Pipeline Gas Trade Between Asian Russia, Northeast Asia Gets Fresh Look

Keun-Wook PaikPipeline trade in natural gas between Asian Russia and Northeast Asia is receiving serious attention from the governments and companies central to the projects that might evolve.

Royal Institute of International Affairs

LondonJae-Yong Choi

University College

London

Such trade has become possible during the past 5 years because of improvements in relations between China and Russia. Prospects for a long-distance pipeline are enhanced by the possibility of extending deliveries of Russian gas to Korea and Japan to supplement imports by those countries of liquefied natural gas.

Korea and Japan have expressed interest in participating in a Russia-China pipeline. But their approaches differ greatly and would require careful coordination. Furthermore, participation by western companies would be essential.

A 2 year study by the Royal Institute of International Affairs examined Japanese and Korean views about energy needs and possible sources of supply. The study included a survey of 32 energy organizations in those countries.

This article reviews the gas potential of Asian Russia, describes events that have brought attention to those resources as a possible source of supply to Northeast Asia, and summarizes findings of the survey.

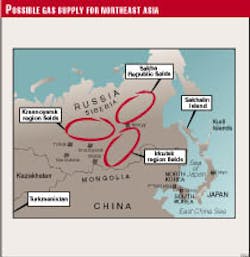

Supply for Northeast Asia

There are four major gas and oil supply sources for Northeast Asia: the Sakhalin Islands, Sakha Republic, East Siberia's Irkutsk and Krasnoyarsk regions, and Turkmenistan.

The Irkutsk region has two major oil and gas fields: Verkhnechonskoye and Kovyktinskoye. Estimated oil in place of Verkhnechonskoye, discovered in 1978 in the Katangsky district 900 km northeast of Irkutsk, is 4.4-4.7 billion bbl, of which 1.6 billion bbl is recoverable.

Kovyktinskoye gas-condensate field, discovered in 1987 in the Zhigalovsky region 350 km north-northeast of Irkutsk, contains an originally estimated 870 billion cu m of gas and 400 million bbl of condensate. After drilling of 28 exploratory wells and geological modeling, the Siberian Far East Petroleum Co. Ltd. (Sidanco) estimated volumes at more than 1.2 trillion cu m and 600 million bbl.

Exploration and development rights of both giant fields belong to Rusia Petroleum, of which Sidanco is the main shareholder. Other major shareholders are Irkutsk Oblast, Irkutskenergo, Angarsk Refinery, and East Asia Gas Co.

The Krasnoyarsk region includes giant Yurubchenskoye oil field, which holds an estimated at 5.5 billion bbl of oil in place, of which 2.6 billion bbl may be recoverable. The exploration and development license of Yurubchenskoye field, 530 km northwest of Krasnoyarsk, belongs to Vostochno-Sibirskaya Oil & Gas Co. (Vsogc), which registered the smallest production and export volumes of all Russian oil and gas companies in 1994 and 1995.

The Sakha Republic's 30 fields include Srednevilyuyskoye, Srednetyungskoye, and Chaiyadinskoye gas fields and Srednebotuobinskoye and Talakanskoye gas and oil fields. An estimated 79 tcf of gas is in place, with recoverable reserves estimated at 42 tcf. Oil in place in Talakanskoye and Srednebotuobinskoye fields is estimated at 1.1 billion bbl.

The combined recoverable reserves of the three regions total more than 5 billion bbl and 2.5 trillion cu m. But sparse exploration makes the estimates very uncertain. An example of the uncertainty appeared recently when an announcement of four tender blocks in Krasnoyarsk put hydrocarbons in place in the offered areas at roughly 680 million metric tons of oil and 244 billion cu m of natural gas.

The Sakhalin I project involves combined gas and oil/condensate reserves estimated at 460 billion cu m and 130 million tons in Lunskoye and Piltun-Askotskoye fields. The Sakhalin II project has 280 billion cu m of gas and 180 million tons of oil reserves in Odoptu, Chaivo, and Daginskoye fields.

Turkmenistan's proved reserves are estimated at 88 tcf out of 364 tcf in place.

Each of the regions has enough gas to support a pipeline project to Northeast Asia. In terms of development economics, transportation distance, and the scale and location of markets, however, East Siberia is well-positioned to provide an opportunity for the region to establish multilateral cooperation for a pipeline development and to make all the regional countries beneficiaries of the project.

East Siberian development

In the early 1990s, BP Exploration Operating Co. Ltd. and Statoil began a comprehensive study of East Siberia, particularly the Irkutsk region, but decided not to enter a joint venture with the Irkutsk Province Executive Committee for oil and gas development. The main reason was the lack of an immediate market for oil and gas produced in the region. At that time, the Chinese market was inconceivable.

Improved Sino-Russian relations and China's energy shortage subsequently drove China to aggressively but discreetly promote imports from East Siberia. In July 1992 Prof. Zhang Yongyi, then vice-president of China National Petroleum Corp. (CNPC), proposed to Russia and Japan the development of oil in East Siberia. Zhang added that the oil pipeline could be extended to Japan via Korea if Japan became involved in the project.

In September 1993, CNPC began to negotiate with the Russians for exploration of Markovskoye and Yaraktinskoye oil and gas fields in the Irkutsk region. CNPC's Russian counterpart was a group of Irkutsk's Petroleum & Gas Geological Co. and Geophysical Research Institute together with 14 local companies and organizations. CNPC's two exploratory wells were drilled in the two virgin fields.

At that time, Russia was also promoting plans to develop Irkutsk gas fields and export electricity to China. Vladimir Yakovenko, then the first deputy head of the administration of Irkutsk Province, pointed out that oil and gas development in the region has two main strengths:

- It can replace fuel oil and local brown coal with gas from Kovyktinskoye in regional power stations, reduce emission of pollutants by 400,000 tons/year, and free 16 million tons/year of coal for delivery to the Russian Far East.

- Electricity from the 4,500-megawatt Bratsk and 3,840 megawatt Ust Ilinsk hydroelectric stations, 1,050 megawatt Irkutsk CHPP No. 10 thermal power station, and many local coal-fired stations could be exported to China.

Russia and China basically agreed to promote East Siberian gas and oil development by signing a memorandum of understanding for construction of a long-distance pipeline in early November 1994. The agreement, signed by CNPC and the Russian Ministry of Fuel and Energy (Mintopenerga), was the first official expression of determination for the pipeline development.

As proposed by Sidanco, the trans-boundary pipeline would carry 20-30 billion cu m/year from the Irkutsk region to the coastal cities of East China and possibly to Korea and Japan.

In early March 1995, Shi Xunzhi, then assistant president of CNPC, stated at a Tokyo international conference that China was considering importing gas from East and West Siberia via a new gas pipeline connecting the Irkutsk region with China via Mongolia. However, a proposal by a bilateral working group to export gas to China from West Siberia's Vostochno-Urengoi field ran into opposition from Gazprom, which suggested that all of western Siberia's gas should be earmarked for Europe or reserved for domestic consumption. Gazprom's recent Asia policy signaled a sweeping change of its Europe-oriented export policy.

At the end of 1996, a Sino-Russian oil and gas cooperation committee chaired by Zhang was established to promote this pipeline development. According to a Chinese newspaper, both Russia and China made an agreement that electricity export from Irkutsk to Beijing will start in 2002, natural gas export in 2003, and crude oil export in 2005.

In July 1996, the East Asia Gas Co. (EAGC), a subsidiary of the Hanbo Group, announced that it had purchased 27.5% of Rusia Petroleum's equity shares and announced that it would promote early development of East Siberia's oil and gas reserves. It remains to be seen how EAGC's approach will affect the pipeline development.

Statements on pipeline

Statements in interviews by three senior Russian officers confirm the importance given to the Sino-Russian pipeline development.

In October 1996, Anatoly Shatalov, first deputy minister of fuel and energy, said Russia aims to implement production sharing projects on the Sakhalin shelf to develop major Russian oil and gas export systems in the Far East and to strengthen the position of Russian oil companies in Northeast Asia.1 The ministry is providing a full weight to support this pipeline development under the guidance of a premier commission established at the end of 1996.

In February 1997 two important interviews by Grigory Karasin, deputy ministry of foreign affairs, and Rem Vyakhirev, chairman of Gazprom, confirmed the policy change. Karasin emphasized the importance of China in Russia's East policy and elaborated on the Sino-Russian cooperation projects, like the delivery of power equipment for the Three Ravines hydraulic power system, construction of gas and oil pipelines from East Siberia to Northeastern China, export of electricity from the Irkutsk Oblast to China, and construction of a nuclear power station in Jiangsu Province.2

The chairman of Russia's giant gas company announced plans to focus its strategy on penetrating the Asian gas market. He said he "saw a prime market for Gazprom's growth in Asia, where the gas market is absolutely empty or devoid of competition." He added that "some of the production from the $40 billion Yamal project could be diverted to Asia."3 Gazprom's new policy will affect the Sino-Russian gas pipeline development, but the real question is when and how Gazprom's Asian policy will be reflected in the development.

Gazprom's Asia policy was elaborated in the World Gas Conference held in Copenhagen in June 1997. Vyakhirev made clear that Gazprom is backing proposals to develop East Siberian gas both for local use and for export to East Asia. In particular, he said that while in the near term demand from East Asian countries would be met by LNG imports, after 2005-2007 the countries would need new sources of gas. A new gas production center would be built after 2000 in the eastern Irkutsk region, which could in the future be linked by trunk pipelines to China, North and South Korea, and Japan.4

Kovyktinskoye development

In February 1997, Anatoli Sivak, then president of Sidanco, gave a clear picture of Kovyktinskoye gas field's development, which is part of a federal program named "Fuel and Energy" and is within the framework of a subprogram entitled "Oil Production and Oil and Gas Construction Complex Stabilization."5 The blueprint of Kovyktinskoye development comprises local (within the Russian Federation) and federal (international export pipeline) programs.

The local program has three stages. The first stage, covering 1994-98, aims at early production of 1.56 billion cu m/year of gas, construction of a 720 mm diameter gas pipeline leading to Angarsk petrochemical complex, construction of a condensate pipeline to the Magistralnaya railway station on the Baikal-Amurskaya main line, and building of condensate refining facilities. The estimated investment is $357 million, of which more than $60 million had been invested as of Jan. 1, 1996.

The second-stage plan, to be implemented during 1998-99, envisages provision of gas-fired power generation based on 5.5 billion cu m/year of gas production. The third stage is to be completed by 2001. The investment necessary for the second and third stages is $220 million and $148 million respectively.

Once this regional program is implemented, there would be a reduction of 20-25% in thermal power generation cost and 30-40% in petrochemical production cost. Besides this, using gas in power generation will improve the Irkutsk region's environment, cutting air pollution dramatically. Use of gas is expected to reduce the generation of harmful wastes by 40% and of hazardous materials, such as ash and sulfur oxides, by 50%.

Currently, the Russian priority is on the regional program, but the core of Kovyktinskoye field development lies in the federal program. Sidanco has negotiated with the Ministry of Energy, Geology and Mining, Mongolia, and CNPC for this export pipeline project and studied four routes.

It concluded that the shortest pipeline is economically attractive. The 3,364 km route includes 1,027 km in Russia, 1,017 km in Mongolia, and 1,320 km in China. The 1,420 mm-diameter pipeline would have capacity of 32 billion cu m/year. It would require 15 compressor stations and capital expenditures estimated at $7 billion.

Even though Kovytinskoye field's development plan was approved by Rusia Petroleum's board in April 1997, financing remains the main obstacle to early implementation. EAGC is not in a position to increase its investment for the regional development program as its parent, the Hanbo Group, went bankrupt in January 1997. The question is who will cover the investment for early development. Western or Japanese companies could handle the financing, but any such company would require serious recognition as a main developer.

Japan and Korea

Even though China is set to provide the biggest market for East Siberian gas and oil development, Japan and Korea are also well-positioned to be important developers as well as beneficiaries of this pipeline development.

Japan's main interest in Asian Russia's energy development has been centered on Sakhalin offshore energy development. Mitsubishi, Mitsui, and Sakhalin Oil & Gas Development Co. (Sodeco) are important players in the Sakhalin I and II projects. It is uncertain whether Japan's domestic gas trunk pipeline development will be realized, but the introduction of 2,225 km of pipeline connecting Sakhalin Island and mainland Japan is not a remote possibility. The pipeline has three sections: 625 km from Katangli to Prigorodnoye, 1,300 km offshore from Prigorodnoye to Niigata, and 300 km from Niigata to Tokyo.

In fact, Japan's Ministry of International Trade and Industry (MITI) minister, Shinji Sato, announced at the International Energy Agency ministerial meeting held last May in Paris that Japan is considering the Sakhalin offshore gas import pipeline. It was the first official remarks by Japan's minister on international pipeline development between Russia and Japan.

Other than the Sakhalin projects, the East Siberian pipeline project is the one in which Japan has shown government-level interest. A group of Japanese companies led by Japan National Oil Corp. (JNOC) is exploring participation in the project. In late June 1996, MITI informed Russia and China that Japan is interested in taking part in the development of Irkutsk gas resources as well as the related export pipeline.

East Siberian gas export to Japan may not be as attractive as East Siberian gas to China and Korea. But East Siberian oil export to Japan is an easily marketable option due to the high quality of crude oil and relatively short transportation distance. A key question is whether the gas reserves in East Siberia are sufficient to justify extension of the pipeline to Japan.

Regardless of EAGC's early positioning in the Irkutsk region's oil and gas development, Korea is very well-positioned to be an important player in this East Siberian pipeline development. At the end of 1995 both Russia and Korea finished the preliminary feasibility study on Republic of Sakha gas development, but the full feasibility study was not undertaken due to the marginal pipeline development economics. Now Korea's preference is tilted toward Kovytinskoye gas imports.

In the early stage of East Siberia pipeline development, Korea can make a strong contribution by making its market available. Currently, a group of Korean companies headed by Korea Gas Corp. (KGC) is working on its feasibility study. Clearly, the approaches by EAGC and the KGC group toward Irkutsk gas development are quite different, and it remains to be seen how their approaches affect the outcome.

Survey results

The survey of Japanese and Korean industry representatives, from 16 companies and government energy agencies in each country, shows a strong preference for natural gas over oil, coal, and nuclear energy. Both countries hope to increase the share of gas in their energy supply mix. Details of the survey will be reported soon in a briefing paper of the Energy & Energy Environmental Program, Royal Institute of International Affairs.

Nearly 60% of the Korean respondents and 40% of the Japanese respondents called a long-distance pipeline likely. Other choices were very unlikely, unlikely, no idea, and very likely.

Respondents in both countries strongly-more than 60%-saw the Irkutsk region as the probable supply source for a long-distance pipeline to Northeast Asia. The Sakhalin offshore area was runner-up.

There are three important points that produce a very different view between Japan and Korea in connection with the trans-boundary pipeline development: 1) who is the driving force; 2) whether the pipeline has to pass through North Korea; and 3) how to finance the development.

Japanese respondents saw China as the driving force, followed by Japan, then Korea. Korean respondents put their country as the driving force, followed by Japan and China.

More than 50% of the Japanese respondents did not support transit of North Korea, while about two thirds of Korean respondents supported the route. This is a strong reflection of Korea's desire for reunification between the two Koreas; in reality, the route passing through North Korea is an obstacle as to financing.

Japanese respondents expressed preference for direct financing but showed a virtually same-level preference to World Bank extended cofinancing guarantees. Korean respondents' preference was for World Bank extended cofinancing guarantees and multilateral investment guarantee agency insurance. The contrast confirms that Japan has a strong advantage in the financing sector.

A pipeline from Russia to Northeast Asia is a possibility, but a number of steps remain before it becomes a reality. A crucial step is appraisal and development of Irkutsk gas and oil reserves and validation that gas from the Sakha Republic and Krasnoyarsk region can significantly supplement supply. Project sponsors will of course require assurance that supply commitments can be met.

From the standpoint of Northeast Asian purchasers, early development of a Sino-Russian pipeline system will need to be a priority. Simultaneous development of parallel oil and gas pipelines could provide needed financial flexibility, assure Northeast Asia of oil and gas supplies, and provide China revenues from oil tariffs to help it adjust to gas-price increases essential to project economics.

References

1. Interfax News Agency Petroleum Report, Oct. 25-Nov. 1, 1996, pp. 6-7.2. Tsekhmistrenko, S., "Russian eyes the East," Business in Russia, No. 74, February 1997, pp. 15-17.

3. Liesman, S., "A Reorder of Lenin: Gasprom in Break from Communist Past, Talks up Share Price," Wall Street Journal, Feb. 27, 1997.

4. Vyakhirev, R. I., "The Perspectives of Russian Natural Gas: Role at the World Gas Market," paper presented at 20th World Gas Conference, Copenhagen, June 10-13, 1997, pp. 14-15.

5. Sivak, A., "Constructing a Gas Pipeline from Irkutsk to China and South Korea: Perspectives and Opportunities in Developing the Kovyktinskoye Gas Condensate Field," paper at International Conference on Oil and Gas Pipeline Projects in Russia and the C.I.S., IBC U.K. Conferences Ltd., Moscow, Feb. 13-14, 1997.

The Authors

Keun-Wook Paik is senior research fellow at the Royal Institute of International Affairs (RIIA) and an honorary research fellow at the University of Aberdeen, Scotland. He is author of Gas and Oil in Northeast Asia: Policies, Projects and Projects, published by RIIA in late 1995. His current work is on natural gas options in Northeast Asia, which will appear in a book to be published by RIIA in early 1998. He is also coauthor and supervisor of EEP (RIIA)-China OGP (Xinhua News Agency's) joint work on the Chinese gas market to be published in February 1998. He holds a PhD from the University of Aberdeen.

Jae-Yong Choi is a PhD candidate at University College London, specializing in survey methods and analysis. He has contributed to a number of publications, including a chapter on Korea in World Construction Cost Handbook (1995) and UNESCO Energy Flow and Conservation (1989).

Copyright 1997 Oil & Gas Journal. All Rights Reserved.