Drilling markets pick up, starting in US

The weekly US rig count grew repeatedly by double-digits through April, with Baker Hughes Inc. attributing most of the drilling gains to onshore plays while the US offshore rig count remained flat.

International drilling recovery typically lags a US drilling recovery. But Baker Hughes statistics showed the international rig count started 2017 stronger than some analysts had expected.

"We are in the midst of a unique and challenging cycle with very different dynamics between the North American and international markets," Jeff Miller, Halliburton's president, said during a first-quarter earnings call.

Deutsche Bank analyst Mike Urban emphasized that the international rig count recovery remains limited. He anticipates production declines in many areas.

"Do not lose sight of the fact that we still expect to see a decline in non-US, non-OPEC regions given the extended nature of the massive spending cuts in those regions and a limited rig count recovery, especially in Latin America," Urban said in an April research note.

Political uncertainties and output declines by some producers contributed to regional differences in drilling demand. Urban said oil service companies reported strong first-quarter demand in Europe and Asia Pacific.

The offshore rig market struggles with overcapacity. But Urban expects deep water will remain a large, growing part of the long-term production mix and foresees large-scale consolidation among offshore contractors.

"International and offshore markets are still experiencing their normal cyclical lag while working through structural issues but both appear to at least be bottoming," Urban said. "With oil having stabilized and customers' production materially hedged, we expect further activity gains, albeit at a slower pace over the balance of the year."

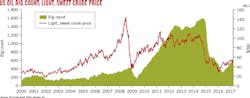

Light, sweet crude oil prices traded in a range of $50-54/bbl on the New York market for much of the first quarter. Prices fell below $50/bbl briefly in March and again in April, prompting some concerns that producers might put drilling plans on hold.

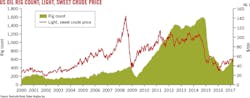

Fig. 1a shows the US oil-directed response to higher prices through January while Fig. 1b shows the US gas-directed response for the same period.

US onshore

Urban expects land drillers to accelerate activity when oil prices recover, adding that onshore traditionally benefits first in a recovery.

Baker Hughes said the US rig count added 159 rigs in the first quarter, the biggest gain in a single quarter since early 2010.

Cowen and Co. oil services analyst Marc Bianchi said in a research note that the firm calculated a US land rig count of 900 as of May 4, which beat the company's forecast of 890.

He said 900 rigs implied 18% growth in the second quarter vs 25% growth in the first quarter.

Bianchi said day-rate improvement has surpassed expectations and that he expects most drilling contractors will see margins bottom in first-half 2017.

Fitch Ratings of Chicago said increasing capital expenditures and rig counts will drive US production growth. Fitch based its outlook on a sample of 40 US-focused exploration and production companies.

Those companies likely will boost total drilling and completion spending about 58% in 2017, marking the first time since late 2014 that guidance indicates expanding US E&P budgets, Fitch said.

"Capital allocation is expected to be weighted toward the highest-return shale plays with growth potential in the Permian, Eagle Ford, STACK, Haynesville, and Marcellus," Fitch said.

Fitch's sample suggests average US Lower 48 states (L48) land rig counts will increase 60-65% year-over-year, with the pace of rig additions moderating following first-quarter 2017.

Colin Cordes, Fitch associate director, said this translates into an average L48 land rig count of around 800 for 2017. He forecast a yearend rig count of 850-875 units.

But the US rig count growth rate will slow after 2017, Fitch said, citing the likelihood of E&P companies continuing to align capital spending with near-term cash flows and rig-efficiency gains.

Average production across the Fitch sample is expected to increase 5% in 2017, with liquids-focused companies exhibiting the greatest increase.

Fitch foresees continued production growth in 2018. Operators are increasing production budgets and shifting spending more toward production than testing and delineation, given an improved oil and gas price outlook (Fig. 1-2).

Capital spending plans remain flexible. Fitch said its sample companies expected light, sweet crude futures prices of $50-$60/bbl and natural gas prices of $3-$3.63/MMbtu during 2017.

Some E&Ps are maintaining options to add rigs in second-half 2017 if prices remain supportive, Fitch said, noting that companies also are ready to reduce budgets and activity levels if oil and gas prices drop below expectations.

Hedges also support increased drilling. E&P companies across Fitch's sample hedged 43% of total 2017 production using a combination of collars and swaps. The hedges are an effort to support development funding and provide pricing upside.

"Notably, gas-weighted producers exhibited a heightened level of hedge coverage, relative to liquids peers, likely due to the operational impact that less predictable, seasonal demand can have on prices," Cordes said.

Fitch said its E&P sample represents about 40% of average 2016 and expected 2017 rig activity. Fitch categorized companies with less than 33% liquids production as gas, and those with more than 67% liquids production as liquids.

The rating agency categorized small companies as those producing fewer than 75,000 boe/d across the L48. Companies producing more than 200 million boe/d were considered large. Companies falling between these two ranges were considered medium.

Offshore markets

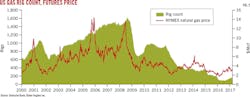

The shallow-water market "is showing some signs of life," Urban said in a Deutsche Bank research note. He said the jack-up market has some newbuilds awaiting contracts. Deepwater will be the last to benefit from the rig-market recovery given its high costs and high risk.

"Deepwater demand has likely bottomed, but utilization will continue to fall as old contracts roll off and new builds are delivered," Urban said. He expects service companies' will report deteriorating offshore earnings going into 2018 while rigs roll off "lucrative long-term contracts into a historically weak-spot market."

He expects accelerating US demand for jack ups (Fig. 3a) but he also expects utilization rates for jack ups outside the US to continue falling with scheduled contract expirations (Fig. 3b).

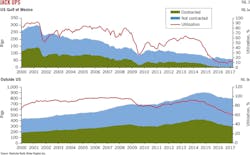

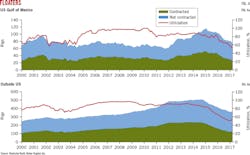

Recovery for drillships and semis is lagging the jack up recovery in the US Gulf of Mexico (Fig. 4a) and elsewhere (Fig. 4b).

"We expect new [contract] awards will carry very little margin due to the massive oversupply of available capable rigs, which limits the upside relative to our estimates even under a bullish demand scenario," Urban said. "Offshore drillers have been able to partially offset revenue declines by significantly lowering their cost profile; however, we see little room left."

Douglas Westwood analysts describe "mixed fortunes" for offshore service companies. North American onshore drilling and well services activity is expected to rebound.

"Offshore spending is likely to be sluggish in rebounding," DW said in a May 1 research note. Spending for newbuild jack ups, semis, and drillships is expected to decline from a peak of $24 billion in 2013 to $4.2 billion by 2023, said Matt Adams with DW's London office.

"This is the result of the substantial number of rigs currently idle, with offshore drilling volumes expected to be insufficient to warrant a newbuild cycle without wholesale rig scrapping," Adams said.

Fleet status reports

Several offshore drilling companies published fleet status reports as they released first-quarter financial statements. The fleet status reports showed jack ups starting to get work while floater demand continued to lag.

Cobalt paid $96 million to end its contract for the Rowan Reliance drillship. Noble Corp. said the Noble Bully I drillship was en route to the Carribean island of Curaco where it was to be cold stacked.

Noble Pres. and Chief Executive Officer David W. Williams said the offshore drilling industry continues to experience fleet oversupply, but he notes improving demand for jack ups.

"Contract awards, especially in the jack up sector, are occurring with greater frequency," Williams said in an earnings conference call on May 5. "We believe long-term oil market fundamentals are supportive of stable to higher crude oil prices, which with time will support an increase in rig demand."

Transocean Ltd. is looking for contracts for drillships Dhirubhai Deepwater KG 1 and Deepwater Invictus, whose contracts end this year. Its Deepwater Asgaard and Discoverer Indian were idle as of Apr 25.

Borr Drilling Ltd. of Hamilton, Bermuda, said it has signed a letter of intent with Transocean to buy 15 high-specification jack ups for $1.25 billion.

In another transaction, Seadrill Ltd. announced plans to sell three jack ups to Shelf Drilling of Hamilton, Bermuda, for $225 million. Seadrill, which owed debt on the units, said its sales proceeds would be $123 million. Seadrill is decreasing debt as it prepares for restructuring.

Statoil ASA in early April announced contracts on the Transocean Spitsbergen semi for three UK Continental Shelf exploration wells and six production wells on the Aasta Hansteen license in Norway.

The UK contracts involve the Mariner, Jock Scott, and Verbier licenses. Drilling is scheduled to start mid-2017. Statoil estimated the contract value for the three fixed wells at about $18 million, including integrated drilling services.

"This year will see our most active exploration campaign for Statoil in the UK since repositioning in 2011, and we look forward to testing our three diverse prospects," said Jenny Morris, Statoil vice-president exploration UK.

The Aasta Hansteen drilling is scheduled for late 2017 or early 2018. Statoil estimated the contract value for six fixed wells at $95 million. Statoil previously used the Transocean Spitsbergen on other Norwegian Continental Shelf projects.

Aasta Hansteen comprises three discoveries; Luva, Haklang, and Snefrid South. Statoil estimates 47 billion standard cu m of recoverable gas reserves. The gas field will be developed using a spar floating production, storage, and offloading unit.

Ensco PLC was the only drilling contractor to announce a long-term contract extension in the various fleet status reports released in April. ConocoPhillips extended its contract for the Ensco 92 jack up in the UK North Sea for 4 years until December 2022.

Ensco also announced three new contracts for other rigs and said it sold the Ensco 56 jack up for scrap. Ensco said the sales price was in line with net book value for the Ensco 56 but it did not specify the amount.

Ensco also did not disclose day rates for its new contracts. Sapura Energy hired the Ensco 106 jack up to drill four wells offshore Malaysia. That contract started in March and ends in September.

Ineos signed a three-well contract for Ensco 121 jack up in the North Sea. The rig is scheduled to work from July to February 2018. The contract has five one-well options. The day rate was undisclosed.

Ankor Energy LLC of New Orleans plans to use the Ensco 68 for a well in the US Gulf of Mexico from June to July. The Ensco 68 had a contract with W&T Offshore from May to June.

Schlumberger Ltd. believes the oil market has stabilized, although the service company anticipates continued supply pressure will keep oil prices low, Paal Kibsgaard, Schlumberger chief executive officer, told investors during a first-quarter earnings call.

Kibsgaard said he sees four areas as critical in restoring the industry's strength and advancing its capabilities:

• Higher E&P spending to meet growing hydrocarbon demand.

• Protecting and encouraging research investments across the oil and gas value chain.

• Developing new business models that foster closer technical collaboration and commercial alignment between operators and suppliers.

• Emergence of broader, more integrated technology platforms that combine hardware, software, data, and expertise.

Schlumberger announced a first-quarter profit of $279 million after a 2016 fourth-quarter loss of $204 million. Kibsgaard also said the company has resumed hiring.

Halliburton also is hiring, saying in late April that it planned to hire another 500 US workers in addition to a previously announced 2,000 new hires.

"Momentum is building, and we only see it getting better" in North America, Miller said recently.

Baker Hughes, which is merging with General Electric, said it cut first-quarter losses to $129 million compared with a first-quarter 2016 loss of nearly $1 billion. Growing demand for technology has allowed Baker Hughes to charge more for new products, such as a self-adjusting drill bit, which is boosting profits, executives said.

"We believe we are on the cusp of a pricing recovery," said Martin Craighead, Baker Hughes chief executive. "The ramp up in North America has become more robust than many had expected."