Verkhnechonsky Field Shows Eastern Russia's Potential

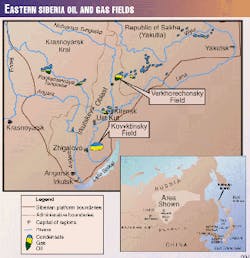

A feasibility study shows the commercial oil potential of the Verkhnechonsky field in the Irkutskaya Oblast, one of the many undeveloped hydrocarbon prospects in the Russian Federation`s Eastern Siberia and Far East regions (Fig. 1).

The Talakanskoye, Yurubcheno-Takhomskoye, Sredne-Botuobinskoye, and Verkhnechonskoye oil/gas provinces are promising for discovering new huge oil fields. Also, the Lena-Tunguz province in the Krasnoyarsk Krai, contains large prospects.1

In these regions, several large gas fields have already been delineated and are ready for development to start.

In the Krasnoyarsk Krai, Irkutskaya Oblast, and Sakha Republic (Yakutia) total potential reserves may be in excess of 9 billion tons (65 billion bbl) oil, 7 trillion cu m (250 tcf) gas, and 1.3 billion tons (10 billion bbl) condensate.

Development of these eastern region prospects is becoming more important because Western Siberian oil reserves are being depleted, with average oil production per well on the decline.

Western Siberia still is credited with the greatest amount of Russia`s undiscovered hydrocarbon potential. But Eastern Siberia and the Far East also contain a sizable portion of Russia`s undiscovered resources-estimated to be 17.6% for oil and 28.7% for gas.

These eastern regions have not been as extensively explored as other parts of Russia. Considering all of Russian exploration, only 8% of the oil and 15% of the gas activity has been in the east. The eastern regions represent only one-third of Russia`s drilled exploration prospects.

The eastern regions are characterized by a severe climate, remoteness from populated areas, lack of access, poor communication networks, etc. These characteristics often serve as a basis for a skeptical assessment of hydrocarbon development potential.

Each political region`s ambitions to solve problems independently also aggravate and complicate hydrocarbon resource development.

Verkhnechonsky field

The Verkhnechonsky field is in the northern part of the Irkutskaya Oblast about 1,100 km from Angarsk and 420 km from Ust-Kut, a town on the Baikal-Amur railway and a port on the Lena river.

The region is sparsely populated and undeveloped. Electric power is not available and the region lacks roads. Also, the rivers are either not navigable, or navigable for only short stretches.

Average annual temperature for the region is -5° C. (23° F.).

Geology

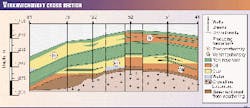

In the Verkhnechonsky field, commercial oil potential is associated with terrigenous sandstones of the lower Motskian (Verkhnechonsky horizon-Vch1 and Vch2 formations), middle Motskian carbonates (Preobrazhensky horizon-Pr), and the Usolskian series (Osinsky horizon).

The Verkhnechonsky and Preobrazhensky formations are extensively explored and are ready to be developed.

The areal extent of the field at the Verkhnechonsky horizon is about 1,500 sq km. A total of 101 exploratory wells have been drilled in this field, providing the data for the development study.

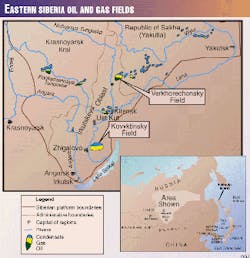

The field is divided into nine tectonically displaced blocks (Figs. 2 and 3).

In the main oil-saturated blocks (I, II, V, and VIII), the Vch1 and Vch2 producing formations merge to become the Vch1+2 formation in 58.4% of the area.Tables 1 and 2 list the producing characteristics and distribution of reserves.

The producing formations are characterized by abnormally low reservoir pressure, 15.3 MPa (2,200 psi), and temperature, 15.9? C. (60? F.), at an average depth of about 1,700 m. The formations contain water with a high salinity, up to 400 g/l. There are salic areas, where 20-30% or more of the pore space is filled with solid water-soluble salt (halite).

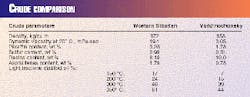

Crude characteristics

Another problem with field development is the crude characteristics.

According to Russia`s 1993 specifications, the field`s crude is classified as a Type 4. This crude has a relatively low yield, about 44%, distilled at 350° C., compared to a Western Siberian yield of about 61%. The crude also contains mercaptan sulfur as follows: 0.007% in gasoline, 0.0106% in kerosine, and 0.012% in diesel.

But in regard to sulfur and paraffin content, Verkhnechonsky crude is a better value than Western Siberian crude (Table 3).

It has better properties, increasing its attractiveness from the point of view of being refined at the Angarsk refinery, which produces a wide range of lubricating oils.

Crude recovery

The main plans for producing the Verkhnechonsky field are as follows:

- Various well spacing, based on layer-by-layer and zone heterogeneity, reservoir fracture and pore distribution, and tectonic displacement

- Separate development of the Verkhnechonsky and Preobrazhensky horizons, with development of the latter by recompleting wells

- Use of a waterflood, based on barrier contours, initiating it at the start of field, and varying its intensity with time

- Separate water injection and simultaneous production in the areas where the Vch1 and Vch2 formations occur separately

- Use of cyclic stimulation, provided that optimum values of bottom-hole injection and discharge pressure, as well as reservoir pressure are ensured

- Alternate gas and water injection after water cut reaches 50-60% in the areas with little salt content. In areas with more salt, gas injection from the start of development.

- Other enhanced oil recovery (EOR) methods.

To draw these conclusions, the study used a 3D phase-phase model (Simmgr-Sabre software from S.A. Holditch & Associates Inc.) and calculations based on TatNIPIneft techniques.

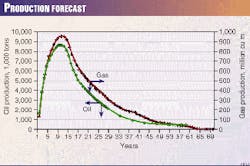

If the development proceeds as recommended, the field will ultimately recover 37.4% of the oil in place. About 7% of this recovery is due to implementing EOR methods, such as physico-chemical, alternate water and gas injection, and horizontal drilling.

The plans include developing the field with a total 1,306 wells. This includes 896 producing wells of which 127 will have horizontal laterals.

Fig. 4 shows oil recovery over time. Maximum annual recovery is 9.5 million tons in the 11th year.

Field development assumes that mostly Russian equipment and materials will be used.

Refining considerations

The plan assumes that crude oil will be transported to the Angarsk refinery through a pipeline through the Kovyktinskoye gas-condensate field. Currently, the Angarsk refinery receives Western Siberian crude, and a study was undertaken to determine the effect of adding the Verknechonsky crude.

For example, a blend of 8 million tons/year of Western Siberian crude, 7 million tons/year of Verkhnechonsky crude, and 0.5 million tons/year of Kovyktinsky condensate will have a gross volume of 18 million tons/year of products, with a value of $200 million/year, based on Western Siberian crude prices as of Apr. 1, 1997.

Refining expenses should decrease because of the lower sulfur content of Verkhnechonsky crude and light oil yield will be greater, compared to the option without condensate.

The refinery will also operate closer to its design capacity. Between November and December 1998, only 17,000 tons/day (6.1 million tons/year) were delivered to the refinery, compared to its design capacity is 65,000 tons/day (23.3 million tons/year).

Not long ago, the Angarsk petrochemical plant supplied refined products of 2 million tons/year to Primorsky Krai, 5.1 million tons/year to Amurskaya Oblast, Khabarovsky Krai, and Sakhalin, and 4.3 million tons/year to Irkutsk, Chitinakaya Oblast, and Buryatiya. Recently, these amounts have dropped off to 0.6, 1.3, 3.0 million tons/year. respectively.2

Demand forecast

Different options for selling Verkhnechonsky crude are possible, including export sales. It is evident that developing the region`s fuel-energy complex should consider all scenarios. For example, two such factors are the decline of Western Siberian crude deliveries to the Angarsk refinery, and a tendency towards increased demand for oil and oil products in other countries in the world.

Demand in the Asian part of Russia, Eastern Siberia, and Far East can be estimated from various statistics. Consumption of oil and oil products in developed countries (Japan, U.S., U.K., Germany, and France) is 2.2-2.4 tons/year/person. But since climatic conditions in Russia are much more severe, Russia should have a much higher energy consumption per person.

Estimates3 indicate that to ensure the same standard of living, consumption of conventional fuel per Russian should be six times as much as, for example, in Japan, where it is 3 tons of conventional fuel. If we assume this relationship, each resident in the Russian regions should be provided with 18 tons of conventional fuel/year.

As of January 1996, 31.7 million persons lived in the Asian part of Russia (22% of Russia`s population). This includes 15 million in Western Siberia and slightly more than 9.1 and 7.5 million persons in Eastern Siberia and the Far East, respectively.4 Consequently, to raise the standard of living in Eastern Siberia and the Far East, it is necessary to ensure an energy supply of about 163.8 and 135.0 million tons/year, or a total 298.8 million tons/year of conventional fuel.

If half of this demand is met with crude, this equals 150 million tons of conventional fuel, or about 105 million tons/year of crude.

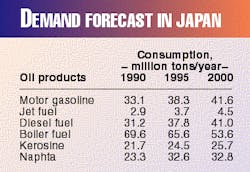

In the Asian-Pacific countries growing demand for oil products is also anticipated. For example, in South Korea consumption of gasoline is expected to increase to 11 million tons in 2000 from 6 million tons in 1997.

Demand for other types of oil products, including petrochemicals, will also be increasing. Along with modernization of existing refineries, South Korea`s government is considering construction of new refineries jointly with China, India, and other countries.

Rebuilding of the Angarsk refinery might also be included in these projects.

Table 4 contains an estimate of the average annual consumption of oil products in Japan.5 The large demand growth will require new sources of either raw materials or oil products.

Since 1993, China has imported oil, and in 1996 imports accounted for nearly 19% of China`s demand (about 33 million tons). In the last 10 years, China`s need for gas has increased by 46% and energy demand is expected to grow by about by 5%/year.

During 1989-1994, annual average oil product consumption growth in the Asian-Pacific countries was about 5.8% (7.8% for gas). The growth is expected to continue, although it was temporarily slowed due to the recent economic crisis in Asia. Low world oil prices during 1998 was one result of the economic slowdown.

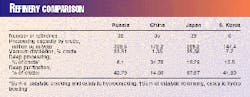

Table 5 compares refinery capacity, as of Jan. 1, 1998, in Russia and Asian-Pacific countries.6 Five refineries are located in the Russian Eastern Siberia and Far East region. The largest are in Angarsk and Omsk. The others are in Komsomolsk, Khabarovsk, and Achinsk, but their capacity is one-fourth or one-fifth of the other two.

As with the Angarsk refinery, the other Russian refineries are not being operated at full capacity, although the degree varies. Table 5 indicates the need for rebuilding existing Russian refineries because of their lack of deep processing and oil upgrading capabilities.

Economics

Field development economics were calculated using methods that determine net profit value (NPV), profit index (PI), and internal rate of return (IRR). Capital investments, operating expenses for oil production and transport, and public revenue (taxes and payments to the Russian Federation budget and non-budget funds) have been included.

Calculations were done for both the field and at Angarsky refinery. Capital and operating expenses, as well as payments and tax rates, were assumed at a level typical for the Siberian region. Discount and inflation coefficients were assumed at a similar level. Calculations for 5, 10, and 20 years and for the entire producing life of Verkhnechonsky field development were made.

Total capital investments were distributed as follows:

- Well construction-31.0%

- Oil field facilities-40.5%

- Oil pipeline-16.2%

- Roads and infrastructure-11.4%.

Investments required for construction of crude pipeline, roads, and industrial centers are planned to be made during the first 2 years prior to starting the field operations.

Operating expenses for the recommended option break down as follows: Production expenses-44.2%, depreciation-20.6%, and taxes and deductions-35.2%.

Without crude transport to the Angarsk refinery, the field development under the existing tax regime will be profitable and have the following economic indices: Internal rate of return (IRR)-32%; profit index (PI)-1.55; capital investment payback period-8 years.

However, inclusion of oil transport to Angarsk refinery deteriorates the economic indices. At the same time, other options of Verkhnechonsky field development are available, such as:

- Simultaneous bringing into development other nearby major oil fields in the neighboring Krasnoyarsky Krai and Sakha Republic (Yakutia), with participating interest in the oil pipeline to Angarsk.

- Sale of oil in the external market or higher crude selling price in Angarsk.

- Tax incentives for the project, in accordance to the Russian Federation Law on mineral resources. This provides for certain deductions when the resources are in difficult economic-geographical locations.

- Development of the field under Russian Federation law on agreements on production sharing. In this case an opportunity of self-financing the project appears with significant income for the government in the first 20 years.

- Construction of a new refinery in this region with participation from the Russian Federation and Asian-Pacific investors.

References

- New energy policy of Russia, edited by Shafranik, Y.K., Moscow, Energotomizdat, 1995.

- Vavilova, A., "Angarsk petrochemical plant: Struggle for crude," Neftegazovaya vertikal, No. 4, 1999, pp. 34-36.

- Lisovsky, N.N., Report presented at Russian Federation Mintopenergo seminar, Apr. 6-8, 1999, Moscow.

- Rossiya, Encyclopedia, 1998.

- OGJ, Vol.94, No. 35, p. 38.

- OGJ, Vol. 95, No. 35, p. 51.

The Authors

Rasim N. Diyashev is deputy-director, science, in the field of geology and development of oil and gas reservoirs for Tafneft JSC, Bugulma, Russia. He specializes in the design and development of oil fields, well tests, enhanced oil recovery, and thermal recovery of heavy crude and bitumen.

Diyashev holds degrees as a technician-geophysicist from the Exploration Geology Technical School, Ufa, reservoir engineering, from the Petroleum Institute, Ufa, doctor of technical sciences from the All-Union Petroleum Research Institute, Moscow. He is a member of SPE, AAPG, European Association of Geoscientists and Engineers (EAGE), and the Russian Academy of Natural Sciences (RANS).

Enver Sakhabovich Ziganshin is the general director and main engineer for Rusia Petroleum Co., Irkutsk, Russia. He previously worked in drilling and as an engineer-technologist for exploration and production of oil and gas. Ziganshin is a graduate of the Buguruslanski Oil Technical School and the Kuibyshevev Polytechnical Institute, specializing in oil and gas well drilling.

Victor Nikolaevich Ryabchenko is the chief geologist for Krasnoyarsk Oil & Gas Co., Krasnoyarsk, Russia. He previously worked as an engineer-geologist with the Tatneft JSC and as a deputy head of department in the Rusia Petroleum Co., Irkutsk, Russia. Ryabchenko is a graduate of the Kazan State University.