Unconventional resources, proving ground for applied analytics

Tayvis Dunnahoe

Exploration Editor

Synergies between data analytics and unconventional exploration and development offer operators a productive future. Exploration companies are adopting an increasingly collaborative mindset among the disciplines employed throughout the life of an oil and gas play. Data-rich unconventional wells are providing multidisciplinary teams with opportunities not only to improve production, but also to increase the focused use of profitable tools and techniques across a wide range of drilling prospects.

"If you look back at the history of this industry, you'll find that science and engineering were first deployed at scale in the early 1900s," ConocoPhillips Chief Technology Officer Greg Leveille told OGJ. "We've developed an understanding of [reservoir] physics over time, which provides robust simulation models that can help to predict production from conventional reservoirs as they drain." Simulation models can accurately describe the volume of hydrocarbons in place for conventional recovery with well logs and other types of samples. "With unconventional reservoirs, we are in a much earlier phase," Leveille continued.

Unconventional development is 10 or so years old and while the industry has devised models and predictive tools to better understand the physics involved in most shale plays, there remain areas that require further understanding.

Unconventional development typically involves many more data streams than conventional wells, both downhole and at the surface. "With analytics we can bring together large amounts of acquired data to find effective solutions for optimizing field operations," Leveille said.

ConocoPhillips applies analytics to more than just its Eagle Ford, Bakken, and Permian basin assets. The company also leverages data acquired offshore Norway, on Alaska's North Slope, and in the oil sands of Alberta. "The immaturity of industry's technical understanding of unconventional reservoirs is however the greatest prize analytics can unlock," Leveille said.

Data analytics are filling the void in unconventional development until knowledge about the physics of these plays leads to better predictions from mathematical bases.

Eagle Ford efficiency

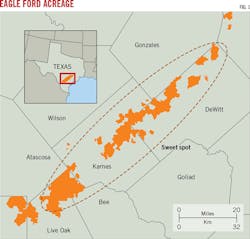

ConocoPhillips began developing the Eagle Ford shale in 2010 and has drilled 1,000 wells to date with another 4,000 targets to complete (Fig. 1). Advanced analytics have reduced ConocoPhillips's Eagle Ford drilling days by 50% over the last 2 years.

ConocoPhillips is investing in further data analytics and experimenting with drilling operations to apply lessons learned in successive wells. "We were fortunate the leadership team in place began making investments in an integrated data warehouse from the beginning," said ConocoPhillips Chief Information Officer Mike Pfister. "These are now driving the savings that we experienced in 2015-16."

The operator acquired data from multiple drilling parameters including rates of penetration, RPM on the drill floor, and pump flow rates. These data were also compared for multiple rigs and crews and the combination provided a large database for ConocoPhillips's Eagle Ford drilling operations. While "there's not a whole lot of magic in that," according to Pfister, the advantage became clear when the data were warehoused for easy access by engineering teams.

Comparing each rig's performance in each hole section, identifying which rigs achieved the best rates, and determining groups of other performance parameters provided the operator with specific characteristics that could be replicated across its drill fleet. "It didn't stop there as we are continually measuring, adjusting, and experimenting through several different cycles to dramatically improve drilling performance over time," Pfister said.

The data warehouse was combined in 2012 with better visualization tools, moving the operator beyond traditional tracking tools to better understand the relationships critical to improving performance.

Eagle Ford wells are horizontally fractured with variables such as proppant, fluid-proppant loading, lb/gal proppant ratios, and fluid systems (slickwater, gels, and hybrids) deployed as needed. For plays like the Eagle Ford, the factory approach implies that stimulation programs are tailored for use across a spectrum of wells targeting similar formations. The resulting large number of variables requires sophisticated completion designs, Leveille said.

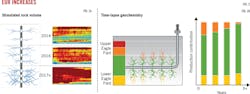

ConocoPhillips's optimal solution combined experimentation with data analytics. The company now pumps 15.5 million lb/well of proppant compared with 7.5 million lb/well and 3.8 million lb/well in 2014 and 2012, respectively. Well performance has increased incrementally with the changes in proppant volume. "Our completion design continues to evolve, but analyzing the data over time has maximized return from our investments in the Eagle Ford," Leveille said (Fig. 2).

These examples do not encompass all of ConocoPhillips' data analytics applications in the Eagle Ford. The operator also has deployed high-end predictive modeling relying on multivariate analysis to attack more complex problems around completion design. "We're using a range of different tools to find a 'fit for purpose' approach for problems we are trying to solve," Pfister said.

Analytics use-cases

Descriptive or diagnostic analytics are not mature and industry has used these methods for some time, but use of predictive analytics has come into the mainstream only within the last couple of years (Fig. 3).

Advanced analytics is not a solution to every problem, and good candidates for these applications have similar characteristics (See box). ConocoPhillips has improved drilling performance by gathering data with relatively simple tools to draw relationships that have led to significant changes.

"We have spent some time over the last 3 years characterizing the types of problems that lend themselves to bringing on data analytics as a primary tool," Pfister said. "Problems that are associated with large amounts of data that lead to better prediction capabilities make sense for data analytics applications."

Analytics applied toward a one-off deepwater platform may not add the same insight as those applied to an unconventional reservoir requiring 1,000s of wells drilled in a manufacturing mode.

The timelines for unconventional development and advanced analytics provide a unique opportunity for many operators. Hydraulic fracturing of horizontal wells, which has only become mainstream within the last 10 years, is an established technique but the rock physics behind fracture propagation still is not completely understood. While experimenting in the Eagle Ford, ConocoPhillips has drilled development wells, fracture stimulated the reservoir, and then taken core samples from the fractured sections. "Mathematical models have been developed over time to describe how a fracture should form, but our samples showed fracture geometries that were much different than mathematical predictions," Leveille said. Data analytics have identified a gap in this specific predictive model, developing knowledge that will better define fracture propagation over time. "Analytical approaches will help in designing better completions and optimizing overall developments," Leveille added.

Hydraulic fracturing of horizontal wells is an excellent use case for data analytics because it is new science compared to conventional hydrocarbon production. "You're not competing with conventional wisdom," Pfister said.

The same applies to disputed technology areas in which multiple methods create a wide range of outcomes. "In some of these analytics use-cases, value was achieved just by narrowing the range of considerations for technological solutions," Pfister said.

Collaboration

Data analytics are a collaborative effort within ConocoPhillips, with strong internal support and a clear structure that encourages teamwork across organizational boundaries.

As a whole, the industry values competitiveness over publicizing knowledge of specific plays. Mid-size and large operators do not make a practice of sharing and trading data, but it is not unprecedented. In areas such as the UK North Sea, companies have shared operating and performance data for at least a decade to their general benefit.

Several companies in the US Lower 48 have made deals to trade data on specific plays, with small scale examples of data trading now in place that did not exist 20 years ago. Most multi-operator data, particularly for North American shale plays, are made public by regulatory entities. North Dakota's Industrial Commission is regulation heavy in terms of capturing data, which can assist in analytics projects in the Bakken. Data service companies also package and iterate publicly available drilling and production data, but open access to operational data has not changed greatly over the last several decades. "The analytics revolution is still early and companies are working to determine how this business proposition plays out," Pfister said.

Discipline agnostic

Applying data analytics has implications for all exploration and development sectors exploration and development, but the most advanced forms are finding a path into unconventional plays. "Most unconventional developments are the greenfield examples where we're using new equipment with more sensors both in the wellbore and at the surface," Pfister said. By default, unconventional wells generate much larger datasets than a typical offshore or conventional well.

Unconventional development has coupled with the "analytics revolution" to make up for the limited understanding of the physics of fracture propagation, proppant placement, and production from shale more than has been the case for traditional limestones and sandstones.

Most exploration companies have different functional groups responsible for different parts of the business, including drilling, completion, and reservoir engineering, along with geosciences and others. "One of the things that has changed within ConocoPhillips is how we manage the data that each of these disciplines use," Leveille said. "You don't have to go too far back in time where most data were stored in discipline-specific systems." The traditional approach included each group solving a specific part of a problem, often with different types of hardware and software. "It made it hard to cross discipline boundaries as far as sharing data and developing holistic or integrated solutions," Leveille said.

ConocoPhillips' data analytics approach today pulls these data together in one place, provides scientists and engineers with discipline-agnostic tools, and allows for interdisciplinary problem solving.

This type of problem solving is not limited to only technical disciplines. "One of the age-old problems in our industry has been to understand profitability at a well level," Pfister said. A deep understanding of maintenance procedures and cost structures is required to differentiate between optimizing production and profit as an end result.

"We had a breakthrough when we successfully began adding cost data to our analytics models," Pfister continued, referring to the marriage of cost data from its accounting software to its field-operational data. Rather than simply recording how much proppant was pumped, field engineers could determine the type used and the cost of each job. "All of our technical disciplines can now combine the cost and technical options they have on hand and are capable of making better economic decisions." The combination of these data have driven the company's Eagle Ford performance in the last 2-3 years, according to Pfister.

ConocoPhillips relies on an integrated operations organization made up of multidiscipline groups. The groups commingle both subsurface and drilling engineers and are supported with embedded IT professionals providing data access and software. "The combination of skillsets working in the same asset toward the same goal has been one of the critical success factors," Leveille said.

Infrastructure

Data analytics projects require real-time decision making, which can be a challenge in some geographical areas. For instance, there were limited commercial data transport options available from traditional telecomm carriers in the Eagle Ford region.

South Texas is remote with wide spans of unpopulated open terrain. Telecommunication networks typically follow urban development and the region's rural setting provided very little infrastructure to operators as the Eagle Ford began attracting more activity.

ConocoPhillips built its own infrastructure in South Texas, including towers, repeaters, and other related equipment. "[Adding this infrastructure] allowed us to bring back more data on a higher frequency, which has led to much of our success in the Eagle Ford," Leveille noted.

Analytics evolution

In the 1980s and early 1990s, many thought computers would eventually solve most analytical problems requiring complex mathematics. "In the present, however, there is a wide range for complexity," Leveille said. "You certainly don't want to invest in a supercomputer when a laptop will do the job." ConocoPhillips addresses this range by solving complex seismic and reservoir simulation problems on clusters of high-powered computers, while outfitting field engineers with simpler tools.

Machine learning, deep learning, and deep neural networks are part of the next-level approach to data analytics. "These are the more immature aspects of data analytics," Pfister said. "They are being deployed in other industries but are just now making their way into the consciousness of exploration and production companies." ConocoPhillips has been experimenting with machine learning for 2 years and is still in the early stages of understanding the various approaches, including linear regression, random forest, or neural network algorithms. "There are different statistical, mathematical approaches to put together different modeling schemes for developing better forecasting or improved optimization."

Analytics is the most dynamic part of information technology today, according to Pfister. New models formerly available only to academic institutions working on complex federal projects are now being created as open-sourced projects and by public sector companies such as Amazon, Google, Microsoft, and others. The commercial availability of these models is opening opportunities for further innovation in the exploration and development sector.

"The evolution of data analytics will have a revolutionary impact on the oil and gas industry and will be amplified by the growth in unconventional development," Leveille said.

Applied analytics indicators

Data analytics' effective application of data analytics requires areas or industry sectors that meet the prerequisites needed to increase operational efficiency. When selecting technology sectors or projects for analytics, operators look for:

• Areas with a large volume of good-quality digital data upon which to perform analysis.

• Projects that have a capacity for rapid testing of new technological concepts in low-cost experiments to expand the range of solutions based on performance-data analysis.

• Projects or areas where optimal solutions can be deployed at-scale to maximize benefit, i.e. establishing manufacturing processes vs. one-off customized procedures.

• Projects with incentives for numerous entities increasing the likelihood of developing solutions that can be data-tested and identified as superseding conventional wisdom.

• Areas or projects that can provide rapid data dispersal across the industry, allowing engineers to draw analytic insight from larger datasets.

• Projects that can commingle data available from a variety of technical disciplines, enabling deeper insights and the development of holistic solutions.

• Areas where technical complexity adds difficulty in determining physics-based solutions, which increases the importance of data-driven decision making. While it may be impossible to determine the physics behind how or why a certain outcome occurs, data-indicated causality can lead to better informed economic decisions.

• Areas where new technical challenges are addressed with immature technologies, which provides lead time for further optimization.