U.S. Drilling At Historic Low, Canada's Drop Not So Severe

Drilling in the U.S. in 1999 could set a historic low, one of the smallest numbers of total completions in the modern petroleum era.

Restoration of oil prices after a dismal 1998 has buoyed the outlook expressed by many operators, even leading a number to announce plans to increase capital spending during the balance of this year. However, other market fundamentals have remained weak.

The lag time between the return to higher and relatively stable oil prices and a ramping up of drilling activity in the field will make for a difficult year.

Canadian operators do not seem to have withdrawn as far from field operations as their counterparts working in the U.S., owing in part to Canada`s bent towards higher percentages of gas drilling in recent years.

Here are highlights of OGJ`s mid-year drilling forecast for 1999:

- Operators will drill 18,600 wells in the U.S., off from an estimated 23,900 wells drilled in 1998 (OGJ, Jan. 29, 1999, p. 73).

- All operators will drill 1,998 exploratory wells of all types, down from about 4,000 such wells drilled last year.

- The count of active drilling rigs as reported by Baker Hughes will average 580/week in the U.S., down from 860/week in 1998.

- Operators will drill 10,075 wells in western Canada this year, up slightly from an estimated 9,387 wells drilled last year.

Operators cautious

OGJ estimates that revenues at the wellhead to U.S. E&P companies could reach $66.6 billion, up about 4.5% from 1998 revenues.

That figure is based on 1999 average prices of $12.20/bbl of oil and $2.04/MMBtu for gas.

Well drilling and completion spending, however, should fall 25% to $11.3 billion this year as operators play the cautious side of the crude oil price recovery. At 16.9%, this is a reinvestment ratio only about three fourths that of 1998`s, which was the highest in at least a decade.

Operators who decide to remain in action can take advantage of nearly static well drilling and completion costs. Those costs should average $111/ft this year, little changed from 1997 or 1998.

Footage should average 5,450 ft/well in the U.S. this year as thousands of very shallow coalbed methane wells offset the additional footage drilled in horizontal wells.

Drilling in the U.S.

It will have been six decades since as few as 18,600 wells were drilled in the U.S. in a given year.

Col. Drake`s well in Pennsylvania started it all as the only oil or gas well drilled in the U.S. in 1859. The next year 240 wells were drilled, according to American Petroleum Institute statistics.

Operators drilled 13,000-14,000 wells/year in 1895-96 and 1899. The first year drilling exceeded 18,600 wells was 1903, with 19,169 wells. The last year in which fewer than 18,600 wells were drilled was 1934, with 18,197 wells.

OGJ forecasts that 689 wells will be drilled off Louisiana and 88 off Texas in the Gulf of Mexico on the year.

Wyoming by yearend 1998 had approved 3,300 permits for coalbed methane wells on state and private lands, including 1,735 that had been spudded and 1,363 that had been completed. Most are in the Powder River basin in a shallow drilling play that is beginning to spill across into Big Horn County, Montana.

Numerous plays are fueling exploration and development drilling in Mississippi, where 126 total wells are forecast.

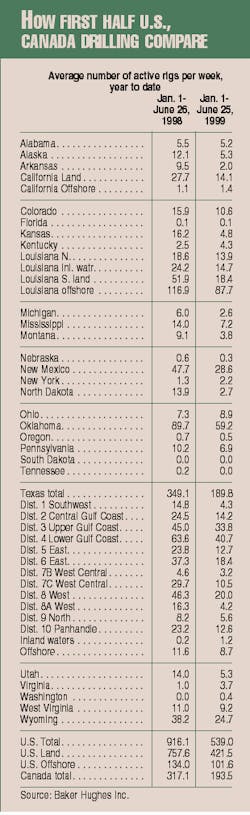

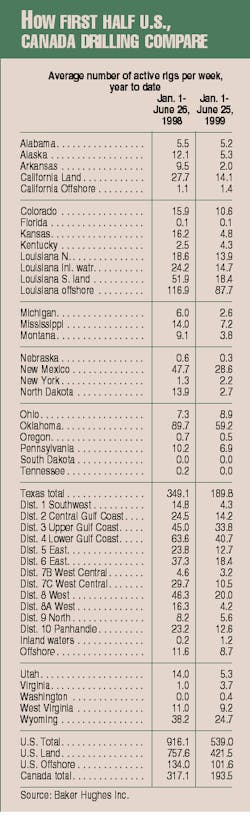

Baker Hughes reported that an average of 535 rigs/week were active in the U.S. in first half 1999, down 41% from first half 1998.

By this measure, land drilling was down 44% on the half year and offshore drilling fell 24%.

Texas first half activity fell 45.6%. Wyoming conventional rig activity was off 35%. Kentucky, Ohio, and Virginia showed slight increases.

By late June 1999 the Baker Hughes count was still running 34% behind the corresponding weeks of 1998.

Canadian outlook

OGJ`s Canadian projection of 10,075 wells is based on only a slight increase in the second half compared with the first half of this year.

About 52% of the year`s total wells would be drilled in the second half in Canada.

About half of total drilling in Canada has been aimed at gas reservoirs in recent years, compared with about one third of total drilling traditionally.

An average 194 rigs/week were at work in Canada in the first half, down 39% from first half 1998.

Drilling growth will continue in the Maritime Provinces, mainly offshore in connection with development projects off Newfoundland and Nova Scotia.

Exploration growth trends are also starting in the Atlantic offshore and Northwest Territories.