OGJ Newsletter

Oil companies in group seeking carbon tax

Four major oil companies have joined a nongovernmental initiative to impose a carbon tax in the US as a precaution against catastrophic climate change.

The Climate Leadership Council, which was launched in February by a group of former officials of Republican administrations, listed BP, ExxonMobil, Shell, and Total in a June 20 disclosure of founding members.

The CLC advocates a tax starting at $40/ton of carbon-dioxide emissions and increasing over time. Tax proceeds would be returned to Americans via monthly dividend checks and be accompanied by border adjustments favoring non-US countries with comparable carbon-pricing systems and by elimination of regulations made unnecessary by carbon pricing.

Other corporate founding members are GM, Johnson & Johnson, P&G, Pepsico, Santander, Schneider Electric, and Unilever. The CLC also reported two nongovernmental organizations as founding members: Conservation International and The Nature Conservancy.

UK oil and gas survey notes confidence

Confidence is returning to the UK oil and gas industry, according to an annual survey by the Bank of Scotland.

Of more than 100 oil and gas business surveyed in Scotland, England, and Wales, 69% expressed confidence they have done enough to survive the latest slump in oil prices. And 75% said they expect the price of Brent crude to reach $75-80/bbl in 2019 or beyond.

The survey noted a jump this year in the “net balance of optimistic businesses”—the number of companies positive in their outlooks less the number negative. In last year’s survey, the net optimistic balance was 2%; this year it is 39%.

Among companies with annual revenue exceeding £750 million, the net balance of optimistic businesses jumped to 33% in 2017 from -33% in 2016.

The share of businesses planning for growth over the next 12 months rose to 58% in this year’s survey from 49% last year.

The share of businesses expecting to reduce headcount during the next 12 months declined to 19% this year from 32% in 2016. This year, 55% of companies expect to increase overall headcount during the next 12 months, while 26% expect headcount to remain the same.

Leading areas for expected employment growth this year are engineering and fabrication, with a net gain of 17%, and equipment and supply rental, 10%. The only negative areas are drilling, with a net loss of 12%, and subsea work, down 5%.

Oxy to buy Seminole-San Andres EOR assets from Hess

Occidental Petroleum Corp. agreed to several transactions in the Permian basin, noting the transactions require no net cash outlay and add 3,500 boe/d to the company’s production.

Oxy will reduce its Permian resources business’s position by 13,000 net acres, divesting non-strategic acreage in Andrews, Martin, and Pecos counties and adding acreage in Glasscock County. Oxy said the Permian resources transactions will generate $600 million in net proceeds. The divested acres had no significant near-term development plans.

Separately, Hess Corp. is selling for $600 million a carbon dioxide enhanced oil recovery property to Oxy, which will assume operatorship when the transaction is final.

The EOR transaction included acquisition of working interests in the Seminole-San Andres unit, a CO2 flood, and interests in the Seminole gas processing plant, source fields at the Bravo Dome unit and West Bravo Dome unit, and the Sheep Mountain and Rosebud CO2 pipelines.

Oxy has had an ownership interest in the EOR assets since 2000. The Seminole-San Andres unit will become Oxy’s largest US oil producing EOR unit. The assets produced an average of 8,200 boe/d in 2016 net to Hess.

FAR, Woodside Senegal dispute taken to arbitration

FAR Ltd., Perth, has moved to arbitration to resolve the current joint operating agreement dispute regarding the firm’s right to preempt the sale of ConocoPhillips’ interest in three blocks, including one containing the SNE oil discovery offshore Senegal.

FAR made its request on June 20 to the International Chamber of Commerce in Paris to commence the arbitration proceedings.

Fellow Perth company Woodside Petroleum Ltd. has confirmed the move but believes that FAR’s claim has no merit.

Woodside bought a 35% stake in the Rufisque, Sangomar, and Sangomar Deep joint ventures from ConocoPhillips for $350 million last year, but FAR maintains that a valid preemptive rights notice had not been issued to the JV partners by ConocoPhillips.

In response to this assertion, Woodside on June 21 released a statement saying that the Republic of Senegal’s Minister of Energy and the Development of Renewable Energy has issued a Ministerial Order that provides further confirmation of Woodside’s participation in the three Senegal blocks.

As arbitration proceedings have now been initiated, Woodside does not intend to make any further comment at this stage.

The SNE project has been scheduled to come on stream as early as 2021. It will be Senegal’s first oil development, but it now faces delays because of the dispute.

As part of the deal to buy into the region, Woodside has also made plans to become operator of the SNE development, taking over from Cairn Energy PLC before a final investment decision is made. This too has been challenged by FAR.

ExxonMobil makes FID on Liza development off Guyana

ExxonMobil Corp. has made a final investment decision on the first phase of development for Liza field 190 km off Guyana.

The company also reported results from the Liza-4 well, which the firm said encountered more than 197 ft of high-quality, oil-bearing sandstone reservoirs and will underpin a potential Liza Phase 2 development.

Gross recoverable resources for the 6-million-acre Stabroek block are now estimated at 2-2.5 billion boe, including Liza and the Liza Deep, Payara, and Snoek exploration wells.

The Liza Phase 1 development includes a subsea production system and a floating production, storage, and offloading vessel designed to produce as much as 120,000 b/d of oil. The FPSO contract was let to SBM Offshore NV late last year.

Liza field lies in 1,500-1,900 m of water. Four drill centers are envisioned with a total of 17 wells, including 8 production wells, 6 water-injection wells, and 3 gas-injection wells.

ExxonMobil last month let an engineering, procurement, construction, and installation contract to Saipem SPA for work on risers, flow lines, and associated structures and jumpers.

Production is expected to begin by 2020, less than 5 years after the field’s discovery. Phase 1 is expected to cost $4.4 billion, which includes a lease capitalization cost of $1.2 billion for the FPSO facility, and will develop 450 million bbl of oil.

Energean submits development plan for fields off Israel

Energean Oil & Gas SA subsidiary Energean Israel expects the start of gas production from the Karish main development in 2020 after an estimated capital expenditure of $1.3-1.5 billion.

The operator’s field development plan calls for three Karish wells drilled from a floating, production, storage, and offloading unit that will be installed 90 km offshore. The FPSO will have a 400-MMcfd capacity.

The company also said the Karish development will include a dry gas pipeline connecting the field to a gas transmission system onshore Israel.

Tanin field will follow Karish development, and Energean expects to drill six wells from the FPSO.

The fields’ lease term runs until 2044 with a possible extension to 2054. Karish and Tanin development is expected to deliver 88 billion cu m of gas to the Israeli market, while more than 40 million bbl of light hydrocarbon liquids may be exported to regional and international markets.

Energean Israel has 100% of Karish and Tanin, which hold a combined 2.7 tcf of gas.

South Sudan oil ministry launches open tender for audit

South Sudan’s government will commission an audit of national oil production and other petroleum industry activities, the Ministry of Petroleum reported. The ministry has invited companies to bid on a public tender to perform the audit and produce a 2017 industry audit report.

The country said the audit is being conducted to complete an accurate assessment of oil, condensate, and natural gas reserves and production; report on revenue and investment flows; and make recommendations on the technical, fiscal, and regulatory issues faced by the petroleum industry.

Companies are invited to bid on the open tender until July 14.

Rosneft cites oil discovery in eastern Arctic

Rosneft PJSC is citing an oil field in the eastern Arctic after three core samples in an exploratory well in the Laptev Sea “showed high oil saturation.”

The samples were taken from 2,305 m to 2,363 m in the Tsentraino-Olginskaya-1 well. Drilling began in early April.

Drilling and core sampling are continuing. The well is being drilled from the shore of the Khara-Tumus Peninsula on the shelf of Khatanga Bay. Rosneft was awarded the Khatanga license in November 2015.

Drilling & Production — Quick TakesIHS Markit: Oil sands production to rise in 2017-18

Nearly 500,000 b/d of Canadian oil sands production will be added in 2017-18, growth only exceeded by US tight oil, according to IHS Markit’s outlook for Canadian oil sands production through 2026. More modest but sustained growth is expected beyond 2019 as some of the impact of lower oil prices and falling investment is felt, with oil sands production at the end of 2026 about 1 million b/d higher than in 2017.

IHS Markit attributes the oil sands’ resilience to falling costs in existing operations and higher utilization rates as well as the completion of projects being constructed at the time of the price collapse. A lack of material production declines from oil sands facilities—unlike other sources of supply—also makes growth more readily achieved than other forms of oil production, the information services firm notes.

“In recent years—even through lower prices—it was not uncommon for oil sands production additions to average more than 150,000 or even 200,000 b/d annually,” said Kevin Birn, energy director for IHS Markit. “Following 2019, modest additions beneath 100,000 b/d may be more common through the early part of the next decade.”

IHS Markit continues to expect oil sands growth to be dominated by expansions of existing facilities, which are lower cost, quicker to construct, and lower risk. More growth is also expected from existing operations as they minimize downtime and increase utilization.

Canadian group eyes oil-sands emissions

Producers in Alberta’s oil sands would face new reporting requirements and controls that toughened with rising emission rates under recommendations by a group advising the provincial government. The Oil Sands Advisory Group disclosed its recommendations after the Canadian Association of Petroleum Producers predicted output from the oil sands will increase by 1.3 million b/d during 2016-30. Alberta created OSAG last year to assist with regulations aimed at limiting to 100 million tonnes/year the greenhouse gas emissions associated with oil-sands production.

OSAG recommended the province require “best available technology economically achievable” in new facilities and expansions. It also recommended preparation of GHG management plans and a “technology roadmap” covering costs of abatement technologies.

GHG emissions from the oil sands now total about 70 million tpy of carbon dioxide-equivalent. Under the OSAG recommendations, reviews would tighten as emissions reached thresholds of 80 million tpy and 95 million tpy and when a 10-year forecast indicated that the 100-million-tpy cap would be reached within 5 years.

Abatement measures in the recommendations include emission allowances, mandatory emission reductions by facilities with high emission intensities, suspension of project approvals, and penalties for emissions above authorized levels.

ESAI: US shale oil production growth to slow in 2018

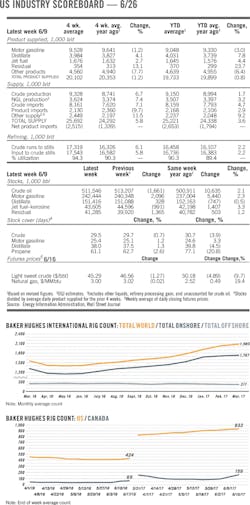

ESAI Energy forecasts that US shale oil production will reach 5.6 million b/d by Dec. 31, more than 1 million b/d higher than at the end of 2016. But the pace of growth is expected to slow in 2018 as current oil prices below $50/bbl are likely to hinder the momentum of rig additions.

US shale and tight oil producers have become more capable of operating profitably with lower oil prices than a year ago, but most require an oil price in the upper $40s/bbl to break even.

ESAI believes the most active basins will see cost inflation of roughly 15-20% in 2017. Analysts expect that productivity gains of 2015-16 are starting to show signs of leveling off.

As operators move outside the unconventional core areas, productivity could fall further. Cost inflation and falling marginal productivity along with lower-than-expected oil prices will give producers pause in deploying more capital to their drilling programs.

BP, RIL to invest $6 billion for India gas field

BP PLC and Reliance Industries Ltd. (RIL) have agreed to expand their energy partnership in India and will move forward in developing already-discovered deepwater gas fields.

The firms will award contracts to advance development of the R-Series deepwater gas fields on Block KGD6 off eastern India. The R-series (D34) project is a dry gas development in more than 2,000 m of water about 70 km offshore. The fields will be developed as a subsea tieback to the existing control and riser platform off Block KGD6. The project is expected to produce as much as 12 MMcfd of gas coming on stream in 2020.

It’s the first of three planned projects on Block KGD6 that are expected to be developed in an integrated manner, producing from about 3 tcf of discovered gas resources. RIL and BP plan to submit development plans for the next two projects for government approval before yearend. Development of the three projects, with total investment of $6 billion, is expected to bring a total 1 bcfd of new domestic gas production on stream, phased over 2020-22.

BP and RIL partnered in 2011 when BP acquired 30% interest in multiple oil and gas blocks in India operated by RIL, including the producing Block KGD6.

BP and RIL together invested $1.6 billion in deepwater exploration and production from 2011 through this May. In addition to the D55 gas discovery in 2013, the partnership has sustained production from the geologically complex reservoirs in D1D3 and D26 fields on Block KGD6.

PROCESSING — Quick TakesChevron Phillips Chemical completes US Gulf PE units

Chevron Phillips Chemical Co. LP (CPCC) has reached mechanical completion of two 500,000-tonne/year polyethylene (PE) plants in Old Ocean, Tex.

The PE units are now undergoing a series of rigorous commissioning activities, system checks, and final certifications to ensure a safe, reliable startup and consistent, high-quality production scheduled to begin during third-quarter 2017.

Ethylene feedstock for the PE units will be supplied via CPCC’s ethylene pipeline and storage system that was also expanded as part of this project, which also included construction of a rail facility with the capacity to store 1,500 rail cars to ship PE pellets to customers around the world as well as the addition of nearly 3,000 rail cars, according to the operator.

The PE units will enable CPCC to take advantage of abundant NGL feedstocks produced from ongoing development of US shale resources to help meet growing PE demand from global customers producing performance films, high-pressure pipe, and packaging, according to CPCC CEO Peter Cella.

The Old Ocean PE units come as part of CPCC’s $6 billion US Gulf Coast petrochemicals project, the final element of which entails construction of an ethane cracker due to be completed in this year’s fourth quarter at the company’s existing Cedar Bayou plant in Baytown, Tex.

Sinopec, Linde form JV to supply gases at Ningbo

Zhenhai Refining & Chemical Co. (ZRCC), a subsidiary of China Petroleum & Chemical Corp. (Sinopec), and Linde AG have formed a €145-million joint venture to boost industrial gas supplies to local petrochemical, steel, and electronics customers operating in the Ningbo Chemical Industrial Zone in eastern China’s Zhejiang province.

The newly formed Ningbo Linde-ZRCC Gases Co. Ltd. (Linde-ZRCC) marks the sixth consecutive 50-50 JV between Sinopec and Linde and complements the Chinese government’s plans to develop Ningbo into a modern petrochemical hub as well as Linde’s growth plans to support customers Asia Pacific, the service provider said on June 20.

As part of the agreement, Linde-ZRCC will acquire two existing air separation units (ASUs) from ZRCC and build a third ASU for a combined oxygen capacity of 150,000 cu m/hr.

Scheduled to be on stream sometime in 2018, the ASU will incorporate Linde’s proprietary technologies for remote operation, diagnostics and analytics, as well as a modular design to increase efficiency, reduce energy requirements, and enhance production flexibility.

The three additional ASUs, which will double Linde’s production capacity of air gases in the Ningbo cluster, also will be connected to the service provider’s pipeline supply network across Ningbo, Linde said.

ZRCC operates the 461,890-b/d integrated refining and petrochemical complex at Ningbo City, which is China’s largest.

DuPont lets contract for Texas ethylene plant

E.I. DuPont de Nemours & Co. has let a contract to CB&I, Houston, to provide engineering, procurement, and construction (EPC) for an ethane-cracking furnace expansion project at DuPont’s 680,000-tonne/year Sabine River Works ethylene plant in Orange, Tex.

To be equipped with CB&I’s proprietary Short Residence Time (SRT) pyrolysis heater technology, the cracking furnace will have an ethylene capacity of 200 million lb/year, the service provider said on June 21.

CB&I valued the EPC contract at about $40 million.

While neither CB&I nor DuPont disclosed further details regarding the proposed expansion project, CB&I confirmed this latest contract follows DuPont’s previous award to the service provider to supply ethylene technology licensing, engineering, and supply of the furnace, which was built at CB&I’s manufacturing plant in Thailand.

TRANSPORTATION — Quick TakesSurvey finds support for gas lines in New England

About half of the registered voters in four New England states support constructing more natural gas pipelines to help reduce power generation costs and consumers’ electric bills in the region, results of a poll that the Consumer Energy Alliance released on June 20 suggested.

The June 6-8 telephone survey, by Washington-based Hickman Analytics Inc., of 513 registered voters in New York, Massachusetts, Connecticut, and New Hampshire found that:

• 88% believe having sufficient gas supplies is important to keep electricity and home heating affordable.

• 76% support using gas to generate electricity.

• 74% agree that “a balanced mix of renewables, gas, and nuclear is important to keep electricity affordable and reliable.”

• 70% recognize that electricity prices are higher in the US Northeast than the rest of the country.

• 53% believe state governments should support pipeline construction to maintain fuel supplies, hold down prices, create jobs and boost economic development.

• 50% believe states should support construction of gas pipelines and local distribution systems to make power generation more efficient and economic, compared to 39% of the respondents who oppose the idea.

Oneok to expand Midcontinent NGL gathering system

Oneok Inc. plans to expand its Midcontinent NGL gathering system and its existing Sterling III pipeline.

The expansions, backed by a long-term contract with a subsidiary of EnLink Midstream Partners LP and EnLink Midstream LLC, will help accommodate expected volume growth from current and certain future EnLink gas processing plants in the STACK play in western Oklahoma along with expected growth from other customers in the region.

Expansions include increasing capacity on the Sterling III pipeline to 250,000 b/d from 190,000 b/d and connecting Oneok’s Arbuckle pipeline to EnLink’s Cajun-Sibon pipeline in southeast Texas. Oneok’s Sterling III pipeline transports either unfractionated NGLs or NGL purity products between the firm’s Midcontinent NGL infrastructure and similar facilities on the Gulf Coast in Mont Belvieu, Tex.

The firm expects to invest $130 million for the projects, which are expected to be complete by the end of 2018.

Oneok’s NGL segment currently gathers 150,000-200,000 b/d of NGL out of the STACK and SCOOP plays and is connected to more than 100 third-party gas processing plants in the Midcontinent. The NGL volumes from EnLink plant connections and other production are part of an incremental 100,000 b/d of expected NGL supply out of the STACK and SCOOP that Oneok expects to add to its system by the end of 2018.

The firm also has entered into a long-term processing services agreement with a third party to gain access to an additional 200 MMcfd of gas processing capacity in the STACK and SCOOP. Oneok plans to connect its gas gathering system to the existing third-party gas processing facility in northern Oklahoma by constructing a 30-mile natural gas gathering pipeline and related infrastructure through the core of the STACK in Blaine County, Okla.

That pipeline is expected to cost $40 million and be completed by yearend.