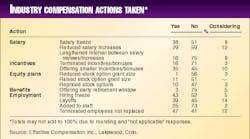

In fact, of the 222 energy firms surveyed Jan. 8 by the Lakewood, Colo.-based consulting firm, Effective Compensation Inc. (ECI), only 13 had not altered their compensation practices for the preceding 6 months.

Taking the hardest hits were drilling contractors and exploration and production (E&P) companies, said ECI. Of those surveyed, 62% of the drilling firms and 37% of the E&P companies opted to place a freeze on salary increases.

And 90% of the drilling contractors questioned have taken measures to reduce workers' salaries or have prolonged the time between salary reviews, according to ECI's survey.

Integrated energy companies, including gas pipeline-based firms, were not as badly stung by lower oil and gas prices.

Only 4% of the pipeline firms surveyed have instituted salary freezes, while 38% of these same pipeline companies either reduced salary increases or prolonged the time between salary reviews.

As might be expected, smaller energy businesses were less sheltered, and therefore harder hit, than were larger corporations.

About 52% of the companies with less than 100 employees that were surveyed had put into effect a freeze on salaries, said ECI.

Of those companies with more than 1,000 workers, about 21% took such actions.

Survey methodology

The survey was begun Jan. 8, and final results were tallied in mid-February.Gary Ritchey, principal of ECI, last week noted regarding the "Considering actions" category in the survey, "We didn't really define what 'considering' meant or what time frame they would be on, if they acted on a particular topicellipseI am sure that many of the companies will actually act on something they are considering, and many won't. Hopefully, the price of crude the last couple of days will ease some of the pressures."

Ritchey also noted that, in terms of compensation, while the oil and gas segment was generally hit harder than the integrated and pipeline companies-with drilling companies hit hardest-only 36% of the E&P firms reported layoffs, while 69% of the drilling segment reported them, as did 47% of integrated firms and 23% of pipelines.

Copyright 1999 Oil & Gas Journal. All Rights Reserved.