Total Cie. Francaise des Petroles and Ste. Nationale Elf Aquitaine, France's two major oil companies, have disclosed three major development deals in the Persian Gulf area.

Total will develop part of Qatar's huge North offshore field to provide feed for a $2 billion liquefied natural gas export chain to Japan due to start up in 1997.

The company also signed a letter of intent with National Iranian Oil Co. (NIOC) that could lead to development of two offshore oil fields in the Sirri area near the Gulf of Hormuz.

Advance payment for purchases of crude from Iran are also covered by the agreement.

Under an agreement with the Qatar government, Elf will receive a portion of North field reserves and will be able to develop a second LNG scheme when customers for the gas have been found.

TOTAL'S AGREEMENT

Total will operate a $600 million development project in North field under a production sharing contract with Qatar General Petroleum Corp. (QGPC).

State owned QGPC will take gas for the LNG project, while Total will have access to about 45,000 b/d of condensate.

It will be the second offshore complex in the 150 tcf field. QGPC is in the final stages of commissioning a six platform complex about 50 miles north of Doha, which will provide 600-800 MMcfd for local industries and utilities. It also will yield about 50,000 b/d of gas liquids for export.

The LNG project is a joint venture, known as Oatargas, among QGPC 70% and BP Exploration, Total, Mitsui & Co. and Marubeni Corp. 7.5% each.

QGPC is negotiating with the other partners in Qatargas to join Total in the production sharing contract.

The LNG project began to move forward after a letter of intent for a 25 year supply contract was signed with Chubu Electric Power of Japan last February.

Chubu will take 4 million tons/year of LNG from Qatar at first.

There is a provision for a third LNG liquefaction train to boost production to 6 million tons/year.

Total said most of the $600 million investment in the offshore facilities is expected to be made in 1994-96.

ELF PROJECT

Elf said the attribution of a portion of North field gas to the company raises the possibility of developing an integrated gas project supplying 4 million tons/year of LNG during a 25 year period.

The reserves attributed to Elf are in the central part of the field. Elf would be responsible for development of the reserves and construction and operation of the LNG project.

The company, which has started sounding out possible customers for the gas, will also seek partners for both stages of the project.

It expects the upstream development to cost about $500 million with another $3 billion required for liquefaction, storage, and export facilities.

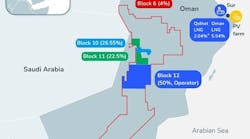

Elf operates Blocks 1 and 6, which cover about half of Qatar's offshore acreage.

Elf has started drilling on Block 6 and will get a drilling program under way shortly on Block 1.

TOTAL IN IRAN

Total's agreement with NIOC provides for development of offshore oil fields "selected by mutual agreement." Industry sources identified these as two undeveloped reservoirs near Sirri Island.

The second stage of the agreement calls for Total to sell large volumes of Iranian crude. Exact volumes have not been settled, but industry sources say there is considerable flexibility in this part of the agreement. Liftings could range up to 100,000 b/d.

Total will pay for the oil in advance through a group of banks.

Total also will take part in a study of the prospects for an LNG project based on Iranian gas.

Total said the agreements with Iran and Qatar in the Persian Gulf and with Algeria (OGJ, May 27, p. 38) are further evidence of the company's willingness to engage in new types of partnerships with producing countries.

Copyright 1991 Oil & Gas Journal. All Rights Reserved.