U.S. oil, gas asset sales hit record in 1998

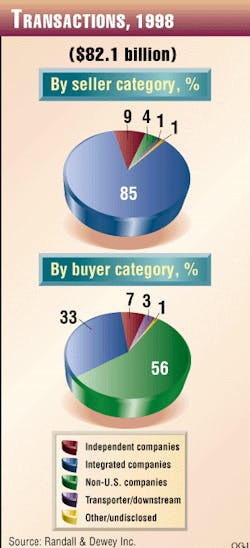

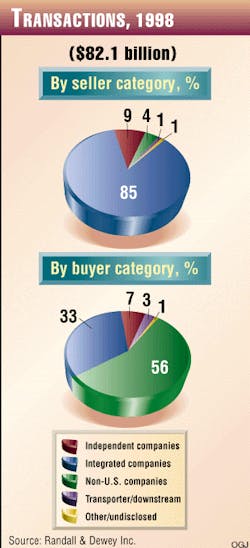

Total U.S. oil and gas property sales reached a record $82.1 billion in 1998, according to a review of acquisition and divestment (A&D) transactions by Randall & Dewey Inc., Houston (see chart, top left on p. 25).

The yearend total is more than triple the $23.9 billion in property sales calculated for 1997 (OGJ, Apr. 20, 1998, p. 41). The amount also surpasses any previous year's total since Randall & Dewey began tracking such sales transactions beginning in 1989.

Randall & Dewey notes that multibillion-dollar deals captured the limelight in the 1998 A&D market. These deals included the merger announcements of Exxon Corp. and Mobil Corp., British Petroleum Co. plc and Amoco Corp., Total and Petrofina SA, Union Pacific Resources Group Inc. and Norcen Energy Resources Ltd., Kerr-McGee Corp. and Oryx Energy Co., and Ocean Energy Inc. and Seagull Energy Corp.

Acquisition costs

Of the $82.1 billion in transactions, deals worth $51.8 billion involved reserves of 5.526 billion boe, yielding an average acquisition cost of $9.38/boe, said Randall & Dewey (see chart at upper right, p. 25)."Clearly, the market in 1998 was driven by the megadeals, as five transactions greater than $500 million accounted for 89% of the market, with an estimated cost of $11.22/boe," said Randall & Dewey. If the larger transactions are excluded from the calculation, the average reported reserves acquisition cost dips to $4.85/boe. By comparison, the average acquisition cost in 1997 was $6.57/boe, said the firm.

Independents selling now

In the past, said Randall & Dewey, independent companies dominated both buying and selling activity in A&D transactions. This was not the case in 1998. "For only the second year since 1990, the independent segment was a net seller in the U.S.," said Randall & Dewey.In 1998, the domination by independents in U.S. A&D activity was greatly overshadowed by the two biggest deals: Exxon-Mobil and BP-Amoco.

The total value of these large transactions was $78 billion, or about 95% of the total volume announced in 1998. "Taken together, the estimated U.S. portion of the Mobil and Amoco megadeals was $67.5 billion."

Changing landscape

Randall & Dewey views 1999 as a year that will contribute greatly to changing the overall landscape of the oil and gas industry.The non-U.S. companies' 56% share of the seller category and 4% share of the buyer category accounted for a net transaction total of $42.8 billion. "The entrance of Amoco and Mobil into the merger market pushed the integrated segment to its customary position as a net seller in the U.S.," said the firm.

Copyright 1999 Oil & Gas Journal. All Rights Reserved.