OGJ Newsletter

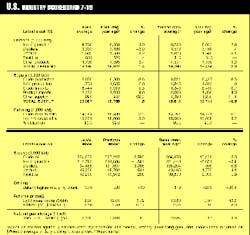

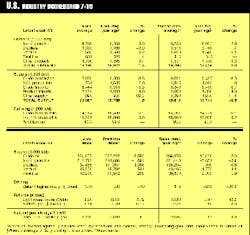

U.S. INDUSTRY SCOREBOARD 7/19

Oil market fundamentals are improving by almost all measures, according to the latest IEA figures. IEA`s June data indicate that oil prices and demand are up, while production and stocks are down.

IEA predicts world oil demand will average 75.1 million b/d this year, up 1.1 million b/d from 1998. This is a 50,000 b/d increase over its June forecast.

"Crude runs in OECD countries declined by more than 1 million b/d in May, driving refinery utilization down to 88%," it said. "Product pricesellipsefollowed crude prices higher but failed to translate into wider refining margins.

"OECD industry stocks rose in May by 0.7 million b/d, a build less than half the normal rate, primarily as a result of production cuts by OPEC and others. In combination with April`s upwardly revised 1 million b/d stockbuild," said IEA, "and an estimated June decline, however, second quarter OECD industry stocks will have risen much more than can be explained by the small difference between global supply and demand.

"This would imply a 0.5 million b/d drawdown in non-OECD stocks. Is this the return of `missing barrels`?" the agency asked, in a playful jab at last year`s controversy over what was deemed IEA`s unaccounted-for discrepancy between the supply and demand figures it reports (OGJ, Nov. 23, 1998, p. 36).

Despite growing indicators that the market is recovering, energy companies are continuing to implement cost-saving schemes and form new ventures and mergers (see stories, pp. 21-26).

As OGJ went to press, BP Amoco CEO John Browne was telling financial analysts in London how the company plans to lop $4 billion off annual costs, sell $10 billion worth of assets, and boost capital outlays to a total of $26 billion during 1999-2001. Browne said BP Amoco is planning on the basis of continued low oil prices and would drive down supply costs so that group finances would be robust at $11/bbl oil: "Since 1989," said Browne, "we`ve reduced our supply costs by 5%/year in real terms. Our objective is now to reduce those costs by a further $2/bbl by the end of 2001, bringing Amoco costs down to the BP level but also continuing to reduce the BP level itself."

The upstream sector is expected to contribute $2.2 billion to the cost reduction, while refining-marketing kicks in $1.4 billion and petrochemicals chips in $400 million. Planned disposals include the company`s Canadian oil interests, its 64% stake in Altura Energy, and a reduction in refining capacity starting with sale of the 250,000 b/d Alliance refinery in Louisiana.

China National Petroleum Corp. is restructuring and moving closer to its planned international IPO (OGJ, June 5, 1999, Newsletter). CNPC will regroup into five businesses, each operated by a subsidiary: exploration-development, refining-petrochemicals, sales, pipeline operations, and foreign cooperation.

CNPC will treat the units as core businesses, to fall under the new corporate umbrella, China Petroleum Holding. Noncore businesses, such as engineering and services, will be operated separately. The holding company will keep 500,000 of CNPC`s 1.54 million employees; the rest will be laid off or reassigned to service firms.

Meanwhile, China`s State Council has approved a proposal to list CNPC shares on three international stock exchanges by yearend. CNPC is looking to raise $10 billion over 2 years through public offerings on the Hong Kong, New York, and London stock exchanges, as well as on domestic exchanges. CNPC plans to categorize its shares as: state shares, corporate shares (held by subsidiaries), public shares, and foreign investors` shares.

Gas and power giant Enron has taken its E&P subsidiary, Enron Oil & Gas (EOG), off the auction block, but what will it do with the unit now? PaineWebber asked this question in a recent analysis of EOG, of which Enron owns 53.5%. "Both companies have recently indicated that they are seeking a separationellipse," said PaineWebber, which called an Enron-EOG split "inevitable."

"In our opinion, Enron Corp. would likely look to alternatives to sell its EOG shares in a secondary offeringellipse." There are two plausible outcomes, says the analyst: sell all the shares in a secondary offering or sell part in a secondary, with the rest repurchased by EOG. The repurchase would be achieved either by swapping some international assets with Enron or by selling them to a third party, the latter being preferable.

Petroplus International, Rotterdam, has opened talks with Shell over possibly acquiring its Cressier refinery in Switzerland. Petroplus sees the 60,000 b/d plant as an "excellent fit" in its strategy to expand its refining capacity in Western Europe. Cressier has been up for sale for some time and is one of a growing list of refineries surplus to Shell`s needs (OGJ, Dec. 21, 1998, p. 31).

In the industrial gases sector, Air Liquide and Air Products are making a joint bid for the BOC Group. The news comes only 2 months after BOC and Praxair were said to be in merger discussions (OGJ, May 17, 1999, Newsletter).

BOC confirmed on June 6 that it had been approached by the firms but said, "The proposal is not satisfactory in a number of important respects, but the board has authorized the exploration of these issues to see if they can be addressed." Discussions among the firms are continuing, says BOC, which, at presstime, was awaiting further information in order to assess the proposal fully.

BP Amoco and Mobil have announced what they are calling the biggest deepwater Gulf of Mexico discovery to date.

Dubbed Crazy Horse, the find has reserves of at least 1 billion boe, say the firms. The liquids-gas split was not quantified, but both companies are calling Crazy Horse an oil discovery. The discovery well was drilled to 25,782 ft in 6,000 ft of water, 125 miles southeast of New Orleans on Mississippi Canyon Block 778. BP Amoco is operator, with a 75% interest, of the three blocks that encompass the Crazy Horse structure; Mobil holds 25%. BP Amoco also announced three other deepwater gulf oil discoveries, with combined reserves, net to BP Amoco, of about 600 million bbl. All are in the southern Green Canyon area, about 150 miles south of New Orleans. The discoveries, and BP Amoco`s partners in them, are: Atlantis, BHP; Mad Dog, BHP and Unocal; and Holstein, Shell.

Shell U.K. Exploration & Production has gotten rid of the Brent spar at last. On July 10-11, the remaining three cut and cleaned rings of the hull were placed on the seabed in Mekjarvik harbor, near Stavanger. The 1,200-1,800 metric ton rings, each about 22 m high and 29 m in diameter, were lifted into place by the Thialf crane barge. They are to be filled with ballast and covered in concrete to form a quay, due to open in 2000 (OGJ, Feb. 9, 1998, p. 30).

Shell Expro Decommissioning Manager Eric Faulds said, "We`ve learned a great deal in the process and-in the spirit of openness and communication that has been a feature of Brent spar decommissioning since we launched the `Way Forward` in October 1995-we will be publishing information on the technical and other lessons learned in a `close-out` report later this year."

Greenhouse gas emissions are much on industry`s mind these days.

Royal Dutch/Shell is on the green trail again, with the announcement last week of a collaboration with Siemens Westinghouse to develop a power generation technology involving Shell`s carbon dioxide sequestration process and Siemens` solid oxide fuel cell (SOFC). A typical SOFC plant would use hundreds of fuel cells, each 150 cm by 2.2 cm, bundled together in stacks, said Shell. Each cell would be capable of generating 200 w.

"SOFC power plants use fuel more efficiently than conventional technology," said Shell. "Stacked together in large numbers, the cells can produce electricity economically in commercial quantities, with cost and space requirements comparable to conventional power generation technologies below 10 MW." The cells use natural gas fuel and produce only water and CO2.

The water is reportedly pure enough to drink, while the CO2 would be injected into depleted oil and gas reservoirs. Shell plans to use the technology to generate power for its oil and gas production operations.

U.S. EPA has revealed that 70 natural gas companies reduced methane emissions by a total of 20 bcf in 1998. The companies are partners in EPA`s voluntary Natural Gas STAR Program, under which EPA and the gas industry are jointly seeking practices and technologies for capturing emissions of methane, the major component of natural gas and a greenhouse gas.

By reducing emissions through cost-effective management practices, says EPA, companies realize cost savings while benefiting the environment. Aggregate emissions reductions over the first 6 years of the industry-government cooperative effort were more than 75 bcf, estimated to be worth $150 million at a market price of $2/Mcf. As part of the U.S. Climate Change Action Plan, the partnership aims to reduce methane emissions by 44 bcf/year by 2000.

U.S. CO2 emissions from burning fossil fuels rose only 0.4% in 1998, the smallest increase since 1991, despite economic growth of 3.9%, says EIA.

Weather played an important role in the reduction. Emissions resulting from increased electricity consumption during the hotter-than-normal summer were more than offset by a much warmer-than-normal winter, which reduced use of heating fuels. CO2 emissions account for about 84% of U.S. greenhouse gas emissions and are a good indicator of total U.S. emissions, according to EIA.