UK sustains oil production, offers strong frontier potential in new licensing round

Tayvis Dunnahoe

Exploration Editor

The UK Oil and Gas Authority's (OGA) 29th Offshore Licensing Round was the first in 20 years to focus solely on frontier underexplored areas and included portions of the Rockall basin, Mid-North Sea High, and East Shetland platform. The round, which closed in October 2016, produced 25 licenses for 111 blocks and partial blocks. OGA awarded bids to 17 companies when it announced winning bids Mar. 23, 2017.

OGA's frontier round was preceded by a £20-million investment in new seismic for the Rockall and Mid-North Sea High areas and subsequent release of 40,000 km of new and reprocessed data, according to OGA Chief Executive Officer Andy Samuel.

Statoil ASA was awarded six licenses, five of which it will operate with partner BP PLC in the northern North Sea. Statoil will partner with Esso Exploration and Production UK Ltd. on the sixth license, which is west of Scotland in the Rockall basin. Statoil's awarded acreage includes "both drill-ready prospects and frontier acreage," said Jez Averty, Statoil senior vice-president for exploration in Norway and the UK. Statoil stands out as the only operator with firm drill commitments, of which three are planned for 2017.

Azinor Catalyst UK secured two operated licenses covering 10 blocks in the Outer Moray Firth, central North Sea. Awarded on a drill-or-drop basis, one license covers Blocks 14/8, 9, and 10 with Azinor holding 100% interest. Azinor split Blocks 14/13, 14, and 15 with Dyas UK Ltd. with 80% and 20% interest, respectively.

The licenses are contiguous acreage to Azinor's PL989 license-Blocks 14/11, 12, and 16-which covers the Partridge prospect. The company plans to drill a well in 2017, targeting Lower Cretaceous prospects. The company also believes newly acquired 3D seismic reveals a potentially large Jurassic structure in the region.

Shell UK won two operating licenses with BP as a partner on one. Four UK-based independents including Zennor Petroleum, Alpha Petroleum Resources Ltd., Decipher Energy Ltd., and Nautical Petroleum Ltd. were awarded licenses. TAQA Bratani, North Sea Natural Resources, Simwell Resources, and Centrica were also awarded licenses.

Steam Oil Production Co. was awarded four partial blocks surrounding the Pilot field in Block 21/27a. The operator will develop one of the first offshore steam-flooding projects. The company believes that successful application of steam flooding in the North Sea could maximize economic recovery from UK Continental Shelf (UKCS) heavy oil fields. The operator's license contains the Blakeney, Feugh, Dandy, and Crinan discoveries as well as feeder channels that are extensions of Pilot field and the low-to-moderate-risk Bowhead and Titchwell prospects.

Ardent Oil received two licenses in the UK Mid-North Sea High area. The first license, where the Zechstein Reef trend has been identified, includes Blocks 36/24, 25, 37/21, 22, 23, 28b, and 29b. The company also secured a license for Blocks 36/15, 36/20, 37/11, and 37/16. Both licenses are shared with Horizon Energy Partners LLC and Simwell Resources, but no details on working interest have been reported.

Chrysaor and Draupner Energy also were granted operating licenses, but no other information was available at this writing.

Oil & Gas UK's Upstream Policy Director Mike Tholen cited the UK authority's "clear and flexible approach" for its Innovate License offering as enabling three new companies to enter the UK this round.

"In total, there were four new UKCS offshore entrants," said Ed Shires, senior consultant, StrategicFit. North Sea Natural Resources, Decipher Energy, and Draupner Energy were completely new to the UK, and Horizon Energy had previously only held onshore UK acreage.

OGA's 2016 Supplementary Round closed for applications on Mar. 7, 2017, and attracted 15 applications for 11 blocks in all. Awards will be announced later this year.

OGA's Andy Samuel said, "While exploration activity has undoubtedly suffered as a result of the difficult market conditions, we are now seeing highly encouraging success rates and finding costs on the UKCS."

The 30th Offshore Licensing Round will focus on mature areas and will offer an extensive number of prospects and undeveloped discoveries. The 30th Round is likely to be announced later this year and will be open for 120 days, according to OGA.

Production increase

The UK upstream industry is showing its resilience with positive results from OGA's 29th Licensing Round. The UKCS has experienced decline in the last decade and production was sustained by higher oil prices before 2014. Despite less activity, analyst firm Oil & Gas UK (OGUK) said in its "Business Outlook 2017," the UKCS produced 630 million boe in 2016, 4.7% year-on-year growth (Fig. 1). The increase was driven by strong first-quarter 2016 production, largely attributed to Total SA's Laggan-Tormore field startup in the West of Shetland area (OGJ Online, Feb. 8, 2016). While Laggan-Tormore represents the largest new West of Shetland development, Premier Oil PLC's startup of Solan oil field in April 2016 (OGJ Online, Apr. 13, 2016) also contributed to the production increase. Additional production came from Engie E&P UK Ltd.'s Cygnus gas field 150 km offshore Lincolnshire, UK, in the North Sea's southern basin (OGJ Online, Dec. 21, 2016).

New fields contributed more than 39 MMboe to production in 2016, up from 33 MMboe in 2015. Other fields that continued to increase volumes after starting late in 2015 include Alma Galia, Cladhan, Brigantine, Enochdu, and Solitaire. Production decline from existing fields slowed to just 3% in 2016 (less than 17 MMboe) from 4% in 2015, and around 12% in 2014, according to OGUK.

The analyst firm said production will increase 3-6% in 2017, peaking at 1.8-1.9 MMboe/d in 2018, an upper forecast growth of 25% on 2014 output (1.5 MMboe/d). These projections follow record levels of investment during 2012-14 and improved efficiency throughout the UKCS.

Ten new developments are estimated to add 600,000 boe/d in 2018, including Schiehallion, Clair Ridge, Kraken, Western Isles, Catcher, and Mariner. Cygnus, Laggan-Tormore, Solan, and Golden Eagle are ramping up to peak production in 2017.

The West of Shetland area offshore Scotland represents vast potential as the UKCS's frontier. Last year it had the biggest production increase of any area in the Shetland basin, largely due to Laggan-Tormore and Solan coming onstream, but also owing to increased production from the Clair and Foinaven fields.

Hurricane Exploration PLC completed drilling the 205/23-3A (Halifax) well in March 2017, which lies on West of Shetlands Blocks 205/22b, 23, and 24. The Halifax well found a 1,156-m hydrocarbon column, Hurricane reported. Porosity is consistent with that at the company's adjacent Lancaster prospect. The principal purpose of the Halifax well was to support the company's view that Lancaster field and the Halifax prospect are one large connected structure (OGJ Online, Mar. 27, 2017).

Opinions differ, however, on the value of some West of Shetland discoveries. Keith Myers from energy research and analysis consultancy, Westwood Global Energy Group, said, "Hurricane Energy is proving lots of oil in place in fractured basement rocks West of the Shetland…but the jury is still out as to how much of this oil will be economic to produce." Only a small part of this field has been appraised with horizontal wells, and long-term production characteristics are hard to predict for such a large geological feature.

Nevertheless, existing development in the West of Shetland region is expected to account for 15-20% of UKCS production by 2018.

Offshore expenditure

The UK's exploration sector is better positioned for growth in 2017 as market conditions improve, but obstacles remain. Projects approved during 2011-13 are nearing completion and minimal capital was committed to UKCS development in 2016. According to OGUK, any delays to developments earmarked for approval in 2017-18 could result in further decline of capital investment and production beyond 2020.

Total UKCS expenditure fell to £17.2 billion in 2016, down from £21.7 billion in 2015 and £26.6 billion in 2014.

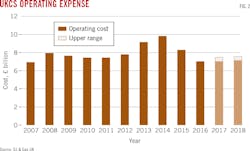

Operational efficiency remained a priority in 2016, and operators spent more than £7 billion sustaining UKCS assets last year. Operational expenditures declined 16% compared to 2015 (£8.3 billion) and more than 25% from 2014 (£9.8 billion) (Fig. 2).

Exploration companies have achieved efficiency gains in areas such as logistics, maintenance, and personnel despite the suppressed market conditions. Average cost savings are expected to slow during 2017-18, with the possibility that expenditures could increase through this period to £7-£7.5 billion, according to OGUK.

A number of fields will cease production in 2017, and new startups will incur greater costs. New developments will account for 10% of 2017 operational expenditures and 15% of 2018's. OGUK's market outlook reported unit operating costs down by 37% from £18/boe in 2014 to around £11.30/boe in 2016, stabilizing near £11/boe during 2017-18.

Investment

Capital expenditure in the UKCS fell 30% to £8.3 billion in 2016, around 8% percentage points less than forecasted to fall at the start of the year. OGUK estimated investment will fall further in 2017-18 as several major UKCS projects come onstream. More investment is required to develop new fields. Cost improvements since 2014 have made UKCS more attractive, but the region will continue to compete with overseas projects for a smaller pool of available capital.

Unit development costs of newly approved projects have fallen from £19.50/boe in 2013 to £9.40/boe in 2016 and are forecast at around £6.70/boe in 2017, according to OGUK. Like other regions, UKCS developments reflect an increase in smaller, near-field projects that are less expensive to tie-back to existing facilities.

Maersk Oil performed an organizational review on its Culzean project that cut its development plan by $500 million, about 15% of the total investment (OGJ Online, Sept. 29, 2016). The company cited improved drilling efficiency and enhanced upfront design and planning as the saving's source.

Drilling activity

Operators drilled 110 wells in 2016 (88 development, 14 exploration, and 8 appraisal), down from 164 wells in 2013 (120, 15, and 29, respectively).

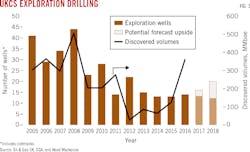

Exploration drilling fell sharply in 2009, before the most recent drop in oil price, and has not recovered. Some of the factors for decline included lower prices in 2008-09, a shortage of exploration funds, poor success rates, and a lack of affordable drilling rigs and access to modern seismic. Since 2014, operators have continued to limit exploration activity and drilling saw no increase in 2015.

The 14 exploration wells drilled in 2016 represent the first increase since activity declined in 2012, and discovered volumes increased by 360 MMboe in 2016 (Fig. 3). Exploration drilling peaked in 2008, when 44. exploration wells spudded, adding 500 MMboe of recoverable reserves. Discoveries in 2016 accounted for half the reserves produced (630 MMboe), according to OGUK.

Operators plan to drill 16 exploration wells in 2017, but this number remains sensitive to market changes.

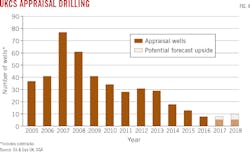

With only eight appraisal wells drilled in 2016, the near-term exploration outlook is expected to remain unchanged in 2017 (Fig. 4). Operators are reducing development costs on smaller prospects by limiting the number of appraisal wells and are less likely to risk appraising marginal discoveries. Lower exploration activity also has produced fewer appraisal opportunities.

Production increases correlate to development drilling rates, which can also indicate future production output. UKCS development drilling fell by a third in 2016 to 88 wells compared with 120-130 wells annually since 2009 (Fig. 5). OGUK predicts development drilling rates will remain lower through 2018, which could impact future production volumes.

New field development will support production in the near future, but fewer development wells in existing fields could initiate a rapid decline in production beyond 2020.

Pipeline opportunities and further well cost reductions could produce some improvement in drilling activity, but a longer term drop in development drilling emphasizes the need to improve exploration rates and rapidly gain investment sanction for new discoveries.

Looking back

Before OGA announced its 29th Licensing Awards, the UK regulator published "Lessons Learned from UKCS Oil and Gas Projects 2011-2016" to highlight strengths and weaknesses that have impacted UK's offshore industry in the last 5 years.

OGA analyzed 58 major projects executed during the period to identify trends in cost overruns and project delays. OGA established a series of structured lessons-learned in a group of 11 projects where half were delivered in close alignment with their field development plans (FDP) and the other half underperformed relative to those objectives.

Fewer than 25% of UKCS oil and gas projects have been delivered on time since 2011, according to OGA. Projects average 10 months' delay and come in around 35% over budget relative to FDP objectives. During this same period, capital expenditures have averaged £12 billion annually, compared to £3-£6 billion annually through the previous decade (Fig. 6).

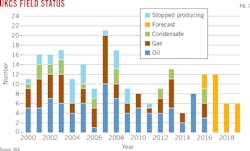

During 2011-15, operators conducted eight field startups annually (Fig. 7). In 2016, field startups fell from a forecast of 12 to nine fields started.

Major projects typically execute in 3-4 years, so startups expected in 2017 were committed to earlier in the decade when oil prices were higher. According to OGA, near-term spend on UKCS developments is dominated by projects already being executed. Once later-than-planned projects come onstream by mid-2017, OGA estimates operators will execute fewer than 10 major UKCS projects. OGA used data for new fields initiated between October 2011 and October 2016 with a capital cost >£50 million or redevelopments costs >£250 million at sanction. OGA's report confirmed a number of lower value projects not included in its study, but attributed 75% of total capital expenditure in the past 5 years to the 58 projects it analyzed. The study revealed examples of both good and poorly executed projects across:

• Greenfield and brownfield.

• Development type (subsea, platform, semi-submersible).

• Operator.

• Region (central and southern North Sea).

The study also noted that virtually all floating production, storage, and offloading (FPSO) projects have experienced cost over-runs and schedule delays. There also were no simple correlations between size or complexity of scope and delays or cost over-runs.

The OGA report concluded that in some cases the method of project execution influenced cost and schedule outcome more than the particular asset type. Much of the deviation resulted from non-technical causes.

The study demonstrated how projects have performed for four different asset types (Fig. 8), comparing 34 projects already in production as of Oct. 1, 2016, with its complete data set of 58 projects. OGA's findings suggested schedule slippage was ongoing, but cost predictability was improving.

Field application

OGA summarized its findings into five key focus areas regarding how development projects are planned and executed rather than what hardware is deployed. Organizational structure can help lower owners' costs, especially where project management focuses on realistic, as opposed to aspirational schedule setting.

Front-end loading (FEL) also provided more predictable costs, shorter schedules, and better production attainment. Aligning elements of work in parallel ensured better decisions. Benchmarking confirmed the readiness of project investment.

OGA found that project values can erode rapidly if the project is poorly executed. Addressing issues early and collaboratively made the difference between project success or failure. Proper FEL can avoid execution risks, but an effective risk management system can help project developers meet objectives.