strict adherence to agreed production levels by all OPEC and non-OPEC producers concerned, until at least the expiry of the March 1999 agreement at the end of March 2000, at which time the market situation could be reviewed, taking into consideration the annual average OPEC reference basket price."

Not overly swayed by rising oil prices, petroleum companies are continuing to look at ways of operating more efficiently.

At presstime, the board of directors of Norwegian state firm Statoil was preparing to pass on to the government its recommendations for future structural changes. The document was to be delivered Aug. 13, and Norwegian media were reporting that a partial privatization proposal was likely.

The report was also expected to include a recommendation on commercializing SDOE, the government entity that controls the state's oil and gas interests. Among the possibilities are a merger of SDOE and Statoil-which would create a firm with a reported 17 billion boe of reserves-and transference of parts of SDOE to other companies, such as state-controlled Norsk Hydro.

Hungary's MOL Rt. and Croatia's INA-Industrija Nafte have signed a memorandum of understanding to start exclusive negotiations for a merger.

MOL produces 33,500 b/d of oil and 330 MMcfd of gas, mainly in Hungary, and operates two refineries, a bitumen plant, a lubricants blending plant, and 420 retail stations. INA produces 34,000 b/d of oil and 150 MMcfd of gas, mainly in Croatia, and likewise runs two refineries, two lubricants plants, and a chain of 500 retail stations. Both companies have E&P interest abroad: MOL in Tunisia, Egypt, Yemen, Qatar, Syria, Greece, Albania, and Pakistan; and INA in Angola, Albania, Algeria, Libya, Egypt, and Russia.

French majors Elf and TotalFina are continuing a war of words over their mutual takeover battle (OGJ, Aug. 9, 1999, p. 26). TotalFina's board last week unanimously rejected Elf's takeover bid, with the exception of one abstention by a state representative. The board also recommended that TotalFina shareholders reject the bid. Among its chief concerns is the viability of Elf's plan to spin off the firms' chemicals businesses.

TotalFina says this would cause "loss of synergies between refining and petrochemicals, substantially lower market valuation for the chemicals as an independent company, and a potential maximum 3.5 billion euro tax liability associated with the spinoff, as estimated by Elf's management." In addition, the cash component of Elf's plan precludes the use of pooling-of-interest accounting and "creates doubts about the ability to bring about the rapid growth in oil and gas production," said TotalFina.

Elf countered by restating the benefits of its offer, including "demonstrable synergies of more than 2.5 billion euros-twice TotalFina's announced level." Elf says the cash component of its offer would improve the capital structure of the combined firm. It also claims its division of petroleum and chemicals would result in: 1999 net income of 0.5 billion euros for the chemicals segment, growing 27.6%/year through 2003; and 1999 net income of 2.4 billion euros for petroleum, growing 21.8%/year through 2003, assuming $15/bbl oil.

Early reports of second quarter earnings for energy firms are revealing an industry in transition from an extended slump (OGJ, Aug. 9, 1999. p. 30). A sampling of earnings follows, with second quarter 1999 results shown first, in millions of dollars, followed by second quarter 1998 earnings; losses are shown in parentheses: BP Amoco, 1,063 vs. 1,091; Duke Energy, 283 vs. 274; Texaco, 273 vs. 342; Enron, 222 vs. 145; Marathon, 134 vs. 162; Conoco, 114 vs. 156; Coastal, 93.3 vs. 91.5; Phillips, 68 vs. 158; Kerr-McGee, 45 vs. 82.9; Sonat, 33.6 vs. 45.8; Tesoro, 32.5 vs. 9.9; Apache, 29.6 vs. 9.2; Cross Timbers, 28.6 vs. 0.80; Dynegy, 28 vs. 23.4; Sunoco, 26 vs. 92; Williams, 17 vs. 60.7; Occidental, 9 vs. 186; Unocal, 9 vs. 105; Anadarko, 8 vs. 2.7; Basin Exploration, 3.45 vs. 0.75; Swift Energy, 3.15 vs. 2.9; McMoRan Exploration, 0.84 vs. (7.86); Mississippi Chemical, (1.2) vs. 17.8; Triton Energy, (2.9) vs. (150.1); Pogo Producing, (3.01) vs. (2.67); Belco Oil & Gas, (6.6) vs. (43.8); Nuevo Energy, (15.6) vs. (7.6); Clark USA, (30.3) vs. 17.2; Consolidated Natural Gas, (80) vs. 57.8; and Santa Fe Snyder, (148) vs. 0.4.

Canadian independent Talisman has joined the list of E&P firms that are increasing 1999 capital spending, spurred on by the crude price rise and second quarter earnings gains (OGJ, July 5, 1999, Newsletter).

Following an increase in its second quarter earnings-to $20.4 million (Canadian) from $1.9 million in second-quarter 1998-Talisman is boosting E&D spending to $887 million from a planned $816 million. Talisman's second-quarter results also reveal an increase in cash flow of 61% to $225.5 million from $139.7 million. The company credits new production from an oil field in Sudan as a factor in its improved performance. Talisman expects its oil output to rise by 40,000 b/d by fourth quarter as a result of increases in the North Sea and elsewhere.

Just as plans to lay a gas pipeline from Nigeria to Benin, Togo, and Ghana were being firmed up last week, reports of interference from the Nigerian government indicated that the deal might crumble.

The proposed West African Gas Pipeline project is led by Chevron, Royal Dutch/Shell, and the national gas companies of the four countries involved (OGJ, Nov. 2, 1998, p. 45). On Aug. 11, Chevron announced that the governments had approved the pipeline, which would move Nigerian gas to the other countries for use in power generation. But later the same day, the pipeline deal fell apart, at least temporarily, when Nigeria demanded to replace Chevron as project leader, prompting the other parties to refuse to sign a joint-venture agreement, according to a report by Dow Jones News Service. Chevron told Dow Jones it is optimistic that details of the deal to lay the $400 million, 120 MMcfd pipeline can be worked out. Start-up of the line is slated for mid-2002.

A group of 10 Canadian oil, gas, and forestry firms-including Syncrude Canada, Suncor, Petro-Canada, and Mobil Oil Canada-has lessened tensions between itself and certain indigenous groups in northern Alberta with the signing of a recent accord. The ground-breaking agreement, signed with the Athabasca Tribal Council in the Fort McMurray oilsands region, is expected to improve job opportunities for the natives in the oil, gas, and forestry industries. The program will receive funding for environmental and job training programs from the firms and from the federal and Alberta governments.

The U.K. government has a new energy supremo following the cabinet reshuffle by Prime Minister Tony Blair. Helen Liddell moved from the transport department to become Minister for Energy & Competitiveness in Europe. She takes over most of the portfolios of former Energy & Industry Minister John Battle-moved to the Foreign Office-and former Minister for Competitiveness in Europe Lord Simon, previously BP chairman. "My priorities," said Liddell, "will be to carry through the work begun by John Battle and Lord Simon, to establish a level playing field in our energy markets, deliver our program of reform of utility regulation, and to work to improve British business competitiveness in Europe."

BP Amoco is continuing a search into six cases of intracranial tumors among chemical researchers at its Naperville, Ill., facility. A report by independent investigators concluded "an occupational exposure at the facility may have contributed to the excess of the brain cancer glioma among chemical re- searchers," said BP Amoco. The investigators noted that all six employees were exposed to two suspect agents: low-level ionizing radiation and n-hexane. All six, five of whom have reportedly died, worked at the Naperville site in the mid-1970s and early 1980s; many were exposed to similar chemicals and agents.

BP Amoco said, "The investigation has established a pattern among people diagnosed with glioma that does not exist for any other illness at the facility." The firm contends, however, that the investigative "results fall short of identifying any specific causative agents" for the glioma cancer.

BP Amoco hired the University of Alabama at Birmingham School of Public Health and Johns Hopkins University in 1996 to conduct the investigation.