Formosa to build new refinery by yearend

Thi Chang

Refining/Petrochemical Editor

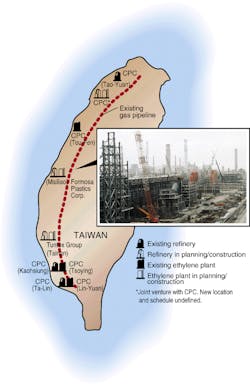

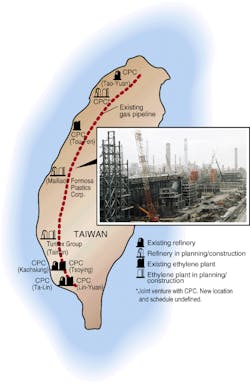

Formosa Petrochemical Corp. is busy building the first phase of its new 450,000 b/d refinery in Mailiao, Taiwan. The entire refinery will be completed at the end of 2000. The red reactors for the atmospheric-resid desulfurization (ARDS) unit are shown in the back and associated fin-fan exchangers are in the front.

To meet local refined-products demand and to supply feedstocks to the petrochemical complex, Formosa Petrochemical Corp., a subsidiary of Formosa Plastics Corp., is building a new 450,000 b/d, or 21 million metric ton/year (mty), refinery in three stages.

The entire refinery is expected to be complete at the end of 2000.

The 407-hectare site for the refinery sits in Mailiao, an industrial zone in Yunlin County, Taiwan, about 150 miles southwest of Formosa's headquarters in Taipei.

The refinery project is part of a larger project, which includes 2,600 hectares of land reclamation, a new Mailiao port, an independent power plant, a naphtha-cracking plant, and a cogeneration plant.

This is possibly the largest petrochemical complex to be built in a single effort. The new refinery will provide naphtha feed to the No. 6 naphtha cracker built in 1998.

A formidable task, the new Mailiao refinery will consist of more than 24 different units, and its complexity factor will rival that of existing refineries in Taiwan.

If all units are built as planned, its complexity factor will be 6.0. Comparatively, the Nelson complexity factors for the three existing refineries owned by Taiwanese state oil firm China Petroleum Corp. (CPC) are 6.5, 5.0, and 3.6.

This is Formosa's first grassroots refinery. Also, it will be the first privately owned refinery in Taiwan.

The refinery will be completed in three phases, each accounting for 150,000 b/d of crude distillation. The first phase will be completed by the end of 1999, the second phase in June of 2000, and the last phase in September 2000.

Process

A refinery-flow diagram of the planned capacity additions is shown in Fig. 1 [176,618 bytes]. There are no new technologies to be implemented in the new refinery.Phase 1 of the project includes several main units:

- A 150,000 b/d atmospheric crude distillation unit (CDU)

- A 90 MMscfd hydrogen-production plant

- A 63,000 b/d distillate-hydrotreating unit

- A 70,000 b/d resid-hydrotreating unit

- A 73,000 b/d resid catalytic-cracking unit (RCCU)

- A 4,500 b/d methyl butyl tertiary ether (MTBE) unit.

With the exception of a new alkylation unit, Phase 3 mainly adds trains to units built in Phases 1 and 2.

Details of unit licensors and unit capacities are shown in Table 1 [29,786 bytes].

The utilities plant will provide electricity, oxygen, and steam for refinery usage. Hydrogen for hydroprocessing processes will be provided by one of three new hydrogen-production trains.

The company will use steam-naphtha reforming. Hydrogen will be separated from the resulting mix of hydrogen and carbon dioxide with a pressure-swing adsorption (PSA) unit. Both the steam reformer and the PSA will each have a capacity of 90 MMscfd/train. These three trains can produce 219,000 mty of hydrogen.

A smaller 19 MMscfd PSA recovery unit will contribute another 11,500 mty of hydrogen to the plant. Hydrogen purity will be 99.9 mole %.

Hydrotreating

The new refinery will have plenty of hydrotreating capacity. Formosa will hydrotreat three different streams: distillate and kerosine for distillate blending, VGO for pretreatment before the RCCU, and resid for the RCCU.In 1994, Formosa selected Chevron Corp.'s atmospheric resid desulfurization (ARDS) process to treat resid in the new refinery. The two ARDS trains will treat feed from the CDU for the downstream RCCU.

Each ARDS train will have a capacity of 70,000 b/d. The total 140,000 b/d ARDS unit makes it the largest installation of Chevron's ARDS technology in the world.

Work on the ARDS unit is shown in Fig. 2.

Coke production

Formosa will use a delayed coker designed by ABB Lummus. The coker will take feed from the vacuum distillation unit and upgrade it to distillate for the VGO HDS unit.The coker will produce about 530,000 metric tons of coke/year. The coke will be either used in the independent power plant or sold to the local market in Taiwan.

Today, the cogeneration plant relies on imported coal feed. In the future, Formosa is considering using a circulating-fluidized bed (CFB) plant to generate steam and electrical power. Use of a CFB in conjunction with the cogeneration unit will allow the refinery to source all of its feed for cogeneration from the refinery coke.

Feed, products

The refinery is designed for a 50/50 vol % blend of Arabian Heavy and Arabian Light crude oils. The refinery will consider other crude sources if the economics are favorable.The refinery has 28 tanks to store crude feed; each tank has a design capacity of 130,000 cu m.

Major products include naphtha (3.8 million mty), jet fuel (1.8 million mty), gasoline (4.8 million mty), and diesel (6.7 million mty).

About 800,000 mty of gasoline and 4.3 million mty of diesel are expected to be exported. Other products will be consumed in Taiwan's domestic market.

Chemical products consist of polymer-grade propylene and chemical-grade propylene from the propylene recovery unit.

The RCCU also produces ethylene. The ethylbenzene-preparation unit removes harmful impurities, mainly propylene, from the ethylene stream.

Domestic products will follow local Chinese National Standard (CNS) specifications as well as the federal government's EPA requirements. Exports will be blended to meet the exported market's requirements.

The new refinery will have a distributed control system (DCS) and use advanced process controls.

All units will be controlled by one central control room. During and after start-up, Formosa expects to require about 650 onsite persons to control the refinery.

Project

Basic engineering for the refinery began in July 1994 by the licensors, as listed in Table 1. Detailed design began in July 1995 by CTCI Corp., a local engineering company. Currently, the detailed design is about 96% complete. Phases 2 and 3 comprise the unfinished design.At peak construction, over 600 onsite people will be involved with the construction; this number does not include contractors.

The winter climate in Mailiao is fraught with high winds and blowing sand. The northeast monsoon blows for half of the year. This harsh weather has been an obstacle, and continues to be one, in the construction of the new units. In consideration of the weather, Formosa has had to postpone its original completion dates by 3-6 months.

Construction was split up among three firms. Samsung Corp. is responsible for the crude-distillation unit (CDU), the amine-regeneration unit, the sour water-stripping unit, the sulfur-recovery unit, the saturated LPG-fractionation unit, the saturated LPG-sweetening unit, the kerosine-sweetening unit, the MTBE unit, the propylene-recovery unit, the RCCU's utilities area, the vacuum-distillation unit, and the delayed coking unit.

Daelim Industrial Co., Ltd. is responsible for construction of two units: the ARDS and the VGO hydrodesulfurization (HDS) unit.

CTCI Corp. is constructing the distillate HDS unit, the hydrogen unit, the RCCU, the unsaturated LPG-sweetening unit, and the gas-sweetening unit.

Total engineering and construction costs are expected to be $2.9 billion.

Land reclamation

Land reclamation at Mailiao is a huge project in itself. The project adds 2,600 hectares of new land on which to build the new petrochemical complex.Land reclamation is done by first constructing an embankment with rock caisson and other materials to encircle the project site. Formosa has dredged sand from the water to fill the embanked area.

The company has employed a process of dynamic compaction to prepare the soil foundation. Although there is more land-reclamation work to be done, reclamation for the refinery project is 100% complete. The unfinished land reclamation consists of the petrochemical projects that are not planned for completion for several years.

Environment

Formosa has made a concerted effort to minimize the refinery's impact on the environment by installing best-practices equipment and providing routine monitoring.According to Keh-Yen Lin, assistant vice-president of Formosa Petrochemical Corp., all construction and processes will meet or beat local and federal environmental requirements.

Taiwan EPA limits SOx to 500 ppm, NOx from fuel oil and gas to 250 and 150 ppm, respectively, and total suspended particles (TSP) to 41 mg/normal cu m. The refinery's design limits are well below all of these numbers. The refinery standards are as follows: a maximum of 250 ppm for SOx, 100 ppm for NOx, and 35 mg/normal cu m for TSP.

Formosa is required by the federal government to make several environmental reports per month. For stack effluent, its continuous emission-management system (CEMS) directly links up to the EPA and automatically issues a monthly report.

Wastewater measurements are reported every 2 months, solid waste is reported every month, and hazardous chemical reports are issued every 3 months.

Pretreatment for wastewater consists of catalytic-wet oxidation.

The entire petrochemical complex will have three central wastewater plants. Each plant has two units. At the wastewater plant, biological enzymes absorb oil from the water, which sits in ponds.

Economics

The refinery is being built to meet present and expected future domestic demand, mainly that for gasoline. Formosa expects growth in Taiwanese gasoline demand to be about 6%/year until 2010. The company expects to be somewhat initially sheltered by the current Asian economic downturn because the local population has a high demand for gasoline.Recent government deregulation allows private companies to participate in the production and refining of oil. In January 1999, the Taiwanese government allowed private companies to import fuel oil, liquefied propane gas, and jet fuel for the first time.1 Formosa is the first to build a refinery after the government deregulation.

Currently, CPC owns the only operating refinery in Taiwan. Taiwan's import regulations place an inventory limit and a 5-12.5% tariff on petroleum imports, which gives CPC quite an advantage in the local market.

In 2002, 2 years after the entire Formosa refinery will have started up, the Taiwan government plans to loosen its import tariffs and privatize many of its state-owned companies. CPC is expected to sell a majority of its company to a private investor by 2001.

These forthcoming changes will increase competition between CPC and Formosa as well as between Taiwan and other Asian countries.

Taiwan's annual consumption of refined petroleum products was about 755,000 b/d in 1997. In comparison, Singapore's annual consumption was 560,000 b/d, Japan consumed 5.8 million b/d, and China 3.7 million b/d.2 According to the BP Statistical Review of World Energy 1998, Asia/Pacific countries have very high growth in demand for gasoline and middle distillates.

No. 6 cracker

Near the new refinery, Formosa is building the sixth naphtha cracker in Taiwan. The first phase of this new cracker will have a capacity of 450,000 tons/year. When complete, the new cracker will have 1.5 million ton/year of ethylene production capacity.It will be the first privately owned cracker in Taiwan. The only other ethylene plant is operated by CPC. CPC operates three naphtha crackers with a combined ethylene capacity of 1.01 million metric tons/year (OGJ, Mar. 30, 1997, p. 48).

Formosa experienced delays commissioning the cracker in 1998. Formosa reports, however, that the unit has been operating smoothly since the restart at end of January 1999.

Formosa is building this cracker in response to a shortage of ethylene supply in the country. CPC has only been able to supply 40% of the domestic demand.3

Because of the devaluation of the Taiwan dollar, import costs are high, and thus, South Korea and China were able to gain huge market shares in the Taiwan ethylene market.

References

- "Taiwan," Country Analysis Briefs, U.S. Energy Information Administration, December 1998.

- BP Statistical Review of World Energy 1998.

- Formosa Plastics Group, 1997 annual report.

Copyright 1999 Oil & Gas Journal. All Rights Reserved.