OGJ Newsletter

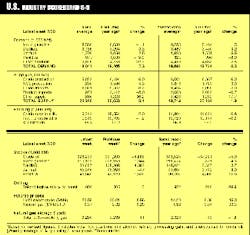

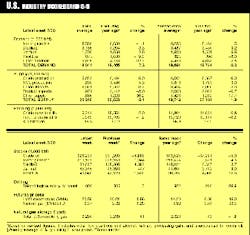

U.S. INDUSTRY SCOREBOARD 8/9

Energy firms are reorganizing to meet the demands of an increasingly competitive and low-margin business. Two state oil companies are looking to privatize portions of their operations, while two private firms are excising non-core businesses from their portfolios.

Brazil`s Petrobras has received board approval to create a new division called Participacoes e Desmobilizacoes (Interests & Asset Sales) to manage its petrochemical and electric power sectors and oversee the sale of assets in several sectors. The company hasn`t decided yet which assets will be sold, although Petrobras Pres. Henri Philippe Reichstul has said it might sell interests in oil refineries. At presstime, nomination of a director for the new division was pending. Interests & Asset Sales will oversee Petrobras`s 20 thermoelectric power plants, its petrochemical projects in the Paulinia complex in Sao Paulo state, and the gas-chemicals complex in Rio de Janeiro state.

Colombian state firm Ecopetrol has decided to transform itself from an oil producer to a "promoting entity," said Ecopetrol Pres. Carlos Rodado. The company will award all future E&P contracts to private firms and take a share of production. The aim is to reduce its financial risk while attracting foreign investment. The plan has been approved by Ecopetrol`s board. As a first step, Ecopetrol will award to outsiders 10 blocks with high productive potential that were previously reserved for Ecopetrol: Santero, Guamito, Rio Zulia, Playon Norte, Provincia, Medina Occidental, Sumapaz, Acevedo, Mocoa, and Rio San Miguel. Together, they could hold 5 billion bbl of oil, says Rodado. Five of the areas have geological characteristics similar to those of Cusiana and Cupiagua fields, he says. Ecopetrol will also award some production-enhancement contracts to private firms, starting with four fields in the Putumayo area: Sur, Orito, Nororiente, and Occidente y Suroriente. To be offered later are Tenay, Dina Terciarios, Cira Infantas, Casabe-Llanito, and Yarigui-Cantagallo fields. "If no oil reserves are found soon, after 2006 the country will become an importer of crudeellipse," Rodado said.

TotalFina has signed a letter of intent to sell its Coates inks division to Sun Chemical Group, a unit of Japan`s Dainippon Ink & Chemicals. TotalFina said its inks business, despite high-quality assets, did not have strong enough positions in the two leading western markets, North America and Germany. The disposal is part of TotalFina`s plan to refocus its chemicals business.

TransCanada PipeLines has agreed to sell its Angus Chemical unit to Dow Chemical. Angus manufactures and markets nitroparaffins and their derivatives. "TransCanada is undertaking to consolidate and streamline existing operations to focus on building greater value from our competitive strengths," said Pres. and CEO Doug Baldwin. "Although Angus Chemical is an excellent asset, it does not fit with our strategic direction."

Meanwhile, ARCO has revealed it is negotiating with Burlington Resources regarding possible sale of its interests in Ecuador`s Villano field (OGJ, Aug. 2, 1999, p. 19). The sale is expected to involve other ARCO exploration properties in Latin America, including Ecuador`s Block 24.

The chemicals industry is jumping on the merger bandwagon, with Dow Chemical and Union Carbide announcing plans to form a supermajor in that sector. The $11.6 billion deal creates the world`s second-largest chemical company, behind Du Pont. Both companies` boards have approved the stock-for-stock transaction. Union Carbide shareholders will receive 0.527 Dow share for each UC share, and Dow will assume $2.3 billion in UC debt.

The firms expect to save $500 million/year within 2 years of closing. Their combined work force will be cut by about 2,000. Dow has completed a program of cost-cutting and portfolio-focusing and is turning toward growth as the next goal. Pres. and CEO Williams Stavropoulos said, "This merger jump-starts the growth phase of our strategyellipseThrough our increased scale and geographic scope, we will be well-positioned for the next peak of the cycle, with a broadened customer base across a wider range of products and applications."

Japan`s newly merged Nippon Mitsubishi Oil (NMO) has agreed to increase its interest in Koa Oil to 55.8% by purchasing Caltex`s 50% stake in the firm for ?26.3 billion. The deal, says NMO, is a reply to "the pressing need for increased productivity and cost reductions amid harsh competition in the oil refining industry." Moody`s Investors Service said, "NMO`s partial purchase of Koa allows the company to integrate its refining and marketing operations and to enhance its petroleum business in Japan by raising its share interest."

Moody`s believes that the deal may help Japan`s refining industry by improving profit potential and possibly leading to other friendly mergers.

Upstream companies increased worldwide capital spending by 5% last year to $83 billion, despite a decline in global revenues to $124.6 billion from 1997`s $163 billion. These are some of the key findings of Arthur Andersen`s 1999 Global E&P Trends report. According to the analyst, a 2% decline in U.S. capital spending was offset by increased spending in Europe and Africa-Middle East, with Europe up 9% to $16.4 billion and Africa-Middle East up 25% to $4.6 billion. "Capital spending by the majors declined 15% in the U.S. but increased 22% in the rest of the world," said Victor Burk, managing director of energy industry services. "Independents increased their capital expenditures in the U.S. by 7% in 1998 while cutting back by 13% outside the U.S."

Other trends noted by Arthur Andersen were: reserve placement and finding and development costs both reached their highest levels in 5 years, production costs decreased 9% to $3.71/boe, oil reserves increased to 73 billion bbl from 70.7 billion bbl in 1997, and natural gas reserves rose 5% to 356.4 tcf.

Much progress is being made toward the signing of some key gas supply contracts in the Asia-Pacific region.

Thai state firm PTT and the TotalFina-led group developing Yadana gas field in the Gulf of Martaban off Myanmar have settled a dispute over PTT`s refusal to take delivery of gas during the first year of their sales pact (OGJ, Mar. 1, 1999, p. 42). PTT will pay $50.5 million to the group by Aug. 31 for gas not taken under the take-or-pay contract. Those volumes will be delivered to PTT, in addition to the continuing contractual quantities, for use by the Ratchaburi power plant and other Thai consumers as soon as gas demand becomes sufficient, says TotalFina. PTT`s payment is $12 million less than the $62 million it originally agreed to pay; this is a result of the lower-than-expected heating value of the gas. PTT also agreed to accept the gas without enrichment until December 2006 in return for price reductions during August 1998-October 1999.

TotalFina said the accord is the outcome of "an extremely good cooperation`` between the buyer and the sellers. PTT was contractually bound to receive 325 MMcfd of Yadana gas in the second contract year that began in March, with volumes increasing to a plateau of 550 MMcfd in later years. It remains unclear whether PTT will be able to take the full contract volumes of Yadana gas this year, as the Ratchaburi power plant has not yet started up.

In Australia, gas supply specifics have been agreed on by the buyers and sellers of gas that will arrive in the country through a proposed pipeline from Papua New Guinea to Queensland. State power utility Energex has signed conditional agreements on price, terms, and conditions to take up to 338 MMcfd of gas from the proposed $3.7 billion (Australian) pipeline, being developed by Chevron Asiatic, Oil Search, and partners (OGJ, Dec. 21, 1998, p. 38).

Energex was negotiating on behalf of four potential gas customers: aluminum producer Comalco, Sithe Energies, and state electricity generators Tarong Energy and OS Energy. According to Australian press reports, the contracts put the pipeline within reach of its baseload capacity and effectively give the pipeline developers a long-awaited green light for the project.

Singapore Power`s multibillion-dollar deal to buy 300 MMscfd of gas from Pertamina may have run into a new stumbling block, just days after SP said the deal would soon be finalized (OGJ, July 19, 1999, p. 37). The problem stems from questions arising over Pertamina`s rights to award E&P contracts, in this case for gas fields on the Jablung block in South Sumatra being developed by Gulf Canada and Santa Fe Energy Resources. Indonesia`s central government has decided to strip E&P contract award rights from Pertamina and has gained support from Indonesian House leaders for that move. This, together with a bid to privatize Pertamina`s refineries, effectively would end the state firm`s monopoly in Indonesia (OGJ, July 26, 1999, p. 27). Minister of Mines and Energy Kuntoro Mangkusubroto says the only issue still to be resolved is the duration of the transition period before the government assumes contract-award rights. Under the pending oil and gas demonopolization bill, Pertamina would become a limited liability company and transfer its contract-award rights to the central government within 2 years of the law`s enactment. Passage is expected when the parliament meets Aug. 23. SP insists the loss of Pertamina`s contract-award rights won`t affect its negotiations with the state firm, as the central government is aware of them. Pertamina earlier had said the deal had stalled because SP was seeking a smaller volume and that the Indonesian firm could not then justify selling the gas to SP at that volume without raising the price-so it was looking at transporting the gas instead to West Java. Since then, SP has acknowledged negotiating to buy 75 MMscfd from Singapore`s SembCorp