Canadian M&A activity up, financings on the decrease

Canadian oil and gas merger and acquisition (M&A) activity in 1998 reached a record high value of $24.9 billion (Canadian).

This was 51% greater than the previous record of $16.5 billion, set in 1997 (see chart, below).

Despite this flurry of new M&A activity, reserve acquisition prices fell 6% to a median of $6.18/boe in 1998 from the 1997 price of $6.58/boe. Conversely, in 1997, reserve acquisition prices jumped 6% from the $6.22/boe price realized in 1996 (OGJ, Mar. 9, 1998, p. 41).

Canadian M&A activity

As elsewhere around the world, large corporate mergers in Canada had a greater presence on the M&A stage than did straight property deals. The largest 36 corporate acquisitions in 1998 each exceeded $5 million in size, said Sayer. These transactions comprised 85% of the total M&A value in 1998."Corporate acquisitions in general remained higher-priced than property acquisitions," noted Sayer, "but the differential between these types of deals narrowed with the fall in oil and gas share prices."

The median reserves acquisition price for corporate transactions in 1998, said Sayer, was about 14% above that paid for properties alone. In 1997, the cost of company transactions was 44% over those paid for properties.

The acquisition of oil reserves comprised 60% of the M&A activity's value in 1997, and more than 15% of the value involved the "acquisition of companies or assets with a significant proportion of heavy oil," said Sayer.

A shift to gas reserve acquisitions was seen in 1998, however, as 54% of the M&A value represented gas purchases, noted Sayer.

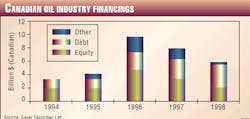

Financings

Equity financing values in the Canadian petroleum industry saw a steep decline in 1998. In fact, says Sayer, this type of financing has fallen consistently by $1 billion/year over the last 2 years. Industry raised a total of $4.64 billion in equity in 1996, $3.43 billion in 1997, and $2.09 billion in 1998.Sayer said, "Despite the overall decrease, flow-through share financings increased 24% in 1998 to $430.7 million compared with $326.5 million in 1997.

"Even with worsening share prices in 1998, the average premium to market price paid on flow-through issues has steadily increased from 16.04% in 1996, to 20.02% in 1997, and then up slightly again to 21.46% in 1998."

Debt financing increased 25% during 1996-98, said Sayer. During 1997, total debt value was $3.1 billion, a 13% increase from the 1996 total of $2.7 billion. The total debt value increased again in 1998, to $3.6 billion.

Sayer attributes this rise in debt financing partly to the fall in interest rates over the period. "For example," explained Sayer, "'A'-rated corporate bonds closed 1996 with an interest rate of 7.37%; 1997 closed at 6.44%; and at December 1998, the rate was 5.75%."

The growth in the U.S. market's demand for Canadian oil issues, said Sayer, is another key component of debt financing growth. The largest drop in 1998 was in the area of treasury financings, labeled by Sayer as the "other" category, primarily composed of royalty trusts. Treasury financings saw a 77% decline in 1998 to $308.9 million. A 38% drop was seen in 1997 from a total of $2.17 billion in 1996.

Copyright 1999 Oil & Gas Journal. All Rights Reserved.