Offshore rig market recovery emerging

David Carter Shinn

Bassoe Offshore

Oslo

Trends signaling a rig market recovery have emerged this year. Rig contracting activity and utilization are up, asset values are up, and first-quarter crude oil benchmark prices held relatively stable.

New buyers are acquiring stranded rigs. Purchase offers are increasing in terms of both number of transactions and value. Buyers seek newer, higher-specification jack ups along with sixth- and seventh-generation semisubmersibles-especially harsh-environment semis-and drillships.

But ominous realities remain. The offshore rig market's problems resulted from 3 years of decreased demand. Rig owners remain frustrated by unbridled construction of newbuild rigs that now sit at shipyards in suspended animation.

Nearly all owners have forecast a recovery for rig demand at various points in the future. The main obstacle to a recovery has been a rig supply vs. demand gap that remains too wide to overcome without additional stimuli.

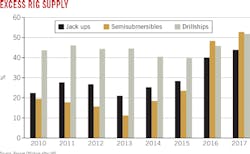

Excess 2010-14 jack up supply (including rigs under construction) was about 25% of the total fleet. The semi fleet excess supply was roughly 15% (see accompanying Figure). Drillship oversupply had been high for much longer.

The rig market experienced a two-phase demand increase, starting with 2005 when contractors placed orders for new equipment. A stronger newbuild round materialized in 2012-13.

Contractors found themselves with a rig oversupply after oil prices tumbled starting in late 2104 and caused drilling activity to fall worldwide.

Bassoe Offshore estimates 50% oversupply exist currently for the offshore drilling fleet worldwide, including jack ups, semis, and drillships.

Market balance

Some analysts believe that a market rebalance will require record rig demand levels or rig scrapping on an extraordinary scale. But oil companies are becoming more selective while rig demand increases.

In March, Ensco PLC executives told investors that they have seen a 200% increase in rig years tendered for jack ups year-over-year. Future deepwater markets likely will become more focused toward operators' growing need for plug and abandonment work and large new projects.

Bassoe Offshore sees opportunities in harsh environments (North Sea and possibly Canada), as well as regions such as Brazil, Mexico, West Africa, the US Gulf of Mexico, and the Middle East.

Demand growth alone will not vanquish oversupply. Too many rigs exist, even assuming complete attrition of the fleet of rigs older than 20 years.

Oil and natural gas companies are becoming increasingly selective regarding rig contract terms. They demand reliable equipment from drilling contractors that demonstrate safe, efficient operations. Producers also expect contractors to meet rigid performance standards.

This selectiveness strengthens established drilling contractors having the necessary organization, experience, and rig fleets ready to work. Well-positioned drilling contractors need not worry about rig oversupply but instead can focus on being truly competitive.

Rigs sitting in yards, whether newbuild or older cold-stacked rigs, become less competitive over time because activation costs increase the longer rigs remain idle.

Established, well-funded, and differentiated drilling contractors will succeed, while speculative, new-entrant jack up owners or ultra-deepwater rig owners with a high proportion of long-term cold-stacked, improperly preserved rigs will falter.

If demand eventually increases enough to bring back even some of the non-competitive rig supply, some contractors might be able to acquire assets. But the original owners of these rigs will likely lose much of their investment.

Successful rig owners will meet the new demands of a lower-cost, higher-efficiency market by taking advantage of an expanding divide between competitiveness and non-competitiveness. Some already are positioning for the future by investing more in rig preservation, investigating deals to buy rigs at lower cost, and strengthening their operational systems and technology.

These rig owners are unconcerned with the 58 speculative (new entrant) jack ups sitting in Asian yards or an undetermined number of idle newbuild ultra-deepwater drillships that are poorly stacked and incurring future costs.

The author

David Carter Shinn ([email protected]) is Bassoe Offshore partner and head of data services. In 2016, he developed and managed strategy for the Norwegian rig brokerage's digital applications and data services. Shinn joined Bassoe Offshore in 2008. He has experience with newbuild rig transactions and offshore rig advisory projects. Previously, he worked for Wallenius Wilhelmsen Logistics in Oslo and Mexico City. He earned a BA in economics from North Carolina State University (2000) and a MS in international economics and management (2002) from SDA Bocconi in Milan, Italy.