What brings Latin America onto our opportunity radar screen today?

As a real estate broker might say, it`s "Location, location, location"-and right now, that location is southern Latin America, most especially so if you are prepared to develop a business and take at least the medium-term view.

We can add some other reasons:

- A number of traditional areas are not currently as attractive.

- Key opportunity countries in regions such as the Far East are troubled by politics.

- The game in the North Sea is closer to a "survival of the fittest," apart from appearing devoid of opportunities to attract a cross-section of industry interests.

- Prospects in Africa abound-but certainly not for the faint of heart.

- Our industry continues to reel from the need to face the realities with which it must eventually deal in the former Soviet Union (FSU), such as accepting the cultural differences and recognizing that the industry there had developed a major business, albeit in a different way.

Latin America`s uniqueness

The situation in the Latin American region today is different.

Many of the countries have come through a 10-year period of major change either in privatization, in deregulation, or in developing forward-thinking methodologies for encouraging new investment to meet their particular requirements. The region continues to offer a cross-section of opportunities to suit almost every appetite-and not just in our industry.

Arguably, the largest prizes remain for those who can see not simply the specific exploration, development, or downstream opportunity but also a broad-based business opportunity to work within a country as a long-term partner. The region also has the benefit of a long petroleum history and a skilled workforce with the capability in several countries both to manufacture and to construct much of our requirements, providing some "hedge"` against the vagaries of importation and currency fluctuation.

We might then ask: What is Latin America-South? The very name evokes an excitement, a perception of the unknown-yet Latin America-South is just, in our context, a regional name for 14 very independent countries, 9 of which produce hydrocarbons; 14 very different countries, with cultures and histories as different as the opportunities and challenges they offer to the petroleum industry. We glibly group them together as we frequently group the opportunities we see in the FSU, Africa, Asia-Pacific, or the Middle East, as our restricted perception of the world casts more regional than specific shadows. Yet it is in the specific that the real opportunity exists, much though a perception of cross-border opportunities and regional trade may help us to appreciate the real scope.

The countries of Latin America are as different culturally as they are geographically but also with much in common. What connects them together? Perhaps language, perhaps circumstances, perhaps that long thread of the Andes running from the north to the very south of the region, perhaps something of a shared history.

We can, of course, call the region south of the Amazon the Southern Cone and consider the scenarios there as linked. There are some business reasons and, indeed, geological reasons, for associations of some sort in certain circumstances. In our Southern Cone there are five producers (Argentina, Bolivia, Brazil, Chile, and Peru) and two countries, Paraguay and Uruguay, with no significant hydrocarbons found to date. North of the Amazon, Venezuela dominates with Colombia, Ecuador, and Trinidad and Togago as east, west, and southwestern reflections of the major Venezuelan basins-a view my geological colleagues may take issue with but a reality in perception.

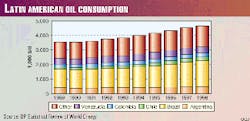

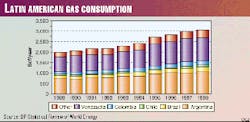

The region as a whole has a population of about 330 million and production of about 7 million b/d of oil and 8 bcfd of natural gas. Domestic consumption is about 4.5 million b/d of oil and about 8 bcfd of gas. Inevitably, the majority of consumption is in the Southern Cone, where about 250 million people live. The region as a whole is a major potential market by any world standards, and the Southern Cone, itself dominated by Brazil, is indeed a growth engine.

Natural gas

My colleagues would argue, as would many other observers, that perhaps there is no better opportunity within Latin America than the combined-cycle power business and, indeed, the substantial numbers speak for themselves (Fig. 1).

If there is to be continued development within the region, gas is a logical direction to go, because gas projects can easily be matched to the demand and have the obvious environmental benefits vs. currently competing fuels. However, gas needs infrastructure that is often expensive and takes a long time and commitment to install. It has been over 20 years since initial agreements on the recently completed Bolivia-Brazil line were signed, and even when a line is installed with a market perception, there is really no guarantee that markets will develop naturally fast enough to justify substantial investments.

Here again in Latin America, both north and south of the Amazon, there is the opportunity for that mid-sized imaginative company to work both on developing a use for, as well as a supply of, the gas. As an industry world-wide, we continue to push for the megaprojects in gas, and yet many of the smaller discoveries in all regions, particularly in Latin America, can be made economic with a little vision and recognition that it takes time to grow markets and that "small" can happen now and frequently have a real rate of return today.

Infrastructure is necessary, and there is little doubt that the producer may well have to accept a lower price at the wellhead for a while in order to get that infrastructure installed for his later long-term benefit (Fig. 2).

Opportunities, challenges

There are almost a hundred basins in Latin America, and geologists have little doubt that there remain substantial opportunities in virtually every petroleum-rich country within the region.

These include exploration of basins hardly touched by the drillbit or ideas for new plays in existing producing basins and a wealth of related upstream, midstream, and downstream potential. As we move south, the range of prospects provides sufficient spread in risk profile to satisfy the appetite of a broad cross-section of our industry.

Regarding transportation, Latin America has the benefit of being able to move its oil relatively quickly and cheaply to port. There can also be a price advantage over Middle East crude in this regard, as many of the opportunities in the region are relatively light oil. Returns can be expected to be at least reasonable.

As elsewhere, the international industry has tended to carry its high costs with it. We have seen costs rise enormously in Venezuela, largely due to the industry`s own love affair with notionally "high-tech" solutions and the unnecessary creation of boom conditions driving up rig and associated costs to astronomical proportions.

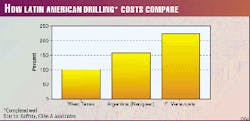

Yet many of the opportunities within the region are in circumstances that demand no significant high technology and within environments that are perhaps little different from those in West Texas or parts of Louisiana (Fig. 3). As elsewhere, the cost issue is frequently an issue of management and mind-set in countries where there is sufficient activity to keep the costs within reasonable proportions. In others, a necessity to bring in equipment inevitably increases costs, making even the smallest job appear unnecessarily expensive.

Legislation

The strong regional interest of major companies and other players tends to suggest that the majority of deals on offer are relatively attractive. Certainly, returns in several countries in the region appear to look better than in many other parts of the world, when all factors are considered.

With a need to attract external investment, the majority of the region`s governments have been able to meet industry expectations as indicated by the success of a number of exploration and rehabilitation rounds. As elsewhere, those countries that have not been able to adjust their terms to adequately reflect market conditions have not done so well. The drive to open up all markets, not just petroleum, has provided its own impetus to both investment activity and interest within the region as a whole.

Many investors, however, still tend to think in terms of the past when they are coming in to undertake an exploration, redevelopment, or downstream project. They frequently fail to understand the sheer weight and speed of change and seem unnaturally distressed at the first signs of a hurdle, be it technical or legislative-a far cry from those braver types who initiated and reaped the benefits of those booms of the past in areas such as Indonesia, North Africa, and even Alaska.

Opportunities in Latin America, as in many other major investment countries in our petroleum world, are best served today by those concerns (large or small) that can see past the first downturn and can ride out the inevitable political and legislative changes and disappointments.

There seems little doubt that the opportunities are there-in the sophisticated, deregulated, and privatized gas industry in Argentina or the hunger for flexible energy supply sources in Brazil, through to the prospects in the north in the great basins of East and West Venezuela-the challenge then remains to capture them. Whether you want an indigenous investment or are bringing in foreign funds to look for opportunity, and whether that entails one of the cross-border mega-schemes for bringing gas to market, or producing oil from the other side of the Andes, or simply making a small gas or oil project work in a not-quite-so-remote place in a subcontinent just to the south, Latin America seems to respond best to a sense of commitment.

As we rebound from $10/bbl oil prices, there has been a natural reluctance for companies to commit to large and risky projects. The intriguing aspects of many opportunities in Latin America is the fact that several of them are onshore and many lend themselves to a step-wise investment approach in a time when once more, small is beautiful.

In no place in the region-or perhaps in all the petroleum world-is it more possible to see an example of small being beautiful as on the island of Trinidad where, over the last 20 or more years, a series of modest-sized plants to use gas have been developed and where the nation is now the largest producer of methanol in the world and a significant regional producer of a number of other gas-based or gas-utilizing products. With the current single-train LNG project, this small island has demonstrated a cost, technical, and timing step-function change in the LNG business.

Problems

No opportunity scenario can or should hide the challenges we face, and we need to be realistic about the difficulties.

There are significant economic problems in some of the countries, such as currency devaluation. However, it is interesting to look at the period of the Mexican peso crisis about 4 years ago, which reverberated through the rest of Latin America. As shown in Figs 4 and 5, it is not really possible to see any significant reduction in demand due to that crisis. One can argue, perhaps, that barring a very significant world crisis, much of Latin America has passed the critical point where a downturn is unlikely to be significant enough to destroy progress.

There are security problems in some countries and uncertainty of legislation and the decision-making process in others, but there are always reasons to assess risk. Indeed, many of those same risks exist in the developed nations, perhaps not in the same form but represented by draconian environmental legislation or significant government interference. Our industry has suffered retroactive legislation and effective nationalization in some of the most sophisticated countries-so the risks are different and yet remain the same.

There is also the cultural risk of not understanding what is really going on. Perhaps that provides the best reason for a commitment to a country rather than the typical approach of rushing in to make a deal without a full understanding of the continuing implications. The risks are there, as they are elsewhere-we just need to be comfortable with them and understand them before we get too committed.

Southern Latin America presents a picture of diverse countries and situations across a broad opportunity spectrum. Each country is different-generalities are dangerous-but, as a region, there are indications that we are past the stop-go phase so damaging to long-term development. Growth possibilities exist in virtually every sector and represent a different risk profile-think about it.

The Author

Peter Gaffney cofounded Gaffney, Cline & Associates (GCA), an international petroleum management and technical advisory firm, with Ben Cline in 1962. Gaffney has lived and worked in Latin America and, for almost 40 years, the firm has handled many multi-discipline projects in the region. A previous president of the Society of Petroleum Engineers, he has worked in the majority of the other petroleum provinces of the world both as an adviser and in senior management positions on behalf of the firm`s clients.