Oil firms' share prices plunged during 1998

This is the conclusion of John S. Herold Inc., Houston, in its annual oil market performance review.

From the end of 1996 to the end of 1998, Herold notes, oil prices plunged by $15/bbl, or 54%, and natural gas has done only slightly better, falling $0.80/ MMBTU, or 30%.

"Based on these poor fundamentals, one would have expected oil and gas shares to have lagged the broad market," said the firm. "In fact, the returns can nearly be described as catastrophically bad."

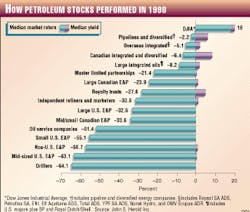

As a whole, the energy sector trailed the broad market-as measured by the Dow Jones Industrial Average (DJIA)-by double-digit percentages, although producers with a high concentration of natural gas output showed "a pronounced performance advantage" over companies leveraged to crude oil.

Large-capitalization firms fared better than small ones, says Herold, and the mergers and strategic alliances formed to reduce costs were rewarded by the market, which placed a value on their expected higher future incomes. "However," said Herold, "debt-financed acquisitions perceived to create size rather than value were severely punished with collapsing equity notes."

Universal decline

Herold analyzed 279 operating and service/supply companies for its 1998 oil stocks review.While results varied depending on company specialization, the overall trend was decidedly downward: the median stock in Herold's study yielded a total return of -36.1% for the year.

E&P firms dominate Herold's group of 279 companies. The sector performed abysmally last year-perhaps even worse than would be expected given the oil price decline, says Herold.

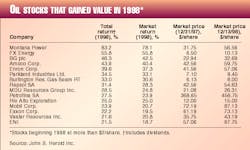

Only 12 E&P stocks gained over the year, all of which are focused primarily on natural gas. Seven of the 12 are Canadian firms that "drew some benefit from the weakening local currency," said Herold.

"E&P shares were devastated worldwide, especially those with substantial future capital costs associated with their undeveloped properties." And, while non-U.S. exploration and production continues to attract capital, upstream firms based outside the U.S. performed similarly to their U.S. counterparts: "just awful," according to the Herold report.

"A few issues did quite well-notably BG plc and Repsol SA-but crude producers suffered, regardless of the location of their reserves." The London market was "universally unkind" in 1998, says the firm.

The majority of the stocks that rose in value during the year were concentrated among the pipeline and diversified group-"the segment with the least exposure to commodity production margins," said Herold.

Performance by segment

Returns from major oil company stocks trailed the broad market by double-digit percentages in 1998 (see chart, p. 21). As a general rule, larger companies outperformed smaller ones, says Herold, "but size did not help Royal Dutch/Shell," which had a total return (market return plus dividends) of -0.7%, compared with +44% for Amoco Corp., +22% for Exxon Corp., +24% for Mobil Corp., and +18% for British Petroleum Co. plc.Only four of the 93 U.S. E&P firms studied posted gains during 1998, and losses of more than 50% were common. Vastar Resources Inc. was the high performer in this category.

"A dramatic segregation of market returns by company size is evident in U.S. E&P share price performance," said Herold. "While the largest firms posted a dreadful 33% median decline, the mid-sized and small groups trailed that by a further 20%."

Internationally oriented E&P companies also performed poorly last year. Enterprise Oil plc, for example, at a decline of 47% was the best performer of the London-based producers. FX Energy topped the international E&P category, with an increase of 56%.

Companies in the "pipelines and diversified" segment were by far the biggest gainers, says Herold. One of this group, Montana Power, was the leading performer in Herold's study (see table, this page). But even so, the group's returns trailed the DJIA by double-digit percentages.

Refiners performed quite poorly in 1998, despite low feedstock costs. Not a single firm in this category posted a positive return for the year.

"Lower Asian demand created a worldwide glut of refined products, leading to lower crack spreads as a result of the inventory build," said Herold.

The drilling and oil field supply sector, which performed well in 1996 and 1997, took a turn for the worse last year. "Drillersellipsesuffered more than suppliers, and the burden fell most heavily on land-based contractors, such as Patterson Energy and Grey Wolf Inc.," said Herold.

"M&A activity was very active in the sector, but returns were still sharply negative."

The best-performing issue, Kaneb Services, declined 23%.

"We caution bargain hunters not to be tempted by the apparently depressed valuations (in the service sector), since we expect much-reduced capital spending by the industry in coming quarters."

M&A activity

Of the 302 companies Herold surveyed at the end of 1997, 30 were lost to mergers during 1998."Three of the 10 best-performing issues were the subject of acquisition offers," noted Herold, "but not all combinations resulted in gains for shareholders.

"Seagull Energy Corp. agreed to be acquired by Ocean Energy Inc. late in the year, only to see the stocks of both parties skid by about 40% following announcement of the deal."

The perceived benefits of the megamergers, in terms of stock performance, could be misleading, says Herold: "While it might appear that merger news drove the returns of the giant oils during 1998, in fact, Exxon Corp. and British Petroleum holders were enjoying very satisfactory years before the bids for Mobil Corp. and Amoco Corpellipsewere announced."

Given the expectation that low oil prices are a long-term phenomenon, Herold believes 1999 could bring an acceleration of the merger and acquisition trend, "particularly among the battered E&P sector."

Copyright 1999 Oil & Gas Journal. All Rights Reserved.