OGJ Newsletter

API: US petroleum demand highest for April since 2008

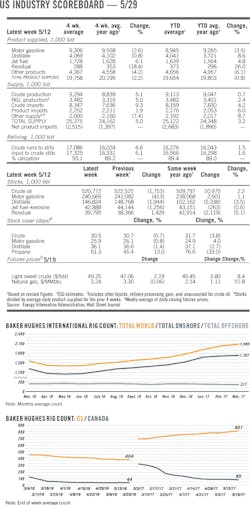

According to data from the American Petroleum Institute, total US petroleum deliveries in April averaged 19.6 million b/d, up 1.7% from April 2016. These were the highest April deliveries in 9 years. Compared with March, total US petroleum deliveries decreased 0.3%. For year-to-date (YTD), total US petroleum deliveries edged up slightly 0.1% compared with the same period last year to average 19.4 million b/d.

The overall US economy showed gains for the fourth time in the year, adding 211,000 jobs in April, according to the latest US Bureau of Labor Statistics report. The US unemployment rate was little changed at 4.4% and the number of unemployed persons also was little changed at 7.1 million.

"The manufacturing sector expanded in April while the overall economy grew for the 95th consecutive month," said Chief Economist Erica Bowman.

Gasoline deliveries in April were up from the prior month and the prior year, but down from the prior YTD. Total motor gasoline deliveries, a measure of consumer gasoline demand, moved up 0.6% from April 2016 to average nearly 9.3 million b/d-the highest April deliveries on record. Compared with March, total motor gasoline deliveries increased 0.4%.

At 9.2 million b/d, crude oil production was the second-highest April output since 1973. Crude oil production increased 1% from March and was up 3.4% from April 2016. This was the highest for any month since November 2015.

Crude production also was up 2.2% YTD compared with 2016. Natural gas liquids production was down from the prior year but up from the prior month and the prior YTD. NGL production in April averaged nearly 3.5 million b/d, down 1.5% from last year, but up 0.4% from last month and up 1.4% from the prior YTD. This was the second-highest April output level on record.

US total petroleum imports in April averaged 10.2 million b/d, up 1.6% from the prior month and up 3.3% from the prior year. Total petroleum imports also were up 3.4% YTD compared with YTD 2016. Crude oil imports increased 3.4% from April 2016 to just below 7.9 million b/d in April. Compared with March, crude oil imports were 0.4% higher. Crude imports YTD also were up 2.7% compared with YTD 2016.

API seeks compliance delay under BLM methane rule

The American Petroleum Institute has asked US Interior Sec. Ryan Zinke to instruct the Bureau of Land Management to defer compliance dates under its methane emissions control rule for 2 years. "We make this request in view of directives in recent presidential and secretarial orders that may lead to changes to or withdrawal of the final rule," API Pres. Jack N. Gerard told Zinke in a May 16 letter.

US President Donald Trump issued an executive order on Mar. 28 aimed at lifting federal restrictions on energy development. Its directions to Zinke included reviewing BLM's final rules on methane emissions and hydraulic fracturing on onshore federal and American Indian lands.

Zinke issued a pair of secretarial orders the following day, one of which set a timetable for reviewing agency actions that may hamper responsible energy development and for reconsidering regulations related to US oil and gas development.

With such reconsiderations under way, Gerard said postponing compliance requirements under BLM's final methane rule "is critical and immediately necessary so that companies subject to the rule are relieved not only from the burdens of compliance with currently applicable requirements, but also expenditures and other burdensome actions necessary to comply with upcoming requirements" that may be changed or withdrawn under the secretarial order.

Swift action is needed since requirements under BLM's methane rule already apply and deadlines to comply are approaching, Gerard said. "Accordingly, we request that you direct BLM to expeditiously publish a notice in the Federal Register to postpone the compliance dates in light of the fact that any final determinations from the review and rulemaking processes will likely take several months," he said.

Former Louisiana state official to lead BSEE

Former Louisiana state official Scott A. Angelle has been named director of the US Bureau of Safety and Environmental Enforcement, effective May 23.

Angelle, who will serve as the fourth director in BSEE's history, most recently served as vice-chairman of the Louisiana public service commission. He has held numerous positions in Louisiana state and parish governments, including interim lieutenant governor, secretary of the Louisiana department of natural resources, and St. Martin parish president.

In the aftermath of the Macondo blowout and crude oil spill, Angelle served at the request of then-Louisiana Gov. Bobby Jindal as liaison to the federal government and negotiated an early end of the previous administration's drilling moratorium.

Angelle also served 8 years as Louisiana's secretary of the department of natural resources.

Cairn group drills SNE appraisal well off Senegal

A combine led by Cairn Energy Ltd. has completed drilling of an appraisal well in SNE oil field offshore Senegal. The group recorded strong flow rates in the SNE-6 well from the upper reservoirs.

Connectivity of these reservoirs has been established with the previous SNE-5 appraisal just 1.6 km away.

A drillstem test found that the main reservoir units, pressure data, and fluid contacts are in line with previous appraisal wells in the field. Samples recovered during the test indicate the oil is of similar quality across the field.

The first of two DSTs flowed from an 11-m interval at a maximum rate of 4,700 b/d of oil through a 60/64-in. choke. A 48-hr main flow period flowed at 3,700 b/d through a 52/64-in. choke.

The second test of an additional 12-m zone resulted in a maximum flow rate of 5,300 b/d through a 1-in. choke followed by a 24-hr flow period at an average flow rate of 4,600 b/d through a 52/64-in. choke.

Perth-based FAR Ltd., a member of the combine, says the SNE-5 and SNE-6 wells are sufficiently connected to optimize production of the S480 reservoirs with water flood-enhanced recovery techniques.

FAR said further analysis will take place once interference test data have been collected from all the observation wells, including SNE-3 and SNE-4, to determine the impact on modelled reservoir architecture, recoverable resource base, and forward development plan.

There is now sufficient data to get on with predevelopment work. The combine plans to submit a field development plan to the Senegal government next year.

The Stena Drilling Ltd. Stena DrillMAX rig is now moving to a pure exploration well: FAN South-1 in 2,139 m of water. The prospect lies to the southwest of SNE field and has two main objectives.

Tag Oil successful with Cheal well in New Zealand

Tag Oil Ltd., Vancouver, BC, reported the successful drilling and flow testing of its Cheal-E8 exploration well, which will now be tied-in to the company's existing production systems as a permanent producer. The well was drilled on the company's operated Cheal East permit (PEP 54877) in New Zealand's Taranaki basin. The well was drilled to a total measured depth of more than 2,000 m.

The well's primary objective was to test the potential of the Urenui formation, with the deeper Mt. Messenger formation as the secondary objective. Tag Oil recorded 17 m net pay of Urenui sands and 4 m net pay of Mt. Messenger sands.

Following the completion of the Urenui zone, Cheal-E8 naturally free flowed oil and gas on choke at an average rate of 318 boe/d over a 4½-day test, during which no water production was observed.

The Mt. Messenger formation also is estimated to be commercial, and will be completed in the future, the company said. Next the company will drill the Cheal-D1 well on PEP 54877. Tag Oil holds 70% interest in PEP 54877.

Talos spuds Zama-1 exploration well off Mexico

Talos Energy LLC, Houston, has spudded the Zama-1 exploration well on Block 7 in the shallow-water Sureste basin offshore Mexico.

The well's principal target is the Zama prospect with supportive direct hydrocarbon indicators in the Tertiary clastic reservoirs. The Zama structure is estimated to have a gross unrisked resource range of 100-500 million bbl. The firm is expected to take up to 90 days to drill both the Zama prospect and the secondary target, Zama Deep.

Zama-1 is the first exploration well to be drilled on acreage awarded in Mexico's first international licensing round in 2015.

Talos Energy is operator of Block 7 with 35% interest. Partners are Sierra Oil & Gas 40% and Premier Oil PLC 25%.

Drilling & Production — Quick TakesPetrobras producing oil, gas from Lula South field

Petroleo Brasileiro SA (Petrobras) started deepwater production through the P-66 floating production, storage, and offloading vessel in Lula South field from the Brazilian presalt of the Santos basin in 2,150 m of water on May 17, said Royal Dutch Shell PLC subsidiary BG E&P Brazil.

The P-66 FPSO can process as much as 150,000 b/d of oil and 6 million cu m/day of natural gas. It's the first in a series of Petrobras-operated vessels to begin production within the BM-S-11 block consortium. More FPSOs are planned within 3 years.

It is the seventh unit of Lula field. This system joins the 11 others already in operation in the Campos and Santos basins presalt.

Petrobras is the consortium operator with 65% interest. Shell has 25% interest. Petrogal Brasil holds 10% interest.

Shell said the P-66 vessel is its 10th deepwater FPSO in operation across Shell's working interest in the presalt areas of Santos basin. Shell operates two other FPSOs offshore Brazil.

Eni begins production from OCTP project off Ghana

Eni SPA has started production from the integrated oil and gas development project on the Offshore Cape Three Points (OCTP) block 60 km offshore western Ghana.

Production is carried out through the John Agyekum Kufuor floating production, storage, and offloading unit, which will produce as much as 85,000 boe/d via 18 underwater wells. A 63-km subsea pipeline will transport gas to Sanzule's onshore receiving facilities (ORF) where it will be processed and transmitted to Ghana's national grid, supplying 180 MMscfd.

The OCTP development comprises Sankofa Main, Sankofa East, and Gye-Nyame fields, which altogether have 770 million boe in place, of which 500 million bbl is oil and 270 million boe is nonassociated gas, or about 40 billion cu m.

Eni said the launch comes 2½ years after approval of the development plan and 3 months ahead of schedule. Eni operates OCTP block with 44.44% interest. Partners Vitol Group holds 35.56% and Ghana National Petroleum Corp. has 20%.

Eni has had a presence in Ghana since 2009 through its subsidiary Eni Ghana. The firm last year obtained the Cape Three Points Block 4 exploration license adjacent to OCTP block. If successful, synergies with OCTP will allow for a fast-tracked startup, Eni said. Drilling of the first exploration well is expected in 2018, in continuity with the drilling of OCTP wells.

Orphan Well Association due Alberta loan

The Alberta government is seeking legislative approval to lend the Orphan Well Association (OWA) $235 million (Can.) to accelerate work on oil and gas wells with defunct or insolvent owners.

The OWA operates as an independent, nonprofit organization under the delegated authority of the Alberta Energy Regulator. Most of its funding comes from the oil and gas producing industry, which currently provides $30 million/year. The industry contribution is to double in fiscal 2019-20.

Alberta Premier Rachel Notley said the loan "is about creating jobs and fixing a longstanding problem."

In its latest inventory, OWA said Alberta last month had 1,411 orphan wells for abandonment, 1,125 orphan wells for suspension, 666 orphan sites for reclamation, and 1,764 orphan pipeline segments for abandonment.

OWA closed 185 wells last year.

According to the provincial government, Alberta has about 180,000 active wells, 83,000 inactive wells, and 69,000 abandoned wells.

PROCESSING — Quick TakesCanada-Kuwait petchem JV advances Alberta PP plant

Pembina Pipeline Corp., Calgary, and Petrochemical Industries Co. KSC (PIC) of Kuwait have formed Canada Kuwait Petrochemical Corp. (CKPC) and will proceed with front-end engineering design for a proposed 1.2 billion-lb/year integrated propylene and polypropylene (PP) production facility in Sturgeon County, Alta.

FEED activities are expected to be completed by late 2018, followed by a final investment decision from each partner. Deliverables of FEED include a refined capital cost estimate, a project execution plan, regulatory applications, an updated construction schedule, and a projected in-service date.

The proposed PP facility is expected to consume 22,000 b/d of Alberta-produced propane, which is expected to be sourced from Pembina's Redwater fractionation complex as well as other regional facilities. Subject to required approvals and FID, the combine expects to construct the PP facility nearby Pembina's Redwater complex. The preliminary capital cost estimate of the project is $3.8-4.2 billion (gross).

"The encouraging results of the recently completed feasibility study, the previously announced award of $300 million in royalty credits from the Alberta government's petrochemicals diversification program, and a joint venture with our world class partner, PIC, gives Pembina the confidence to further advance the project," said Stuart Taylor, Pembina's senior vice-president, NGL and natural gas facilities. "This project represents a material extension of our natural gas liquids value chain strategy and creates a significant incremental local market for western Canadian hydrocarbons."

ExxonMobil completes PE lines at Mont Belvieu plant

ExxonMobil Chemical Co. has reached mechanical completion of two 650,000-tonne/year high-performance polyethylene lines at its plastics plant in Mont Belvieu, Tex. The company expects production to begin during the third quarter.

Part of a previously announced multibillion dollar expansion project in the Baytown, Tex., area, the polyethylene lines will process ethylene feedstock from the new 1.5 million-tpy steam cracker currently under construction at the Baytown complex.

ExxonMobil Chemical Pres. Neil Chapman said the "facility will double the plant's production capacity, making it one of the largest polyethylene plants in the world."

The Baytown expansion project is one of 11 ExxonMobil announced as part of its 10-year, $20-billion "Growing the Gulf" initiative. As part of the initiative, ExxonMobil Chemical and Saudi Arabian Basic Industries Corp. (SABIC) last month selected a site in San Patricio County, Tex., as the possible location for a jointly owned petrochemical complex the companies hope to build on the Gulf Coast.

Lucid commissions Delaware basin Red Hills II plant

Lucid Energy Group LLC, Dallas, has reported the startup of the Red Hills II cryogenic natural gas processing plant in Lea County, NM.

With the expansion, the Red Hills processing complex has the capacity to process 310 MMcfd of gas, which brings the total processing capacity of Lucid's South Carlsbad gas gathering and processing system in Lea and Eddy counties to 345 MMcfd, tripling processing capacity since Lucid's September 2016 acquisition of Agave Energy Co.

The South Carlsbad System serves producers developing the prolific Wolfcamp, Bone Springs, and Avalon formations of the northern Delaware basin.

Separately, Lucid also reported that it remains on schedule with its previously announced Roadrunner cryogenic processing plant. Roadrunner I, the first plant at the Roadrunner complex in Eddy County, is a 200-MMcfd plant, which will bring the total capacity of the South Carlsbad system to 545 MMcfd in January 2018.

TRANSPORTATION — Quick TakesPoll shows pipeline support in three Mid-Atlantic states

Majorities of voters in Virginia, West Virginia, and North Carolina support approval and construction of the Atlantic Coast Pipeline and similar projects, telephone surveys commissioned by the Consumer Energy Alliance indicated. Most respondents also consider pipelines the safest way to transport natural gas, and back construction of the Keystone XL crude oil pipeline, CEA officials said as the group released the results on May 22.

"As we've seen in years past, the success of those running for governor or for [congressional] seats in this election cycle will hinge on their ability to promote issues that stimulate the economy, create jobs, contribute to the well-being of US families and small businesses, as well as helping to ensure the protection of our environment," CEA Pres. David Holt said.

"Promoting the expansion of domestic energy production and infrastructure, especially pipelines, remains the best way to achieve all of the above," Holt said. Of the three states, Virginia is the only one that will hold gubernatorial and state legislature elections in November. All will hold congressional elections in 2018.

Hickman Analytics Inc. surveyed 500 registered voters in Virginia, 405 in West Virginia, and 660 in North Carolina May 9-11 for CEA. It found support among the polls' participants for building the Atlantic Coast Pipeline was strongest in West Virginia, 60%, followed by Virginia's 54% and North Carolina's 52%.

The US Federal Energy Regulatory Commission issued a draft environmental impact statement for the more than 600-mile project in early January and took public comments until Apr. 6. FERC is expected to issue a final EIS on June 30.

The pipeline would originate in Harrison County, W.Va.; continue to Greensville County, Va., where a lateral would extend east to Chesapeake; and proceed south into eastern North Carolina, where it would end in Robeson County. Two shorter laterals would connect to Dominion Energy power plants in Brunswick and Greensville counties.

Richmond-based Dominion Energy is the primary sponsor. Two Charlotte utilities-Duke Energy and Piedmont Natural Gas-and Atlanta-based Southern Co. Gas are partners.

Quantum buys stake in Marcellus midstream venture

Houston private equity firm Quantum Energy Partners has agreed to acquire a holding company that owns 50% of CONE Gathering LLC and 21.7 million common and subordinated limited partnership units from Noble Energy Inc., Houston, for $765 million.

The limited partnership units represent 33.5% ownership interest in CONE Midstream Partners LP, which, as of yearend 2016, operated 250 miles of pipeline with installed compression of more than 91,000 hp. The general partner of CONE Midstream is owned by CONE Gathering, whose other 50% interest is held by Pittsburgh-based Consol Energy Inc.

The deal, expected to close in the third quarter, follows the move earlier this month by another Quantum portfolio company to acquire all of Noble's Marcellus upstream assets in northern West Virginia and southern Pennsylvania for $1.225 billion. Quantum had not been identified as the buyer during that deal's announcement.

The upstream acreage previously was part of a separate 50-50 upstream joint venture of Noble and Consol that the firms agreed to split last fall.

"Including this transaction, Noble Energy will realize more than $1 billion in total value from our Marcellus midstream business, which represents approximately three times our net invested capital," said David L. Stover, Noble chairman, president, and chief executive officer. "Going forward, our midstream efforts are focused on Noble Midstream Partners, supporting our DJ basin and Delaware basin growth areas."

Noble's cumulative 2017 divestiture proceeds total $2 billion, primarily reflecting its Appalachia upstream and midstream sales. The firm says proceeds announced thus far this year are being used to cover cash costs from the firm's purchase of Clayton Williams Energy Inc., for debt reduction, and to provide more financial capacity and flexibility for its US onshore oil development.

Origin divests Queensland natural gas pipeline

Origin Energy Ltd., Sydney, has completed its program of shedding noncore assets with the sale of the Darling Downs natural gas pipeline in southeast Queensland to Jemena Gas Pipelines Holdings for $392 million (Aus.).

This 292-km line transports gas to Origin's Darling Downs electric power station as well as to the Australia Pacific LNG project on Curtis Island near Gladstone and to the domestic market via the Wallumbilla hub in central Queensland.

As part of the deal Origin has secured gas transport services on the line for periods ranging 10-30 years.

The sale is expected to be completed by the end of June.

Jemena, which is backed by Chinese interests, owns a portfolio of energy and water transportation assets along the east coast of Australia. It has also been selected by the Northern Territory government to build and operate an $800-million (Aus.) pipeline to transport gas from the north to Mount Isa in Queensland.

The Darling Downs pipeline deal increases Origin's proceeds from its asset sale program to $1 billion (Aus.).