OGJ Newsletter

GENERAL INTEREST — Quick Takes

CNRL to buy Alberta assets for $975 million (Can.)

Canadian Natural Resources Ltd. is to buy assets in northern Alberta for gross cash consideration of $975 million (Can.) from Cenovus Energy Inc. The package has 19,600 boe/d of production including heavy oil from Pelican Lake operations and some natural gas production from other assets in northern Alberta.

CNRL said the purchase provides an additional 38% interest in the Pelican Lake sales pipeline, which would bring CNRL's overall ownership to 100%. The acquisition also includes a net profits interest in the Primrose East operations area and "undeveloped land."

The transaction is targeted to close on or before Sept. 30.

Cenovus said proceeds from the sale will help fund the company's acquisition of assets from ConocoPhillips earlier this year (OGJ Online, Mar. 30, 2017).

ONGC exec says HPCL deal won't be merger

Acquisition by Oil & Natural Gas Corp. of the Indian governments' majority interest in Hindustan Petroleum Corp. Ltd. (HPCL) will not result in a merger, according to an ONGC executive (OGJ Online, July 18, 2017).

A.K. Srinivasan, director-finance, told reporters that HPCL, which operates refineries in Mumbai and Visakhapatnam and a joint-venture refinery in Bathinda, will remain a stand-alone company after ONGC acquires the 51% interest in a deal expected to be valued at $5 billion.

A federal budget presentation early this year suggested value-chain integration through the merger of some or all of the country's state-owned oil and gas companies.

DOE proposes rule change to expedite US gas exports

The US Department of Energy proposed a rule that would allow it to authorize natural gas exports of as much as 140 MMcfd to customers in countries that do not have a free-trade agreement with the US, providing the application does not require an environmental impact statement or assessment under the 1969 National Environmental Policy Act. Comments on the Sept. 1 proposal will be accepted through Oct. 16.

The US small-scale gas exports market includes shipments primarily to countries in the Caribbean, and Central and South America, DOE noted in its announcement.

"Many of these countries do not generate enough natural gas demand to support the economies of scale required to justify large volumes of LNG imports from large-scale LNG terminals via conventional LNG tankers," it said. "The small-scale gas export market has developed as a solution to the practical and economic constraints limiting gas exports to these countries."

Under federal law, DOE must determine whether approving an application to export US-produced gas to customers in non-FTA countries are in the US national interest. The proposed regulatory change would let it approve applications involving shipments of as much as 140 MMcfd on receipt if a NEPA compliance review is not required.

Officials with groups supporting expanded US LNG exports applauded DOE's proposal. "Such small-scale LNG export projects have-as DOE clearly recognizes-minimal market effects and environmental impacts," Fred H. Hutchison, executive director of LNG Allies and Our Energy Moment, told OGJ.

"The proposed rule is further evidence that the administration is 'all in' when it comes to US LNG exports," he said. "[US Energy Sec. Rick Perry] and other top officials understand the highly competitive nature of the global LNG marketplace, and we are pleased to be working with them on a number of fronts."

Hanssen appointed DEA chief executive officer

Maria Moraeus Hanssen has been named chief executive officer and chairman of DEA Deutsche Erdoel AG, effective January 2018. She will succeed Thomas Rappuhn, who spent 30 years at the company, including 12 years on the executive board and 8 years as chief executive officer.

Hanssen, who is trained as a reservoir engineer and petroleum economist, is currently chief executive officer of the French utility group Engie's exploration and production business. Her oil and gas industry experience includes stints with Hydro ASA, Statoil ASA, and Aker ASA.

Exploration & Development — Quick Takes

Western Australia places moratorium on fracing

The Western Australian government has joined the growing number of Australian states and territories to place a moratorium on hydraulic fracturing.

Premier Mark McGowan announced this week that his government was banning existing and future fracing petroleum titles in the Perth and southwest regions of the state, while imposing a state-wide moratorium pending an independent scientific inquiry.

The inquiry will be headed by Tom Hatton, chairman of the Environmental Protection Authority, and will assess the risk and regulations governing fracing used to develop and produce unconventional oil and gas reserves.

The decision has met with harsh criticism from the Australian Petroleum Production & Exploration Association. Stedman Ellis, chief executive of the association's Western Australia branch, said an inquiry by the Environment and Public Affairs committee has already declared that fracing posed a "negligible risk" to the environment.

The findings, Ellis said, echoed those of more than a dozen other inquiries in Australia as well as numerous independent reviews and studies that all confirmed that fracing is safe.

Ellis claimed that the effective moratorium on all fracing projects that has been in place since the MacGowan government came to power in March has stalled $380 million (Aus.) in investment in new projects.

"[Western Australia] does not need another fracing inquiry," Ellis said. "What it desperately needs is new jobs, investment, and royalties to help repair the state budget. The industry should be allowed to get on with it."

Cooper moves forward on Sole gas field off Australia

Cooper Energy will deliver gas sales of 4 MMboe/year, which is four times the company's 2017 production, on the heels of taking a financial investment decision for its Sole natural gas field development in eastern Bass Strait offshore Victoria in southeastern Australia. Cooper's managing director David Maxwell cited the FID as a "culmination of 5 years' effort" to provide the country with a new source of gas supply.

The company fully funded the gas development with its $98 million investment. New gas is expected to be delivered in 2019. The classification of Sole field as economic has boosted the operators proved and probable (2P) reserves by 43 MMboe, and it said about 75% of the field's gas is under longterm contracts with AGL Energy, EnergyAustralia, Alinta Energy, a O-I Australia. APA Group will acquire, upgrade, and operate the Orbost gas plant to process gas from Sole. In March, Cooper let a contract for the fabrication and installation of the subsea infrastructure to Subsea 7 (OGJ Online, Mar. 1, 2017).

Cooper Energy's total 2P reserves are now 54 MMboe of which 52 MMboe are gas.

BLM begins protest periods for proposed leases in Utah

The US Bureau of Land Management's Utah state office said on Sept. 1 that it will accept protests through Oct. 2 of two sets of oil and gas leases it plans to offer as part of its quarterly online lease sale on Dec. 12. The proposed tracts were prepared by its Vernal and Price field offices.

Officials from the Southern Utah Wilderness Alliance in Salt Lake City and two national environmental organizations in Washington immediately denounced plans to offer the acreage. They said one set of tracts was too close to Dinosaur National Monument east of Vernal and the other would damage the San Rafael Swell southeast of Price.

BLM's Vernal field office said it was planning to offer 75 parcels totaling 94,000 acres in Duchesne, Uintah, and Emery Counties. Documents that are available online include a final environmental assessment and an unsigned finding of no significant impacts (FONSI).

SUWA noted Utah Gov. Gary R. Herbert (R) said in a July 25 letter that while the state government supports offering most of the proposed leases in Duchesne and Uintah counties, it would like BLM to reevaluate Parcels 069, 070, and 0271 "to ensure that leasing of these parcels does not [affect] visual resources or cause light or sound disturbances within Dinosaur National Monument."

The Price field office said it was considering offering 15 parcels comprised of 32,013 acres in Emery County about 7 miles southeast of the town of Ferron. Online documents include a final EA and FONSI.

Centrica lets contract for Fogelberg appraisal in 2018

Centrica PLC has let a drilling contract to Island Drilling Co. AS for an appraisal well in 2018 at the 2010 Fogelberg natural gas discovery in the Haltenbanken area of the Norwegian Sea.

Drilling will begin in the first quarter in production license 433 with the Island Innovator semisubmersible drilling rig operated by Odfjell Drilling. The rig agreement with Island Drilling contains an option for two additional wells.

Fogelberg is estimated to hold 60 million boe (OGJ Online, July 17, 2017; Feb. 1, 2013). Operator Centrica has 50% in the Fogelberg license while Faroe Petroleum and DEA Norge each have 25%.

The current development concept is a subsea tie-in to the Statoil-operated Asgard B platform.

CNOOC inks PSC for South China Sea block

China National Offshore Oil Corp. signed a production-sharing contract with SK Innovation Co. Ltd., Seoul, for Block 17/08 in the South China Sea (OGJ Online, Feb. 10, 2015).

The block covers 466 sq km in 100-130 m of water in the Pearl River Mouth basin (OGJ Online, Apr. 17, 2017).

SK will be operator and cover all expenditures during the exploration period. CNOOC has the right to participate in as much as 51% in any commercial discoveries.

Drilling & Production — Quick Takes

Irma: BP evacuates Thunder Horse platform in US gulf

BP PLC has begun securing offshore facilities and evacuating nonessential personnel from its Thunder Horse platform and the West Vela drilling rig in the Gulf of Mexico as Hurricane Irma moves westward over the Atlantic toward Florida.

Thunder Horse is 150 miles southeast of New Orleans in 6,050 ft of water. It can process as much as 250,000 bbl of oil and 200 MMcfd of natural gas.

BP said it's also preparing for the possible evacuation of remaining offshore workers and the shut-in of production at facilities if needed. However, no production is shut-in at this time.

Elsewhere, BP has begun storm preparations at its Cooper River petrochemical complex near Charleston, SC. The plant produces 1.4 million tonnes/year of purified terephthalic acid.

In the US Gulf Coast region, which is recovering from Hurricane Harvey, BP said it been able to meet the needs of its wholesale customers, but it expects intermittent terminal supply outages and will continue working to find alternate supplies of gasoline, diesel, and other refined fuels as needed.

BP's US business activities were minimally impacted by Harvey. However, its Westlake campus in Houston sustained significant flooding and will be closed until further notice. Westlake employees are currently working in temporary office space.

Botswana awards CBM gas-to-power tender

Tlou Energy Ltd., Brisbane, will move ahead on coalbed methane development on the 900-sq-km prospecting license 002/2004 in western Botswana, South Africa. The Ministry of Mineral Resources, Green Technology, and Energy Security granted the company a 25-year mining license to terminate in August 2042.

The ministry requires an annual $9,000 license fee with an additional royalty of 3% of gross market value, opting not to take up a sharehold in the project. No minimum spend is stipulated in the license and project development can commence at any time.

Tlou has operated in the region since 2007, flaring its first gas in 2014 at its Lesedi CBM project, which holds an estimated 3.2 tcf of gas. The company holds a mining license and nine prospecting licenses covering 8,300 sq km in Botswana. Tlou is pursuing a scalable gas-to-power project in the region capable of generating 100 Mw.

Tlou was shortlisted with Sekaname Pvt Ltd. for the ministry's CBM tender. Botswana's government developed the initiative to facilitate CBM supplies to its own 90-Mw Orapa power plant, which is 150 km north of Tlou's Lesedi CBM project.

PROCESSING — Quick Takes

SemGroup restores Gulf Coast terminal operations

SemGroup Corp., Tulsa, has restored full operations at subsidiary Houston Fuel Oil Terminal Co.'s (HFOTCO) 16.8 million-bbl terminal following a temporary shutdown in the wake of Hurricane Harvey.

All inbound and outbound facilities at HFOTCO are operating as normal, including receiving ships and barges through the Houston Ship Channel, as well as sending and receiving deliveries via pipeline, truck, and rail, SemGroup said.

Restart of operations at the terminal follows the reopening of the Houston Ship Channel, which currently is open to vessels with a 40-ft draft on a 24-hr basis, SemGroup said.

SemGroup's Maurepas pipeline and other installations remained relatively unimpacted by the storm, the company added.

Located at the Texas Gulf Coast on 330 acres along the Houston Ship Channel, HFOTCO's terminal features crude pipeline delivery connectivity to the local refining complex, deepwater marine access and inbound-crude receipt pipeline connectivity, as well as rail-truck loading and unloading capabilities from major producing basins.

HFOTCO, which SemGroup acquired in July, is currently executing on contractually supported growth projects, including a ship dock, a pipeline and associated connections, as well as an additional 1.45 million bbl of crude oil storage, which is scheduled to enter service in mid-2018, according to a July 17 release from SemGroup.

API reiterates RFS concerns in comments to EPA

The American Petroleum Institute reiterated its concerns about possible consequences from allowing ethanol blends of more than 10% in the nation's gasoline supplies in comments it submitted to the US Environmental Protection Agency.

The Aug. 31 comments followed API's previous joint submission with the American Fuel & Petrochemical Manufacturers on EPA's proposed 2019 quotas for biomass-based diesel fuel and 2018 quotas for all other domestic motor fuels.

"There are serious vehicle and infrastructure compatibility issues with ethanol blends above 10%," API Downstream and Industry Operations Director Frank J. Macchiarola said in a letter accompanying the comments.

Increases in gasoline demand that were anticipated when the RFS was expanded under the 2007 Energy Independence and Security Act have not materialized, Macchiarola said. Commercialization of cellulosic biofuels has not grown at the rate Congress envisioned when it passed the law, he said.

"The statutory volumes set in [EISA] are unattainable, and mandating these levels could result in fuel supply disruptions that damage our economy," he said. "Congress provided EPA with waiver authority to reduce the RFS volumes, thereby avoiding the potential negative impacts on America's fuel supply and preventing harm to American consumers."

PetroChina wraps unit revamp at Qinzhou complex

PetroChina Co. Ltd.-the publicly listed arm of state-owned China National Petroleum Corp. (CNPC)-has completed a project to retrofit an existing pressure-swing adsorption (PSA) unit at subsidiary CNPC Guangxi Petrochemical Co.'s 10 million-tonne/year Qinzhou integrated refining complex in China's Gaungxi province with proprietary process technology from Honeywell UOP LLC.

Newly upgraded with UOP's Polybed PSA technology, the revamped unit now supplies hydrogen at 99.9% purity and with increased hydrogen recovery for the complex's hydrotreating units, which use the hydrogen to extract impurities from feedstock, UOP said.

Selected by CNPC Guangxi Petrochemicals for its effectiveness at addressing several issued faced by Chinese manufacturers-including low recovery rates and purity, control-valve leakage, and poor or inconsistent performance-the PSA process uses proprietary UOP adsorbents to remove impurities at high pressure from hydrogen-containing process streams to enable recovery of high-purity hydrogen for use in other refining processes.

This latest revamp for CNPC Guangxi Petrochemical follows installation of a previous UOP Polybed unit for the operator in 2014, the service provider said.

UOP disclosed neither the value of the project nor a capacity of the revamped unit.

Alongside recovering and purifying hydrogen from steam reformers and refinery off gases, the Polybed PSA system can be used to produce hydrogen from other sources such as ethylene off gas, methanol off gas, and partial-oxidation synthesis, UOP said.

TRANSPORTATION — Quick Takes

Magellan to expand Texas products pipeline system

Magellan Midstream Partners LP plans to expand its refined products pipeline system in Texas to handle incremental demand for transportation of gasoline, diesel fuel, and jet fuel to the central and northern portions of the state.

Supported by long-term customer commitments, Magellan plans to build a 135-mile, 16-in. pipeline from its terminal in East Houston to Hearne, Tex. The company will own the newly constructed pipeline via an undivided joint interest agreement with Valero Energy Corp.

Magellan's ownership interest in the new pipeline will enable it to deliver additional product north to Temple, Waco, and Dallas as well as the company's Midcontinent markets, including Little Rock, Ark.

Magellan plans to reverse an existing pipeline that will connect to the new pipeline segment, providing the company an incremental 85,000 b/d of refined products capacity originating from the Houston area for an increase of nearly 50% to service the Texas, Midcontinent, and Little Rock markets.

The company also will make enhancements to its existing pipeline and terminal infrastructure, including construction of 1 million bbl of refined products storage on a combined basis at its facilities in Dallas, East Houston, and Hearne, and additional connections to third-party refineries, pipelines, and terminals in the Houston Gulf Coast region, including Magellan's new Pasadena, Tex., marine terminal currently under construction and expected to be operational in early 2019.

Magellan expects to spend $375 million for its share of the project, with the expanded capacity available in mid-2019, subject to receipt of necessary permits and regulatory approvals.

If warranted by additional customer demand, Magellan's pipeline capacity originating in the Houston area could be further increased.

Eni units, Nord Stream unit let contracts to Saipem

Saipem has booked three contracts with a combined value of $370 million. The company's E&C Offshore division will construct and install deepwater umbilicals, risers, and flowlines for the development of Block 15/06 for Eni Angola SPA's West Hub development project 350 km northwest of Luanda and 130 km west of Soyo (OGJ Online, Jan. 11, 2016).

In the framework of its maintenance, modifications, and operations activities, the company reported that Eni Ghana Exploration & Production Ltd. has let a contract for engineering, procurement, and construction of capacity-boosting systems for gas stations in Ghana's Takoradi and Tema ports.

In the Baltic Sea, Nord Stream 2 AG assigned Saipem a contract to install the last section of a cross-Baltic pipeline and shore approach in Greiswald, Germany (OGJ Online, Apr. 25, 2017).

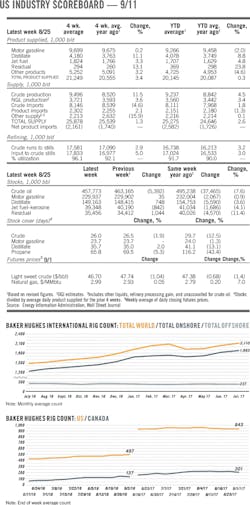

EIA: US natural gas underground storage up 30 bcf

The US Energy Information Administration reported underground natural gas storage across the Lower 48 states rose 30 bcf for the week ended Aug. 25.

The Weekly Natural Storage Gas Report showed gas storage at 3.155 tcf, down 239 bcf from the same period a year ago. The current level was 8 bcf above the 5-year average.

Separately, EIA statistics also showed Lower 48 gas production rose to a high for 2017 of 81.4 bcfd in June, the agency said Aug. 31. Texas led the rise in gas production followed by Oklahoma, Louisiana, and Ohio.

But analysts expect US gas production likely will fall sharply because of production shut-ins offshore in the Gulf of Mexico and onshore in the South Texas Eagle Ford play. Hurricane Harvey made landfall near Corpus Christi, Tex., on Aug. 25, before being downgraded to a tropical storm as it flooded Houston and East Texas.

Meanwhile, gas futures prices rose on the New York Mercantile Exchange on Aug. 31 (OGJ Online, Aug. 31, 2017).

KBR to study Papua New Guinea energy hub

State-owned Kumul Petroleum Holdings Ltd. (KPHL) has let a contract to KBR Inc. for conceptual development and feasibility study services for an energy hub in the Kikori region of Gulf Province, Papua New Guinea.

The Kikori Energy Hub would be an extension of KPHL's Western Pipeline project under consideration to connect oil and gas fields in the western part of the country to export facilities on the Gulf of Papua (OGJ Online, Feb. 8, 2017).

KBR will provide location and technology screening studies for a midscale gas liquefaction and export terminal, a 180-Mw power generation plant; a methanol plant, and a condensate stabilization, storage, and regional export facility.