Oil companies invest in digitalization

Paula Dittrick

OGJ Upstream Technology Editor

Oil and gas companies are investing in data analytics and big data. Most industry executives expect corporate strategy increasingly will include the ability to compete on data management and analytic proficiency.

An Apache Corp. engineer told a Ryder Scott Petroleum Consultants reserves conference in Houston how Apache had used machine learning to possibly replace manual production forecasting for unconventional wells in a pilot involving both the Bakken formation and Permian basin.

Machine learning is a computer-based discipline in which algorithms "learn" by using data to build and constantly refine a forecasting model.

David Fulford, Apache reservoir engineer, has compared probabilistic machine learning with manual production forecasting for certain Apache wells. He developed a decline-curve analysis (DCA) method using a Markov-chain Monte Carlo (MCMC) simulation algorithm.1

Apache's pilot work

The Markov decision process hinges on machine learning. Fulford devised an algorithm to handle "the mathematical drudgery" of fitting curves to data. This freed time for Apache's reservoir engineers to concentrate on other work.

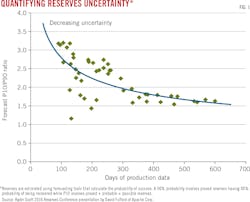

Fulford developed a probabilistic DCA method that provides P10, P50, and P90 forecasts (Fig. 1). These forecasts account for production data variances.

The US Securities and Exchange Commission (SEC) has said machine learning can be considered a reliable technology. SEC defines reliable technology in probabilistic terms.2

Limited production history can hinder the accuracy of production forecasting. Fulford believes machine learning can quantify forecasting uncertainty by mitigating human biases toward overconfidence.

He suggests that quantified uncertainty provides a diagnostic tool helpful in setting thresholds for reserves bookings and for guiding investment decisions.

Elm Coulee wells in the Bakken formation have at least 5 years of production history. Fulford selected 136 wells exhibiting a discernable, consistent production trend. He excluded refractured wells.

In the Permian, he analyzed 85 Wolfcamp wells having low-proppant loadings and 39 Wolfcamp wells having high-proppant loadings. Fulford concluded that the machine-learning approach and associated diagnostic tools led to quicker, more reliable forecasts that manual forecasts.

"Production surveillance is not possible given the [number] of wells that need forecasting every quarter," he said.

Statoil's digitalization

Statoil Chief Executive Officer Edlar Saetre announced in May that the Norwegian producer plans to invest $240 million in digitalization efforts by 2020, establishing a center to coordinate and manage these efforts companywide. The center will have units dedicated to data analytics, machine learning, and artificial intelligence. Statoil executives expect analytics about subsurface operations to improve data accessibility, enabling better decisions. Executives also expect real-time analytics and increased automation to enhance next-generation well delivery, optimize production, and improve maintenance.

Saetre assigned Jannicke Nilsson, Statoil chief operating officer, to oversee the digital center. Saetre expects digital data will provide Statoil with a better decision-making basis and reduce exposure in risky operations.

"This is about leaner operations in the future," Saetre said, adding he wants an increased probability of exploration success and improved regularity in operations to enhance revenues.

Nilsson anticipates "improved safety and security, reduced emissions, and more efficient operations" through Statoil's digitalization program.

Drilling contractor Noble Corp. and GE announced a partnership in May to collaborate on the digital rig by using data analytics to improve operational efficiency. Noble seeks to cut expenses 20% across its offshore rig fleet.

David W. Williams, Noble chairman, president, and chief executive officer, said the offshore industry "is on the cusp of change." He expects data-driven decisions will improve drilling efficiencies.

"It is imperative for our industry to embrace the digital revolution to stay efficient and nimble," Williams said. Initially, GE will use its marine asset performance management (APM) program on four rigs.

Noble and GE anticipate the following benefits:

• Enhanced drilling efficiency through early-detection of equipment anomalies and the ability to deviate drilling processes to reduce unplanned downtime.

• A shift to predictive maintenance to achieve sustainable operating cost-savings across the fleet.

• Reduced third-party service costs.

GE said its marine APM combined data models and advanced analytics, which it calls "digital twins," to detect off-standard behavior of targeted equipment on a rig. Off-standard behavior can indicate a potential failure or performance decline, providing an early warning for operators. The system will learn about the targeted equipment, enabling forecasts of assess performance across a rig as part of moving from planned to predictive maintenance.

Separately, BP and GE last year launched plant operations advisor (POA), a digital approach to improving the efficiency, reliability, and safety of BP's oil and gas production operations. BP currently manages performance on one Gulf of Mexico rig using POA, It plans to deploy the system on other assets worldwide. GE and BP jointly developed the POA, which was built on GE's Predix system.

The technology combines big data, cloud hosting, and analytics on individual pieces of equipment as well as the entire production system. Ahmen Hashmi, BP's upstream technology head, said, "When fully deployed, these advanced digital technologies will change the way we work and improve the integrity and performance of our assets around the globe."

The POA integrates operational data from production sites, generating notifications and analytical reports for engineers so they can identify any operational issues before the issues turn into major problems, GE said. POA assesses various live data feeds and analyzes case studies to support learning from earlier operational issues.

Human, digital knowledge

Maana, a start-up technology company in Palo Alto, Calif., received financing from Saudi Aramco Energy Ventures, Shell Technology Ventures, Chevron Technology Ventures, GE Ventures, and others to provide analytics for the oil and gas industry.

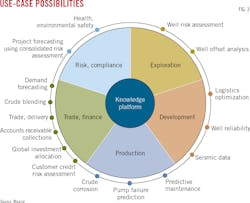

Maana's patented technology enables data analysts, business analysts, data scientists, and others to collaborate in an integrated system. It uses machine learning to consolidate operating data so customers can make better decisions (Fig. 2).

Azita Martin, Maana chief marketing officer, said the firm's software turns "human experience into digital knowledge to make better and faster decisions." The process starts by breaking down a customer's business problem into smaller questions to build a model using artificial intelligence algorithms.

"We can demonstrate business value in 3 months," she told OGJ. Maana develops a use case for a specific customer to address a specific problem (Fig. 3).

Jeff Dalgliesh, Maana's oil and gas specialist who formerly worked for Chevron Corp., said Maana used natural language processing techniques on Chevron's statistics to train a machine to understand how drillers describe operational problems. "We built a model," Dalgliesh said. "The employee knows the business inside and out through human experience. But so much data is out there that the expert in the field needs help to use the data to make decisions."

For instance, well-planning engineers can get a better understanding of potential risks associated with drilling a well if they know the problems encountered with a project's previous wells. A trained algorithm deciphers a driller's jargon and technical terminology in the company's records.

Maana uses natural language processing algorithms to build statistical language models to classify a comment into a problem type. "We are trying to get the most production out of a well. Models help answer questions," Dalgliesh said.

For instance, a driller who makes eight comments daily while drilling a well every 30 days would generate 240 comments/well. A company having more than 100,000 wells worldwide would end up with 24 million comments in its records.

Dalglish said training a machine to read 24 million comments and then classify each comment into a problem type allows engineers to better understand the frequency of certain problems. A human taking 5 sec to read and classify each of the 24 million comments would need 3 years 9 months nonstop to do the work that an algorithm can do in a few minutes, Dalglish said.

He suggests drillers will use artificial intelligence (AI) to evaluate types of completions.

AI also can help oil companies check the accuracy of invoices from drilling contractors, he said. Drilling contracts might contain discounts for operational interruptions, Dalglish said. But drilling contracts can be 70 pages long so not all discounts might get included on invoices, especially in unusual circumstances such as a hurricane.

References

1. Fulford, D., "Machine Learning for Production Forecasting: Accuracy Through Uncertainty," Ryder Scott Reserves Conference, Houston, Sept. 14, 2016.

2. US Securities and Exchange Commission, IM Guidance Update, "Robo-Advisers," Feb. 23, 2017.