OGJ Newsletter

Harvey shuts in production, refining along Gulf Coast

As OGJ went to press last week, Houston and surrounding areas in southeastern Texas were starting to assess the damage caused by Hurricane Harvey, which made landfall Aug. 25 as a Category 4 storm.

The peak of US Gulf of Mexico production outages occurred on Aug. 26-27 after the hurricane made its way inland and weakened into a tropical storm, according to the US Bureau of Safety and Environmental Enforcement. Both oil and natural gas production saw 25% of production shut-in. Prior to the storm, US gulf oil and gas production respectively averaged 1.75 million b/d and 3.22 bcfd.

At peak, some 15% of 737 manned platforms in the US gulf were evacuated as were half of the 10 nondynamically positioned rigs.

The Texas Railroad Commission as of Aug. 26 estimated that 300,000-500,000 b/d of Eagle Ford crude production had been shut in from a pre-storm estimate of 870,000 b/d, and 3 bcfd of gas production had been shut-in from a pre-storm estimate of 6 bcfd. Drilling, completion, and production activities are expected to begin slowly ramping up as operators assessed damage to their assets and remobilized personnel. Activities also were shut in East Texas as the storm moved toward Louisiana.

As for damage, companies in the Eagle Ford were assessing operations, while it was too early for downstream operators to assess the damage because their sites remained flooded at presstime.

Also, as of Aug. 28, 22 oil tankers carrying 15.3 million bbl of imported crude near Texas ports were unable to offload due to port closures.

DOE extends deadline to submit bids for SPR sour crude

The US Department of Energy's Fossil Energy Office extended the deadline for bidding on crude oil it has offered for sale from the US Strategic Petroleum Reserve until 2 p.m. CDT on Sept. 6. It cited impacts from Hurricane Harvey along the US Gulf Coast, where the reserve's storage facilities are located, as the reason for its Aug. 28 move.

FEO previously announced that it would sell 14 million bbl of sour crude from the SPR from three sites-Bryan Mound and Big Hill in Texas, and West Hackberry in Louisiana (OGJ Online, Aug. 22, 2017).

Kufpec to add another 15% interest Gina Krog field

Kuwait Foreign Petroleum Exploration Co. KSC wholly owned subsidiary Kufpec Norway AS has reached agreement to acquire 15% interest in Gina Krog field from Total E&P Norge AS for $317 million.

The deal, effective Jan. 1, will double Kufpec's interest in the field to 30%. Kufpec will gain an additional 34 million boe in net reserves and 9,000 boe/d of production, bringing the company's overall Norway output to 25,000 boe/d. Gina Krog came on stream in June and is operated by Statoil (OGJ Online, July 3, 2017)

"Kufpec continues to execute its strategy to grow in profitable projects in Norway, and this transaction builds on our 2016 acquisition of Greater Sleipner Area assets from Total, which included a 15% interest in Gina Krog," said Shaikh Nawaf Saud Nasir Al-Sabah, Kufpec chief executive officer.

AGL sells stake in Moranbah gas project

Sydney gas utility AGL Ltd. has struck a deal to sell its 50% interest in the Moranbah Gas Project in north Queensland to privately owned Chinese gas distributer Shandong Order Gas Co. and Australian private investment company Orient Energy Pty. Ltd.

The selling price was not disclosed and the transaction is subject to preemptive rights by AGL's joint venture partner Arrow Energy (also with 50% interest), which itself is a joint venture of Royal Dutch Shell PLC and PetroChina.

The deal also is subject to approval by Australian and Chinese regulatory authorities.

The Moranbah project is the earliest coal-seam gas project in Australia and has been producing CSG since September 2004.

It comprises producing gas fields in the Bowen basin of central-eastern Queensland, processing facilities (compression units, metering and monitoring equipment and a dehydration unit), transportation rights via the Moranbah-Townsville gas pipeline and gas contracts.

Key recipients of Moranbah gas are the Townsville power station, North Queensland copper and nickel refineries and fertilizer plants as well as the Moranbah power station.

The gas fields are about 140 km west of Mackay and 400 km south of Townsville.

AGL has been trying to sell its Moranbah assets for about 3 years in a bid to dispose of noncore assets.

Shandong Order Gas Co. supplies gas to about 7 million customers in China and has $5.5 billion in assets, $3 billion of which are energy assets according to AGL. The AGL buy is believed to be the company's first entry into the Australian gas industry.

Although and Australian entity, Orient Energy is backed by Chinese investors.

Committee takes control of YPF after Darre resigns

Ricardo Darre has resigned as chief executive officer of Argentina's YPF SA citing personal reasons. His position will be replaced by a committee comprising six executives at the company.

The committee includes Carlos Alfonsi, formerly downstream executive vice-president, as executive vice-president for operations and transformation; and Pablo Bizzotto, formerly executive manager of unconventional resources, as upstream executive vice-president.

Darre took the leadership position on July 1, 2016, after departing Total SA (OGJ Online, June 7, 2016).

FAR awarded more equity in licenses off Guinea-Bissau

FAR Ltd., Perth, has received confirmation that the increase in equity and amendments to its Guinea-Bissau offshore licences in West Africa have been approved by government decree.

Negotiations for the changes were concluded last April with state oil company Petroguin revising the terms of the licenses for Sinapa and Esperanca. FAR will now hold 21.42% participating and paying interest in both permits, an increase from the earlier 15% participating and 21.42% paying interests.

The changes have come about because Petroguin will no longer have a participating interest in the combine prior to any commercial discovery.

Additionally, when a commercial discovery is made, Petroguin will take a reduced participating and paying interest of 10%. This will leave FAR and its combine partner Svenska Petroleum Exploration AB with 19.28% and 70.71%, respectively.

The renegotiated license terms also include more favorable arrangements for deepwater investment, including a reduction in the production royalty rates payable to the Guinea-Bissau government.

In the light of FAR's success further north offshore Senegal with its SNE oil field discovery, the combine has decided to focus on the shelf edge areas of the Sinapa and Esperanca permits because of their similar geological setting to SNE field. The group has previously mapped the Atum prospect on the Guinea-Bissau shelf edge, which has potential to hold 470 million bbl of recoverable oil. A number of other prospects and leads have been identified in the permits.

The Guinea-Bissau government has recognized this new focus by granting a 3-year extension to the current license terms to allow more time for FAR and Svenska to evaluate the newly acquired 3D seismic data in the area. The two license will now extend until the end of November 2020.

The work obligation includes one exploration well and a minimum expenditure commitment of $3 million in each permit.

Energean nears FID for Karish, Tanin gas fields

Energean Oil & Gas is working to reach final investment decision before yearend for its Karish and Tanin natural gas fields offshore Israel. Subsidiary Energean Israel expects to start gas production in 2020 from the fields' combined 531 MMboe 2C resources, which include 2.7 tcf of gas and 41 MMboe of light hydrocarbon liquids (OGJ Online, Dec. 7, 2016).

The FDP, submitted in June, calls for three development wells on the Karish Main Development with a floating production, storage, and offloading vessel about 90 km offshore Israel (OGJ Online, June 20, 2017). Production capacity will be 400 MMcfd. The Karish development will require an estimated $1.3-1.5 billion.

Energean Israel owns 100% of Karish and Tanin fields, but comprises a 50-50 joint venture between Energean and Kerogen Capital.

Wellesley, Faroe spud Goanna well off Norway

Wellesley Petroleum AS and Faroe Petroleum PLC have spudded the Goanna exploration well 39/9-22 S on PL 881, targeting a structural and stratigraphic prospect of Upper Jurassic Munin formation sandstones.

The Goanna license is in the northern part of the Norwegian North Sea near the UK border and adjacent to the giant producing Statfjord and Snorre fields, which offer potential for alternative export routes, Faroe says. The Goanna prospect straddles the border between PL 881 and PL 037.

The well is being drilled by the Deepsea Bergen semisubmersible drilling rig.

License PL881 is operated by Wellesley with 70% interest, with Faroe holding the remaining 30%. It was awarded earlier this year as part of Norway's Awards in Predefined Areas (APA) 2016 licensing round (OGJ Online, Jan. 17, 2017).

"We are pleased to announce the spudding of this near field exploration well in the very prolific Tampen area and surrounded by giant oil fields," commented Graham Stewart, Faroe chief executive.

"Our rolling exploration program continues with the Iris-Hades (Aerosmith) exploration well and Fogelberg appraisal well scheduled for the end of the year and the beginning of 2018, taking advantage of low drilling costs and Norwegian tax incentives," he said.

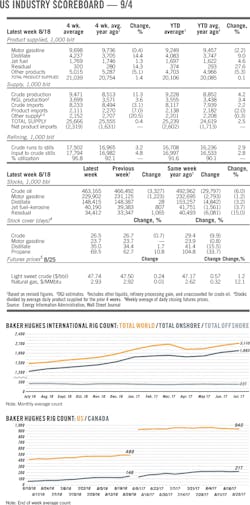

Drilling & Production — Quick TakesUS rig count falls 6 units to 940

The overall US rig count had fallen again during the week ended Aug. 25, marking the fourth straight week of declines. Baker Hughes' calculation of active US rigs dropped 6 units to 940 rigs working.

Rigs drilling for oil fell 4 units to 759 rigs working, while those rigs targeting natural gas also declined 2 units to 180 rigs. Rigs unclassified sat unchanged at 1 unit.

The US rig count was up 451 units from the previous week's count of 489, with oil rigs up 353, gas rigs up 99, and unclassified rigs down 1 to 1.

The US offshore rig count increased 1 rig from the previous week to 17. This count remains unchanged year-over-year. On land, meanwhile, the count landed at 920 units after losing 7 rigs for the week.

Among the major oil and gas-producing states, Texas and Pennsylvania were down 3 rigs each to respective counts of 456 and 31. Oklahoma, Utah, and Alaska were down 1 rig each to respective counts of 130, 8, and 4.

Six states were unchanged this week: New Mexico, 62; Colorado, 37; Wyoming, 26; California, 16; West Virginia, 14; and Arkansas, 1.

Three states-Louisiana, North Dakota, and Ohio-were up 1 rig each this week to respective counts of 66, 52, and 29.

Total brings Edradour-Glenlivet fields onstream off UK

Total SA said it brought onstream Edradour-Glenlivet gas and condensate fields in 300-435 m of water in the UK North Sea.

The Edradour-Glenlivet development is in the West of Shetland area. It will bring additional production capacity of as much as 56,000 boe/d, Total said. The Glenlivet development involves a 35-km tieback of three subsea wells to the massive Laggan-Tormore development, which began producing gas last year.

Total E&P UK operates Edradour-Glenlivet with 60% interest. Partners are Dong E&P (UK) Ltd. 20% and SSE E&P UK Ltd 20%.

Dirok field starts flow in Assam, India

Hindustan Oil Exploration Co. (HOEC) has started production of natural gas and condensate from Dirok field near Digboi in Assam, India (OGJ Online, Sept. 21, 2016).

State-owned Indian Oil Corp. Ltd. (IOC), which holds a 29.03% interest in Block AAP-ON-94/1, reported initial production from three wells at 10 MMscfd of gas and 120-140 b/d of condensate.

Produced fluids flow through a 4-in., 20-km pipeline from a gathering station at the Dirok-4 well to the Kusijan gas processing plant operated by state-owned Oil India Ltd. (OIL) 4 km from Digboi.

OIL, which holds a 44.08% interest in the block, is buying first-phase Dirok gas. IOC is buying the condensate. Private HOEC is operator with the remaining interest.

After a second development phase, Dirok output will rise to 35 MMscfd of gas and 800 b/d of condensate.

That work will include construction of a modular gas processing plant at Borpowai, 10 km south of Digboi, and a 12-in. pipeline from the Dirok-4 gas-gathering station to the new facility.

PROCESSING — Quick TakesMotiva shutters Port Arthur refinery

Motiva Enterprises LLC, a wholly owned subsidiary of Saudi Aramco's Saudi Refining Inc. (SRI), has suspended processing operations at its 600,000-b/d Port Arthur, Tex., refinery, the largest in the US, amid inclement weather conditions caused by Hurricane and Tropical Storm Harvey.

To ensure the safety of its employees and surrounding community, Motiva began a controlled shutdown of the Port Arthur refinery in response to increasing local flood conditions at 5:00 a.m. local time on Aug. 30, the company told OGJ via e-mail on Aug. 31.

According to the US Department of Energy's latest statistical update on the storm, 10 US Gulf Coast refineries with a combined capacity of about 3.08 million b/d-equal to 31.7% of total Gulf Coast (PADD 3) refining capacity and 16.6% of total US refining capacity-remained shut down as of 2:00 p.m. CST on Aug. 30.

At that time, six refineries with a combined capacity of 1.27 million b/d-equal to 13.1% of total PADD 3 refining capacity and 4.2% of total US refining capacity-had initiated the restart process, which is projected to take several days or weeks depending on whether the plants sustained damage from the storm.

Two Gulf Coast refineries with a combined capacity of 688,776 b/d-equal to 7.1% of total PADD 3 refining capacity and 3.7% of total US refining capacity-were continuing to operate at reduced rates, DOE said.

Motiva said at presstime last week that it was conducting all necessary assessments and preparations to ready the Port Arthur refinery for startup as soon as the local area flooding has receded. Given the unprecedented flooding in the city of Port Arthur, it remained uncertain how quickly the flood waters would recede, so the company could not provide a timeline for restart.

Kuwait lets contract for Al-Zour refinery pipeline

State-owned Kuwait Petroleum Corp. (KPC) subsidiary Kuwait Oil Co. (KOC) has let a contract to Saipem SPA to build a system of onshore feed pipelines to connect KOC's domestic petroleum production to fellow KPC subsidiary Kuwait National Petroleum Co.'s (KNPC) grassroots 615,000-b/d Al-Zour refinery complex now under construction in southern Kuwait (OGJ Online, Aug. 5, 2016).

Saipem will deliver engineering, procurement, construction, and commissioning of a 450-km onshore pipeline system that will transport crude oil and gas from various KOC South Tank Farm manifolds to the new Al-Zour refinery, the service provider said.

Saipem's scope of work under the $850-million EPCC contract also will include development of a transportation network designed to move refined products to existing storage areas of KNPC's Mina Al Ahmadi refinery, which lies about 28 miles south of Kuwait City on the Persian Gulf.

A duration of the contract was not disclosed.

Part of KNPC's Clean Fuels Project to upgrade, expand, and transform the 270,000-b/d Mina Abdullah and 466,000-b/d Mina Al Ahmadi refineries into an integrated 800,000 b/d merchant refining complex and permanently shut down the 200,000-b/d Shuaiba refinery, the long-planned Al-Zour refinery is scheduled to be commissioned sometime in 2018-19 (OGJ Online, Oct. 27, 2016).

KNPC officially shuttered the Shuaiba refinery on Apr. 1, 2017 (OGJ Online, July 31, 2017).

Gazprom Neft gas plant in Iraq gets performance testing

Gazprom Neft PJSC said a gas plant at Badra field in eastern Iraq is undergoing performance testing and is expected to go into commercial production in the fourth quarter. It will be able to process 1.6 billion cu m/year.

The company has begun trial shipments of liquefied petroleum gas to Iraq's state-owned Gas Filling Co. Gas also is being sent to the Az-Zubaydiyah electric power station 100 km away.

Gazprom Neft said the gas production complex will greatly increase electricity production in Iraq.

Commercial gas will be used as fuel at five generators at the Badra gas-turbine power plant, which has a total planned capacity of 123.5 Mw.

The gas plant project also includes construction of a granulated sulfur production facility.

Sinopec's Zibo refinery due alkylation unit

China Petrochemical Corp. (Sinopec) has let a contract to a division of E.I. DuPont de Nemours & Co. for delivery of an alkylation unit for subsidiary Sinopec Qilu Petrochemical Corp.'s (SQPC) 13 million-tonne/year refinery at Zibo in China's eastern province of Shandong.

DuPont Clean Technologies will provide technology licensing, engineering, and equipment for a proprietary STRATCO alkylation unit, which will have a nameplate capacity of 400,000 tpy, the service provider said.

Plot-space limitations at the refinery required the unit to be custom designed for the first commercial use of DuPont's Model 74 Contactor reactors, which were developed to reduce the number of reactors required for an alkylation unit.

Based on the design of DuPont's standard-size Model 63 Contactor reactor, the Model 74 version features an individual reactor volume of 18,000-gal volume vs. the Model 63's 11,500-gal reactor volume.

Scheduled for startup in mid-2018, SQPC's new STRATCO alkylation unit comes as part of the refinery's plan to produce low-sulfur, high-octane, low-RVP alkylate to help ensure overall quality of its fuel production complies with China 5 emission standards, which equivalent to Euro 5 specifications, cap the maximum sulfur content of gasoline and diesel at 10 ppm.

Earlier in the year, Sinopec let a contract to DuPont for a 300,000-tpy STRATCO alkylation unit to be installed at subsidiary Tianjin Petroleum & Chemical Corp.'s (TPCC) 15.5 million-tpy integrated refining and petrochemical complex at Tianjin Binhai New Area, Tianjin, in northern China (OGJ Online, Jan. 26, 2017).

DuPont said TPCC's unit remains on schedule for startup in mid-2018.

Saudi crude arrives at CNOOC refinery

Saudi Aramco said a cargo of Arabian crude has arrived at the Huizhou refinery operated by China National Offshore Oil Corp.

The groundwork for the delivery was laid through a 2016 memorandum of understanding on future crude supply and downstream cooperation.

Prior to an expansion configured to process sour Arab Gulf grades, the refinery in Guangdong province had no need for imported sour crudes, Aramco said (OGJ Online, Apr. 27, 2015).

"Aramco Asia will continue to support Chinese and other Asian refiners to have access to reliable Saudi crude," said Nabil A. Al-Nuaim, president and chief executive officer of Aramco Asia.

Aramco said CNOOC is the third of China's national oil companies to become a customer.

TRANSPORTATION — Quick TakesINGAA president unhappy with NEPA requirement ruling

Interstate Natural Gas Association of America Pres. Donald F. Santa expressed disappointment on Aug. 24 with the US Appeals Court for the District of Columbia's decision days earlier to vacate the US Federal Energy Regulatory Commission's approval of three Southeastern US natural gas pipelines (OGJ Online, Aug. 23, 2017).

"While INGAA disagrees with the majority's conclusion that downstream power plant greenhouse-gas emissions are an indirect effect of authorizing the project, we recognize that FERC has the opportunity to seek additional review of this decision," Santa said.

He noted that Judge Janice Rogers Brown "issued a strong and well-reasoned dissent on the question of whether FERC's National Environmental Policy Act analysis of indirect impacts must include an analysis of downstream GHG emissions."

Santa said the Sierra Club, which brought the lawsuit, challenged several other aspects of the court's Aug. 22 order. "However, the court found that FERC acted properly with respect to all other aspects of FERC's order," he said. "This includes the NEPA analysis of environmental justice impacts of the project, alternatives and safety considerations, as well as the initial rates and market need finding."