Global petrochemical R&D focus on projects that provide a return

David Knott

Senior Editor

Basic research is largely a thing of the past among global petrochemical companies. Tough market conditions have forced them to confine their efforts to projects that are likely to offer a payback.

Research and development spending has been cut across the board during the 1990s. Some companies are cutting back after overly ambitious attempts to diversify, and are focusing on core products.

Petrochemical R&D is driven by technology rather than pure science nowadays, and minimizing costs is a major aim of every project.

In universities, traditional home of basic research, the last decade has seen a growth of commercial realism, with researchers increasingly relying on outside projects to provide income.

Colin Richards, general manager for research and technology on polymers and olefins at BP Chemicals Ltd., told of a growing interdependence between petrochemical producers and academia.

Link to academia

While admitting that "blue sky" work has declined within industry, Richards said there is still a role for pure research, but not a dominant position as it once had.

"BP Chemicals is not now doing most of its blue sky research itself," said Richards. "We have established links with academics, setting up projects with research groups we think it beneficial to work with.

"The difference is that now it is a case of managing our portfolio of academics, not just giving them a lot of money and seeing what they come up with.

"Blue sky research is better done in universities than in companies, while we have to do process-driven research, because this is similarly not best done externally. Our own research is focused, tied in with our business groups."

Within BP, all research is handled within the groups rather than across the company, said Richards.

"Skills networks" led by senior researchers have been set up within the business groups, linking company and academic R&D people pursuing the same aims.

"We are better integrated than ever before," said Richards. "There may not be as much money spent on research, but we are doing things now in different ways, and more effectively than before."

Mark Morgan, European process evaluation and research planning coordinator at Chem Systems Ltd., London, confirmed that petrochemical industry research in companies is very much targeted toward key strategic products.

"Lots of petrochemical companies have little time for blue sky research," said Morgan. "I think this is a shame, but that's the world we have to live in."

He highlighted four key areas for current R&D in petrochemicals:

- Basic petrochemicals such as ethylene and propylene.

- Petrochemical intermediates such as 1,4 butanediol and vinyl chloride monomer.

- Commodity polymers, notably linear low density polyethylene (Lldpe).

- Specialty polymers such as engineering plastics.

Basic petrochemicals

Morgan noted that there have been innovations in production of basic petrochemicals in recent years, such as development by UOP and Norsk Hydro AS of a process to produce ethylene and propylene from natural gas via methanol.

"This kind of technology requires the production of methanol from natural gas," said Morgan, "followed by conversion to olefins with a considerable amount of water as a byproduct.

"This new methanol-to-olefins (MTO) process has a silica-alumina-phosphate catalyst that gives far higher olefin selectivity than the previous MTO process developed by Mobil Corp. based on zeolite ZSM5."

Henning Reier Nilsen, technical director of Norsk Hydro's petrochemical divisions, told a recent conference that efficient conversion of methane to higher value products has been a goal of catalytic scientists the last 50 years.

Nilsen said the first step of natural gas conversion to methanol is a well-established process, but economics of large scale methanol production followed by MTO processing makes continuing the search for a direct gas to olefins process still attractive.

"Some developing nations," said Nilsen, "require small ethylene producing sites to meet local demand. However, in many places, transportation of ethylene is expensive and so is not feasible. Methanol can be shipped to these sites, and MTO units can be built to meet the local demand.

"The UOP/Hydro MTO process has favorable economics in areas where low cost natural gas is available and easily beats the internal rates of return for traditional naphtha cracking in these locations."

Besides new processes, ethylene producers and users are also researching ways to recover ethylene from plant waste streams, a technique called ethylene scavenging.

Olefins plant at Wilton, U.K., is owned by ICI and BP Chemicals. Ethylene and propylene are produced by thermal cracking of crude oil and liquid petroleum gas. Photo courtesy ICI.

FCC conversion

Propylene is typically produced in a steam cracker or from a refinery via fluid catalytic cracking (FCC), said Morgan.

Research is continuing to improve propylene yields from refineries through modification of FCC catalysts.

Produced propylene is upgraded to polymer grade by fractionation. In Europe and the Far East propylene is produced by catalytic dehydrogenation.

"These involve highly complex processes requiring vacuum operation or continuous catalyst regeneration," explained Morgan. "Research continues into performing propane dehydrogenation in fixed-bed isothermal reactors, using new improved catalysts as demonstrated by Mobil and BP Chemicals."

Recent developments in FCC technology include three processes for converting vacuum gas oil (VGO) or atmospheric residue (AR) into light olefins and aromatics.

Deep catalytic cracking (DCC) is an extension of FCC developed by China's Research Institute of Petroleum Processing, Beijing. The process employs a proprietary catalyst based on zeolites.

DCC has been developed and commercialized in China by the institute and state firm China National Petrochemical Corp. (Sinopec) and is being licensed outside China by Stone & Webster Technology Corp. (SWTC), Houston.

Five DCC units are already in operation in China, the first a 60,000 metric ton/year plant at Jinan brought into production in 1990.

Two more units are planned in China: a 600,000 metric ton/year plant at Jingmen, under construction, and a 1.8 million metric ton/year unit at Daqing, currently under engineering design.

At a recent conference in Houston, SWTC Pres. Axel R. Johnson and colleagues presented a paper that explained the DCC process yields high amounts of propylene, butylenes, and amylenes, along with aromatic-rich, high-octane gasoline.

Another process described by Johnson et al. was the Alpha process developed and commercialized by Japan's Asahi Chemical Industry Co. Ltd.

In the last 10 years, work also has progressed in extending the envelope of economic operation of FCC plants to include AR and VGO after hydroprocessing.

Johnson said these three processes expand the refinery-based petrochemical feed slate beyond naphtha to encompass the whole crude barrel, including residues.

"On this basis," said Johnson, "crude oil or atmospheric residue-based petrochemical production is now practical, either on a stand-alone basis or as a complement to an ethylene/ propylene cracker."

The first DCC plant to be developed outside China will be completed by yearend. This will be a 750,000 metric ton/year plant at Rayong, Thailand, that is expected to begin commercial operation next year.

Intermediates

Morgan said there is a constant R&D drive to add value to steam cracker operations, through upgrading byproduct streams such as C4 and C5 output.

"Research continues into finding new ways to upgrade 1,3 butadiene into high value products, said Morgan. "Another example has been development of a process to convert 1,4 butadiene into styrene monomer for polystyrene, unsaturated polyester resins, acrylonitrile butadiene styrene (ABS) resins, etc."

Morgan said more exciting research is being brought to fruition by European Vinyls Corp. (EVC), which is developing a process to make vinyl chloride monomer (VCM) from ethane. This will markedly reduce production costs.

"In recent years there has been a great deal of R&D effort expended on developing new routes to 1,4 butanediol and derivatives-for example, tetrahydrofuran and gamma butyrolactone," said Morgan.

Processes have been developed from butane and maleic anhydride feedstocks by BP Chemicals, Du Pont de Nemours International SA, and Lonza AG, among others. These processes are claimed to be competitive with acetylene-based and other routes to butanediol.

Commodity polymers

"The word 'metallocene' is synonymous with R&D into new catalysts for commodity polymers like linear low density polyethylene, polypropylene, and so on," said Morgan.

"Recent alliances have been announced by BP Chemicals with Dow Chemical Co. and Exxon Chemical Co. with Union Carbide Corp. to develop further this kind of polymer production chemistry."

Petrochemical producers have worked to improve their catalysts since the industry first began, but the introduction of metallocene is reckoned to be the most significant leap forward in polyolefin catalysts.

Polyolefin catalysts are effectively molecular templates on which a polymer chain is assembled from smaller molecules.

Before metallocenes, catalysts were blends of substances, creating a variety of template configurations and thus a variety of resulting polymer molecules.

Metallocene catalysts consist of identical molecules, so the polymer templates are all the same and the resulting polymers are consistent, giving more predictable properties.

Because of their structural uniformity and predictability, metallocenes can be used to create polymers with specific qualities in mind-in essence, "designer polymers."

Use of metallocenes is not restricted to commodity polymers but can be found in elastomers as well, said Morgan. For example, metallocenes are being developed and used by Exxon, DSM NV, and Du Pont, among others, to manufacture ethylene propylene diene terpolymer (EPDM) elastomers.

Another example was said to be syndiotactic polystyrene, where metallocene catalysts impart a unique stereoregularity to the polystyrene chains, causing crystallization, which imparts new properties to the polymer such as high melting point and heat distortion temperatures.

Earlier this month BP/Dow and Exxon/Union Carbide separately disclosed joint ventures to develop technology based on metallocene catalysis.

BP/Dow venture

BP and Dow are developing and marketing BP's Innovene gas phase polyethylene process in combination with Dow's Insite metallocene catalyst.

The alliance is being viewed as a way to work towards bringing the benefits of high quality polyethylene output to manufacturers at a lower per unit cost.

In disclosing the deal, Bryan Sanderson, chief executive officer of BP Chemicals, said the alliance will help the companies meet market demand for a range of advanced commodity products, with the cost benefits of using a single gas-phase reactor.

"It will prove extremely attractive to both existing and future Innovene licensees," predicted Sanderson, "giving them access to new markets and the ability to improve their competitiveness."

The Innovene technology was developed from a BP idea of some years ago: a novel fire suppression system for rapid quenching of airplane, tunnel, and oil fires.

The fire system relies on a specially designed nozzle for rapid application of a fine mist of water to extinguish fires in seconds. With Innovene, liquid is applied directly to the fluid bed reactor to provide rapid cooling and enable ethylene polymerization.

BP Chemicals claims that reaction heat is so effectively removed that plant capacity can be doubled, reducing costs and substantially improving returns on investment.

Since 1975 BP has licensed 23 operators in 16 countries to build Innovene-based plants, with combined capacity to produce 3.5 million metric tons/year of polyethylene.

The current Innovene plants use Ziegler and chromium catalysts, but BP and Dow claim metallocene technology can be introduced progressively to existing plants without disruption.

Dow started up a 55,000 metric ton/year capacity plant at Freeport, Tex., in June 1993 to produce polymers using Insite technology. Since then the company has brought 16 new products to market.

The company reckons metallocenes will change the way polyethylenes are developed and used, enabling producers to manipulate properties of materials including density, molecular weight, and comonomer and molecular weight distribution.

"This type of molecular architecture control has also greatly improved the application development and commercialization cycle," said Dow.

"By using computer models, Dow can design a molecule based on structure-property relationships, determine plant conditions to make the polymer, and know what the polymer can do after it is made. The capability to generate this amount and type of information is unprecedented in the plastics industry."

Exxon/Union Carbide

Three days after the BP/Dow alliance announcement, Exxon and Union Carbide announced their own 50-50 joint venture to research, develop, market, and license leading-edge technologies for polyethylene production.

The alliance will combine Union Carbide's Unipol I and II gas-phase processes and catalysts with Exxon's Exxpol metallocene catalysts and supercondensed mode gas-phase process improvement.

Exxon and Dow are the only companies to have developed commercial metallocene catalyst families, and Exxon claims to have been the pioneer, a role it said was a change from its technology follower status in petrochemicals at the time.

In a recent interview Greg McPike, Exxon's global vice president for Exxpol, reflected on the risks and rewards of taking a lead. The metallocenes project started with a decision in 1979 to develop new products.

"The catalyst was the key to doing this," said McPike, "so a catalyst group was formed to spearhead the program. At that time, research on polyolefin catalysts was being done in the universities, including Kaminsky's work with metallocenes.

"We concluded early in the '80s that the next technology revolution in polyolefins would be based on single-site catalysts. We had a breakthrough shortly thereafter when we hit upon a ligand structure combination that allowed the catalyst to be commercially feasible."

Exxon filed patents in 1983 for its Exxpol technology and by the end of 1995 had either received or filed for more than 140 separate patents for Exxpol and its application.

McPike said metallocene products are finding many applications in both specialty and premium commodity polymer production. While metallocene catalysts are expected to become the dominant technology, the takeover will be slower than some observers estimate," said McPike.

"I think the estimate of 80% penetration of metallocenes in commodity applications by 2005 is way too high," said McPike. "While metallocenes will reach and exceed that level of penetration, it will take more time.

"The whole converting and end-user industries grew up processing imprecise polymers made by the multi-sited catalysts. They will not change overnight. On the other hand, metallocene plastomers, Lldpes, and propylene polymers process well on most existing molding and film converting equipment with either no or only minor modifications."

Exxon formed a metallocenes alliance for propylene production with Hoechst AG in 1994. Hoechst holds several patents here, and the two companies have developed a commercial technology.

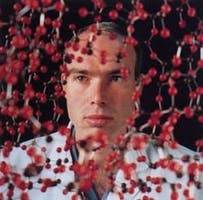

Molecular structures are under study at BP Chemicals' Sunbury-on-Thames, U.K., research center. The recent development of metallocene catalysts is enabling producers to predict the structures and qualities of polymers more accurately than ever. Photo courtesy BP.

Polypropylene push

In June Dow disclosed a plan to apply its metallocenes technology to polypropylene, through a licensing agreement with Montell Polyolefins, the Shell/Montedison SpA joint venture.

Montell awarded a license to Dow for production of polypropylene at a new plant to be built at Schkopau, Germany, and based on Montell's Spheripol polypropylene process.

The two companies are discussing plans for more Spheripol licenses at other Dow plants throughout Europe, North America, and the Asia-Pacific region.

In addition to the licensing agreement, the two companies have agreed to work together to evaluate suitability of metallocene catalysts in the Spheripol process.

Montell said the companies are discussing an agreement allowing the partners to purchase polypropylene products from each other. This would "provide a stable source of products for both companies."

Robert Wood, Dow's business vice president of engineering plastics, said: "Metallocenes have the potential to affect the polypropylene industry as significantly as they have influenced the polyethylene business.

"The performance and processability improvements we expect to achieve in products made with metallocene catalysts will expand the range of polypropylene's uses, building new demand and further supporting the above-average growth rates in the marketplace."

Dow expects to be able to begin selling polypropylene as early as the fourth quarter because of the licensing agreement with Montell.

The Schkopau plant is expected to begin production early in 1998 and have capacity to produce 200,000 metric tons/year of polypropylene.

By 2000 Dow intends to build at least two more world scale polypropylene plants. Sites under consideration include Dow operations at Tarragona, Spain, and in North America.

Specialty polymers

Morgan said new engineering plastics are being researched and developed, with a recent newcomer being Carilon, developed by Shell International Chemicals Ltd. using ethylene, propylene and carbon monoxide feedstocks.

Carilon thermoplastic polymers are aliphatic ketones and came about because of the chance discovery of a unique catalyst made at Shell's research laboratories in Amsterdam.

A Shell official explained that researchers were looking for one thing but stumbled across something else: "They were expecting a catalyst for an existing solvent from their experiments but produced instead a powder that everyone had been looking for without success.

"There has been a Carilon market development unit in place since 1987, but now there is a rush on applications, and a commercial production plant is expected to start up later this year."

Shell said the new catalyst made it possible to polymerize carbon monoxide and alpha olefins such as ethylene into linear, perfectly alternating structures. This led directly to aliphatic ketones.

Shell is not shy about its discovery: "Carilon could be one of the most significant new polymer developments since nylon and polycarbonate.

"Currently the world market for engineering thermoplastics is predominantly made up from the so-called 'big five': polyamides, polyacetal, polyester, polycarbonate, and polyphenylene oxide. This could now become the big six."

Since the mid-1980s Shell's Moerdijk market development unit in the Netherlands has been making sample quantities available to potential Carilon customers. Its Carrington plant in U.K. will begin full scale production later this year.

The product is initially being promoted for the traditional automotive, consumer appliance, electrical, and industrial markets for engineering thermoplastics. Other potential markets are said to include industrial packaging, film, fibers and coatings.

"This unique polymerization chemistry makes it possible to generate a completely new family of polymers," said Shell. "The first grades to be commercialized will have a melting point of 220° C. with a specific gravity of 1.24 at room temperature.

"Glass-filled and flame-retardant versions without the use of halogen or red phosphorus are under development."

Chem Systems' Morgan said, "BP Chemicals has formed an alliance with General Electric Co. to produce and market a similar product to Carilon. Other new polymers that are being researched and developed include cyclic olefin copolymers.

"These are derivatives of cyclopentadiene, a C5 hydrocarbon byproduct of steam cracking. These polymers are transparent and have excellent optical properties, making them a potential competitor for polycarbonate and poly-methylmethacrylate."

Mark Morgan, European process evaluation and research planning coordinator at Chem Systems Ltd., London:

Petrochemical industry research in companies is very much targeted to- ward key strategic products. Petrochemical companies have little time for "blue sky" research. I think this is a shame, but that's the world we have to live in.

Colin Richards, general manager for research and technology on polymers and olefins at BP Chemicals Ltd., tells of a growing interdependence between petrochemical producers and academia.

"We are better integrated than ever before. There may not be as much money spent on research, but we are doing things now in different ways and more effectively than before."

Copyright 1996 Oil & Gas Journal. All Rights Reserved.