Outlook Bright for Fueling Growth Of Natural Gas In The Southern Cone

Generally blessed with plentiful hydrocarbon reserves, South America boasts proven oil reserves of 129 billion bbl and proven gas reserves of 265 tcf, or 10% of the world`s total oil equivalent reserves.

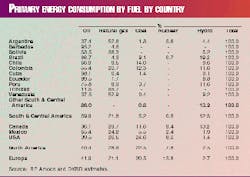

Although Latin America and the Southern Cone (for purposes of this discussion comprising Argentina, Brazil, Chile, Bolivia, and Peru) as a whole are fairly balanced in their production and consumption of oil and gas, countries such as Brazil and Chile find themselves in a deficit position. The primary reason is that the high-growth economies of Brazil and Chile do not possess sufficient indigenous reserves and production capacity. This results in imports by the two countries, which are expected to reach 500,000 b/d of oil and 1.565 bcfd of gas by 2000 (Table 1).

Focusing more on natural gas, it is a geological irony that, while Brazil and Chile, having inadequate natural gas reserves, have been in perennial need of natural gas, they have been surrounded by rich gas fields in Argentina, Bolivia, and Peru. Poor economic integration in the region and lack of supply infrastructure have forced natural gas to play a secondary role to less energy-efficient and less environmentally friendly crude oil.

However, in the last few years, the situation has been changing dramatically. Formation of regional trade blocks such as Mercosur and the Andean Pact have given rise to gradual elimination of cross-border tariffs, which, in turn, have encouraged the construction of large pipelines facilitating the transfer of vast amounts of natural gas across national boundaries. We believe that the availability of natural gas in the energy-starved region of the Southern Cone will give rise to a tremendous boost in natural gas consumption and change the energy landscape of the region over the next few years. The three key catalysts that should reduce the region`s energy imbalance, while fostering growth in natural gas demand are: (1) economic liberalization of the regional economies, giving rise to trade pacts such as Mercosur; (2) liberalization of previously state-owned oil monopolies; and (3) construction of large cross-border pipelines, facilitating direct exports of natural gas.

Gas market underdeveloped

Although the Southern Cone has a population of about 270 million people-nearly the same as the U.S.-its natural gas consumption has been quite modest, amounting to less than 3% of worldwide gas demand; that compares with U.S. share of about 29% of world demand (Fig. 2).

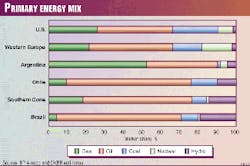

The story is similar when the Southern Cone is compared to other regions of the world, and appears even more exaggerated when natural gas consumption is benchmarked with the gross domestic product of other regions of the world. Not only is the region generally low in energy consumption, but the proportion of natural gas in the overall energy mix has been quite dismal. For instance, the Southern Cone`s largest economy, Brazil, has a current GDP of $803 billion, or a tenth that of the U.S., but only has 1% of the U.S.`s gas consumption (Fig. 3).

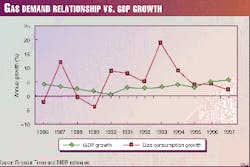

Despite the meager contribution of natural gas to the Southern Cone`s energy mix, the long-term demand trend has been quite encouraging. In 1990, the region consumed 2.1 tcf of gas, which improved to 3.1 tcf in 1997 and an estimated 3.3 tcf in 1998. This translated into a average growth rate of 5%/year over the last 8 years, higher than the region`s average GDP growth of 2.2%/year.

We believe that economic activity will continue to play a dominant role in gas demand in the region. Given our positive long-term growth forecast for the Southern Cone-Dresdner Kleinwort Benson economists are forecasting 3.3% GDP growth for 2000-demand outlook for natural gas in the region does look quite bright, indeed.

We believe that the key drivers of natural gas demand in the region are:

- Liberalization of the hydrocarbon industry.

- Future electricity generation to be fueled by natural gas, particularly in Brazil.

- The continuing switch of industries from fuel oil to more-efficient natural gas.

- Growth among the gas-to-petrochemical industries.

- A higher penetration of residential markets.

- Growing use of compressed natural gas as an automotive fuel, driven by environmental concerns.

Fast-track liberalization

Historically, most Latin American economies have been isolated, with their energy sectors being largely under state control.

However, recent times have seen a dramatic change in economic liberalization. Development of several trade blocks such as Mercosur (with members comprising Argentina, Brazil, Uruguay, and Paraguay, with associate members Chile and Peru), and the Andean Zone (Bolivia, Peru, Ecuador, Colombia, and Venezuela) should not only facilitate cross-border trade through reduction of tariffs but also should foster growth throughout the region.

Concurrently, most state-owned oil and gas companies in the region, driven by economic liberalization and a need to attract foreign capital and technology, have undergone some degree of free market transformation as well.

Argentina has been ahead of the curve, with outright privatization of its oil and gas industry in 1993, which transformed the loss-making state-owned monopoly into one of the most cost-competitive petroleum companies in the world.

Venezuela, with its huge reserves, has been met with an impressive scale of foreign partners, investments in production, and could continue to attract significant foreign capital and technology through its Apertura plan involving production sharing.

While Bolivia has opted for strategic investment and capitalization, Peru has embarked on a piecemeal divestment of its oil and gas assets. Should the government be able to attract sufficient international interest for development of its Camisea project, we could see substantial change in the dynamics of the natural gas industry in the region. Incidentally, with the completion of several upcoming pipelines, Camisea will be the only large natural gas reserve out of the top five in the region that will not be linked to major industrial centers in the region.

The newest entry to the liberalization trend is Brazil, with its oil and gas industry still undergoing substantial change on the path of free-market liberalization. With the effective demonopolization of state-owned Petroleo Brasileiro SA (Petrobras), the regulatory body National Petroleum Agency (ANP) is quickly moving to open up Brazil`s large hydrocarbon potential to exploration and production by foreign interests. Thanks to aggressive steps by ANP, the country`s complex web of import restrictions and subsidies could give rise to transparent import price parity terms over the next 18 months.

Although a few regulatory and fiscal problems so far have dissuaded large joint-venture participation with Petrobras, the government seems to be committed to removing the hurdles and attracting foreign capital. Over the next 12 months, two more rounds should follow the first-round auction, which was met with mixed results in June. Two of the biggest beneficiaries of the growing foreign interest in Brazil`s hydrocarbon sector are likely to be: (1) growth in oil and gas production, particularly from the rich hydrocarbon reserves of the deepwater Campos Basin; and (2) integrated (natural gas to electricity) energy projects.

Brazilian gas demand

Although demand for natural gas is generally a complex function of several factors, including the level of economic activity, population growth, and the appetite of the industrial and power generation sectors for natural gas, the Southern Cone`s future demand growth is likely to be most influenced by electricity generation.

We believe electricity generation will be switching away from hydropower to natural gas-based cogeneration. Although natural gas makes up 22% of South America`s energy consumption, comparing favorably with North America`s 27% and Europe`s 21%, this is misleading because Venezuela, Argentina,and Bolivia contribute heavily, while Brazil and Chile-two of the high-growth economies in the region-are severely underrepresented. With the availability of natural gas in Brazil through indigenous production and imports via recently constructed pipelines, a significant proportion of electricity generation should be fueled by natural gas, and the electricity industry might lessen its dependence on hydropower.

We estimate that 5% annual growth in electricity generation over the next 5 years alone should translate into about 12% annual growth in natural gas demand in Brazil (see related article, p. 54).

Gas in energy mix

The overall contribution of natural gas to the region`s primary energy mix is 22%, in line with the developed world`s average of 25% (Table 2).

However, within this region, the individual economies have varying degrees of penetration, ranging from 53% in Argentina to 4% in Brazil. We believe that the huge disparity of natural gas penetration in the region is attributable to the availability of natural gas-whereby Argentina`s abundant reserves and production have contributed to the development of its natural gas industry; on the other hand, Brazil`s natural gas industry has been quite undeveloped due to its reserves and indigenous production being inadequate, as well as the absence of pipelines to transport natural gas from rich reserves in adjacent countries.

With several pipeline projects expected to connect the natural gas reserves of Argentina and Bolivia-and in the distant future Peru and possibly Venezuela-to Chile and the industrial south of Brazil, we may see the region undergo substantial growth in natural gas consumption (Fig. 1). While Argentina, with its high natural gas penetration, may experience relatively moderate consumption growth of around 4-5%/year for the next 2-3 years, the key drivers of growth in the region are likely to be Brazil, with an estimated demand growth of 25%/year for the next 5 years, followed by Chile with an estimated annual growth rate of 12%.

Projects

Thanks partly to economic liberalization, the region`s supply-demand imbalance in natural gas is expected to be reduced through construction of various cross-border pipelines.

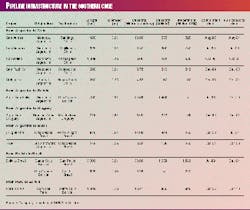

The most prominent is the 3,000-km Bolivia-to-Brazil (BTB) pipeline connecting the gas-rich Santa Cruz area fields of Bolivia to the industrial hub of Sao Paulo in Brazil. The 1.06 bcfd capacity pipeline, commencing the dispatch of natural gas at a reduced volume starting this year, should largely fill Brazil`s demand for natural gas for the next 2-3 years. Even assuming moderate demand growth in the region, we expect that BTB should increase throughput from about 200 MMcfd in July 1999 to at least fourfold that volume over the next 3 years.

Once natural gas arrives in Brazil, there are plans to build a connecting pipeline to Enron Corp.`s electricity generating plants in Cuiaba and the industrial city of Porto Alegre. An existing pipeline, which has traditionally exported natural gas from Bolivia to Argentina, could reverse the flow and feed the BTB pipeline from the northern Argentine gas fields. In addition, given the tremendous growth potential of the Brazilian market for natural gas, several pipelines connecting Argentina to Bolivia are being conceptualized. Prominent among them are the Buenos Aires-Montevideo pipeline to be built by the BG plc consortium, which will most likely be extended to Sao Paulo in the next 5 years, and the Gas Atacama pipeline connecting the Noreste producing area of Argentina to Mejillones, Chile.

The pipeline projects from Argentina to Chile are at an advanced stage. The Methanex and GasAndes pipelines have recently been completed. Two other pipelines, Gas Atacama and NorAndino, should be completed by the end of this year, boosting the supply of Argentine gas to Chilean industries. Although we share the short-term general concern that, while industries in Brazil and Chile are still developing their switch to natural gas the supply may overwhelm demand, the long-term growth pattern appears to be sufficiently encouraging for these new pipelines.

There is some concern that the Bolivian reserves may not be able to meet the potentially large long-term demand growth of natural gas in Brazil. Under this situation, the gas pipeline currently used to export 177 MMcfd gas from Bolivia to Argentina could reverse flow and import close to 1.4 bcfd of Argentine gas into Bolivia. Should this happen, the San Jorge area gas fields of northern Argentina could be tapped to export gas to Brazil via Bolivia. In addition, given strong demand growth from Brazil, there are several additional pipelines that are being planned, such as Uruguaiana, expected to come on line in late 2000 and an Argentina-Uruguay pipeline, which, after crossing the Plata River, should connect Buenos Aires with both Montevideo and Sao Paulo.

The tremendous gas development potential in Brazil and Chile could translate into construction of several future pipeline projects. As Table 3 shows, assuming healthy long-term economic growth in the region, we could see the evolution of various other gas pipelines, giving rise to about 4.5 bcfd of gas transported across national boundaries by 2005, at an estimated investment of $3.5 billion. This would be a giant step in fostering energy integration in the region.

The Authors

PR Panigrahi is a senior vice-president and oil and gas analyst for Dresdner Kleinwort Benson North America LLC, based in New York, covering 10 oil and gas companies in Latin America. Prior to joining Dresdner Kleinwort Benson, he worked for 2 years at Credit Suisse First Boston covering natural resource-based conglomerates and for 5 years at Bankers Trust Company, New York, in corporate finance and cross-border mergers and acquisitions. Before coming to Wall Street, Panigrahi spent 6 years as an engineer with McDermott International, Houston, where he was involved in design, fabrication and installation of various petroleum projects. He has an undergraduate degree in engineering from the Indian Institute of Technology, an MS in Ocean Engineering from Texas A&M University, and an MBA from the University of Chicago with specialization in finance.

Xavier Grunauer is an assistant vice-president for Dresdner Kleinwort Benson North America LLC and part of the global oil and gas team based in New York. He joined Dresdner Kleinwort Benson upon completing his MBA degree and prior to that worked for 5 years as a consulting engineer involved in the design and commissioning of heavy equipment for the steel and mining industries. Grunauer holds an engineering degree from the University of Toronto and an MBA from the University of Western Ontario.