Subsea production market poised to double

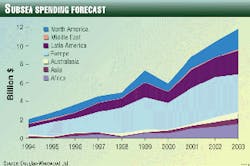

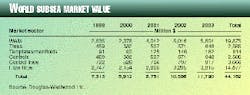

The global market for subsea production equipment is expected to double from its 1998 level over the next 5 years, to almost $12 billion in 2003.

This is the forecast of Douglas-Westwood Ltd., Canterbury, U.K., which calculates that subsea developments worth a total $7 billion will be brought on stream this year.

The analyst reckons that a total of 287 subsea well completions will begin production in 1999. The annual total will fall to 239 in 2000 and then climb to 404 by 2003 (see chart, right and table, below).

Economic benefits

Dominic Harbinson, analyst at Douglas-Westwood, told OGJ that subsea installations have generally become the most economical way to develop oil and gas fields.

They can be tied back to existing installations, a bonus in mature plays like the North Sea, and they can be tied back to floating production systems as a means of economically opening up new areas, particularly in deep water.

Douglas-Westwood predicts that operators will spend $44 billion worldwide on subsea oil and gas development over the next 5 years, of which $20 billion will comprise drilling and completion costs and $15 billion will be spent on flow lines.

During 1999-2003, the analyst predicts that fields with a total of 1,604 subsea wells are due to begin production: 700 of these will be off Northwest Europe; 380 in Latin America-mainly off Brazil; and 213 off North America, mostly in the Gulf of Mexico.

Market drivers

The drivers for the boom in subsea developments are increasing oil and gas prices, reducing costs of subsea developments, the great number of small reservoirs within reach of existing platforms, the increasing number of deepwater developments, and technological advances.

"Subsea development costs will fall significantly over time, in the immediate future as a result of low rig day rates," said Douglas-Westwood. "However, major fundamental cost reductions are required, mainly through reducing the time taken to drill and complete wells and to increase well productivity.

"In the latter case, multilateral wells, horizontal drilling, and advances in seismic technology all offer great prospects. Flow line and riser costs remain a major inhibiting factor, and these are expected to fall as a result of improving technologies and competitive pricing.

"Other significant technological developments are forecast over the period. Their impact will be not only to reduce subsea field development costs but also to extend considerably the flow distances between the well and the platform. This process will bring more reserves within the range of economic subsea development and further boost the market."