OGJ Newsletter

Norwegian voters snub Green antioil push

An election seen partly as a referendum on Norway’s future as an oil-producing country went solidly for the status quo.

Prime Minister Erna Solberg of the center-right Conservative Party and her main collation partner, the Progress Party, won 89 seats in Norway’s 169-seat Parliament, defeating a group led by the Labor Party that was projected to win 80 seats.

Before the election, weakening of the Labor coalition was thought to have created an opportunity for the Green Party to gain influence. The Greens campaigned to halt oil and gas exploration and to phase out the Norwegian oil industry in 15 years.

But the party only retained its single seat, winning an estimated 3.3% of the vote.

No Conservative-led Norwegian government has retained power in an election since 1985.

The Labor Party was projected to lose 6 of its 55 seats but to remain Norway’s largest single party.

Norway produces about 1.7 million b/d of oil and 10.6 bcfd of natural gas.

CEFC China Energy to buy Rosneft interest

CEFC China Energy Co. Ltd., Shanghai, has agreed to buy 14.16% of the share capital of Rosneft from a combine of Glencore, Baar, Switzerland, and Qatar Investment Authority (QIA).

CEFC says it is China’s largest private oil and gas company. The agreed purchase price represents a 16.1% premium to the Russian company’s recent stock-market valuation.

After completion of the deal, Glencore will retain about 0.5% of Rosneft shares, and QIA will retain 4.7%.

Sabinal Energy buys West Texas assets from Chevron

Sabinal Energy LLC, The Woodlands, Tex., has acquired assets comprising 7,500 boe/d of production and covering 66,500 net acres in Hockley, Terry, and Gaines counties in Texas, part of the Central Basin Platform and Northern Shelf, from Chevron USA Inc.

Sabinal was founded in 2016 with a $300-million equity commitment from Kayne Private Energy Income Fund LP. In addition to Texas, Sabinal is focused on the Midcontinent region, San Juan basin, and Rockies.

The company is led by Bret Jameson, president and chief executive officer and former chief operating officer of Lewis Energy Group LP. Chris McMahon serves as vice-president, technical; and Dan Higdon is executive vice-president, land.

Elliott expected to be nominated PHMSA administrator

The White House intends to nominate Howard R. Elliott, who presently leads public safety, health, environment, and security operations for CSX Transportation in Jacksonville, Fla., to serve as the new administrator of the US Pipeline & Hazardous Material Safety Administration, it announced on Sept. 8.

Elliott is a 40-year US freight rail industry veteran. “[Elliott’s} portfolio of responsibility included hazardous materials transportation safety, homeland security, railroad policing, crisis management, environmental compliance and operations, occupational health management, and continuity of business operations,” the White House said.

It called Elliott “a pioneer and leading advocate in developing and implementing computer-based tools to assist emergency management officials, first responders, and homeland security personnel in preparing for and responding to a railroad hazardous materials or security incident.”

Responses to rail accidents involving crude oil became important as shipments grew once it became apparent that there were not enough pipelines to carry light, sweet crude produced from the Bakken shale in North Dakota and eastern Montana and elsewhere in the US.

The issue grew critical after a crew member forgot to set the brake on a parked 72-car train at Lac Megantic, Que., on July 6, 2013, and it rolled away. It eventually jumped the tracks and spilled some 1,000 bbl of Bakken crude that ignited. The fire killed 47 people and destroyed much of the city’s business district.

Oman opens 2017 licensing round

Oman’s Ministry of Oil & Gas has opened 10 blocks to be tendered over the next several years. Bidding starts Sept. 20 for Blocks 43B, 47, 51, and 65. The ministry deployed a living data room in 2016, making high-quality raw data available via its web interface.

The 11,967-sq-km Dhahirah block (43B) has potential for oil and gas but is the only block of the four on offer to contain no discoveries. Only two wells have been drilled on the block, according to the ministry.

Jebel Hammah (Block 47), Baqlah (Block 51), and Block 65 each contain conventional oil and gas discoveries predominantly in the Natih, Shuaiba, and Amin formations. All three blocks have potential in the Natih E unconventional subplay with varying prospectives for tight gas and oil. Unconventional oil and gas development has only begun in Oman, and the Natih E has been recognized as a prime target across the northern part of the country.

In May, the ministry granted Eni SPA and Oman Oil Co. SAOC (OOC), the sultanate’s energy investment arm, exploration rights for Block 52, a 90,000-sq-km area in 10-2,000 m of water offshore Oman. The area is largely unexplored, and was awarded following an international bid round launched in October 2016.

The deadline for bids closes Dec. 31.

Kuwait okays oil field work with Iraq

The government of Kuwait has moved toward development of four border oil fields in cooperation with the government of Iraq.

An amiri decree submitted to the Kuwait parliament approves a memorandum of understanding between the countries’ oil ministries for joint development of Ratqa and Abdali fields in northern Kuwait and Rumaila and Safwan in southern Iraq.

The decree was reported in the official Kuwaiti press.

DNO takes on third operating license in Kurdistan

DNO ASA, Oslo, will drill two large, undrilled structures on the Baeshiqa license in Kurdistan in the first half of 2018, pending Kurdistan government approval.

The 324-sq-km license is 60 km west of Erbil and 20 km east of Mosul, Iraq. ExxonMobil Corp. previously conducted geological and geophysical studies and constructed a drilling pad before abandoning the site due to security concerns in the region. The Baeshiqa license’s two large, undrilled structures are expected to contain multiple stacked Cretaceous, Jurassic, and Triassic reservoirs.

DNO first entered the Kurdistan region in 2004, and operates two other licenses, one of which contains the Tawke and Peshkabir fields, producing a combined 110,000 bo/d. The company’s other license contains Benenan and Bastora heavy oil fields, which are undergoing further appraisal and development.

DNO is the most active driller in Kurdistan with three rigs currently deployed.

DNO has assumed operatorship of its third license from ExxonMobil with a 32% net interest, which is one half of ExxonMobil’s position. ExxonMobil retains 32% interest in the license along with Turkish Energy Co. (16%) and the Kurdistan regional government (20%).

GeoPark makes oil discovery in Colombia

After adding its third new oil field this year, GeoPark Ltd. plans to drill seven wells on the Llanos 34 block during this year’s third quarter to further delineate southern Jacana and northern Tigana oil fields.

The operator completed the Curucucu 1 exploration well on a new fault trend east of the Tigana-Jacana fault trend on Llanos 34 block in Colombia. The well was drilled to a total depth of 14,600 ft. An electric submersible pump tested the Guadalupe formation at a production rate of 1,700 bo/d through a 100/64-in. choke. The 15.8° gravity oil maintained 70 psi wellhead pressure with a 0.4% water cut. Geopark said additional production history is required to determine stabilized flow rates, but petrophysical log analysis indicated potentially productive hydrocarbons in the shallower Mirador formation.

The operator drilled Curucucu 1 from an existing well pad in the recently discovered Jacamar oil field. The well’s 9,000-ft lateral extension set a horizontal record for Llanos 34 block. Curucucu is adjacent to Jacamar field and marks the eleventh oil field discovered on Llanos 34 block since Geopark’s 2012 acquisition. The operator has discovered 13 oil fields in Colombia.

Geopark is operator of Llanos 34 with 45% working interest.

Statoil increases frontier acreage in South Africa

Statoil ASA has ramped up its offshore participation in South Africa in two transactions. The operator acquired 35% interest in the 12/3/252 Transkei-Algoa Exploration Right from ExxonMobil Exploration & Production South Africa Ltd. ExxonMobil retains 40% interest, while Impact Africa holds 25%. The Transkei-Algoa license covers 45,000 sq km in 3,000 m of water.

In its second bid, Statoil acquired 90% and operatorship from OK Energy Ltd. in the 12/3/257 East Algoa Exploration Right. OK Energy holds the remaining 10%. East Algoa covers 9,300 sq km.

Statoil entered its first South Africa license in 2015, acquiring 35% interest in the ExxonMobil-operated Tugela South Exploration Right, which covers an area of 9,054 sq km. It is offshore eastern South Africa in 1,800 m of water.

Energean’s Katakolon field development approved

Pending 2018 approval of its environmental and social impact assessment, Energean Oil & Gas will take a final investment decision on its Katakolon field development with drilling and production commencing in 2019 and 2020, respectively.

The company’s field development plan (FDP) has been approved by the Hellenic Hydrocarbons Resources Management Co., the Greek government agency responsible for the country’s hydrocarbon development.

Katakolon is the third oil and gas field to be developed by Energean in Greece and will mark the first-ever hydrocarbon production in western Greece.

The $50-million FDP, submitted in February, will target 11 MMboe of recoverable oil that was discovered by state-owned Public Petroleum Corp. in the early 1980s. Katakolon field lies 3.5 km southwest of Katakolon peninsula off western Peloponessus in 200-300 m of water with production from Eocene-Cretaceous carbonates at 2,300-2,600 m.

The 545-sq-km block is delimited onshore at 60 sq km for use in drilling and production. Energean’s FDP will deploy extended reach drilling from onshore down to 1,200 m and then horizontally for 3,500 m. The FDP includes investments in roads, storage facilities, bouys, and onshore dehydration.

Energean plans to develop Katakolon alongside its two other current development projects, Prinos oil field, which is part of the Prinos Concession located offshore northeast Greece, and the 2.4 tcf (2C) Karish and Tanin gas fields, offshore Israel.

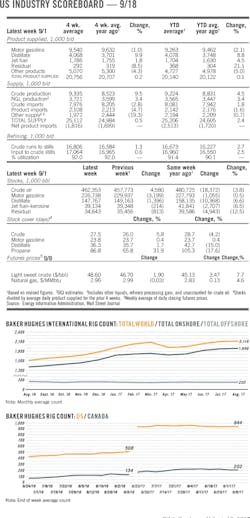

Drilling & Production — Quick TakesOPEC production falls to 32.76 million b/d in August

The Organization of Petroleum Exporting Countries said secondary sources estimated its oil production fell 79,000 b/d in August to 32.76 million b/d compared with July. It was the first time since April that the oil cartel reported a production drop.

Crude oil production increased in Nigeria while production declined in Libya, Gabon, Venezuela, and Iraq.

OPEC has been working to support oil prices through production-cut targets agreed upon by the group as well as some non-OPEC members. The 1.8 million b/d targets extend through March 2018. The cuts are compared with October 2016 production levels.

In a Monthly Oil Market Report, OPEC said the world would need 32.83 million b/d of OPEC crude next year, up 410,000 b/d from its previous forecast.

OPEC said inventories were falling and a rebalancing of the market is under way.

“The oil market will rebalance over the next year with a major drawdown in crude and product stocks,” OPEC said in the report.

The August production figures mean OPEC’s compliance with its output-cutting pledge stands at 83%, Reuters calculated.

Samson Resources II to drill five wells in Wyoming

Samson Resources II LLC, Tulsa, is slated to drill five operated wells on its Fort Union property in Sweetwater County, Wyo., and will conduct an accelerated permitting program in the Powder River basin.

The company will use two rigs to drill the wells in the liquids-rich Fort Union gas formation and expects to produce 3.7 bcf of gas equivalent/well with 45% liquids at a cost of $2.9 million/well. Samson says it will employ a modern completion design to stimulate the reservoir and maximize deliverability from each well. Sales are expected to begin in first-quarter 2018.

Samson also says it has begun an aggressive state and federal permitting program across its assets in the Powder River basin of Wyoming ahead of a planned second-half 2018 drilling program.

Samson in August reported that it’s exiting East Texas and North Louisiana in a $525-million property sale to Rockliff Energy II LLC. The deal is expected to close late this month.

Samson will use the proceeds to retire existing debt of $210 million, fund a distribution to existing equity holders, and fund its 2018 drilling and completion capital program.

Seadrill files Chapter 11, enters restructuring

Seadrill Ltd., Hamilton, Bermuda, has filed prearranged Chapter 11 cases in the Southern District of Texas along with an agreed upon restructuring plan.

The company also filed first-day motions that will enable its day-to-day operations to continue as usual. Seadrill says it has more than $1 billion in cash and will not need debtor-in-possession financing.

The restructuring agreement involves more than 97% of its secured bank lenders, 40% of its bondholders, and a consortium of investors led by its largest shareholder, Hemen Holding Ltd.

The agreement provides Seadrill $1.06 billion of capital consisting of $860 million of secured notes and $200 million of equity. The company’s secured lending banks have agreed to defer maturities of all secured credit facilities, totaling $5.7 billion, by 5 years with no amortization payments until 2020 and significant covenant relief.

Also, assuming unsecured creditors support the plan, the company’s $2.3 billion of unsecured bonds and other unsecured claims will be converted into 15% of the post-restructured equity with participation rights in both the new secured notes and equity, and holders of Seadrill common stock will receive 2% of the post-restructured equity.

Seadrill says the restructuring plan was developed over the course of more than a year of discussions. The company has a fleet of 68 drilling units, including drillships, jack ups, semisubmersibles, and tender rigs for operations in shallow to ultradeepwater areas in both harsh and benign environments.

PROCESSING — Quick TakesEssar’s UK refinery due capacity expansion

Essar Energy Ltd. subsidiary Essar Oil (UK) Ltd. will invest $250 million during fiscal-year 2018 to further boost operational efficiency and improve production performance at its 9 million-tonne/year Stanlow refining complex in the UK, near Ellesmere Port, Cheshire.

Primarily targeting projects aimed at expanding both processing and production capacities at the site, the proposed capital investment will result in increasing the refinery’s overall crude oil throughputs to more than 10.2 million tpy, Essar said.

Alongside unidentified maintenance works, the investment includes Essar’s $137-million Project Tiger Cub, which proposes major improvements to Stanlow’s key units that will help further reduce crude costs and improve yields across the refinery’s production slate, according to the company’s web site.

Essar, however, has yet to reveal details regarding the scope of work to be completed or the specific units to be targeted under Project Tiger Cub.

By the end Essar’s fiscal-year 2018 on Mar. 31, the operator said it will have invested more than $800 million on projects to turn around performance of the Stanlow refinery since purchasing the complex from Royal Dutch Shell PLC in.

In fiscal-year 2015, Essar completed a project to reconfigure Stanlow into a single-train manufacturing site, which included mothballing the refinery’s smaller CD3 crude unit to reduce fuel oil and naphtha production as well as help increase absolute margins.

Santos, Origin sign ethane supply contract

Santos Ltd., Adelaide, and its partner Origin Energy Ltd., Sydney, have signed an agreement to continue supply of ethane to Qenos, Australia’s only producer of polyethylene and polymers.

Under the agreement, Santos and Origin will supply 27 petajoules of ethane to Qenos for the remainder of this year and on until yearend 2019.

The ethane is separated from the natural gas stream at Santos’ Moomba gas plant in South Australia and piped to the Qenos plant at Botany Bay in Sydney for use as feedstock for the manufacture of polyethylene.

The product is used across a range of industries and applications, including consumer and industrial packaging, water conservation, waste management, and agriculture.

The Cooper basin fields have been supplying ethane to Qenos for more than 20 years.

Chinese operator lets contract for PDH unit

Xuzhou HaiDing Chemical Technology Co. Ltd. (XHCT) has let a joint contract to CB&I, Houston, and Clariant International Ltd., Muttenz, Switzerland, to provide technology licensing and engineering design of a grassroots propane dehydrogenation (PDH) unit to be built in Pizhou, in China’s Jiangsu province.

The unit will use CB&I’s Catofin catalytic dehydrogenation process technology and Clariant’s tailor-made, nonnoble, Catofin catalyst to produce 600,000 tonnes/year of propylene, CB&I said.

While it confirmed XHCT’s proposed PDH unit is on a fast track to completion, CB&I did not disclose further details regarding the project, including a value of the contract.

TRANSPORTATION — Quick TakesBP expects fourth-quarter IPO for midstream unit

BP Midstream Partners, a wholly owned, indirect subsidiary of BP PLC, has filed a registration statement on Form S-1 with the US Securities and Exchange Commission related to its proposed initial public offering of common units representing limited partner interests.

BP Midstream Partners expects the offering to occur in the fourth quarter, dependent on market conditions.

The announcement comes after BP said in July it had begun evaluating the formation and IPO of a master limited partnership to grow its midstream business. BP Midstream Partners will own, operate, develop, and acquire pipelines and other midstream assets. It will be headquartered in Houston and have offices in Chicago.

BP Midstream Partners’ initial assets are expected to consist of ownership interests in one onshore crude oil pipeline system, one onshore refined products pipeline system, and one onshore diluent pipeline system, which carry shipments to or from BP’s Whiting Refinery in Indiana.

It also will have interests in four offshore crude pipeline systems and one offshore natural gas pipeline system that connect offshore production areas in the Gulf of Mexico with the Gulf Coast refining and distribution hubs.

If the IPO is completed, BP would own the general partner of BP Midstream Partners, all of its incentive distribution rights, and a majority of its limited partner interests.

TransCanada seeks Energy East suspension

TransCanada PipeLines Ltd. has asked the National Energy Board of Canada to suspend for 30 days action on applications for the Energy East and Eastern Mainline pipeline projects while it studies an expansion environmental review (OGJ Online, Jan. 30, 2017).

The NEB on Aug. 23 announced it will “consider upstream and downstream greenhouse gas emissions (GHGs) in determining whether these projects are in the public interest.”

The agency said it “also wants to examine the potential market impacts of GHGs reduction targets embedded in laws and policies on the economic viability of the projects.”

The Energy East project combines construction and conversion of existing pipelines to create a 4,500-km system able to carry 1.1 million b/d of crude from Hardisty, Alta., to refineries and terminals in eastern Canada.

Eastern Mainline would involve 279 km of new natural gas pipeline between Markham, and Brouseville, Ont.

Petronet to develop Sri Lankan LNG terminal

A joint venture of Petronet LNG Ltd. along with Japanese and Sri Lankan companies will develop an LNG terminal in Sri Lanka to supply the island nation’s power, manufacturing, and transport segments. The terminal’s capacity is still being determined. Petronet expects construction to take 2 years after all formal agreements have been signed.

The proposed terminal site is on Sri Lanka’s west coast near the capital city of Colombo. Most of the country’s power is currently generated by burning liquid fuels, with 82% of total primary energy consumption met by petroleum products and biomass.

The Sri Lankan and Indian governments on Sept. 1 signed a letter of intent regarding the project.