Auto and Oil Industries Improving Quality, Efficiency of EU Fuels

Both European Union (EU) refiners and automakers are facing major changes that are aimed at reducing pollution from road vehicles.

Along with sharp reductions in future emissions standards for carbon monoxide (CO), hydrocarbons (HC), nitrous oxides (NOx), and particulates, a new focus on improving vehicle efficiency has emerged as a result of climate change concerns.

The auto industry is increasing vehicle efficiency and reducing tailpipe emissions by improving today`s internal combustion engines. In the longer term, research is directed at replacement power trains, with fuel cell technology in the lead.

Changes to internal combustion engines are requiring the refining industry in Europe to produce higher-quality fuels. Low sulfur and aromatics in gasoline and lower-sulfur diesel are already mandated for 2005. Further changes to other specifications are currently under review.

Although future demand for road fuels in Western Europe is expected to increase, the rate of growth is expected to be lower than in the past. Slowing fuel demand in conjunction with changing gasoline and diesel specifications present challenges to the existing European refining industry.

Road transport fuel in Western Europe currently represents around 42% of total inland oil consumption in the region. It is therefore of primary importance to the European refining industry.

Several emerging issues will significantly impact the market for road transport fuels and refining in the region. Those companies which are aware of the impact of these trends will be able to effectively position themselves to take advantage of the changes and to avoid abortive investment.

EU market and taxes

Western Europe is a market of about 450 million people in 19 countries.

As a region, it is relatively wealthy in comparative terms with an average gross domestic product (GDP) per capita of $22,000 (in 1990 dollars). The U.S. per capita GDP is $24,850.

There are wide disparities in economic development among the European countries, although regional aid policies administered by the EU (which covers 15 of the 19 countries), aim to narrow these gaps over time.

At the end of 1997, there were 176 million registered private cars in the region, representing an ownership level of 392 vehicles per 1,000 inhabitants. Commercial vehicles, including buses and taxis, totaled 25 million. The car population grew at over 2%/year between 1990 and 1997, a growth rate which is about 0.5% above the level of economic growth over the same period.

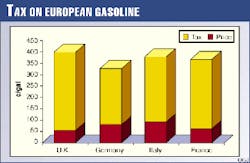

European governments have taxed road fuel heavily as a means of raising revenue. This tax policy has been justified to the consumer as sound environmental policy. As a result, taxes account for an average of 76% of the pump price of European gasoline. The tax percentage, or tax take, ranges between 68% and 86% across the 19 countries.

Fig. 1 compares the tax take on gasoline as a proportion of the pump price in the four major Western European markets.

The U.K. now has the most highly taxed gasoline in Europe, with a tax take of 86%. The U.K. government has declared its intention to increase gasoline and diesel taxes at 6% per year above the inflation rate. The EU is currently considering a lower escalation rate for fuel taxes.

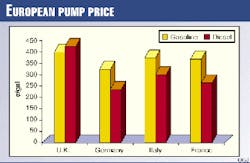

Fig. 2 compares the pump price of gasoline and diesel for the four largest European economies. Diesel is generally taxed at a lower rate because it is associated with commercial transport.

The U.K. stands out as an exception, however, with the diesel price above that of gasoline due to recent tax changes. The road transport industry is protesting the recent tax increases, arguing that, in a single market, U.K. truckers are at a disadvantage vs. their continental rivals.

Environmental objectives influence fuel tax policy in Europe but other measures which will significantly impact the demand for and quality of road fuels are now developing. These issues are inter-related but the outlook for demand will be examined first.

Improved efficiency

As discussed above, the consumer price of road transport fuel in Europe, particularly gasoline, is high as a result of high taxes. The high consumer prices have encouraged vehicle manufacturers to produce highly efficient, small engines for use in European vehicles. The majority of European cars have engines sized below 2 l.

In the course of international discussions on climate change, the EU has committed to a reduction in greenhouse gas emissions in 2010 of 8% less than the 1990 level. Reducing emissions of CO 2 from motor vehicles is one of the primary areas targeted despite the relatively high efficiency of the vehicle fleet.

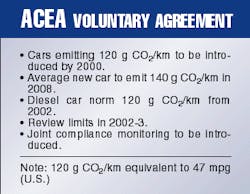

Discussions between the EU Commission and the European automakers, represented by their industry association ACEA (European Automobile Manufacturers Association), have resulted in a voluntary agreement on efficiency targets for new vehicles.

The main terms of the agreement are shown in Table 1.

The ACEA voluntary agreement is considered to be the first step in ever-increasing efficiency standards. A review is to be conducted in 2002 to define new (higher) standards for 2010.

Based on the estimated CO2 emissions from the 1995 new car fleet, the target for 2008 represents a gain in efficiency of around 25%. This goal is a significant reduction considering the high mileage efficiency of the base fleet.

To meet the vehicle efficiency targets, the auto industry will need to introduce direct-injection gasoline and diesel engines into the majority of new vehicles with 1.6-2 l. engines. Such engines are expected to be between 20% and 25% more efficient than their current counterparts.

Furthermore, a number of new, highly efficient gasoline and diesel-engine vehicles are expected to be developed. These are known as "3-liter cars" with fuel consumption of 3 l./100 km, which is 78 mpg.

Technology for diesel cars

The diesel engine is inherently more efficient than its gasoline counterpart. This efficiency, coupled with substantially lower fuel prices in some countries as a result of tax differentiation, has resulted in growing popularity for diesel cars.

Some European car makers have focused on developing sophisticated high-speed diesel engines for passenger cars. The high quality of European diesel fuel (cetane number of 49) coupled with advanced engine technology allows relatively smooth running of such engines.

The move to direct injection from a high-pressure manifold (common rail), which is now rapidly taking place, makes the diesel engine substantially more efficient and also smoother running. The higher injection pressure (up to 1,700 bar or 25,000 psi) results in fine fuel dispersion and better combustion. Currently, this technology is being rapidly introduced, making the vehicles more attractive to buyers.

Despite concerns about exhaust emissions (which should be allayed by new, tighter tailpipe emissions standards), some European governments see more-efficient diesel cars as a means of helping to meet their Kyoto targets.

In Italy, a punitive circulation tax on diesel cars has been reduced to encourage consumer acceptance. As gasoline cars become more complex and therefore expensive, the cost premium for diesel cars is likely to decrease, further encouraging their use.

Future developments

To further improve vehicle efficiency, the auto industry is looking at alternatives to the conventional internal combustion engine. Extensive research is under way on alternative power-train concepts, which include electric vehicles, hybrids with both internal combustion engines and electric drives, and fuel cells.

The fuel cell has received the most publicity, and prototype vehicles have already been built. The main developers have ambitious programs to reach commercial production in the mid-2000s.

It is unlikely, however, that there will be widespread use of fuel cells until beyond 2010. Even then, widespread use will occur only if the considerable technical and commercial challenges can be overcome.

It is worthy of note that for those fuel cell developers looking at on-board reformers to produce hydrogen, the reformer feed is usually methanol. The manufacture and widespread distribution of methanol with the attendant handling problems has yet to feature in the debate to any significant extent.

Fuel demand outlook

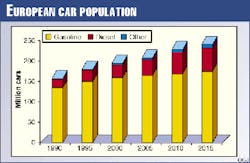

Purvin & Gertz`s forecast of European road-fuel demand assumes that the vehicle population increases to 225 million by 2015, which represents an ownership level of nearly 460 cars/1,000 people (Fig. 3).

This is a slowdown in growth rate vs. recent history and reflects an approach to saturation in some of the more mature markets.

The proportion of diesel-engine cars in the vehicle fleet is expected to rise from the current 15% to 22%. This increase reflects consumer acceptance of diesel in those markets where they are currently discouraged and modest gains elsewhere.

Despite the increase in diesel cars, the market for road diesel is dominated by the commercial sector, which is estimated to consume around 80% of total diesel fuel. Use in this sector is expected to continue to grow at a rate close to economic growth.

Unlike diesel cars, there is no significant technology breakthrough expected to improve efficiency as heavy duty diesels already have direct injection.

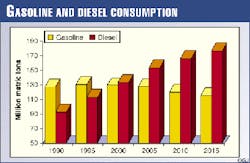

Fig. 4 illustrates Purvin & Gertz` outlook on gasoline and road-diesel consumption.

Overall diesel demand is expected to continue to increase by 55 million metric tons (1.1 million b/d) by 2015. This level of increase over 18 years is modest when compared to the 37 million metric ton (740,000 b/d) rise between 1990 and 1997 and reflects substantial efficiency gains.

The outlook for gasoline demand reflects the expected efficiency gains in new vehicles, the continued switch to diesel cars, and the growth in the car population.

Gasoline use has been flat to slightly declining in Western Europe since 1993. The forecast assumes a flat market until the mid-2000s, after which time the number of direct gasoline-injection engine cars will increase.

From 2005 onwards, the decline in demand accelerates such that, by 2015, demand is some 17 million metric tons (340,000 b/d) below the 1998 level. If production remained constant, this decline will more than double European gasoline exports.

The challenge for the European refining industry, which is equipped with many fluid-catalytic crackers, is to increase the yield of high-quality diesel.

Transport-fuel quality

In addition to the challenge of a changing pattern of demand, the European refining industry also faces the need to dramatically improve the quality of the gasoline and diesel it produces to meet changing EU regulations.

In 1996, the European oil and the auto industries conducted a joint research study to determine the impact of a range of fuel quality parameters on tailpipe emissions from European vehicles. This study, known as the Epefe study (European Program on Emissions, Fuels and Engine technology), became part of the Auto/Oil I program which aimed to reduce transport fuel emissions to improve urban air quality.

The recommendations of the Auto/Oil I study were reflected in a common position of the Council of Ministers (of the EU member states). The Council of Ministers` recommendations contained modest changes to fuel quality.

There was a political movement by the European Parliament, however, in favor of achieving the air-quality targets earlier than 2010. As a consequence, the original proposals were significantly modified during the first and second readings by the European Parliament, culminating in a conciliation process of June 29, 1998.

The legislation that has emerged is stringent for both emissions standards and fuel specifications. Table 2 tracks the changes between the commission`s proposal, the European Parliament amendments, and the final conciliation agreement.

The year 2005 specifications have a number of items left open to be resolved during a second phase of the Auto/Oil study. This study is due to report at the end of 1999.

As some extreme quality requirements could result in very different processing solutions, the refining industry has to wait and see the outcome before determining its investment path.

It is noteworthy that the one fixed item for both gasoline and diesel in 2005 is the sulfur level, which is set at the common value of 50 ppm (wt). It is at this point that the dual objectives of improving air quality and increasing vehicle efficiency meet.

The lean-burn, direct-injection engines referred to above use less fuel and therefore reduce CO2 emissions. They produce higher NOx emissions, however. To meet NOx targets, a catalytic trap must be used along with sophisticated engine management systems.

Sulfur in the fuel is oxidized, and the sulfur oxides are preferentially absorbed in the NOx trap, reducing its effectiveness. Reduction in the fuel sulfur, therefore, allows the introduction of lean-burn engine technology which gives the efficiency gain.

A condition of the ACEA voluntary agreement is that low-sulfur fuels are made widely available.

Impact on refining

In a recent industry-wide study, Purvin & Gertz made an in-depth analysis of the impact of the proposed specification changes on the European refining industry. The analysis was made using linear program models of regional refinery capacity and considered both the quality changes and the expected changes in the pattern of demand, with declining gasoline and strongly growing middle distillates.

The regional approach allows, de facto, the trade of intermediate components between nearby refineries. This is expected to be a feature of the approach which some refiners will take to minimize investment requirements.

The modeling highlighted some key conclusions regarding the industry development:

- Virtually all European refineries will have to add diesel desulfurization capacity to meet the 50 ppm sulfur mandated for 2005.

- Most refineries will minimize gasoline yield as part of their strategy to make lower sulfur product.

- The low gasoline and diesel sulfur levels required in 2005 are such that they cannot be achieved by processing a sweeter crude slate.

- There will be a need to increase hydrocracking capacity to meet the middle distillate yield and quality requirements.

The changes to capacity and configuration necessary to meet the demand and quality requirements in 2015 will result in an investment between $30 and $35 billion in new and expanded facilities by the industry. Around 60% of this can be directly associated with the improved quality of transport fuels. This is not an exact figure as some investments to improve yields also improve quality.

The level of investment also depends on the 2005 specifications finally agreed. The figures quoted here reflect only moderate changes to the 2000 qualities in 2005. This investment burden will cause refiners to seek innovative processing and supply solutions and drive the industry toward further consolidation.

The Author

Nigel R. Cuthbert is a senior principal of Purvin & Gertz Inc. in the London office. He has worked on a wide variety of oil-related projects, including refinery analysis and profitability improvement, transaction assistance, and market analysis. Cuthbert directed Purvin & Gertz` recent study entitled "European Refining to 2015-The Quality Challenge," on which this article is based.

Previously, he worked for Esso Petroleum Co. in the U.K. in both refining and head office functions. Cuthbert holds a BS in chemical engineering from the University of Exeter, U.K.